November 1, 2019

The Week’s Biggest Winner & Loser

Salesforce (CRM)

Salesforce (CRM), the grand-daddy of all Cloud plays, finally returned to greatness this week gaining +6.15% which earned it the week’s Biggest Winner. CRM doesn’t report until 11/27, however, and a lot can happen between now and then.

Canopy Growth (CGC)

With no catalysts in the cannabis space and Canopy Growth (CGC) still holding no CEO, its -10.08% is both expected and earns it this week’s Biggest Loser position.

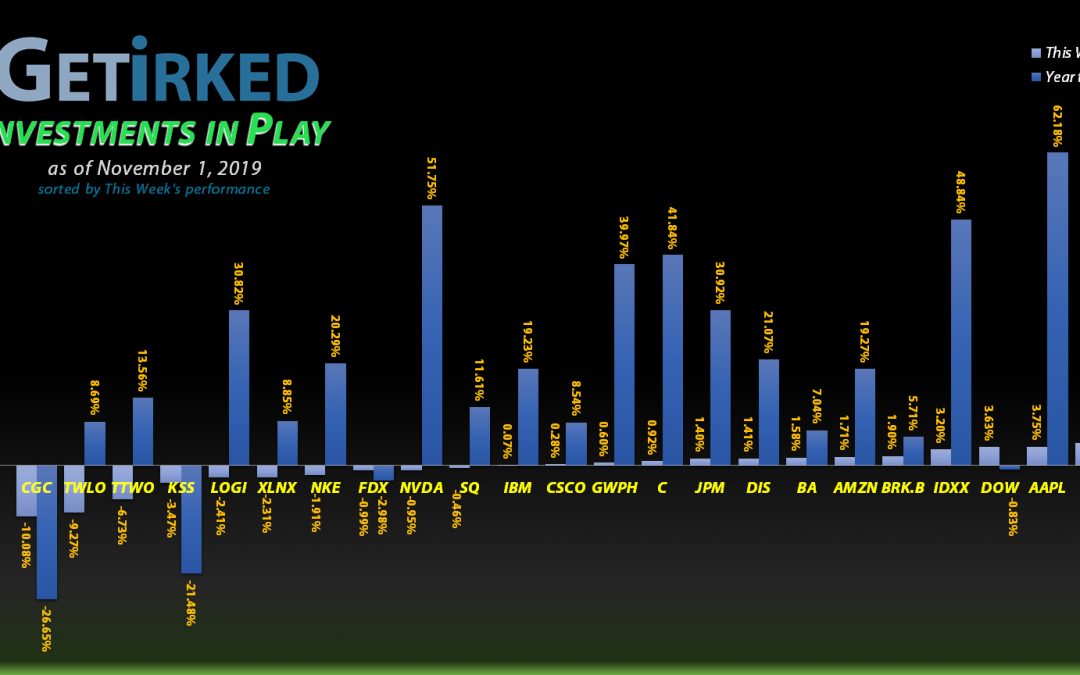

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+783.90%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,053.52)*

Nvidia (NVDA)

+588.53%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.42

Apple (AAPL)

+430.55%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$112.44)*

Square (SQ)

+390.62%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$37.86)*

Nike (NKE)

+349.20%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.25)*

Disney (DIS)

+256.91%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$6.07)*

IDEXX Lab (IDXX)

+178.26%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

Salesforce (CRM)

+33.01%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $120.10

JP Morgan (JPM)

+31.50%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $97.18

Citigroup (C)

+26.55%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $58.35

Logitech (LOGI)

+25.82%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.52

IBM (IBM)

+24.06%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $109.24

Take Two (TTWO)

+19.78%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $97.60

Amazon (AMZN)

+10.87%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Kohl’s (KSS)

+9.68%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $47.49

Dow (DOW)

+9.55%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.75

GW Pharm (GWPH)

+7.62%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $126.67

Berkshire (BRK.B)

+6.87%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

FedEx (FDX)

+2.58%

1st Buy 9/18/2019 @ $152.59

Current Per-Share: $152.59

Canopy (CGC)

+0.11%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $19.69

Pfizer (PFE)

-0.38%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.54

Cisco (CSCO)

-0.45%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $47.24

Xilinx (XLNX)

-9.61%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $102.57

Twilio (TWLO)

-10.87%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $108.89

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

Apple (AAPL): Profit-Taking

Apple (AAPL) skyrocketed to new all-time highs on Monday following a JP Morgan (JPM) analyst raising his price target to $275, the highest of all Wall Street analysts for the stock.

Apple had a remarkable run going into this week and with its earnings report on Wednesday, it would need to report a miraculous quarter in order to prevent a selloff, so I placed a trailing stop sell order to further reduce Apple’s position size in my portfolio by selling 9.73% of the position when Apple fell back and filled my order at $248.27 later Monday morning.

The sale lowered my allocation from 4.5% to under the target allocation at 4.06%. My next buy target for Apple is $211.50, about -15% lower than Monday’s highs.

AAPL closed the week at $255.82, up +3.04% from where I sold on Monday.

Kohl’s (KSS): Profit-Taking

Kohl’s (KSS) continued to climb when the rest of the markets shot higher on Monday, triggering a trailing stop sell order at $54.44 which filled at $54.34.

The order lowered my per-share cost -0.88% from $47.91 to $47.49 and finishes the remaining trimming for the position. From here, I have no additional sell targets unless Kohl’s attempts to retest its all-time highs in the low-to-mid $80s.

My next buy target is $46.15 followed by additional buy targets lower than that including $43.75, $38.05, $34.15 and lower still.

KSS closed the week at $52.09, down -4.14% from where I sold on Monday.

Twilio (TWLO): Added to Position

Twilio (TWLO) completely bombed its quarterly earnings report on Wednesday, and collapsed to trigger a trailing stop order I had placed at a key trend-line at $93.24 which filled at $93.01 on Thursday.

The buy order reduced my per-share cost by -4.2% from $113.66 to $108.89. Given this makes TWLO’s second bad quarterly report in-a-row, I’m building the position painfully slowly. My next buy target is $83.24 followed by $73.34, $67.54, $56.74, and even $48.64.

TWLO closed the week at $97.06, up +4.35% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.