January 7, 2022

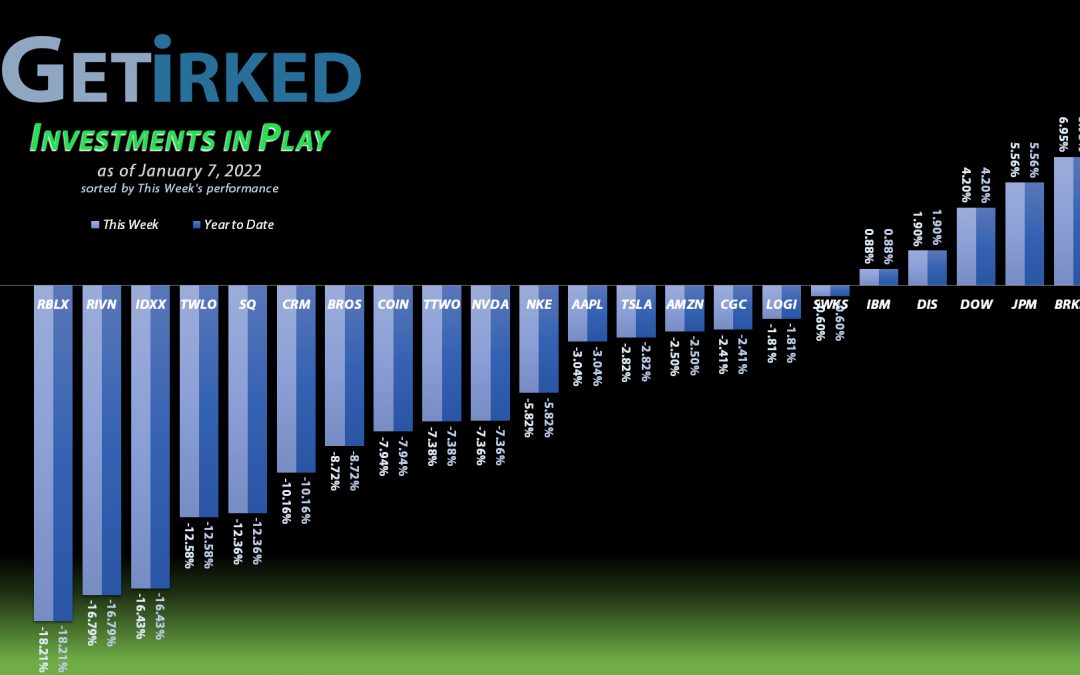

The Week’s Biggest Winner & Loser

Boeing (BA)

Landing itself a giant contract from a previous Airbus customer, Boeing (BA) rocketed into the new year a winner. BA slotted in a +7.04% in a week of red, easily securing the spot of the Week’s Biggest Winner (can Boeing keep it up, however, is the big question…)

Roblox (RBLX)

All the high-flying, brand-new, growth tech stocks were slammed hard this week, with some of the metaverse-focused ones like Roblox (RBLX) getting hit the absolute hardest. RBLX was robbed of an astound -18.21% of its value this week, playing the round as the Week’s Biggest Loser by far.

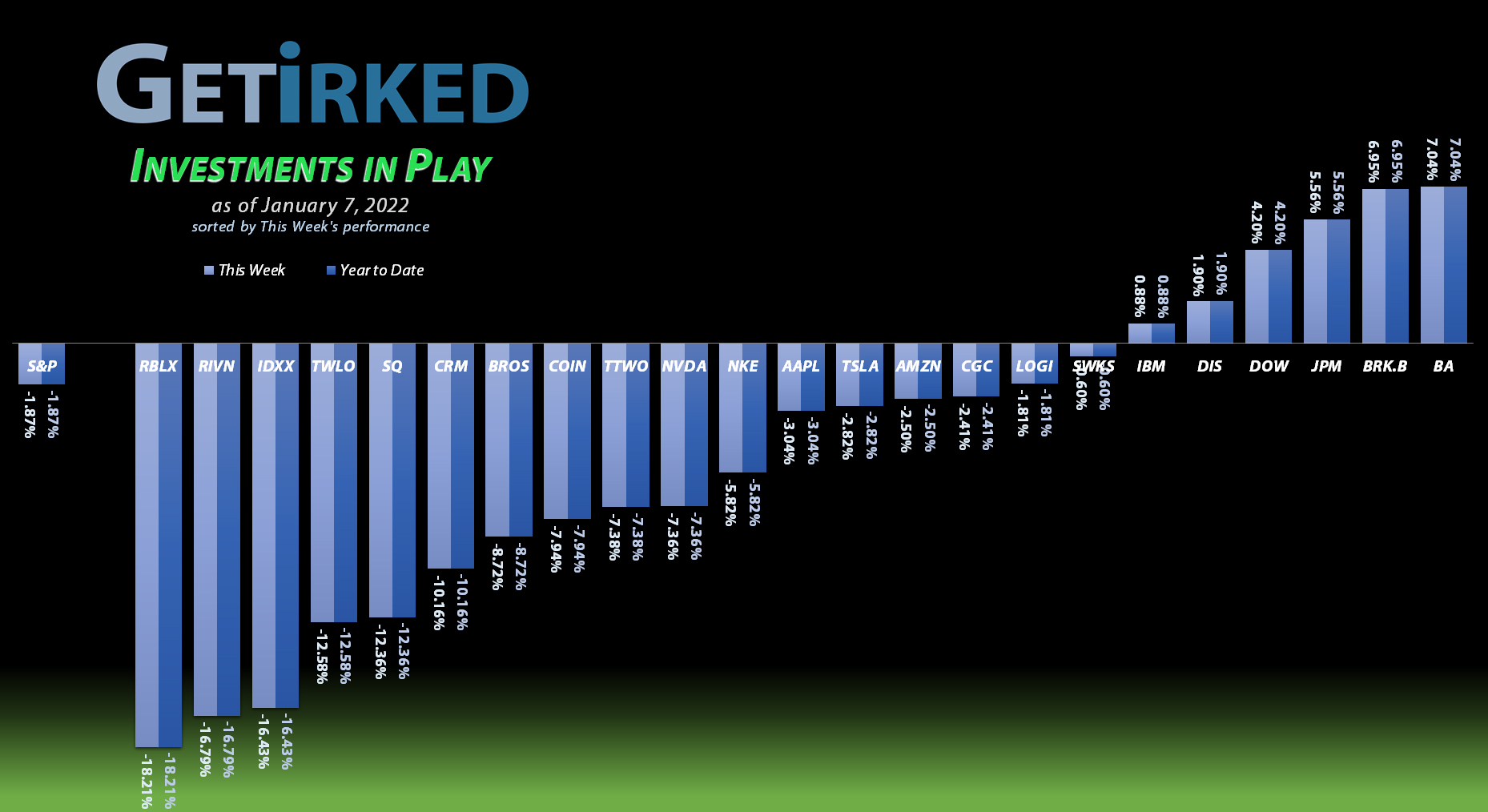

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of nine (9) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), Dutch Bros (BROS), Rivian (RIVN), Roblox (RBLX), Salesforce (CRM), Skyworks Solutions (SWKS), Take Two Interactive (TTWO), and Twilio (TWLO).

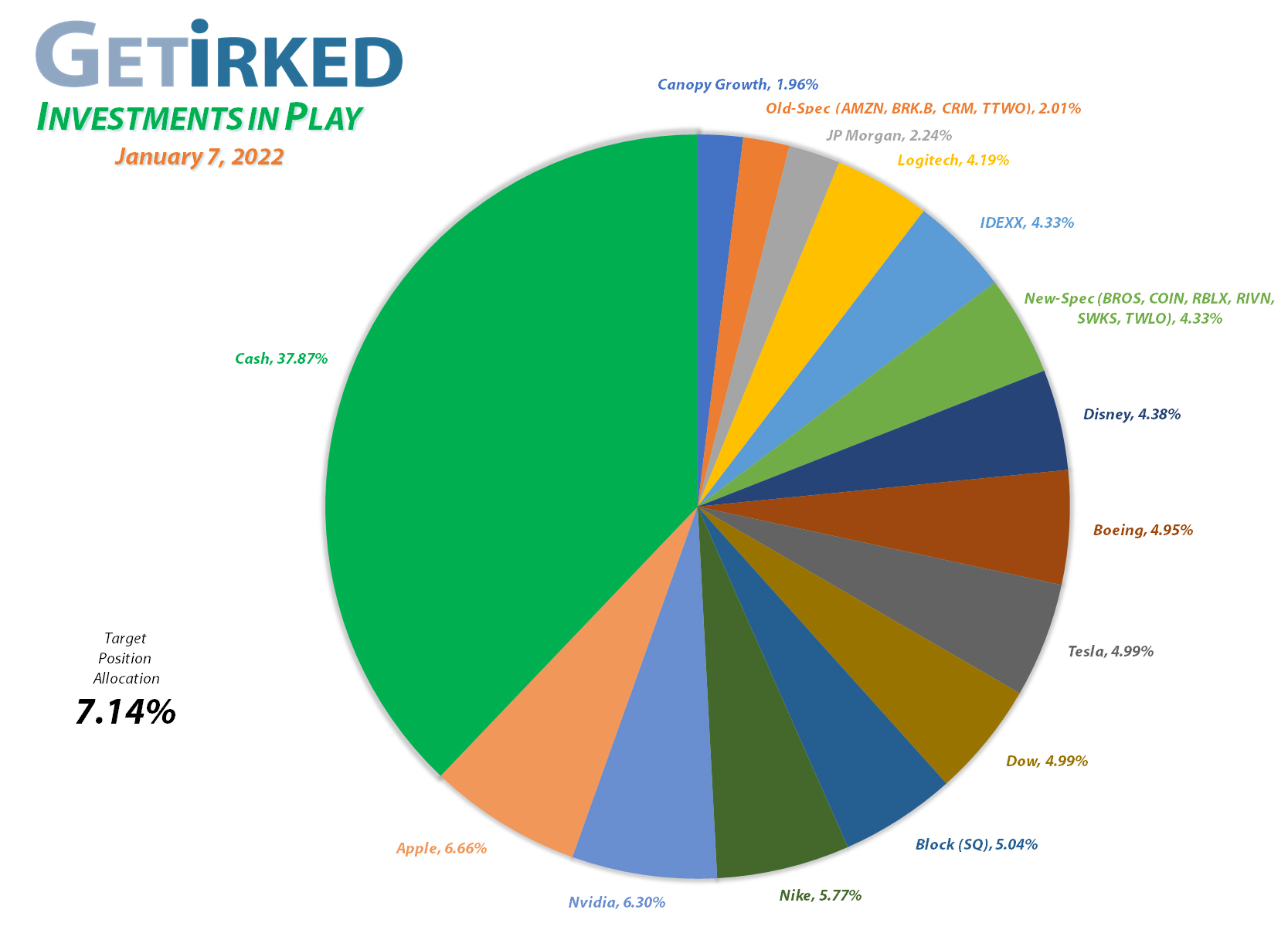

Current Position Performance

Nvidia (NVDA)

+981.40%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$35.20)*

Apple (AAPL)

+902.24%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$40.27)*

Tesla (TSLA)

+857.28%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

Block (SQ)

+769.68%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$107.50)*

Boeing (BA)

+681.94%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$192.80)*

Logitech (LOGI)

+678.20%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $7.45

Nike (NKE)

+583.00%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.88)*

Skyworks (SWKS)

+507.09%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$57.56)*

IDEXX Labs (IDXX)

+497.43%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$60.26)*

Disney (DIS)

+485.65%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $26.95

Take Two (TTWO)

+416.10%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Salesforce (CRM)

+280.52%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Twilio (TWLO)

+171.89%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $84.67

JP Morgan (JPM)

+165.20%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $63.03

Amazon (AMZN)

+135.71%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

Berkshire (BRK.B)

+74.86%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+64.22%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.99

IBM (IBM)

+59.12%*

1st Buy 11/6/2018 @ $120.87

Current Per-Share: -($2.02)*

Roblox (RLBX)

+40.62%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $60.00

Canopy (CGC)

+21.73%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $7.00

Dutch Bros (BROS)

+14.74%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Rivian (RIVN)

-19.93%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $107.75

Coinbase (COIN)

-32.97%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $346.60

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position

Block (SQ) (the company formerly known as Square) lost the support it had been building over the past week on Tuesday, breaking pretty dramatically through $160 and triggering a buy order I had in place at $152.00.

The buy locked in a -29.13% discount on shares I sold up at $214.49 back on December 9, 2020 and raised my per-share “cost” $8.65 from -$116.15 to $107.50 (a negative per-share cost indicates all capital has been taken out of the position in addition to $107.50 per share which is added to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $132.50, slightly below another key point of support, and my sell target is $260.00, near the high of SQ’s last run.

SQ closed the week at $141.54, down -6.88% from where I added Tuesday.

Coinbase (COIN): Added to Position

Following Wednesday’s market-wide selloff, I decided to raise my price target on Coinbase (COIN) as it continued to test the $230 mark, and my buy order was filled on Thursday at $233.04.

My first buy since the day after opening the position back on April 14, 2021, the buy lowered my per-share cost -9.85% from $384.45 to $346.60. From here, my next buy target is $208.10, slightly above its all-time low, and my next sell target is $366.40, slightly below the high of COIN’s last bull rally.

COIN closed the week at $232.33, down -0.30% from where I added Thursday.

IBM (IBM): *Closed Position: +61.93%*

After a spectacular run throughout the end of 2021 and into the start of 2022, I decided it was time to close down IBM (IBM), a position I first opened at $120.87 back on November 6, 2018 when it broke through $140 on Wednesday.

IBM hasn’t been a terrible performer for the past three years, however, it’s been very much stuck in a trading range between $90-$160. Additionally, while management has been showing progress, the experience has very much felt like “three steps forward, two steps back.” Accordingly, I’m no longer interested in holding the position and would rather free the capital to use in other plays in the Speculative Basket where IBM was held.

My sell order filled at $141.69 midday Wednesday, locking in a lifetime gain of more than 60% which annualizes to slightly under 20%/yr. Rather than taking all of the position off the table, I am keeping most of the profits in IBM, however, I will no longer be adding to the position so the remaining shares will be accounted for in the cash position portion of the Investments in Play portfolio.

IBM closed the week at $134.83, down -4.84% from where I closed it.

IDEXX Laboratories (IDXX): Added to Position

On Thursday, IDEXX Laboratories (IDXX) broke through my next price target with a buy order filling at $576.79. On Friday, IDXX continued its selloff, triggering a second order the filled at $553.27, giving me an average buying price of $565.03 between the two orders.

The combined orders lock in a -18.24% discount replacing some of the shares I sold at $691.11 back on July 28, 2021. The buy raises my per-share “cost” +$16.57 from -$76.83 to -$60.26 (a negative per-share price indicates all capital has been removed from the position and each share now adds $60.26 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $508.90 and I have no plans to take profits until IDEXX exceeds the target allocation for the portfolio, currently giving it a selling price near $1,100/shr (so it’s going to be awhile).

IDXX closed the week at $550.30, down -2.61% from my average buy price.

Nvidia (NVDA): Added to Position

Nvidia (NVDA) has held up pretty well during the latest selloffs which prompted me to raise my price target and have a buy order filled on Friday at $274.51. The order locks in a -19.97% discount on shares I sold for $343.03 back on November 22, 2021 and raises my per-share “cost” +$16.19 from -$51.39 to -$35.20 (a negative per-share cost indicates all capital has been removed from the position and each share instead adds $35.20 to the portfolio in addition to the value of each share).

From here, my next buy target is $240.50, above both NVDA’s 150-Day Moving Average and significantly above the key 38.20% Fibonacci Retracement level, from its pandemic lows to its all-time high. My next sell target is $343.50, below NVDA’s current all-time high where my position will once again substantially exceed the target allocation size for the portfolio.

NVDA closed the week at $272.47, down -0.74% from where I added Friday.

Rivian (RIVN): Added to Position

Rivian (RIVN) completely broke down as a result of the market-wide selloff combining with news that Amazon (AMZN), Rivian’s biggest client, would also be working with another EV supplier to get all of the last-mile delivery trucks AMZN needs.

The resulting selloff triggered another buy order I had in place which filled at $83.75 on Thursday, lowering my per-share cost -6.91% from $115.75 to $107.75. From here, my next buy target is $69.00, around one of RIVN’s many rumored IPO prices before it came public. I have no sell targets for this position at this time.

RIVN closed the week at $86.28, up +3.02% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.