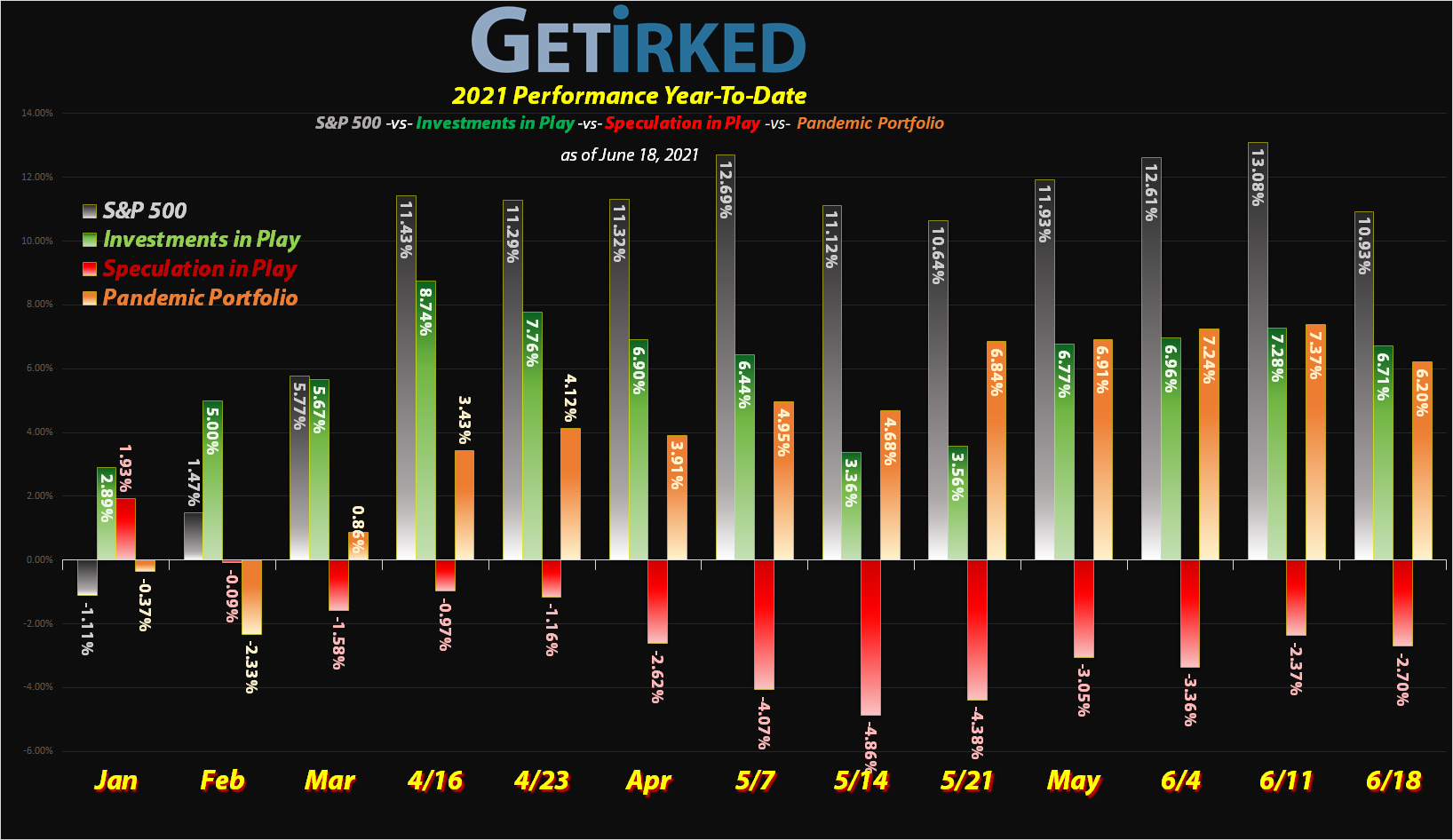

June 18, 2021

The Week’s Biggest Winner & Loser

Twilio (TWLO)

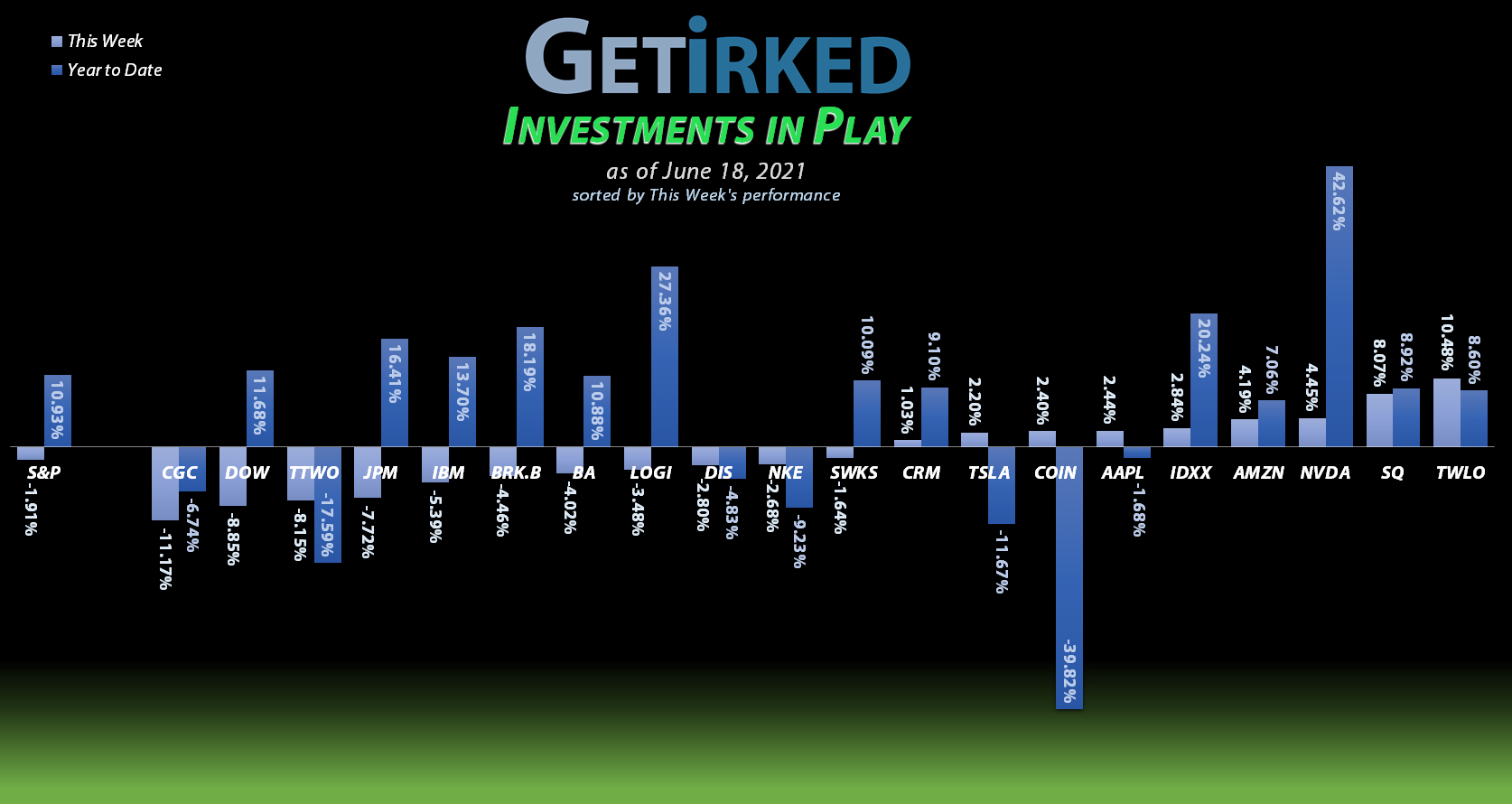

The rotation out of reflation and into growth definitely spun my Investments in Play portfolio with Twilio (TWLO) winding up the Week’s Biggest Winner with a gain of +10.48%.

Canopy Growth Corp (CGC)

Cannabis is always an odd duck and this week was no exception. Whereas industrials like Dow Chemical and Boeing should have led the portfolio lower, it was Canopy Growth Corp (CGC) winning the Week’s Biggest Loser spot with a loss of -11.17%.

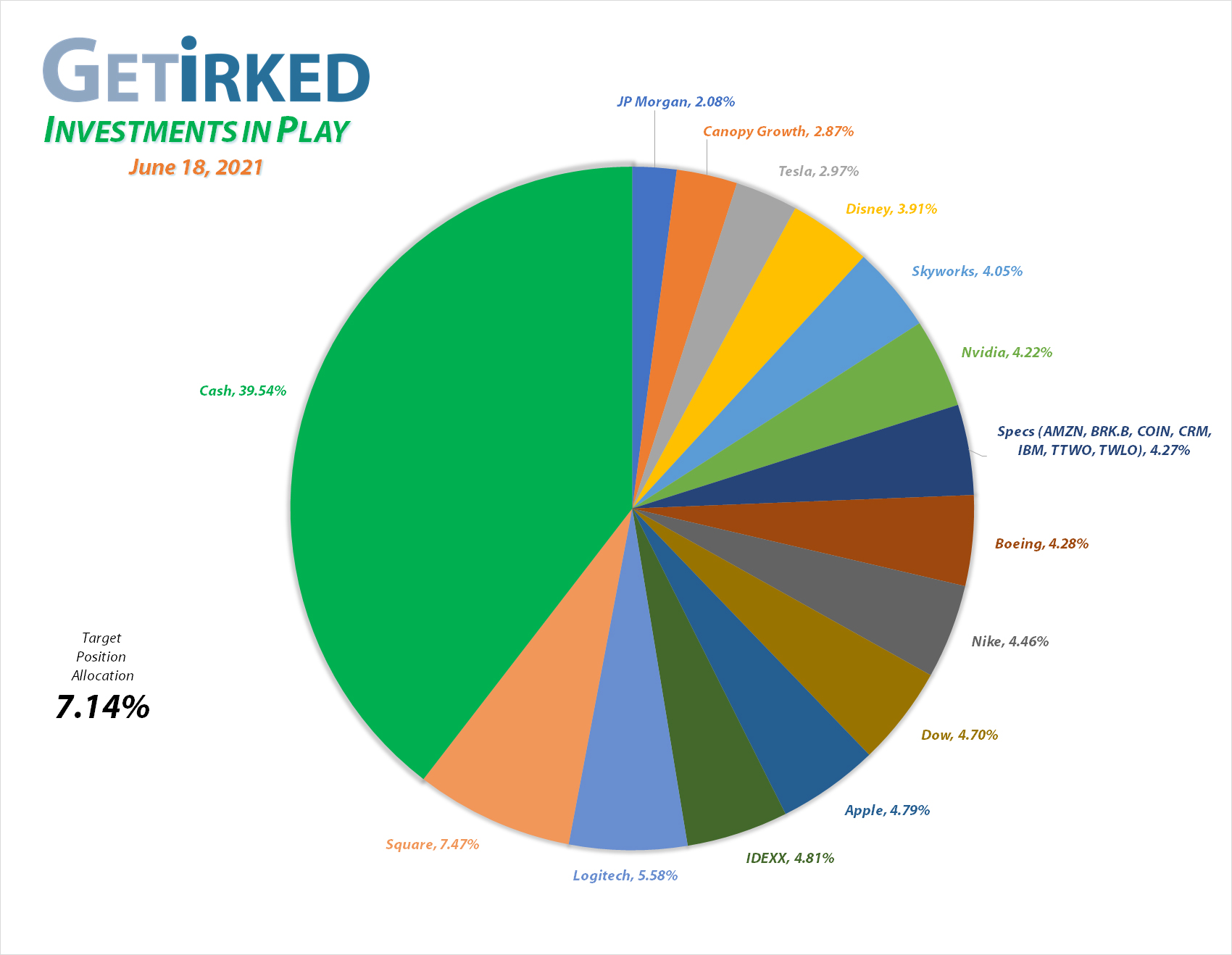

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Take Two (TTWO)

+2718.90%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $6.30

Canopy (CGC)

+1078.46%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $1.95

Square (SQ)

+1035.50%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$133.90)*

Logitech (LOGI)

+1033.47%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+720.62%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$44.94)*

Boeing (BA)

+707.39%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$292.05)*

Nvidia (NVDA)

+675.46%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Tesla (TSLA)

+550.78%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$102.03)*

IDEXX Labs (IDXX)

+529.23%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Nike (NKE)

+489.09%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

Disney (DIS)

+360.50%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+282.47%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

Twilio (TWLO)

+203.57%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

IBM (IBM)

+107.25%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.06

Salesforce (CRM)

+110.75%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

JP Morgan (JPM)

+105.36%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $72.03

Skyworks (SWKS)

+103.65%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $82.65

Dow (DOW)

+74.35%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.55

Berkshire (BRK.B)

+67.13%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-40.36%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow Chemical (DOW): Added to Position & Dividends

Dow Chemical (DOW) paid out its ample quarterly dividend of $0.70 a share on Monday, and while $0.70 may not sound like much, it works out to an annual yield of 4.178% based on Monday’s $67.02 closing price. That’s HUGE!

When reinvested (like I do for any eligible stock through my broker’s Dividend Reinvestment Program or DRiP), a dividend that large means the per-share cost for a position will be lowered by more than 1% every quarter for doing nothing but holding on to the shares for three months. In my case, my per-share cost was lowered -1.04% from $35.46 to $35.09.

On Wednesday, selling pressure caused DOW to slip below my next buying target with an order filling at $65.95. Given DOW is a reopening play with a substantial dividend, I decided to add to the position should it sell off, even though doing so raised my per-share cost back up +1.31% from $35.09 to $35.55. From here, my next buy target is $59.50.

DOW closed the week at $61.98, down -6.02% from where I added Wednesday.

IBM (IBM): Dividend Reinvesting

IBM (IBM) paid out its quarterly dividend last Friday after the Investments in Play was released. Much like DOW above, IBM’s quarterly dividend of $1.64 per share works out to a hefty annual yield of 4.332% based on Friday’s closing price of $151.42. My per-share cost was lowered -1.06% from $69.80 to $69.06 just for holding on to the position for three months.

My next buy target for IBM is $130.65. IBM closed the week at $143.12.

JP Morgan (JPM): Added to Position

When the financials got smacked following the Federal Reserve announcing that they do acknowledge inflation, I added to my JP Morgan (JPM) when it continued to see weakness on Friday with an order that filled at $148.52.

The buy replaced some of the shares I sold back on May 6 for $160.23, locking in a discount of -7.31% (-11.3% off JPM’s $167.44 all-time high). From here, my next buy target is much lower at $118.90.

JPM closed the week at $147.92, down -0.40% from where I added Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.