December 20, 2019

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

Nvidia (NVDA) received upgrades from analysts on positive China partnership and acquisition news (they’ve been wanting to buy Mellanox for some time), causing the stock to rip higher, gaining +6.87% this week and earning itself our Biggest Winner for the week.

Boeing (BA)

Unless you’ve been living under a rock, you know that Boeing’s (BA) 737-Max plane has been grounded for a year. Well, that didn’t stop them from making new ones (and parking them)… that is, until this week. To make matters even worse, their new spaceship screwed up on Friday… on the last test flight before it was supposed to carry humans. It’s kind of surprising Boeing didn’t lose more than -4.00%, but it still earned its spot as the Biggest Loser.

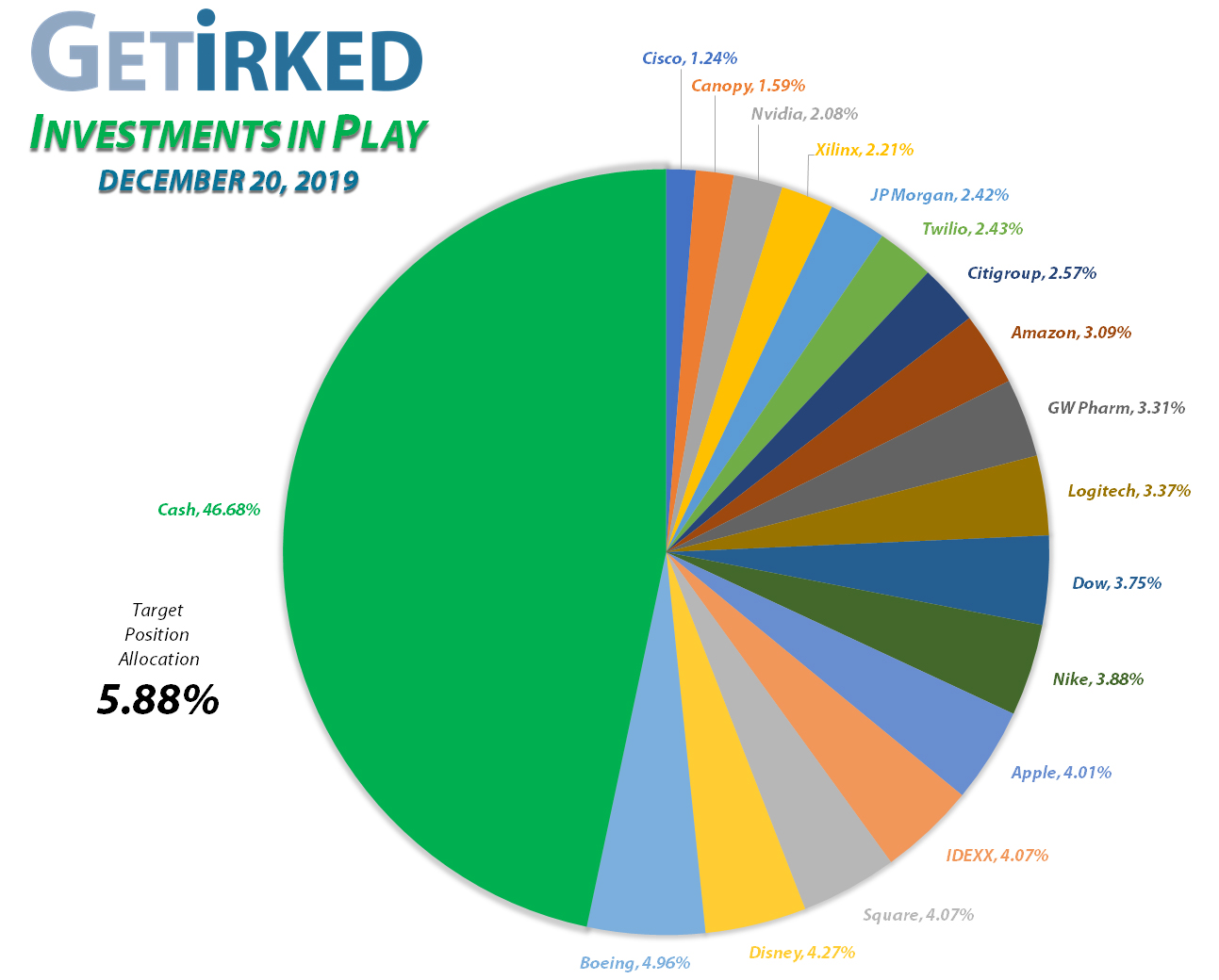

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+774.12%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$731.41)*

Apple (AAPL)

+458.31%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$158.51)*

Square (SQ)

+395.48%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$43.58)*

Nike (NKE)

+376.32%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$61.82)*

Disney (DIS)

+283.21%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$15.25)*

Nvidia (NVDA)

+226.89%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-46.15)*

IDEXX Lab (IDXX)

+123.81%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $116.86

JP Morgan (JPM)

+57.96%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.89

Logitech (LOGI)

+46.11%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $31.72

Citigroup (C)

+40.11%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $56.04

Dow (DOW)

+16.68%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $46.80

Amazon (AMZN)

+10.56%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Canopy (CGC)

+7.09%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.71

Cisco (CSCO)

+1.56%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $46.72

Xilinx (XLNX)

-2.54%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $100.41

Twilio (TWLO)

-6.83%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $107.61

GW Pharm (GWPH)

-10.53%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $118.90

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

Boeing (BA): Added to Position

Boeing (BA) shares were smacked for more than -4% on Monday following news that the company would suspend 737 Max airline production, reported CNBC. Additional bad news (covered in this week’s Week in Review) went into details on exactly how devastating the cuts will be to both Boeing, but, potentially, to the U.S. economy as a whole.

I added shares throughout the week during the selloff with an average buying price of $329.86, replacing shares I recently sold at back in April of this year at an average price of $368.29, locking in 10.43% in gains.

My next buying price target is $312.55.

Boeing is the most unique position in my Investments in Play portfolio; it’s my biggest all-time winner. I built the position’s full allocation in 2012 by Buying in Stages to achieve an average price of $75.28 and then took profits on the initial investment plus 2.40 times in gains by Selling in Stages when Boeing’s stock rose from $350-446.01 starting in July 2018 and continuing into 2019, capturing an average sale price of $423.94 per share, a profit of +663.15% per share (including dividends over the prior 6-7 years).

The result is a long-term holding where I would be up +534.45% over my initial investment even if Boeing went bankrupt and my current allocation’s stock price fell completely to zero.

My plan is to continue adding small amounts to the position (taking care not to exceed my allocation target of 5.88%) as Boeing sells off due to one bad news story after another. I have price targets down to $180 where I will stop adding, locking in a minimum gain of 408.37% over my initial 2012 investment even if Boeing disappears from the Earth.

All that being said, this position is a very long-term investment with no end in sight to the potential headline risk for the stock. The possibility Boeing could be down for the year in 2020 is significant. However, with a 20-25 year time horizon, where do you think Boeing will be?

Boeing has recovered from stories similar to this before, and, in the next two decades, it’s quite possible that space travel will become a real thing, and Boeing, a leader in commercial and military aerospace technology, will likely be near the head of those developing into this new space (pun not intended).

The potential that Boeing will be much higher than these levels in the coming decades is very, very probable. Add to this an annual dividend of 2.5% (or more) at these levels, and Boeing is a recipe for a long-term turnaround investment.

BA closed the week at $328.00, down -0.56% from my average buying price.

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corp (CGC) suddenly lost support on Wednesday, dropping more than -5% on no real news. Although above my per-share cost, I decided to replace some shares that I had sold at $20.33 in November with a buy order filling at $19.64.

The buy locked in a nominal +3.5% in profits and increased my per-share cost by 0.27% from $18.65 to $18.71, but, more importantly, increased my allocation. I’ve become slightly more bullish on CGC given the news of its new permanent CEO combined with newfound strength in the stock and sector.

All that being said, I’m adding in very small quantities with my next price target to buy at $18.85. I do plan to take profits if CGC reaches above $32 in the next few months.

CGC closed the week at $20.04, up +2.04% from where I added Wednesday.

IDEXX Laboratories (IDXX): Added to Position

IDEXX Laboratories (IDXX) has been stabilizing around the $250-255 mark for several weeks now, and ended up triggering a trailing-stop buy order on Monday which filled at $255.74.

While I could have likely landed a better price, my weekend analysis revealed that I was way off thinking IDXX could sell off significantly more than this. In fact, it looked like IDXX might be posed for a breakout after the price consolidation it saw at this level over the past weeks.

Monday’s buy replaces some of the shares I sold in July at $287.97 locking in +11.19% in gains and raised my per-share cost to $116.86.

IDXX is a long-term play on the humanization of pets and will be in this portfolio for some time to come. My next buy target is $214.55 and I have no intention to sell until IDXX exceeds my 5.88% target allocation which gives me a $425.00 price target, a gain of +66.18% from Monday’s order.

IDXX closed the week at $261.55, up +2.27% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.