November 3, 2023

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

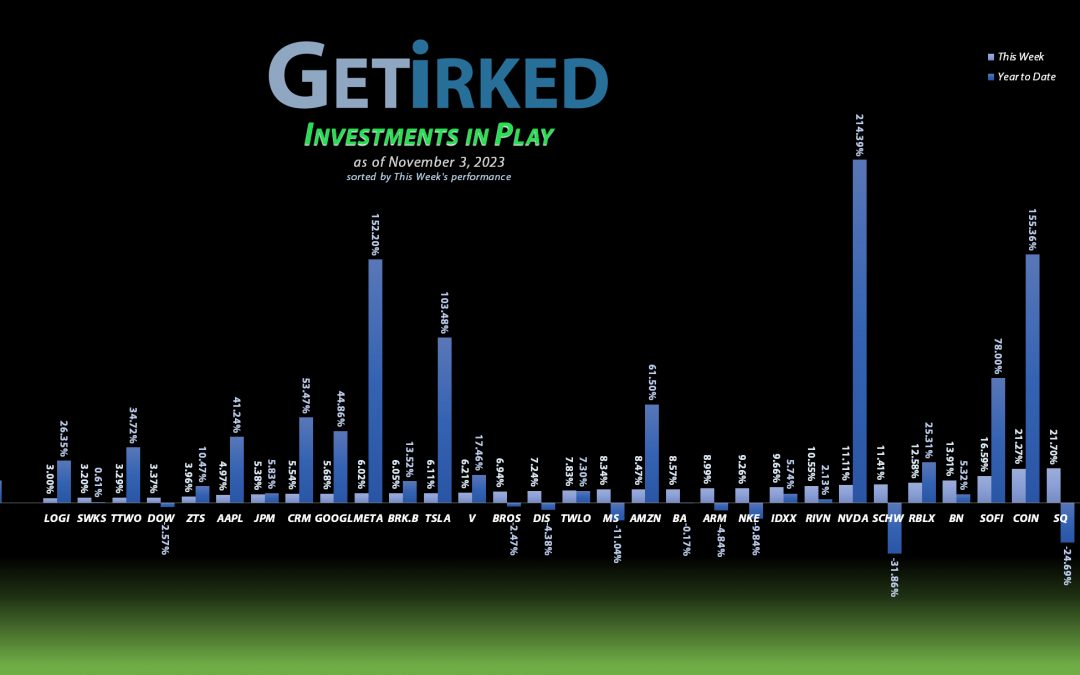

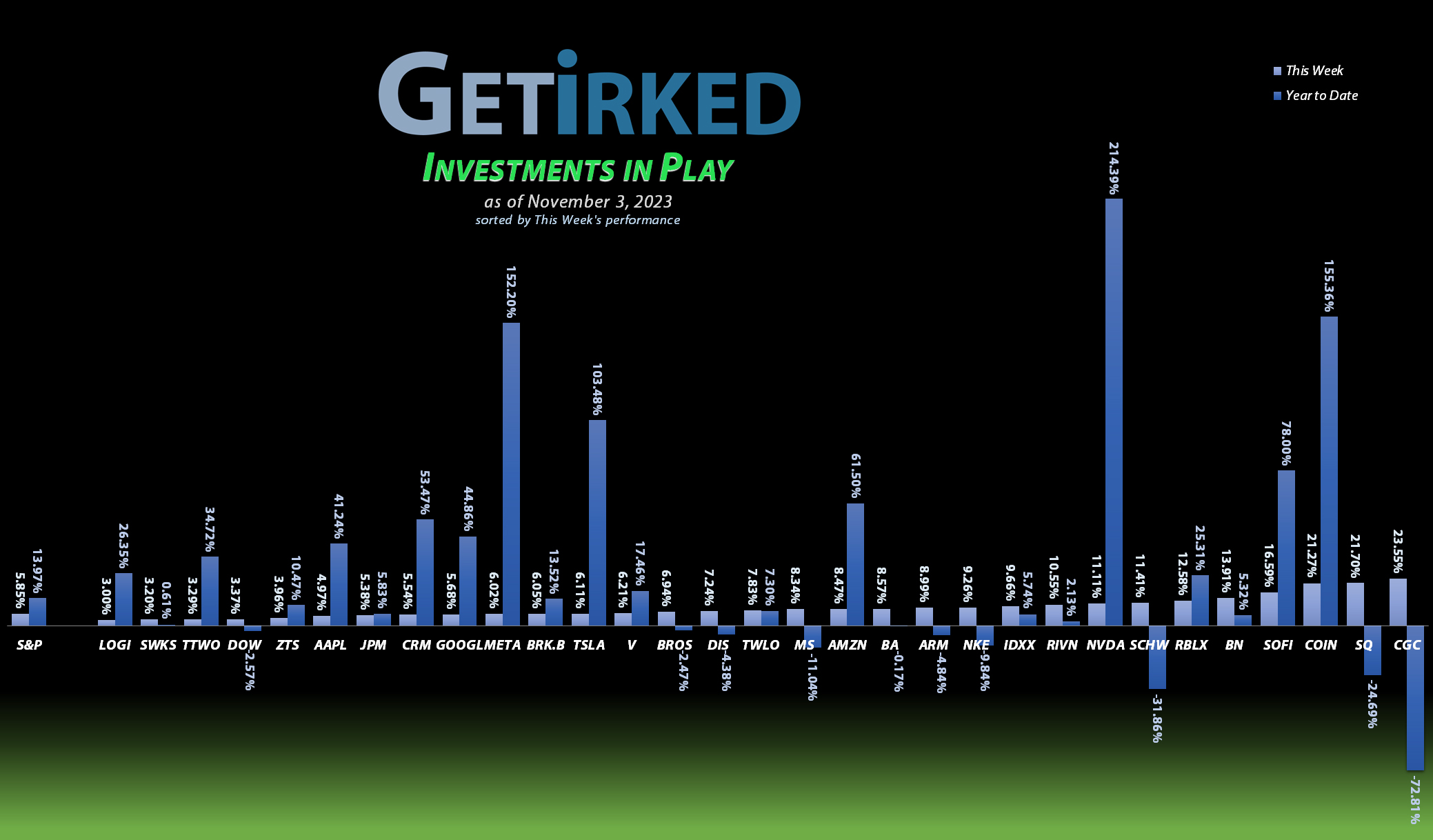

Sometimes, these crazy rallies on the back of surprising news will lift the worst stocks higher than anyone else. That was the case this week when Canopy Growth Corp (CGC) got high on the back of the Fed pause and weak economic numbers, rallying +23.55% and coming in as the Week’s Biggest Winner.

Logitech (LOGI)

You know it’s been a winning week when the the “Biggest Loser” is simply the stock that rallied the least. After reporting a blowout quarter and rallying huge to become last week’s Biggest Winner, Logitech (LOGI) continued to rally this week, but not enough to beat out the next in line, popping another +3.00% this week but only coming in as the Biggest Loser.

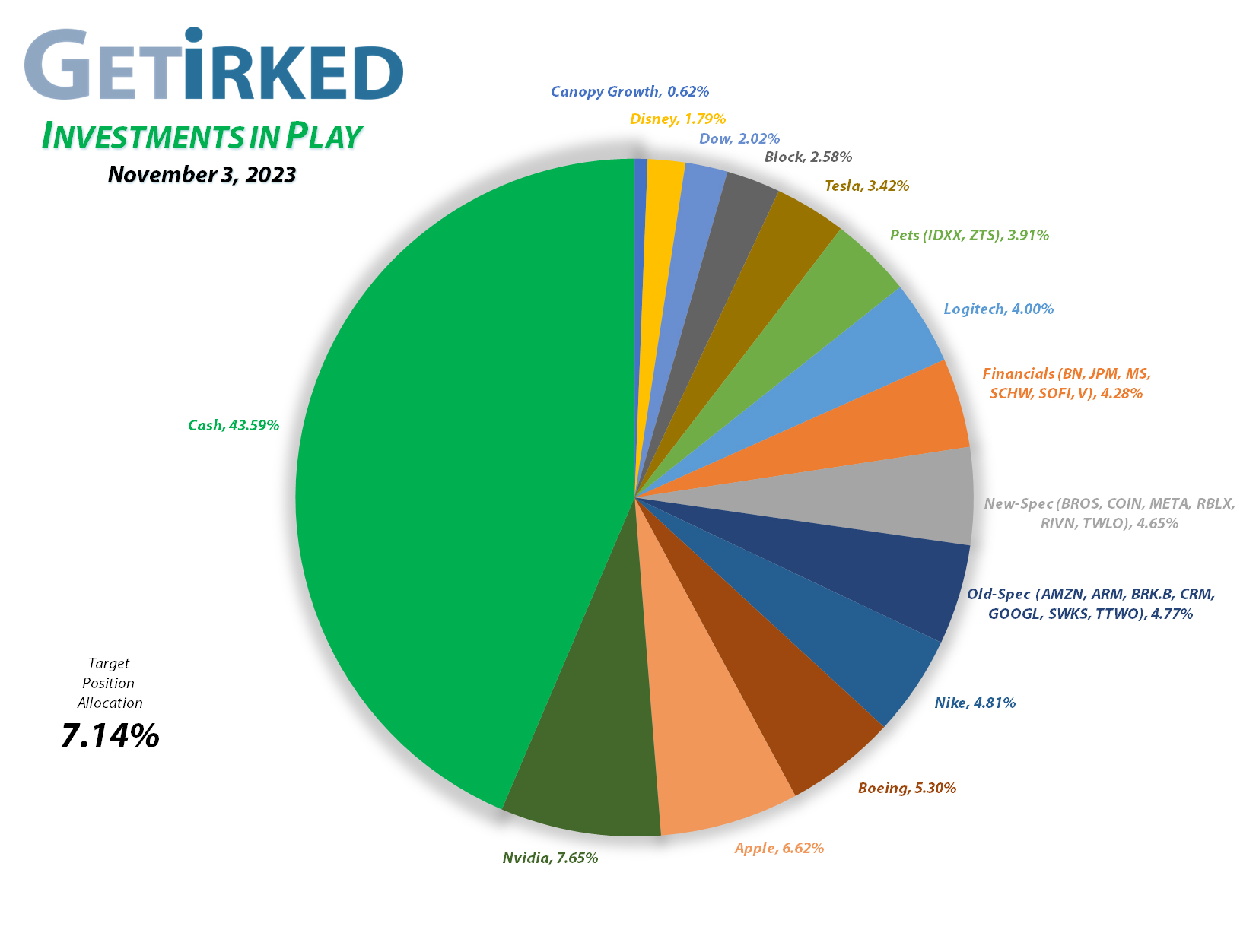

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1478.87%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$259.28)*

Apple (AAPL)

+929.34%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.48)*

Logitech (LOGI)

+661.05%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($3.35)*

Boeing (BA)

+656.75%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+579.25%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+458.08%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$63.41)*

Skyworks (SWKS)

+432.51%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.48)*

Nike (NKE)

+422.82%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

IDEXX Labs (IDXX)

+397.90%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Dow (DOW)

+295.15%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.326)*

JP Morgan (JPM)

+189.72%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.36

Amazon (AMZN)

+182.85%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Disney (DIS)

+147.30%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Salesforce (CRM)

+135.20%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

SoFi (SOFI)

+110.80%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+107.49%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+98.56%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+87.35%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+57.44%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+40.32%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.60

Zoetis (ZTS)

+14.08%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.19

Morgan Stan (MS)

+10.92%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $68.75

Brookfield (BN)

+4.04%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.95

Arm Hldgs (ARM)

+0.64%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $53.15

Schwab (SCHW)

-12.33%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.68

Roblox (RLBX)

-18.48%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.80

Dutch Bros (BROS)

-20.09%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-40.15%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-40.56%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-58.75%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-84.09%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

JP Morgan Chase (JPM): Dividend Reinvestment

JP Morgan Chase (JPM) paid out its quarterly dividend on Halloween (wooo… spooky!). Whenever possible, I set my positions to automatically reinvest their dividends as studies show that positions enrolled in DRiPs (Dividend Reinvestment Programs) typically outperform those where the investor chooses to take the payout as cash to put into the stock at lower levels.

The dividend lowered my per-share cost -0.74%, from $49.73 to $49.36. From here, my next buy target is $102.16, slightly above JP Morgan’s low from 2022, and my next sell target is $159.07, just under the high JPM saw earlier this year.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.