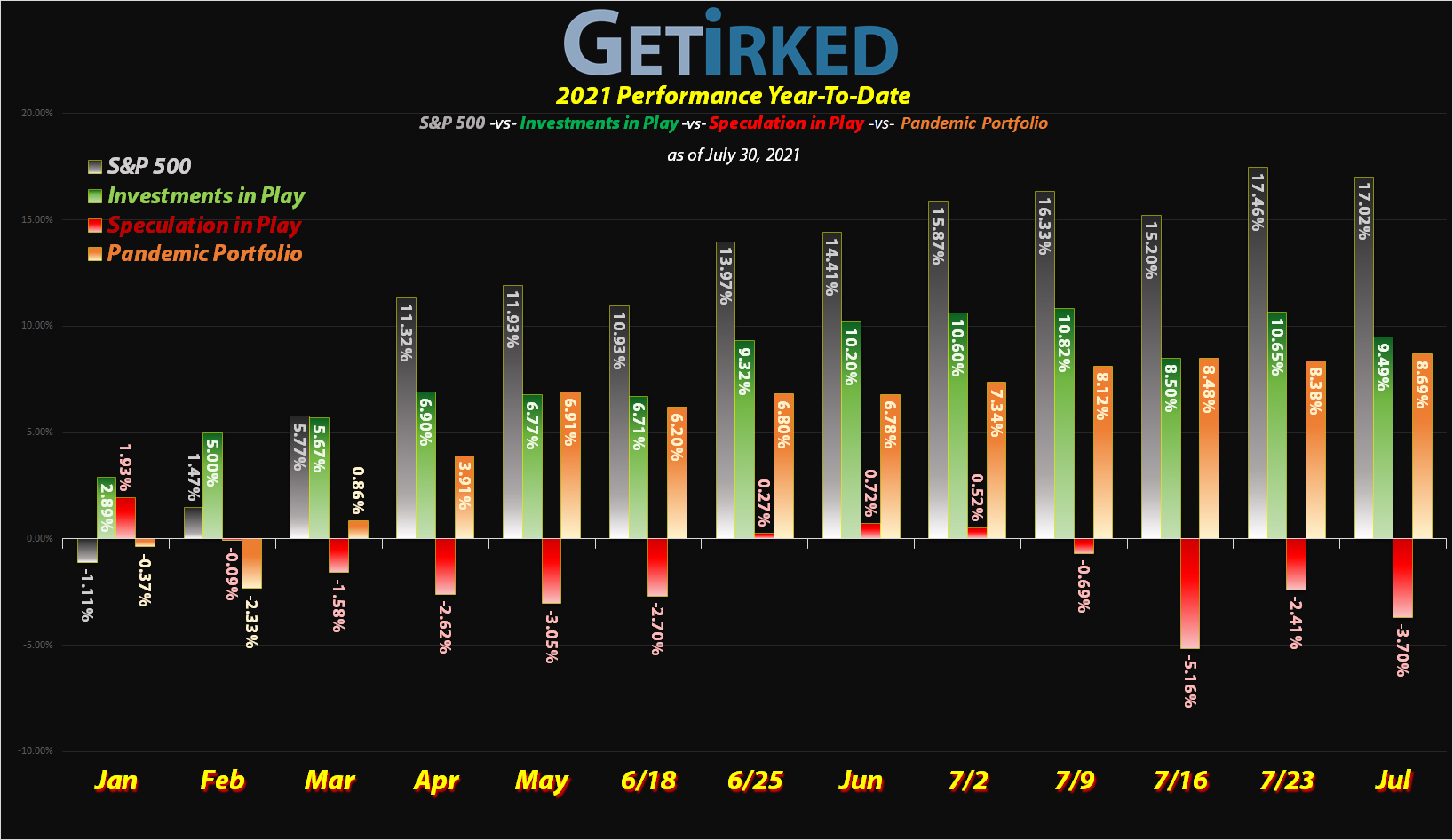

July 30, 2021

The Week’s Biggest Winner & Loser

Tesla (TSLA)

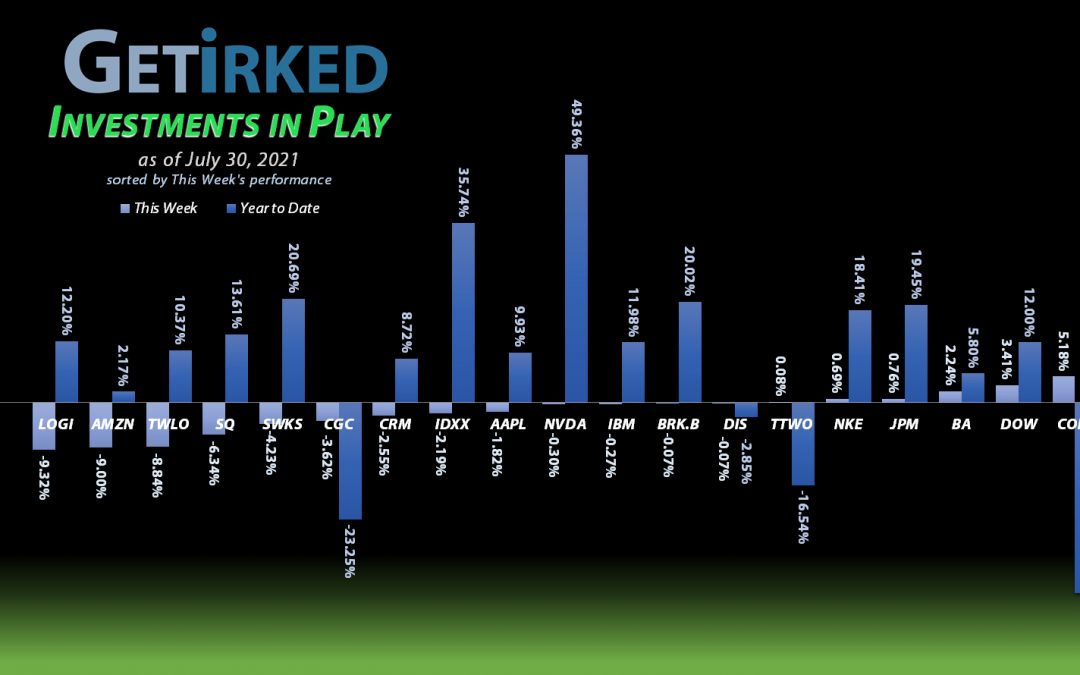

Tesla (TSLA) reported a darn good quarter and even though CEO Elon Musk tried to do his best to shoot himself and his company in the foot by talking about how difficult the car manufacturing business is, investors ignored him and caused TSLA to pop +6.81% for the week and earn the spot of the Biggest Winner.

Logitech (LOGI)

Logitech (LOGI) reported a fantastic quarter, and, yet, somehow plummeted. The reasoning behind the selloff still eludes me. While the CEO refrained from providing guidance, with the Delta COVID variant in full-swing, you’d think the market would believe we’re headed back into remote teaching and learning where Logitech thrives, right? Who knows, but LOGI lost -9.32% this week and that was enough to slide into the Week’s Biggest Loser.

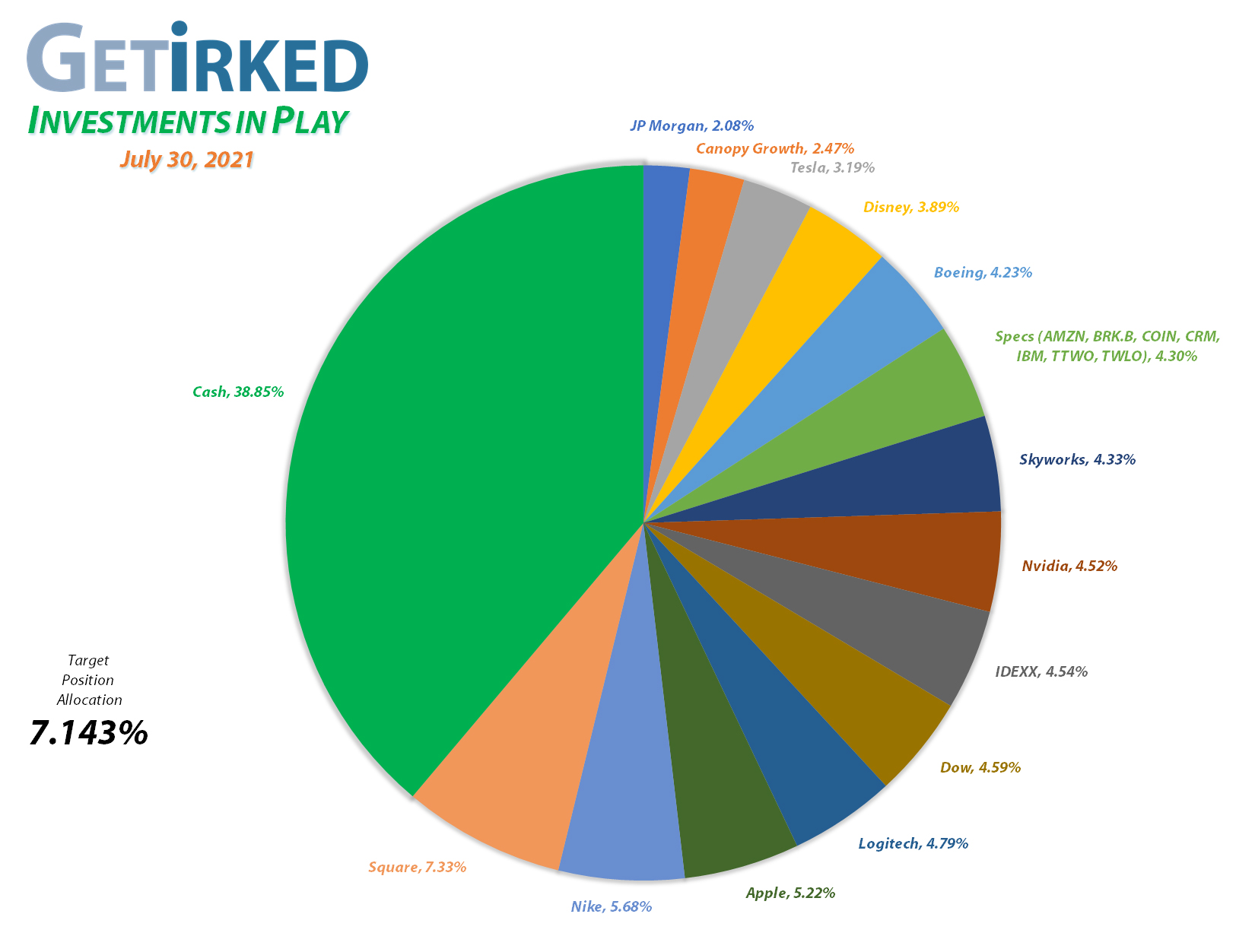

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

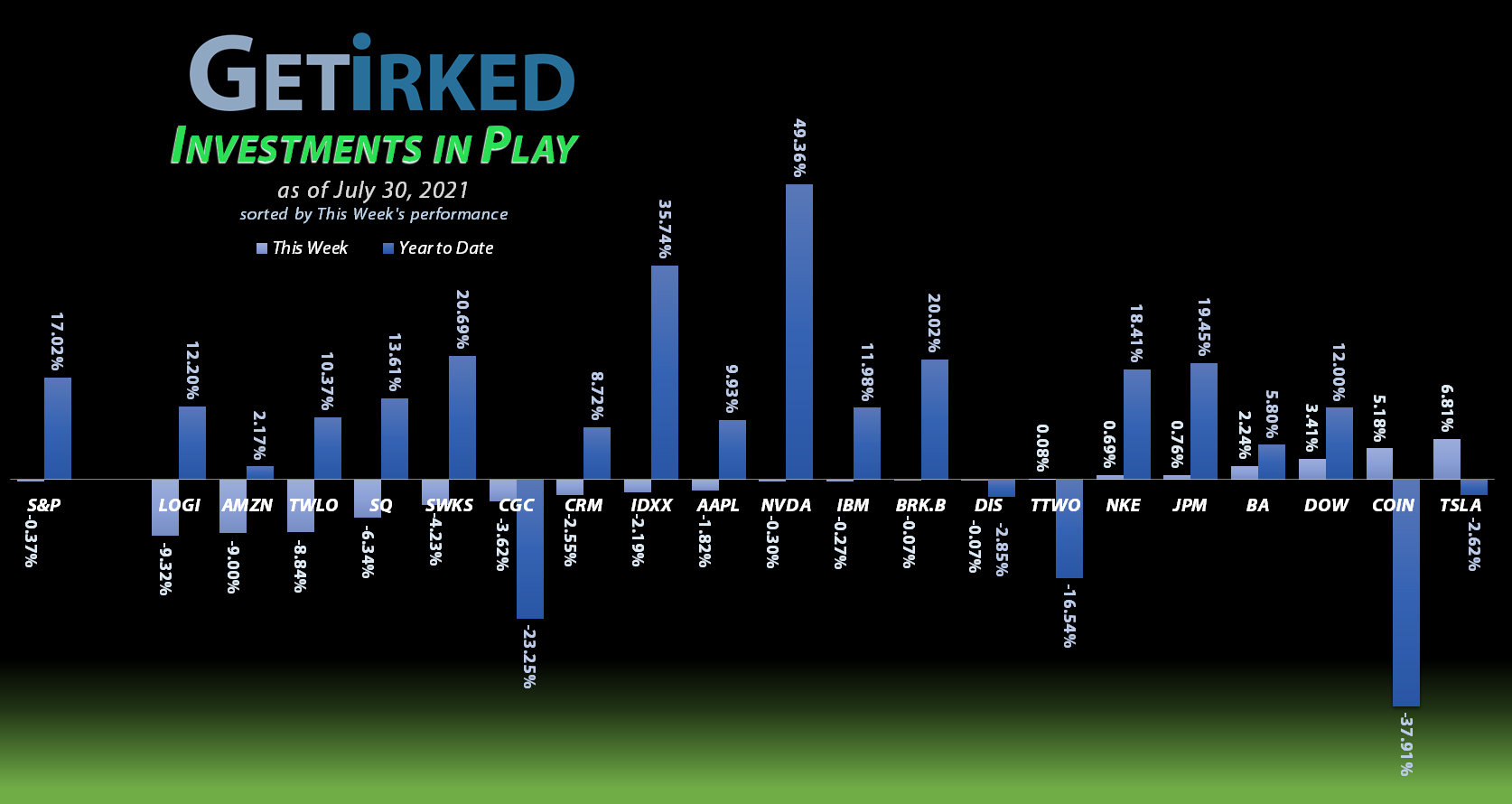

Square (SQ)

+1065.46%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$148.56)*

Logitech (LOGI)

+912.72%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+783.89%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.94)*

Nvidia (NVDA)

+704.57%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$15.50)*

Boeing (BA)

+693.22%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$261.81)*

Take Two (TTWO)

+645.83%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $26.85

Nike (NKE)

+614.91%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.66)*

Tesla (TSLA)

+599.29%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+596.20%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$142.65)*

Canopy (CGC)

+490.94%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.20

Disney (DIS)

+368.03%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Twilio (TWLO)

+206.74%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Amazon (AMZN)

+179.16%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($2249.40)*

Skyworks (SWKS)

+123.25%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

JP Morgan (JPM)

+110.72%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $72.03

Salesforce (CRM)

+110.01%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+104.13%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.06

Dow (DOW)

+74.85%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Berkshire (BRK.B)

+69.72%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-38.46%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Added to Position

After Amazon (AMZN) disappointed with its quarterly report on Thursday after the market closed, I added to the position shortly after the market opened Friday when Amazon plummeted nearly 10% with a buy order that filled at $3,333.33.

The buy raised my per-share cost to -$2,249.40/shr (each share of the position cost no capital and, instead, adds $2,249.40 to the portfolio’s bottom line plus the current value of the share). From here, my next buy target is $2959.90 and I have no sell targets as I am rebuilding this position after completely closing it back in January 2020 (at much lower levels, of course… sigh)

AMZN closed the week at $3,327.59, down -0.17% from where I added Friday.

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corp (CGC) and the rest of the cannabis sector continue to get hit, with CGC triggering a buy order on Tuesday that filled at $19.16. The order replaces some of the shares I sold for $43.81 on February 3, locking in a -56.27% discount on those shares. The order also raises my per-share cost $0.70 from $2.50/shr to $3.20/shr.

Cannabis is truly one of the most volatile sectors I’ve ever been involved in. It’s shocking to look back at my Investments in Play #108 (January 29, 2021) where Canopy Growth was the biggest position in my portfolio with a 6.93% allocation only to have it crash in less than 6 months to less than a 3% allocation.

Given I do believe in the long-term prospects for this company, my next buy target for the stock is $17.60. My next sell target is around $50.85 (obviously, this is a long-term holding along with all the positions in my Investments in Play portfolio).

CGC closed the week at $18.91, down -1.30% from where I added Tuesday.

IDEXX Laboratories (IDXX): Profit-Taking

IDEXX Laboratories (IDXX), my play on the Humanification of Pets theory, has been an absolute outperformer, rocketing more than +40% from the start of the year to hit its all-time high at $696.35.

As much as I believe in the long term thesis, with IDXX near its all-time high as it headed into earnings and overbought on the Relative Strength Index (RSI) on all timeframes including monthly, I decided IDXX was priced for perfection and it was time to take profits.

The last time I sold any of my position was on November 6, 2020 at $470.82, +47.90% away from my sell order which filled at $691.11 on Wednesday. The sale locked in an astounding +352.92% in gains on some of the shares I bought for $152.59 back on August 3, 2017.

Additionally, the sale lowered my per-share “cost” from -$25.25/shr to -$142.65/shr (each remaining share of the position cost no capital and, instead, adds $142.65 to the portfolio’s bottom line plus the current value of the share). From here, my next buy order is $518.20 and I have no additional sell targets at this time as I wait for IDXX to work higher.

IDXX closed the week at $678.53, down -2.56% from where I sold Wednesday.

Nvidia (NVDA): Added to Position

I’ve made some big mistakes with Nvidia (NVDA) over the years and each one had to do with underestimating the sheer powerhouse performance of this company.

Well, no more.

After waiting the hubbub from the 4:1 stock split to finally float away, I put some profits I had taken back into the position when it dipped below $190 on Tuesday with a buy order which filled at $189.26, a discount of -9.34% from NVDA’s all-time high of $208.75 made earlier this year.

Even after this buy, my per-share cost is -$15.50/shr meaning each share cost nothing and, instead, adds $15.50 in profits taken to the bottom line. From here, my next buy target is $155.95 and my next sell target, believe it or not, is $322 (I kid you not).

NVDA closed the week at $194.99, up +3.03% from where I bought Tuesday.

Take Two Interactive (TTWO): Added to Position

Take Two Interactive (TTWO) got hit along with the rest of the video game sector on Tuesday, dipping below $166 where it triggered a buy order of mine that filled at $165.70. The order replaced some of the shares I sold for $177.39 on November 6, 2020, locking in a -6.59% discount on those shares

From here, my next buy target is $140.00 and my next sell target is $216.05.

TTWO closed the week at $173.42, up +4.66% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.