June 28, 2019

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)*

+535.20%

1st Buy 2/14/2012 @ $79.58

Current Per-Share Cost: $0.00*

Square (SQ)*

+523.06%

1st Buy 8/5/2016 @ $11.10

Current Per-Share Cost: $0.00*

Nvidia (NVDA)

+457.65%

1st Buy 9/6/2016 @ $63.10

Current Per-Share Cost: $29.45

Apple (AAPL)*

+390.76%

1st Buy 4/18/2013 @ $56.38

Current Per-Share Cost: $0.00*

Nike (NKE)*

+317.92%

1st Buy 2/14/2012 @ $26.71

Current Per-Share Cost: $0.00*

Disney (DIS)*

+278.63%

1st Buy 2/14/2012 @ $41.70

Current Per-Share Cost: $0.00*

IDEXX Labs (IDXX)

+129.45%

1st Buy 7/26/2017 @ $167.29

Current Per-Share Cost: $120.00

Canopy Growth (CGC)

+121.18%

1st Buy 5/24/2018 @ $29.53

Current Per-Share Cost: $17.50

GW Pharma (GWPH)

+32.89%

1st Buy 7/25/2018 @ $142.28

Current Per-Share Cost: $129.73

Salesforce.com (CRM)

+26.34%

1st Buy 6/11/2018 @ $134.05

Current Per-Share Cost: $120.10

Logitech (LOGI)

+20.46%

1st Buy 11/11/2016 @ $24.20

Current Per-Share Cost: $33.01

Amazon (AMZN)

+17.19%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share Cost: $1,615.85

IBM (IBM)

+15.66%

1st Buy 11/6/2018 @ $120.87

Current Per-Share Cost: $119.23

Citigroup (C)

+14.76%

1st Buy 10/26/2017 @ $74.06

Current Per-Share Cost: $61.02

JP Morgan (JPM)

+10.19%

1st Buy 10/26/2017 @ $102.30

Current Per-Share Cost: $101.47

Xilinx (XLNX)

+9.81%

1st Buy 5/13/2019 @ $111.57

Current Per-Share Cost: $107.39

Pfizer (PFE)

+8.39%

1st Buy 1/28/2019 @ $40.50

Current Per-Share Cost: $39.97

Take Two Inter (TTWO)

+5.29%

1st Buy 7/30/2018 @ $120.99

Current Per-Share Cost: $107.82

3M (MMM)

+0.53%

1st Buy 5/1/2019 @ $188.97

Current Per-Share Cost: $172.42

Dow (DOW)

-1.33%

1st Buy 5/13/2019 @ $53.18

Current Per-Share Cost: $49.98

Kohl’s (KSS)

-3.12%

1st Buy 6/3/2019 @ $50.45

Current Per-Share Cost: $49.08

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

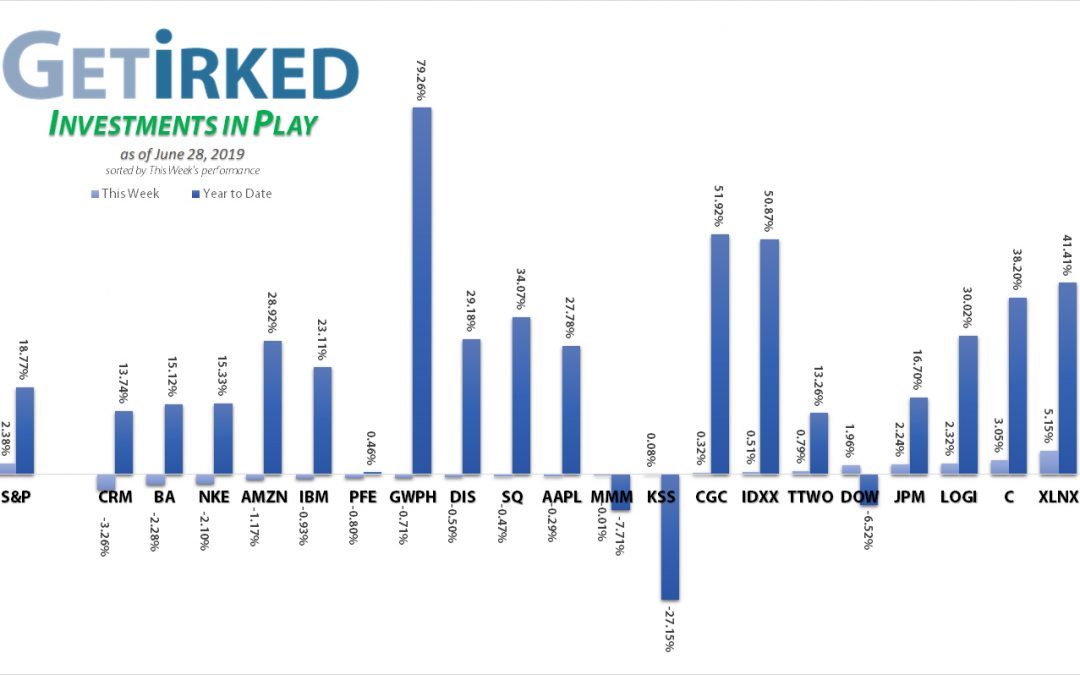

Highlights from the Week

Biggest Winner: Nvidia (NVDA)

Following Micron’s (MU) earnings report where they recognized significant releases in the semiconductor space, all of the sector saw a huge pop including Xilinx (XLNX), Get Irked’s play on the 5G rollout.

However, none saw as big a pop as Nvidia (NVDA) which rocketed skyward to close the week as our Weekly Winner with a +8.22% gain, rounding out a very respectable +25.71% Year-To-Date (YTD) gain.

Biggest Loser: Salesforce.com (CRM)

Salesforce.com (CRM) continues to withdraw following its recent acquisition of Tableau Software, the data analysis firm. CRM pulled back -3.26% and that should be a sign of what a big week it was in the markets because that small retreat earned Salesforce our Weekly Loser recognition.

This Week’s Moves

GW Pharmaceuticals (GWPH): Added to Position

GW Pharmaceuticals (GWPH) pulled back dramatically on no real news during Thursday’s trading, triggering a small buy order we had in place at $165.15 to add to the position from our last sale at $179.84, raising our per-share cost to $129.73.

Our next buy order is slightly above our per-share cost – $131.90 – which is right around a key level of support for the stock.

GWPH closed the week at $172.39, up +4.38% from where we added Thursday.

Want Further Clarification?

As always, if you have questions about any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.