January 24, 2020

The Week’s Biggest Winner & Loser

Logitech (LOGI)

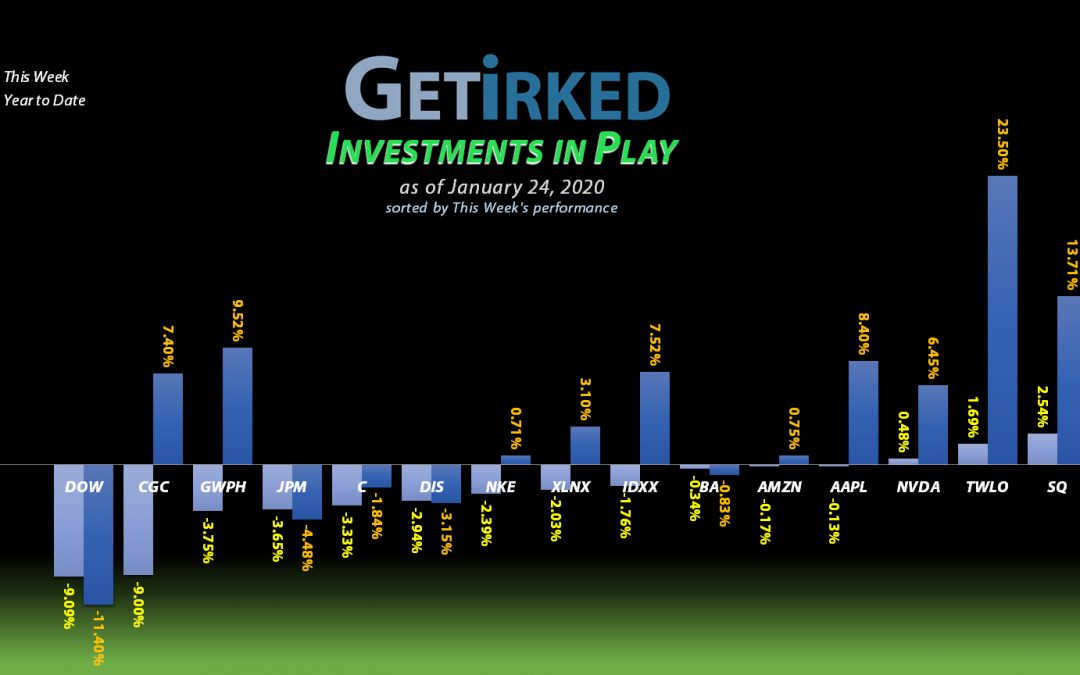

Logitech (LOGI), my main long-term play on e-sports and gaming, reported a rock-solid quarterly report and held up throughout the Wuhan Coronavirus to earn 3.35% for the week, making it my Biggest Weekly Winner.

Dow Chemical (DOW)

Despite analysts claiming Dow Chemical’s (DOW) earnings will be outstanding, the stock got slammed following the Global Economic Forum in Davos, Switzerland focusing on sustainability. Investors shot first and asked questions later – Dow is actually focused on the Earth and its plastics will be key in the future of the planet. Regardless, a -9.09% beat-down earned DOW the spot of this week’s Biggest Loser.

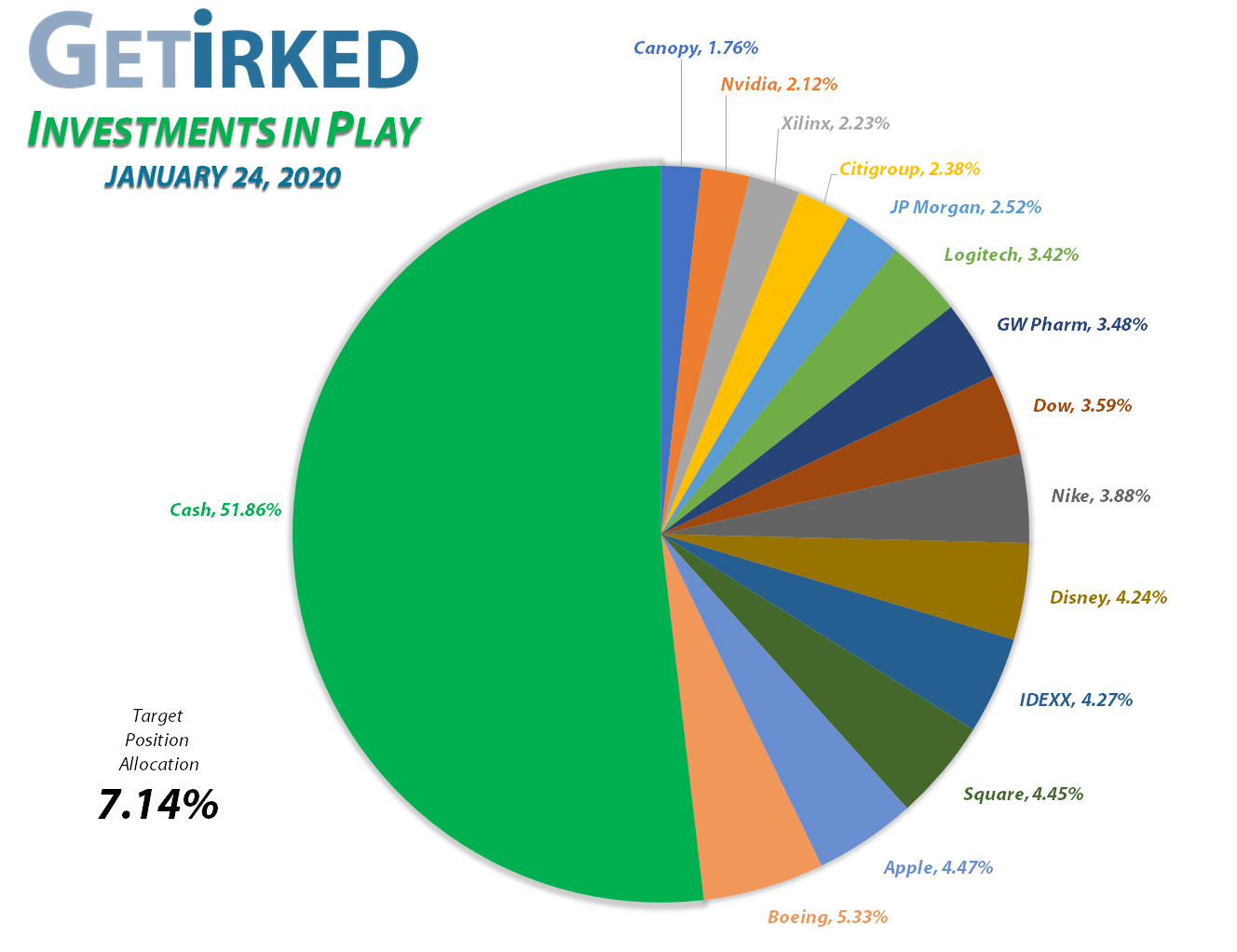

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+771.63%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$624.66)*

Apple (AAPL)

+498.98%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$158.51)*

Square (SQ)

+423.18%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$43.58)*

Nike (NKE)

+381.74%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$61.66)*

Disney (DIS)

+272.69%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$6.43)*

Nvidia (NVDA)

+235.88%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-46.12)*

IDEXX Lab (IDXX)

+140.26%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $116.86

Logitech (LOGI)

+51.75%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $31.72

JP Morgan (JPM)

+46.37%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $90.97

Citigroup (C)

+43.37%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $54.70

Twilio (TWLO)

+33.44%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $0.00

Canopy (CGC)

+21.04%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.71

Amazon (AMZN)

+19.44%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $0.00

Dow (DOW)

+3.10%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.03

Xilinx (XLNX)

+0.39%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $100.41

GW Pharm (GWPH)

-3.71%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $118.92

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

Chopping Block

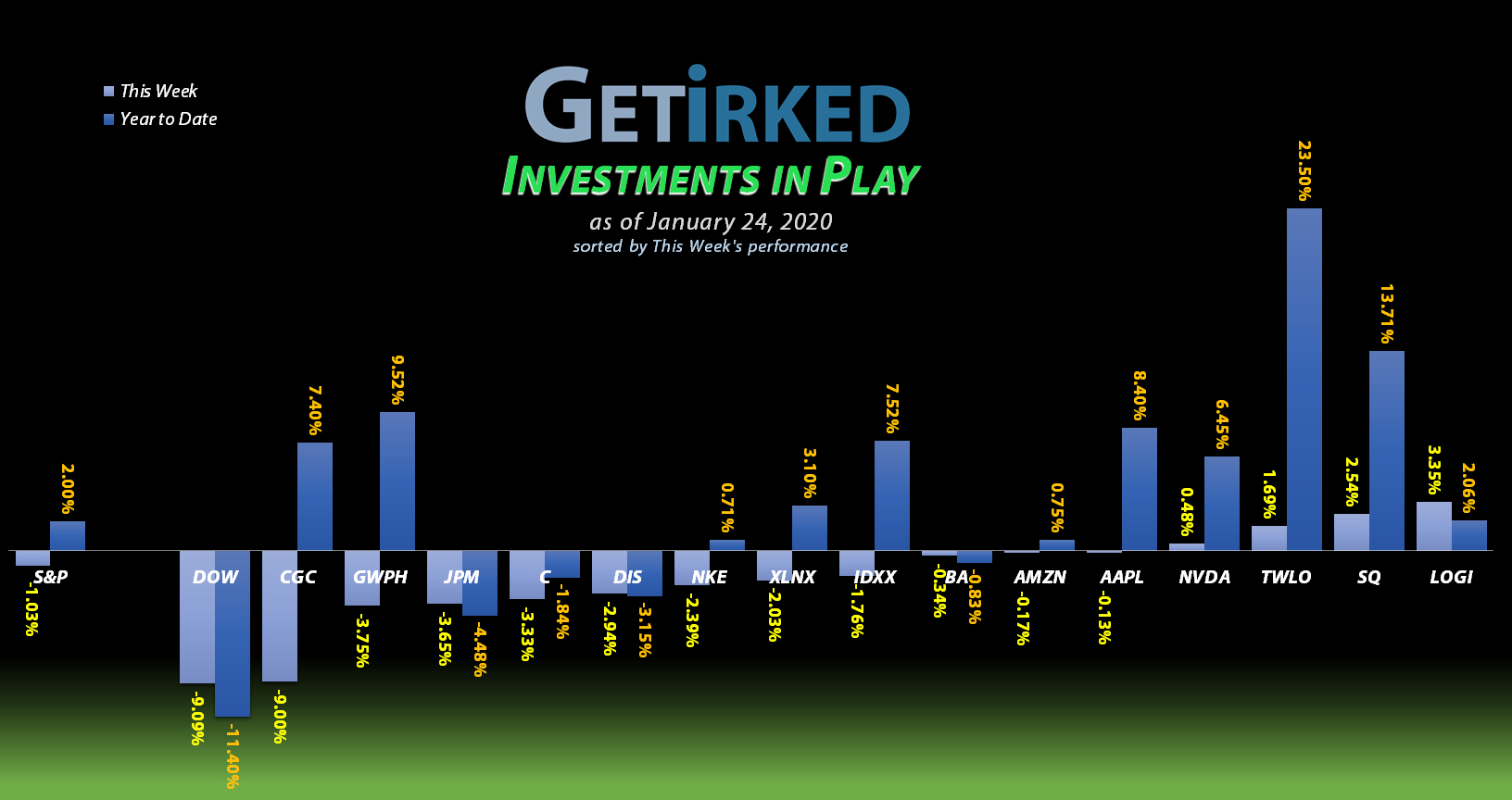

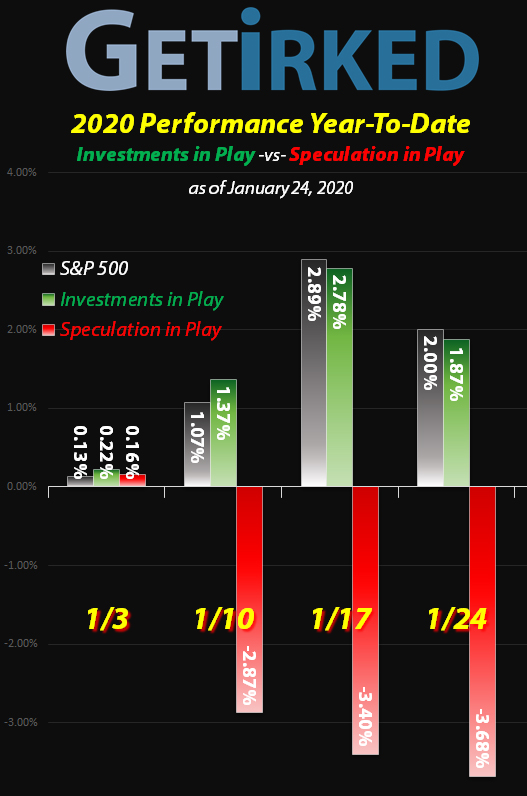

Since 2020 began with earnest, I’ve been taking a long, hard look at my portfolio. Not only was I still running too many positions with 16 different stocks in my Investments in Play, I continue to be painfully overweight in the highly-valued technology sector.

This week, it was time to take a keen focus on eliminating a few of the positions with particularly powerful nosebleed valuations – Twilio (TWLO), the cloud data map and messaging play, and, believe it or not, Amazon (AMZN).

Now, it should come as no shock as to why I want to ditch Twilio. It’s a notoriously-overvalued stock that has already jumped more than 20% in the past three weeks since the start of 2020. It’s the poster-child of a stock that will be positively obliterated during a market-wide selloff.

However, anyone who knows me knows I have a distinct love for Amazon, or, at least, I did, until changes they started making in the last year.

In 2019, CEOS Jeff Bezos claimed Amazon would make a concentrated effort in offering one-day Prime shipping for a large percentage of its products. Up until this point, Amazon had been providing excellent two-day shipping with its Prime membership service, but Bezos and the management team felt that one-day shipping would push it into a new caliber.

I live on the border of Washington and Oregon with Washington being the home state of Amazon (its HQ is in Seattle, Wash.). Over the years, I have been privileged to receive the newest services Amazon has to offer as it tends to test its newest products and services close to home. However, this isn’t always a good thing.

Amazon’s one-day shipping sucks.

There’s no sugar-coating it. It sucks. Not only is there only a 50/50 chance of me getting a one-day package in one day, if it doesn’t arrive in one day, it will typically get delayed 3-4 days instead of arriving in the consistent-like-the-sunrise two-day shipping of Amazon Prime of Yore.

The two-day shipping service never failed with many two-day packages arriving in one day, but now the one-day shipping arrives in 3-4 days. I miss my two-day shipping!

Now, before you’re tempted to say “first-world problems,” remember that Amazon charges $120 (plus tax) annually for the “privilege” of its Prime shipping.

If this was a free service, I wouldn’t complain about some glitches and hiccups. However, this is a service I pay for. It’s most decidedly not free.

While I appreciate Prime Video, Prime Music, and the other ancillary membership benefits, I’m only a Prime member for the expedited shipping. However, now I don’t get my packages in two days. In fact, I now don’t often get them in 3-4 days!

Meanwhile, Wal-Mart (WMT) successfully delivers packages with free 2-day shipping and no membership fee (with a minimum order of $35).

Amazon’s claim-to-fame has always been top-notch customer service, however, this recent misguided goal of (in my opinion, totally unnecessary) one-day shipping combined with the huge investment costs to implement one-day shipping nationally has caused me to lose faith as an investor in the company.

I believe implementing one-day shipping nationwide will cost Amazon far more than CEO Jeff Bezos thinks, and the resulting massive expenses will cause the highly-valued stock to sell off substantially.

It’s time to get out of Dodge, or, well, Seattle.

Streamlining for Success?

I’ve never been afraid of having too many positions in my portfolios, however, 24 was far too many. 20 was too many. Heck, even my (now) current 14 may be too many, but at least the smaller number will be more manageable.

By trimming a few of the highly-valued tech stocks from my portfolio, I’m freeing up capital to focus more intensely on the remaining positions.

Don’t worry about the Investments in Play getting boring, though, as I’ve still got high-flyers with Apple (AAPL), IDEXX (IDXX), Nvidia (NVDA), Square (SQ), and, hell, even Nike (NKE), all reaching intensely overbought conditions in the current market.

This Week’s Moves

Amazon (AMZN): *Position Closed: +19.44% Gain*

As long-time readers may have noticed, I’ve been closely reviewing my long-term Investments in Play portfolio.

Given the current overbought conditions in the market, I am concerned with my overweight positions in the technology sector, particularly those companies with lofty valuations. One of those companies is Amazon (AMZN), a company I have faith will not go out of business in the long-term, however whose valuation is incredibly high.

After popping on Tuesday, I decided it was time to close my Amazon position, selling it when it pulled back to $1884.00 on Wednesday and locking in 19.44% profits on the position since I first opened it two years ago on 2/6/2018 (an average annual gain of 9.72%).

Mistakes were made – what I learned from holding Amazon shares.

Holding Amazon (AMZN) has been quite the learning experience for me. I opened the position during the Q1-2018 collapse, holding my nose and getting an excellent starting price of $1,382.96.

Later that year, I thought I would add more and doubled-down on my position, buying shares when AMZN pulled back from its first attempt cracking $2,000 at $1,887.73. This buy raised my per-share cost +18.39% to $1,637.35.

After the market bounced from the Q4-2018 Christmas Eve massacre, fears of a test of the December low caused me to free up capital in the position, selling at a loss when AMZN appeared to lose strength during the bounce at $1,662.84 in January 2019.

Amazon went on to make a new high over $2,000 in less than six months from that point, of course.

What was the damage?

By selling the shares I purchased at $1,887.73 when Amazon was at $1,662.84, I took a $224.89 per share loss. Instead of a 19.44% gain, I could have had a 35.65% gain.

While it is true that no one ever got hurt taking a profit, my Amazon position taught me to have more conviction in my investing theses. If my thesis for an investment is still sound – and at the time in January 2019 it was – the appropriate strategy would have been to hang on for the long-term.

However, if my thesis was broken, as I feel it is now, then it’s time to get out. I might re-enter AMZN if it pulls back substantially, preferably to the $1400 mark as a starting point, but, for the moment, its incredibly high valuation inspired me to get out while the getting was good.

AMZN closed the week at $1861.64, down -1.19% from where I closed out.

Boeing (BA): Added to Position

Boeing’s (BA) stock was slammed on Monday when it announced that it expects regulators won’t sign off on the 737 Max until mid-2020, causing the stock to drop more than -5% during Monday trading.

I had a price target on Boeing if it fell through $310 using a trailing-stop order (whose tail was a little tight, I must say) which filled at $309.55 before Boeing found support around $303.

The buy order replaces some shares that I sold last February at an average selling price of $429.88, capturing 28% in profits on those shares. My next buying target for Boeing is below $300 near the $285 level, below where it bottomed during the 2018 Christmas Eve selloff.

BA closed the week at $323.05, up +4.36% from where I added on Monday.

Disney (DIS): Added to Position

Disney (DIS) experienced selling pressure this week as the potential of the Wuhan coronavirus was investigated by the World Health Organization.

Since much of Disney’s revenues are generated from its theme parks, any potential health crisis will often trigger a selloff in the stock as more visitors will stay home rather than go to the parks and risk getting sick.

On Friday, I used a trailing stop buy order when Disney fell below $141 which filled at $141.24. The order replaces shares I sold back in November 2019 at $148.29, effectively discounting those shares by 4.75%.

My next buy target is $132.20 and would likely require a key news event either health-related or a poor showing in Disney’s upcoming earnings.

DIS closed the week at $140.08, down -0.82% from where I added on Friday.

Dow Chemical (DOW): Added to Position

Dow Chemical (DOW) lost ground this week, dropping below $50.00 a share starting on Thursday and continuing on Friday.

I used multiple orders to add small quantities to my position on the way down, buying some at $49.76 and $48.81.

Buying above my per-share cost did raise it slightly by 0.49% from $46.80 to $47.03, however, the opportunity to add to this long-term holding with a dividend yield nearing 5.6% was too good to pass up.

My next buy target is $47.10 with additional buy targets following around $44, $43, $41 and so on.

DOW closed the week at $48.49, down -0.66% from where I last added.

JP Morgan Chase (JPM): Added to Position

When news of the second confirmed U.S. case of Wuhan coronavirus hit the wires on Friday, the markets sold off in a frenzy, triggering a buy order in my JP Morgan Chase (JPM) position which filled at $132.64.

The order replaces shares I sold back on December 13 at $138.26 and locked in slightly more than a -4% reduction on the cost of those shares. My next buy target for JPM is $124.85, a point of past support in its run to current levels.

JPM closed the week at $133.15, up +0.38% from where I added Friday.

Twilio (TWLO): *Position Closed: +33.44% Gain*

Like my position in Amazon above, Twilio (TWLO) is a notoriously high (e.g. overvalued) valuation cloud data stock.

However, unlike Amazon, I do not have faith that this company will exist for the long-term as many unprofitable IPOs, despite their high growth rates, often go out of business.

Even more, TWLO already exploded to the upside in the first three weeks of 2020 with gains of more than 20%+ in such a short time. Accordingly, on Monday, I used limit orders to close the position at $119.32, locking in a gain of 33.44% since August 8, 2019, less than six months ago, when I first opened the position at $125.71 before Buying in Stages down to $90.96.

TWLO closed the week at $121.38, up +1.73% from where I closed on Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.