March 10, 2023

The Week’s Biggest Winner & Loser

Apple (AAPL)

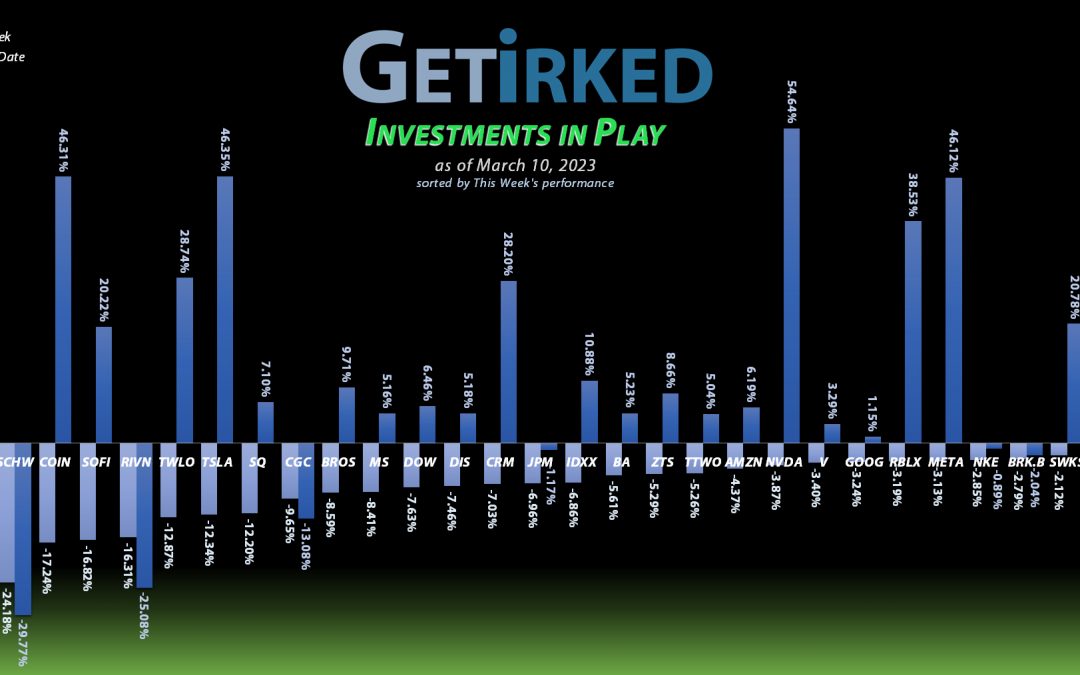

It’s always a rough week when the “biggest winner” is just the “lesser loser.” In this case, it was everyone’s favorite stock darling, Apple (AAPL), which held up remarkably well in this week’s rout, only losing -1.66% where even the venerable S&P 500 index lost -4.55%.

Schwab (SCHW)

It was a bad week to be in the financial sector with crypto bank Silvergate Capital (SI) and startup-funder Silicon Valley Bank (SVIB) both declaring bankruptcy in the same week. However, when JPMorgan (JPM) announced it had a huge “block sale” sell order out on Schwab (SCHW), that’s when things went real crazy for the brokerage. A block sale is when a single large shareholder wants to sell a huge lump of stock… not a good sign.

This made people (including me) wonder if Schwab (SCHW) could be in trouble. While I did add to my small position in the stock, I must admit that I liquidated all of the money market funds I held at Schwab since those are not insured by the SIPC.

Schwab dropped an epic -24.18% this week alone, earning itself the spot of the Week’s Biggest Loser.

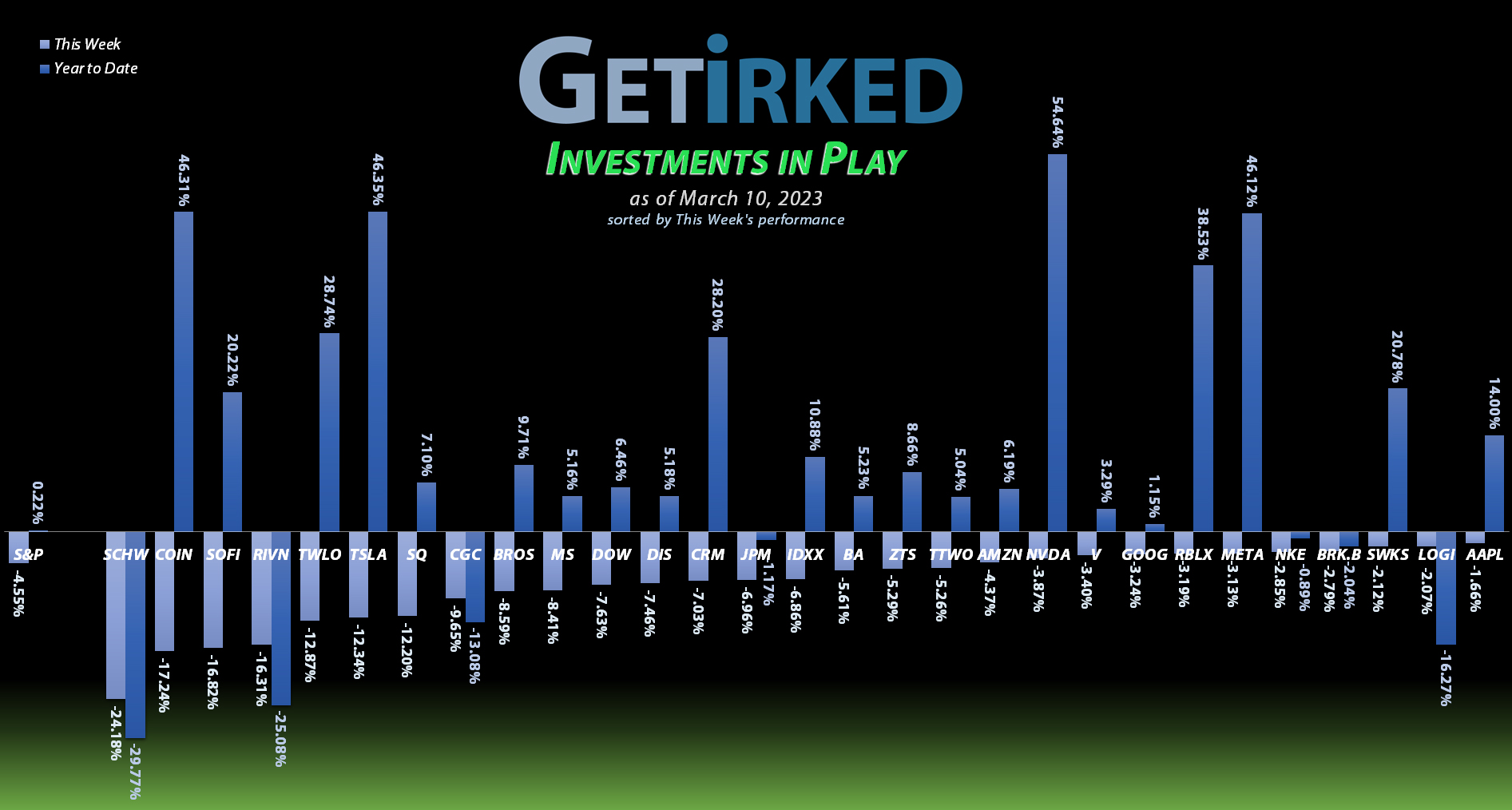

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

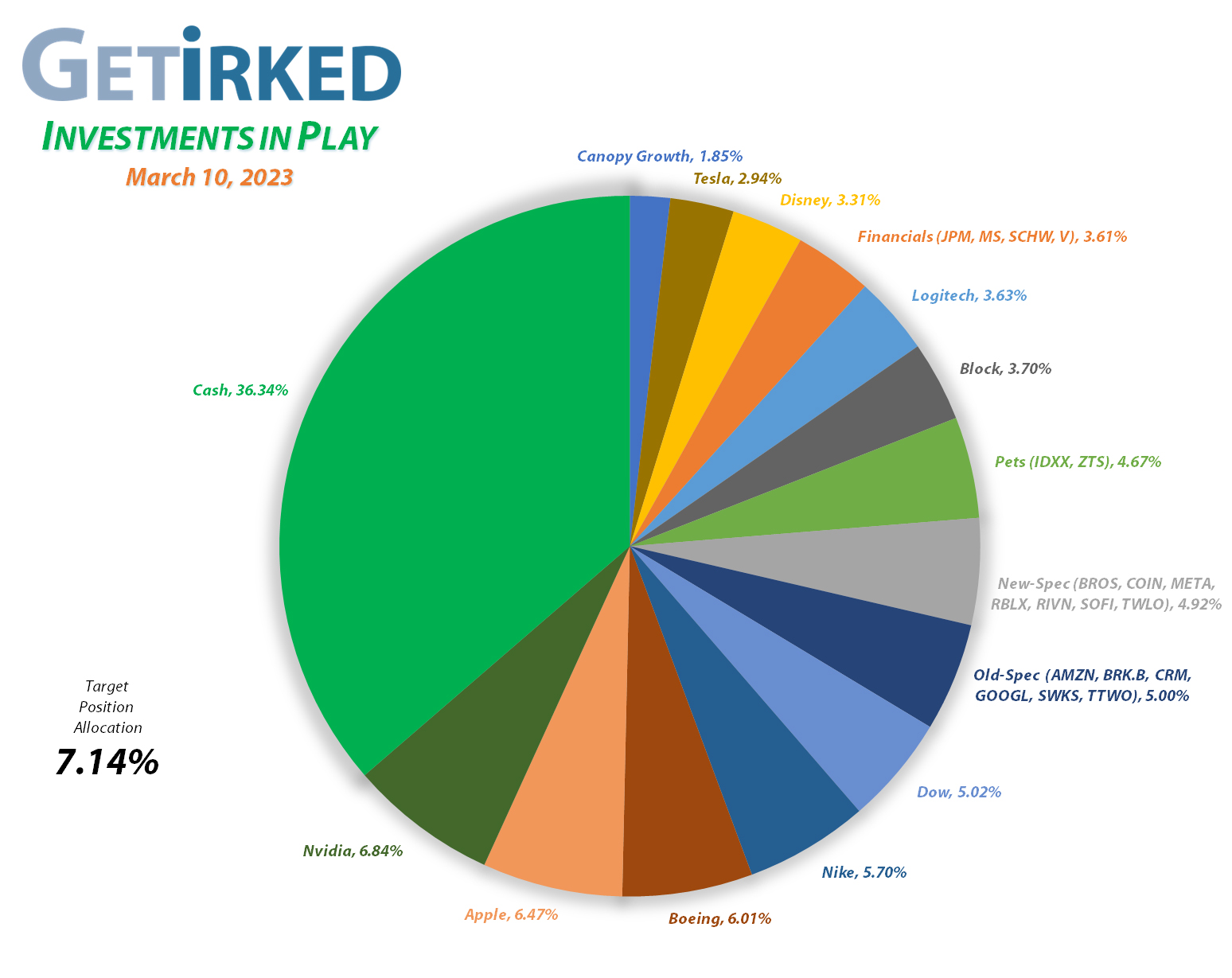

Nvidia (NVDA)

+854.13%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$25.17)*

Apple (AAPL)

+815.69%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+670.73%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+539.71%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+495.62%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Tesla (TSLA)

+478.80%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Nike (NKE)

+456.37%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

IDEXX Labs (IDXX)

+413.55%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Logitech (LOGI)

+394.63%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

Disney (DIS)

+207.29%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+101.29%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+79.30%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $30.05

Meta (META)

+75.47%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+65.17%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Berkshire (BRK.B)

+61.71%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Salesforce (CRM)

+50.92%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Morgan Stan (MS)

+38.66%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

SoFi (SOFI)

+26.82%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Visa (V)

+24.03%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Amazon (AMZN)

+22.45%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Zoetis (ZTS)

+8.84%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.42

Alphabet (GOOGL)

-6.52%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Schwab (SCHW)

-12.19%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $66.85

Roblox (RLBX)

-11.10%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.05

Dutch Bros (BROS)

-12.63%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.95

Twilio (TWLO)

-32.50%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-52.48%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Canopy (CGC)

-54.44%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.50

Coinbase (COIN)

-74.31%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) resumed its downward slide this week, finally triggering my next buy order on Tuesday which filled at $2.21. Since CGC’s approaching its all-time low, I’ve decided to bump up the quantity I bought to lower my per-share cost underneath CGC’s 2022 high.

However, on Friday, Canopy broke through its all-time low, where my next small buy order filled at $2.09, leaving me with an average buy price of $2.20. The combined buys lowered my per-share cost -16.67% from $5.40 to $4.50.

From here, I’m going to be hands-off for awhile as my next buy target will be my last buy at $1.01, and my next sell target is $4.75 just under CGC’s 2022 high of $4.77.

CGC closed the week at $2.05, down -6.82% from my $2.20 average buy price.

Schwab (SCHW): Added to Position

Schwab (SCHW) broke down in spectacular fashion this week after a news story broke that JPMorgan (JPM) had a huge block sell order for Schwab’s stock. A “block sale” is when a single shareholder owning a significant amount of stock decides to sell a large quantity all at once.

Combine that news with weakness in the financial sector and Schwab positively collapsed, dropping through $60.00 on Friday and triggering my next buy order which filled at $59.79. The buy locked in a -27.06% discount on shares I sold less than three months ago for $81.97 on December 23, 2022.

The buy also lowered my per-share cost -2.60% from $68.58 to $66.85. From here, my next buy target is $51.07, above a past point of resistance, and my next sell target is $86.58, slightly under SCHW’s 2023 high.

SCHW closed the week at $58.70, down -1.82% from where I added Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.