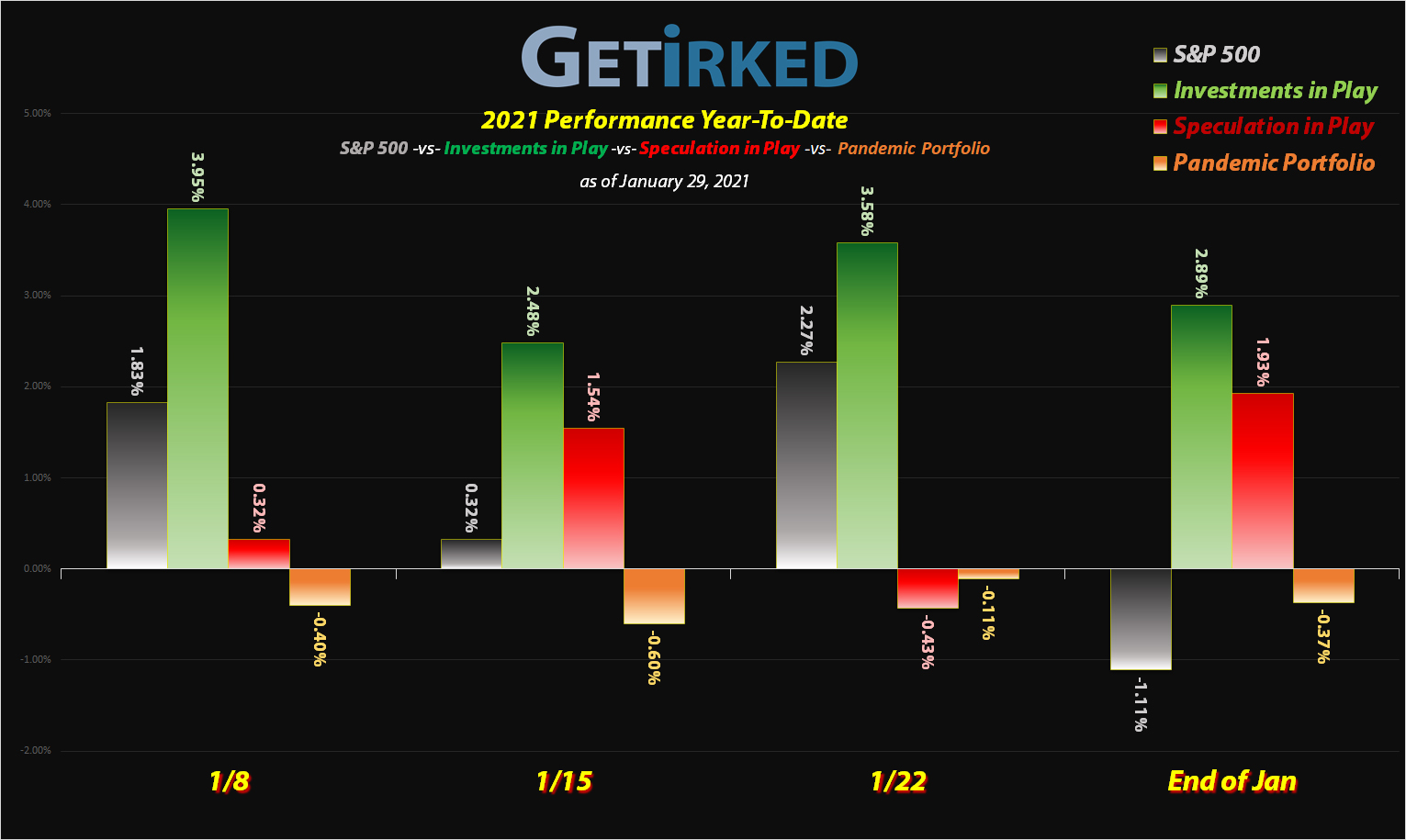

January 29, 2021

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

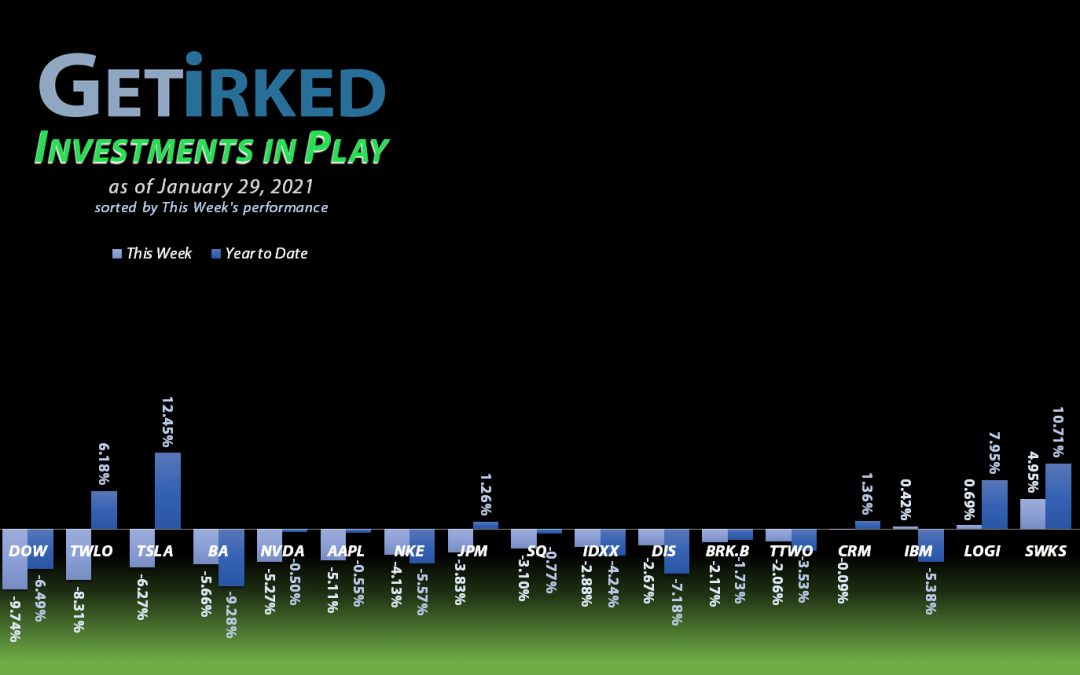

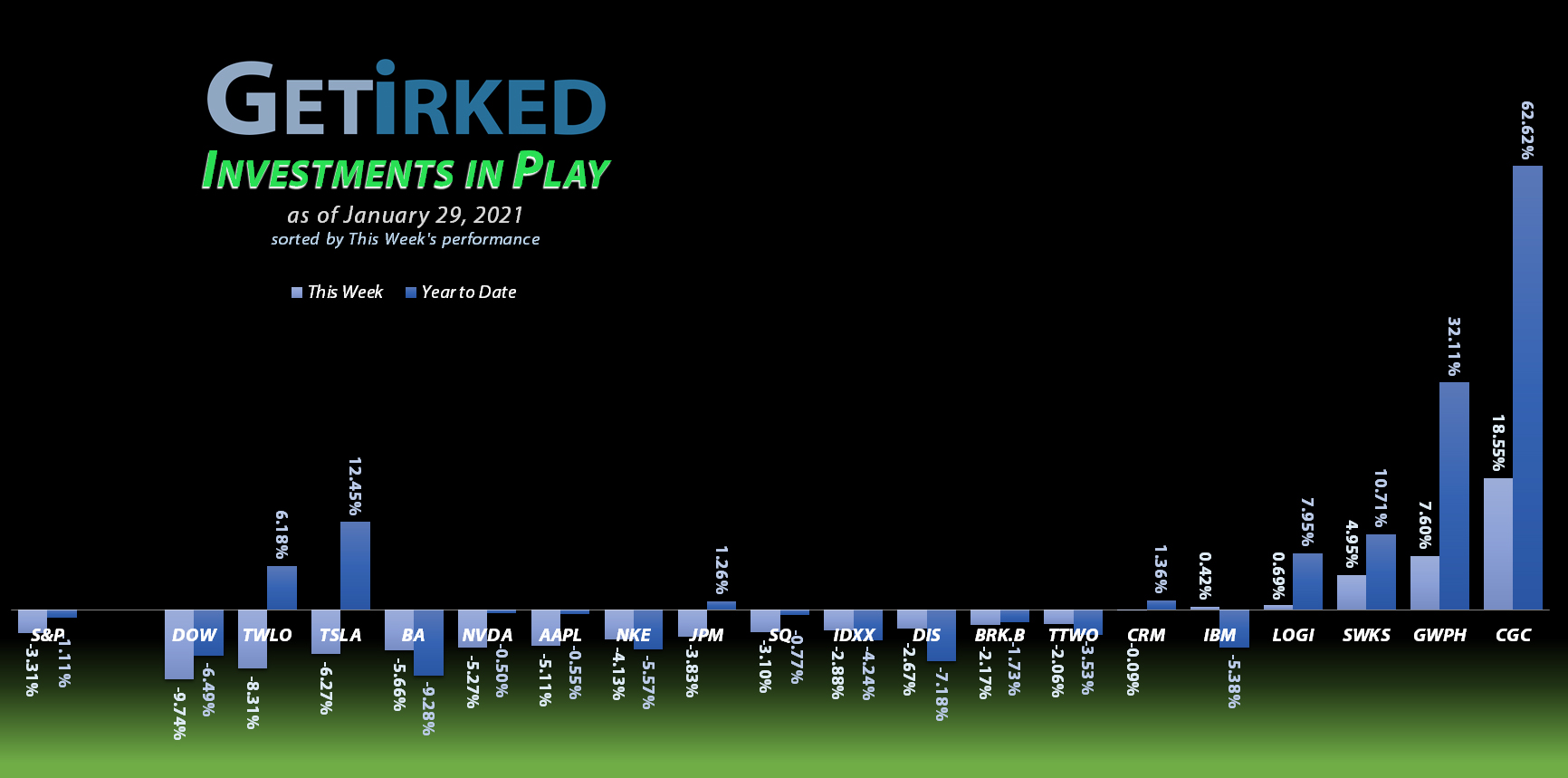

In one of the strangest team-ups ever, Canopy Growth Corp (CGC) announced a partnership with housekeeping mistress, Martha Stewart, causing the stock to gain +18.55% and finish the week as its Biggest Winner in a down market.

Dow Chemical (DOW)

While the entire market sold off this week, the reopening plays took it the hardest, with infrastructure plays like Dow Chemical (DOW) getting positively slammed. DOW lost -9.74% this week to earn itself the spot of the Week’s Biggest Loser.

Portfolio Allocation

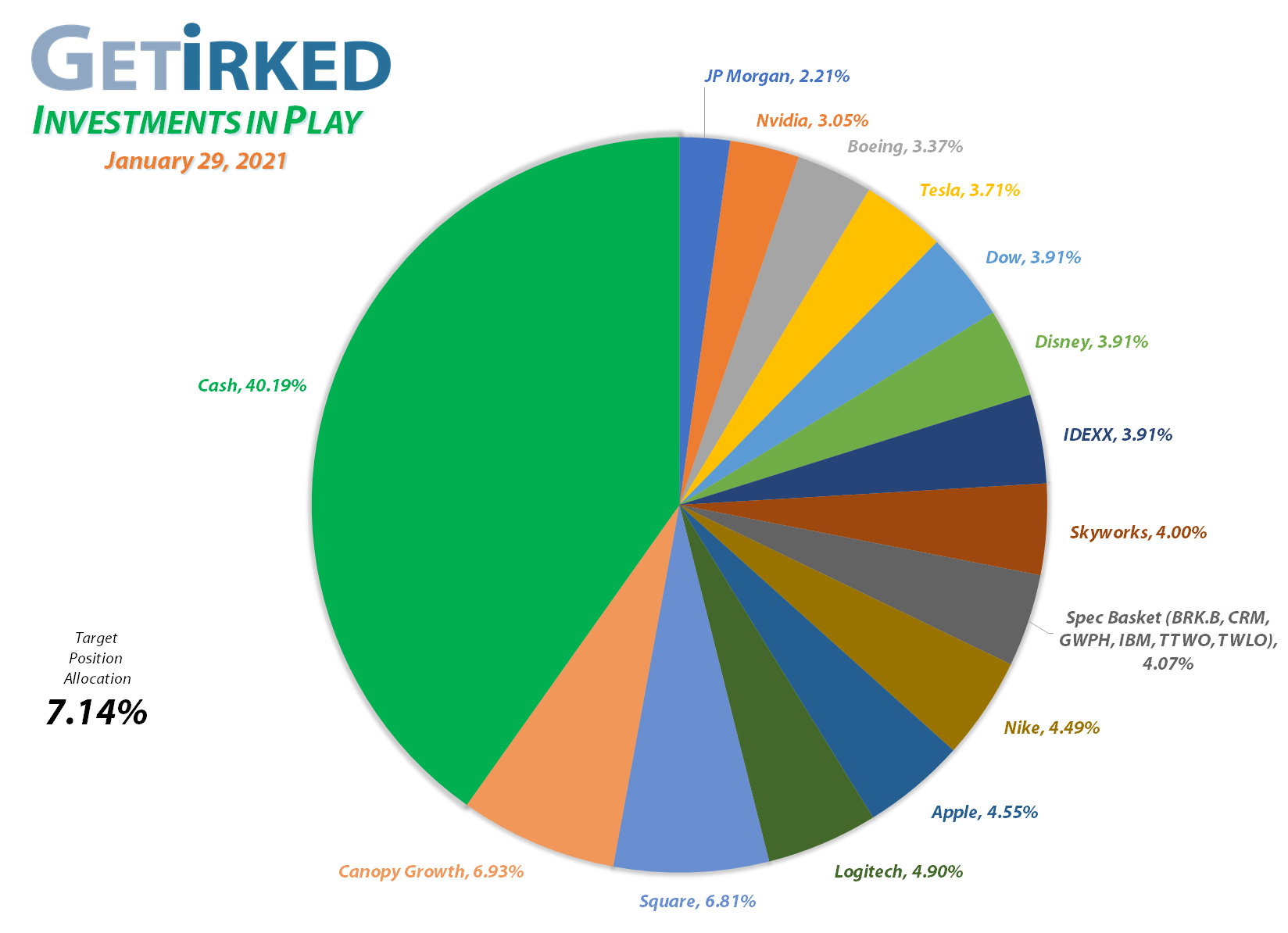

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+958.46%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$140.11)*

Logitech (LOGI)

+878.86%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+722.12%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Tesla (TSLA)

+671.39%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Boeing (BA)

+653.74%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$333.52)*

Nike (NKE)

+503.96%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.48)*

Nvidia (NVDA)

+495.89%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

IDEXX Labs (IDXX)

+425.97%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+352.07%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.00)*

Twilio (TWLO)

+199.23%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Canopy (CGC)

+182.09%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.20

Take Two (TTWO)

+148.82%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

GW Pharm (GWPH)

+116.27%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $70.50

Skyworks (SWKS)

+113.50%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.28

Salesforce (CRM)

+95.80%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+68.49%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

Berkshire (BRK.B)

+60.22%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

JP Morgan (JPM)

+48.90%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.42

Dow (DOW)

+45.58%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.65

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Boeing (BA): Added to Position

On Monday, Boeing (BA) lost support and dropped through my price target which filled with a buy order at $203.41. Despite being the absolute biggest loser of the portfolio in 2020, I believe BA has some significant prospects in 2021 having gotten its top-selling plane, the 737-Max, back in the airspace’s good graces and with China in desperate need of new jets (plus, the need to look good to a new U.S. administration) the prospects of new orders to replace aging fleets is high.

Boeing is my biggest all-time winner, having earned in more realized gains than any position in the portfolio, so I have no problem adding in here, down -16.66% from its recent $244.08 high, even though my last buy was -37.57% lower from here on May 4 at $126.99.

Monday’s buy replaces a few of the shares I took profits on from September 2018 to May 2019 at an average price of $369.67, capturing +44.98% in gains on the difference between what I sold the shares for and the $203.41 where I’m buying them back. The buy also “raises” my per-share cost +10.42% from -$372.32 to -$333.52 (the negative per-share price means each share I hold of Boeing cost the portfolio no capital and, in fact, adds $333.52 in realized profits to the bottom line).

From here, my next price target to add more is $178.75 and I won’t be reducing the position until Boeing approaches its all-time high near $450. (Yes, I’m a loooonggg-term investor when it comes to Boeing, having initially opened the position on February 14, 2012 at $79.58)

BA closed the week at $194.19, down -4.53% from where I added Monday.

GW Pharmaceuticals (GWPH): Profit-Taking

GW Pharmaceuticals (GWPH) once again made its way into the $140s on Monday, triggering a sell order I had in place to reduce the position which filled with a sell order at $143.55.

Instead of following its range-bound trading between the low $110s and low $140s, GWPH rocketed higher on Wednesday, triggering a second sell order I had in place which filled at $162.26, giving me an average selling price of $152.90.

The combined sales lowered my per-share cost -22.61% from $91.10 to $70.50, and locked in +67.84% in gains.

I still have long-range goals for this stock, so my next selling price target is $174.25. I won’t add back into it unless it drops back below $90, a feat it just did a few months ago.

GWPH closed the week at $152.47, down -0.28% from my average selling price.

Square (SQ): Added to Position

Much like many of the other stocks in this portfolio, Square (SQ) has been trading in a range between slightly under $210 and slightly over $240 for the past few weeks and months. Accordingly, I added back into the position on Monday when SQ triggered a buy order that filled at $215.92.

The buy replaced shares I sold for $241.69 back on December 22, 2020 and locked in +10.66% in gains. It also “raised” my per-share cost for the position +8.90% from -$153.80 to -$140.11 (each share in the portfolio costs no capital and actually adds $140.11 in profits to the bottom line).

From here, my next buy target is $198.25, a past point of support, and my next sell target is near $250.

SQ closed the week at $215.96, up $0.04 from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.