March 3, 2023

The Week’s Biggest Winner & Loser

Twilio (TWLO)

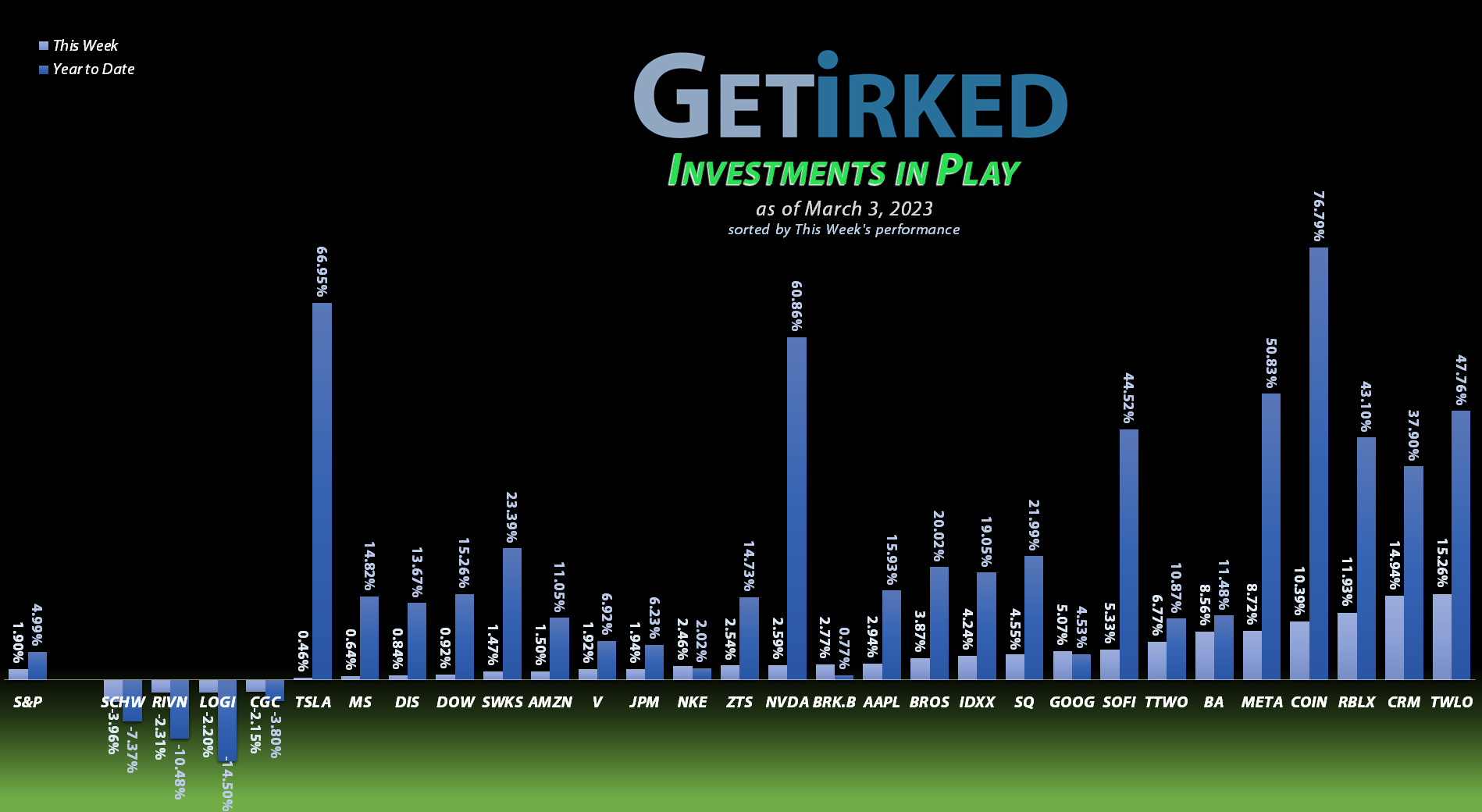

Twilio (TWLO) heads back into the Cloud with a rocketing +15.26% weekly gain, earning itself the spot of the week’s Biggest Winner!

Schwab (SCHW)

Schwab (SCHW) can’t catch a break when yet another analyst downgrades the stock citing poor forward guidance and dismal overall performance. As a result, my favorite stock broke dipped -3.96% on a week when nearly everything else rallied, easily slotting it in as the Week’s Biggest Loser.

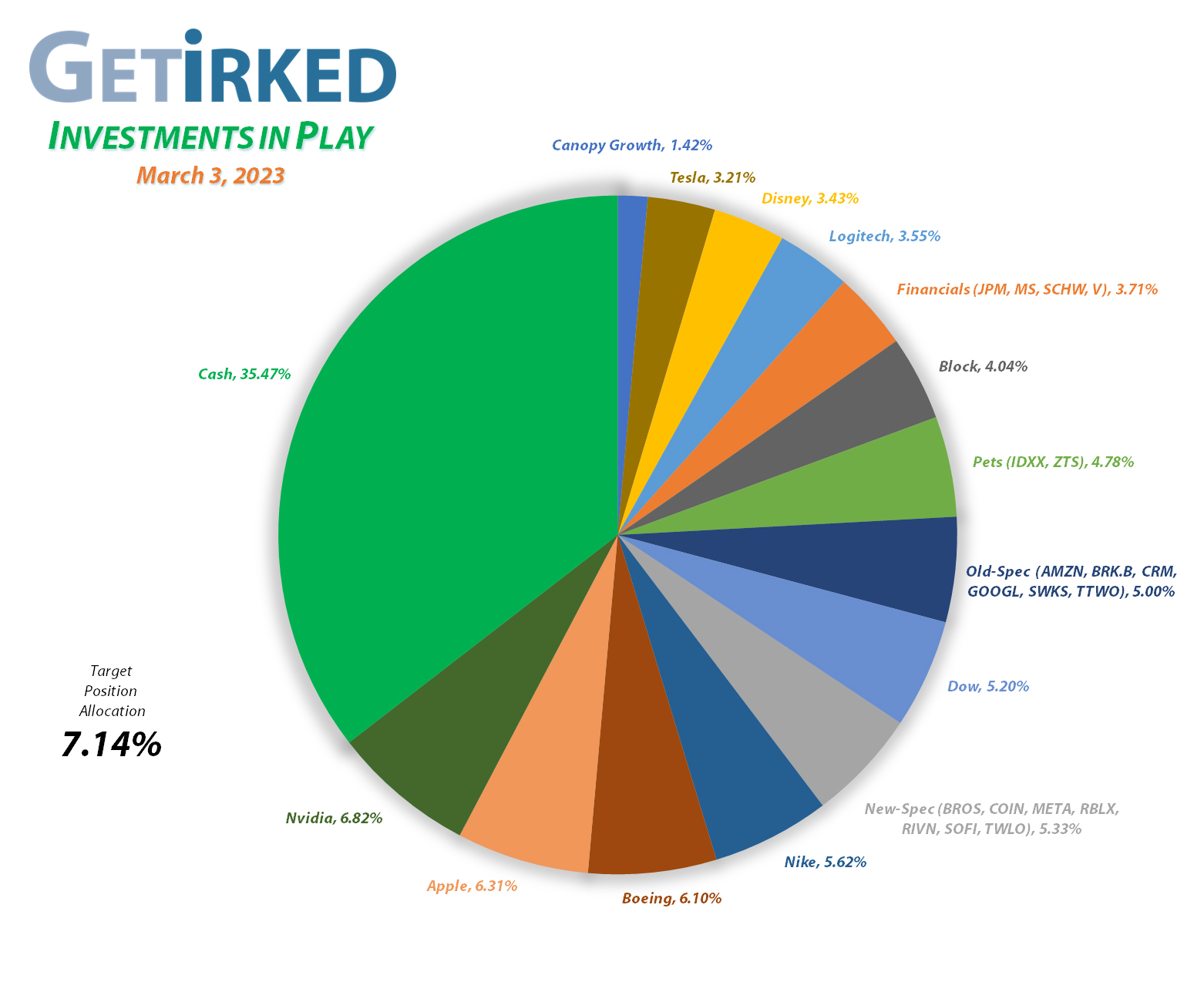

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+885.14%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$25.17)*

Apple (AAPL)

+825.55%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+691.85%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+576.12%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+531.38%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+503.78%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Nike (NKE)

+468.67%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

IDEXX Labs (IDXX)

+433.82%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Logitech (LOGI)

+405.06%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

Disney (DIS)

+232.15%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+116.37%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+94.08%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $30.05

Meta (META)

+77.25%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+74.31%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Berkshire (BRK.B)

+66.40%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Salesforce (CRM)

+62.47%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

SoFi (SOFI)

+52.73%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Morgan Stan (MS)

+51.41%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

Visa (V)

+28.40%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Amazon (AMZN)

+28.07%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Zoetis (ZTS)

+14.92%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.42

Schwab (SCHW)

+12.87%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $68.58

Alphabet (GOOGL)

-3.40%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Dutch Bros (BROS)

-4.45%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.95

Roblox (RLBX)

-8.17%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.05

Twilio (TWLO)

-22.52%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-43.22%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Canopy (CGC)

-57.77%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.40

Coinbase (COIN)

-68.99%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Visa (V): Dividend Reinvestment

Visa (V) paid it out its rather paltry quarterly dividend Thursday night, which only lowered my per-share cost -0.21% from $174.63 to $174.27 after being reinvested. However, anything’s better than nothing.

From here, my next buy target is $174.93 and I have no sell targets until Visa decides where it wants to go next.

Zoetis (ZTS): Dividend Reinvestment

Like Visa (V) above, Zoetis (ZTS) also paid out its rather paltry quarterly dividend on Thursday night. And, like V, Zoetis’ dividend lowered my per-share cost -0.22% after reinvestment from $148.75 to $148.42.

From here, my next buy target is $125.07, slightly above ZTS’ low from 2022, and my next sell target is $182.50, just under the next point of resistance above where Zoetis currently trades.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.