March 11, 2022

The Week’s Biggest Winner & Loser

Dow Chemical (DOW)

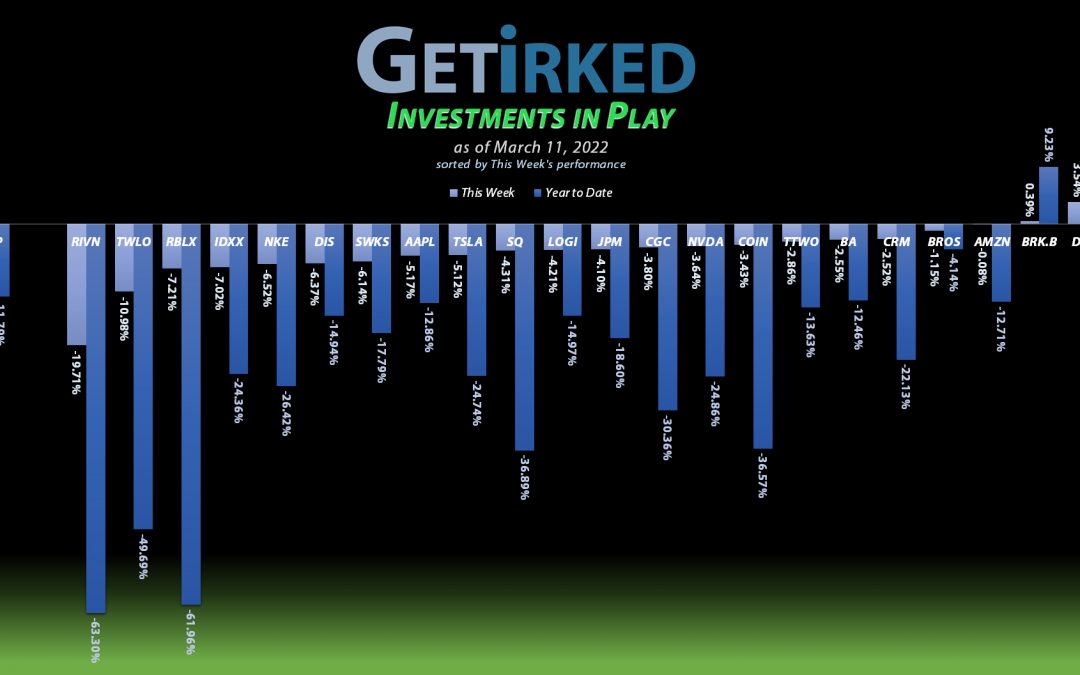

In a world of geopolitical uncertainty, commodities are king, and Dow Chemical (DOW), maker of all things needed to build stuff, reigned supreme in a down week. DOW locked in a meager +3.54% gain for the week which was still more than enough to earn it the spot of the Week’s Biggest Winner.

Rivian (RIVN)

Rivian’s (RIVN) battery died two weeks in a row after reporting an absolutely dismal quarter and giving mediocre forward guidance. Investors shoved the stock down another –19.71%, leaving RIVN down an epic -61.30% Year-to-Date and easily bringing home the title of the Week’s Biggest Loser for the second week running.

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of 11 positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Meta (FB), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

Current Position Performance

Apple (AAPL)

+829.04%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$34.61)*

Nvidia (NVDA)

+815.14%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$22.45)*

Tesla (TSLA)

+681.29%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Block (SQ)

+647.89%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Boeing (BA)

+616.65%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$175.40)*

Logitech (LOGI)

+578.08%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Nike (NKE)

+465.81%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$9.61)*

IDEXX Labs (IDXX)

+455.02%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$52.18)*

Skyworks (SWKS)

+430.63%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

Disney (DIS)

+322.08%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $31.21

Take Two (TTWO)

+305.58%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $50.23

Amazon (AMZN)

+297.64%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $731.95

Salesforce (CRM)

+101.41%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $98.25

Berkshire (BRK.B)

+78.59%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Meta (FB)

+74.64%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

JP Morgan (JPM)

+74.53%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $73.85

Dow (DOW)

+69.25%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

Dutch Bros (BROS)

+20.49%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Twilio (TWLO)

+8.57%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $122.03

Canopy (CGC)

-13.13%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Roblox (RLBX)

-27.87%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $54.40

Coinbase (COIN)

-45.45%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $293.43

Rivian (RIVN)

-52.29%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $79.75

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Added to Position

Amazon (AMZN) was slapped down this week with the rest of the market, triggering a buy order on Monday which filled at $2,811.86. The order raised my per-share cost to $731.95 as I continue adding to the position.

On Wednesday, AMZN announced a 20:1 stock split – its first split since 1999 – which will reduce the share price to around $150. While stock splits add no fundamental value to the position, reducing Amazon’s share price for nearly $3,000 to around $150 will allow more retail investors to jump in and will also likely increase options trading in the position – a win-win for long-term performance.

From here, my next buy target is $2,451.90 and I have no sell targets for my AMZN position at this time since I’m still rebuilding it after closing it entirely before the pandemic selloff in 2020.

AMZN closed the week at $2,910.49, up +3.51% from where I added Monday.

Boeing (BA): Added to Position

With the Ukrainian-Russian crisis causing oil prices to skyrocket, the entire airlines sector got positively slammed and Boeing (BA) was not exempt. On Monday, BA triggered a buy order which filled at $172.66. The buy locked in a -53.293% discount on some of the shares I sold throughout 2018-2019 for an average price of $369.67 and raised my per-share “cost” +9.02% from -$192.80 to -$175.40 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $175.40 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $145.85, above a past point of support, and my next sell target is around $300 when Boeing will have outgrown the target allocation size for my Investments in Play portfolio.

BA closed the week at $176.23, up +2.07% from where I added on Monday.

JP Morgan (JPM): Added to Position

Banks with international exposure like JP Morgan (JPM) sold off hard this week as investors tried to calculate in the potential risk of a bank collapse in Russia.

On Tuesday, JPM triggered a buy order which filled at $128.28, raising my per-share cost +6.15% from $69.57 to $73.85, still a -28.09% reduction from my initial buy at $102.70 way back on October 26, 2017. From here, my next buy target is $112.90 and my next sell target is just under $170.

JPM closed the week at $128.89, up +0.48% from where I added on Tuesday.

Nike (NKE): Added to Position

Nike (NKE) broke down below $130.00 this week, triggering a buy order which filled on Monday at $127.10. The order raised my per-share “cost” +$4.14 from -$13.75 to -$9.61 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $9.61 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $104.50, above a past point of support, and my next sell target is $173.30, below a past high that presented a lot of resistance in NKE’s current bear selloff since its $179.10 all-time high.

NKE closed the week at $122.63, down -3.52% from where I added on Monday.

Rivian (RIVN): Added to Position

Rivian’s (RIVN) precarious collapse continued as investors dumped anything speculative in an attempt to avoid the market-wide slaughter taking place. RIVN triggered a buy order on Tuesday that filled at $41.60 and lowered my per-share cost -6.40% from $85.20 to $79.75.

From here, my next buy target is $35.50, a point of potential support calculated using the Fibonacci Method, and my next sell target is just under RIVN’s current $179.47 all-time high set a few months ago.

RIVN closed the week at $38.05, down -8.53% from where I added on Tuesday.

Roblox (RBLX): Added to Position

Roblox (RBLX) continued selling off with the rest of the Class of 2021 IPOs and SPACs this week, triggering a buy order on Thursday which filled at $39.90. The order lowered my per-share cost -5.56% from $57.60 to $54.40.

From here, my next buy target is $35.80, a price determined using Fibonacci Retracement Method, and my next sell target is under $140, near RBLX’s all-time high.

RBLX closed the week at $39.24, down -1.65% from where I added on Thursday.

Twilio (TWLO): Added to Position

High-flying cloud play Twilio’s (TWLO) fall from grace has been nothing short of catastrophic. Since TWLO’s all-time high of $457.30 set in February 2021, the cloud play has fallen more than –70% to its low this week and shows no sign of stopping. On Tuesday, TWLO filled my next buy order at $138.14.

Just to give you an idea of how nuts this drop has been, my last buy was less than two months ago at $218.00 on January 10, 2022. TWLO has dropped -36.63% just from my last buy. Yikes!

Tuesday’s buy raised my per-share cost +3.42% from $118.00 to $122.03. At this point, my position’s per-share cost is only -2.93% lower than where I initially opened the position two-and-a-half years ago at $125.71 on August 8, 2019. From here, my next buy target is much lower than here (again) at $102.40 and my next sell target is just under TWLO’s $457.30 all-time high set last year.

TWLO closed the week at $132.48, down -4.10% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.