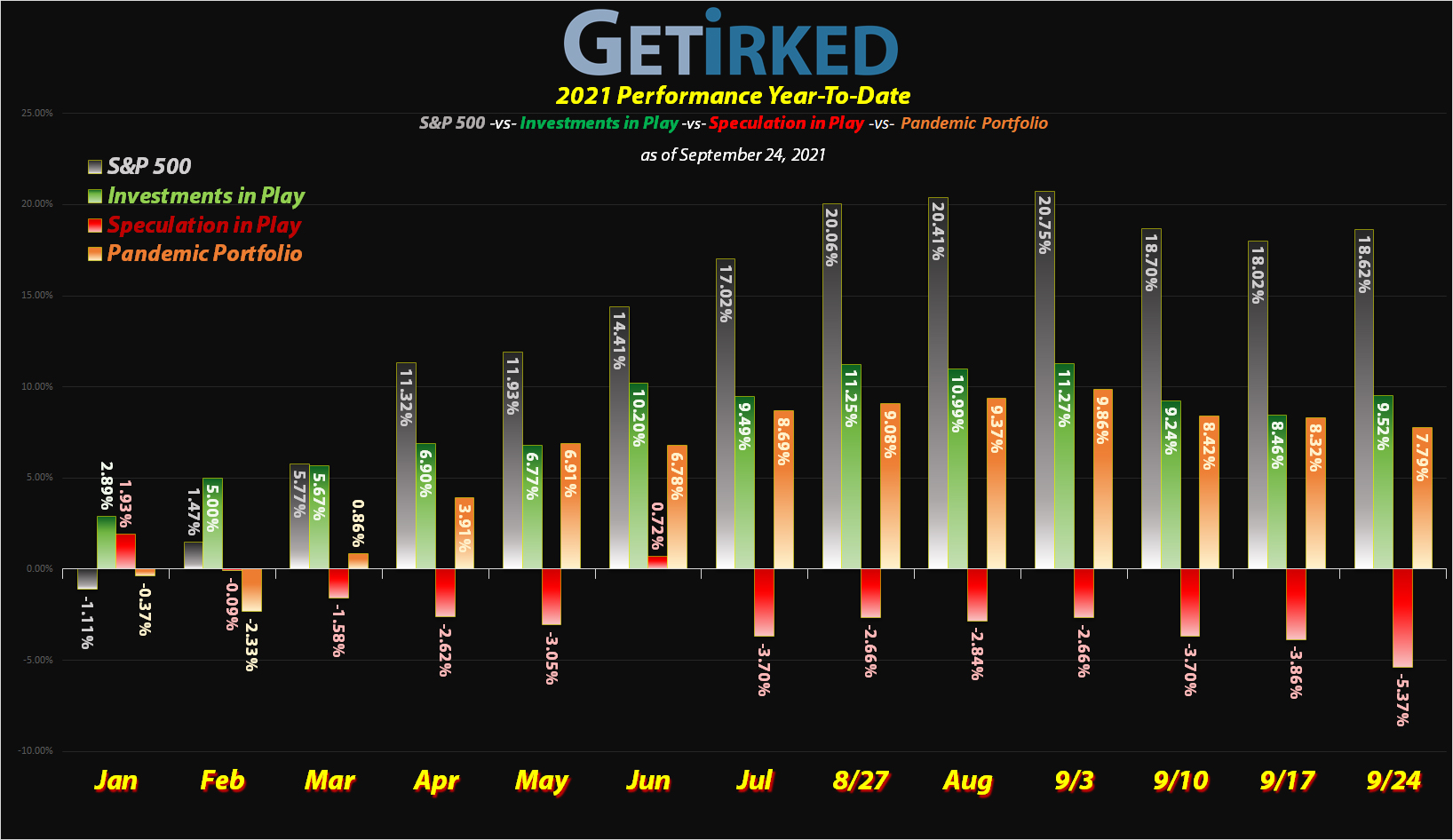

September 24, 2021

The Week’s Biggest Winner & Loser

Dutch Bros (BROS)

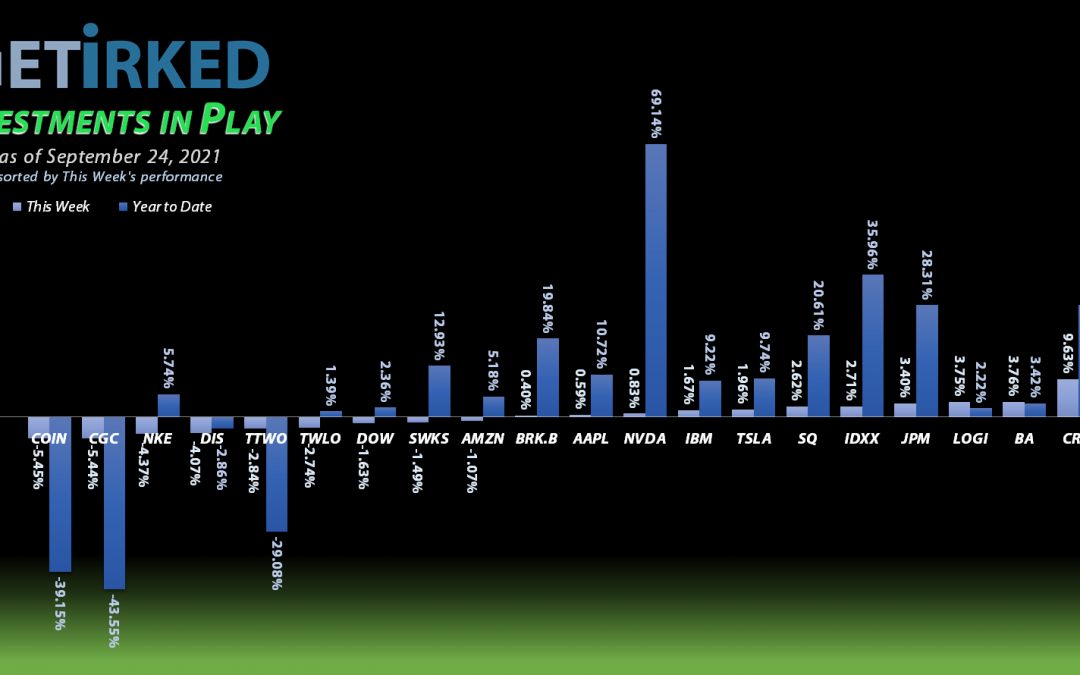

Freshly-brewed Dutch Bros (BROS) coffee-and-drink kiosk company only just came public last week. I picked some up on Monday, and it was off to the races, despite an incredibly volatile week. Starbucks (SBUX) competitor and Pacific Northwest-based BROS rocked the week, earning +21.45% and landing itself the spot of the Week’s Biggest Winner.

Coinbase (COIN)

As goes Bitcoin, so goes Coinbase (COIN), and this week had nothing but bad news for the crypto sector with China cracking down, the SEC saying regulations are in order, and the entire crypto space pooping the bed in an epic way.

The result? COIN sold off -5.45% and locked in the spot of the Week’s Biggest Loser.

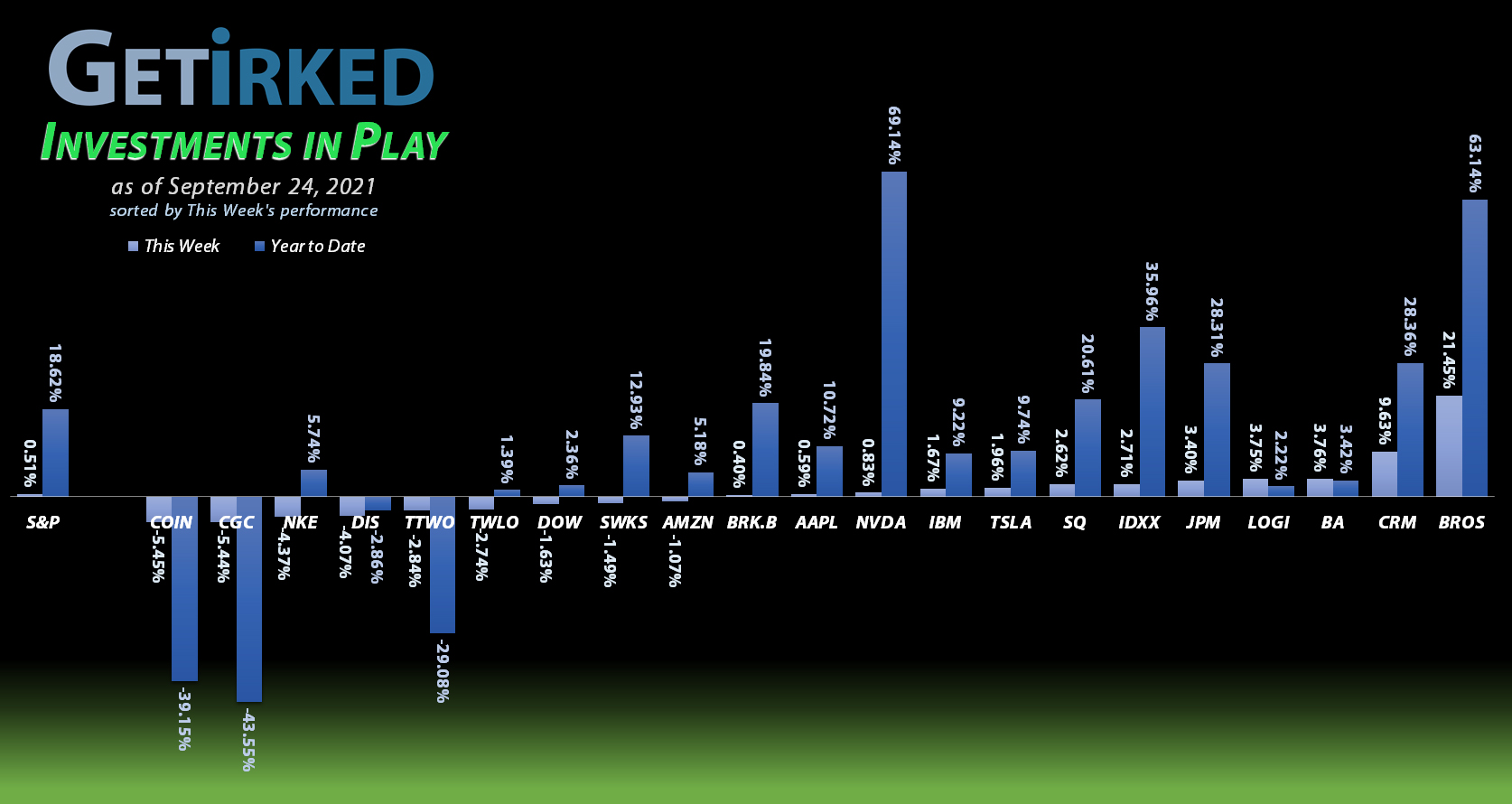

Portfolio Allocation

Positions

%

Target Position Size

The Speculative Basket

The Speculative Basket is made up of seven (7) positions that cumulatively share two target allocations. While I have more faith in these positions than those in my Speculation in Play portfolio (why they’re in this portfolio), I don’t want a full allocation to any of them.

The current basket members are: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Coinbase (COIN), IBM (IBM), Salesforce (CRM), Take Two Interactive (TTWO), and Twilio (TWLO).

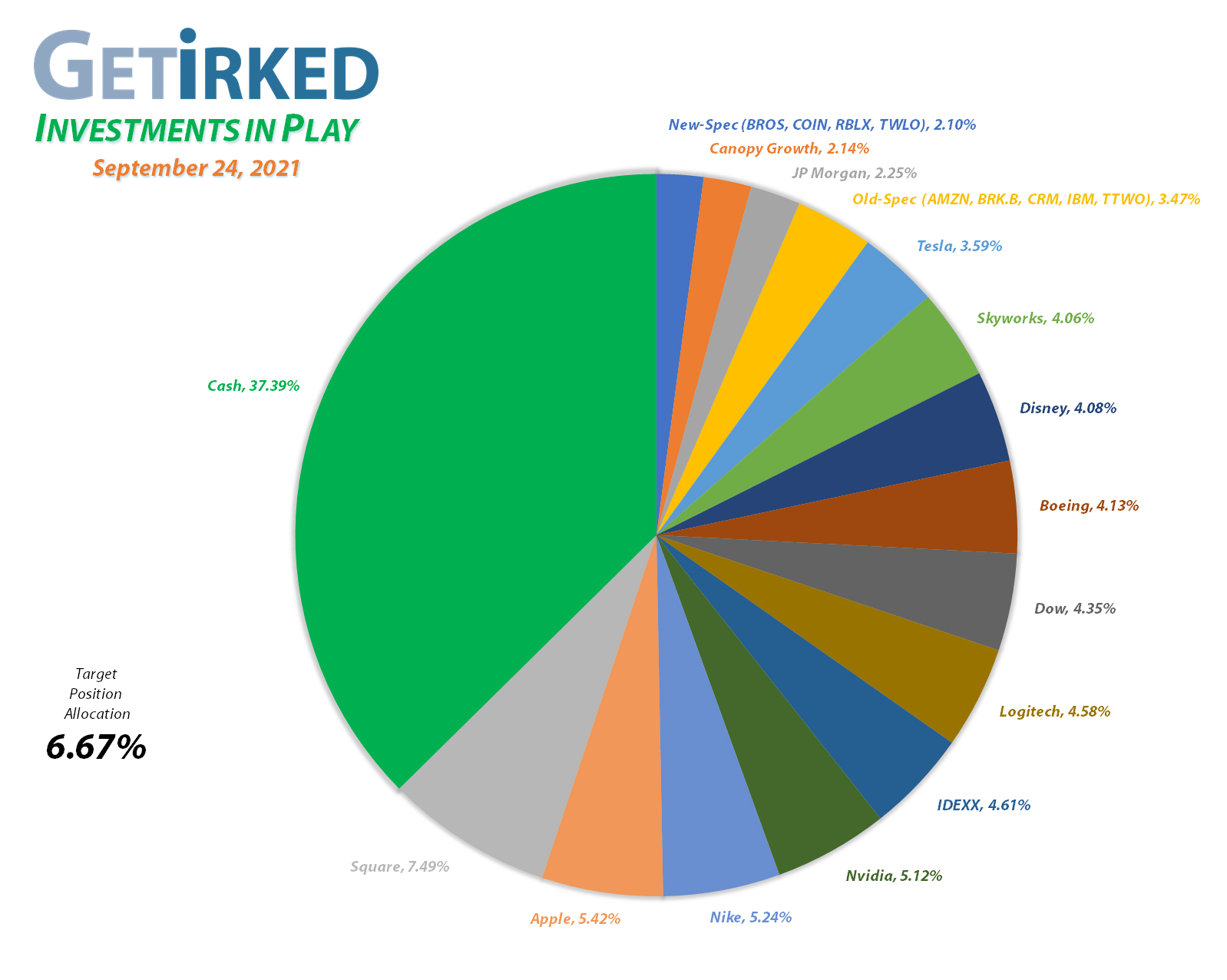

Current Position Performance

Square (SQ)

+1108.25%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$165.05)*

Logitech (LOGI)

+832.34%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $2.65

Apple (AAPL)

+789.25%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$39.20)*

Nvidia (NVDA)

+790.99%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Boeing (BA)

+685.99%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Tesla (TSLA)

+665.49%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+597.11%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$132.83)*

Nike (NKE)

+556.75%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$18.95)*

Salesforce (CRM)

+376.05%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $60.00

Take Two (TTWO)

+372.52%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $39.56

Disney (DIS)

+368.29%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $8.15

Twilio (TWLO)

+190.63%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Canopy (CGC)

+170.10%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.15

Amazon (AMZN)

+141.28%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($995.54)*

JP Morgan (JPM)

+127.70%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $36.00

Skyworks (SWKS)

+109.56%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.39

IBM (IBM)

+68.73%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $81.49

Dow (DOW)

+59.20%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.69

Berkshire (BRK.B)

+51.95%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dutch Bros (BROS)

+25.18%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $42.25

Coinbase (COIN)

-39.70%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Adding more OOMPH to the Speculative Basket…

The more eagle-eyed among my readers may have noticed that my number of positions increased from 14 to 15 this week, decreasing the target allocation size to 6.67% from 7.14%.

The reason for this is that there are more long-term positions that I’d like to add to the Investments in Play portfolio, but, so far, none of them are interesting enough to take up their own allocation; they’re all to speculative.

However, with seven (7) positions already sharing the crowded Speculative Basket, I decided to give the entire basket two (2) allocations to share, so if I do end up adding my two targets – newly-minted Dutch Bros (BROS) and IPO darling Roblox (RBLX) – that the basket will share double the allocation size, having access to two 6.67% blocks instead of one.

As for any positions now exceeding the new target allocation (I’m looking at you, Square (SQ)), I’m going to let them run hot and overweight until my cash position shrinks substantially from its current levels near 40%.

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) sold off with the rest of the market, naturally, since the cannabis sector had been week going into the week. CGC triggered a buy order on Monday that filled at $13.70, raising my per-share cost +9.57% from $4.70 to $5.15.

The order locks in a -68.73% discount on some of the shares I sold during the meme-stock-pop on February 3 at $43.81. From here, my next buy target to add more is $10.40 and my sell target is $51.50.

CGC closed the week at $13.91, up +1.53% from where I added Monday.

Dow Chemical (DOW): Added to Position

After getting positively walloped last week, the beatings didn’t stop for Dow Chemical (DOW) and the rest of the industrial sector this week. On Monday, DOW got positively pounded through my next buy target with an order filling at $56.26 which raised my per-share cost +0.85% from $35.39 to $35.69.

From here, my next buy target is $50.90 and my next sell target is $72.50.

DOW closed the week at $56.81, up +0.98% from where I added Monday.

Dutch Bros (BROS): *New Position*

Dutch Bros (BROS), an incredibly popular Pacific Northwest coffee chain that truly rivals Starbucks (SBUX), went public last week and I’d been keeping my eye on it. After leaping from a $32.42 opening to a high of $54.39 in its first two days of trading, it pulled back to the low $40s.

On Monday, I made my first buy with an opening order at $42.25. From here, my next buy target is $36.65, a recent point of support followed by around its opening bid of $32.42, and lower.

BROS closed the week at $52.89, up +25.18% from where I opened Monday.

Salesforce (CRM): Profit-Taking

It certainly seemed weird to take profits in the middle of such a volatile week, but that’s exactly what happened Friday when Salesforce (CRM) jumped over my sell target with a sale order that filled at $280.80.

The order locked in +27.02% in gains on shares bought back on January 4, 2021 for $221.06, and lowered my per-share cost -47.92% from $115.20 to $60.00. From here, I have no additional sell targets as I let CRM run and my next buy target is $210.00.

CRM closed the week at $285.63, up +1.72% from where I took profits Friday.

Take Two Interactive (TTWO): Added to Position

Even though the markets started to bounce Tuesday morning, Take Two Interactive (TTWO) continued selling off, triggering a buy order that I had in place which filled at $146.81.

The order replaces some of the shares I sold on November 6, 2020 at $177.39, locking in a -17.24% discount and increasing my per-share cost from $26.85 to $39.56, still a -69.38% reduction from my first buy at $129.20 from back on October 9, 2018.

From here, my next buy price target is $119.60 and my next sell target is $214.15, right below TTWO’s all-time high.

TTWO closed the week at $147.36, up +0.37% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.