May 7, 2021

The Week’s Biggest Winner & Loser

Dow Chemical (DOW)

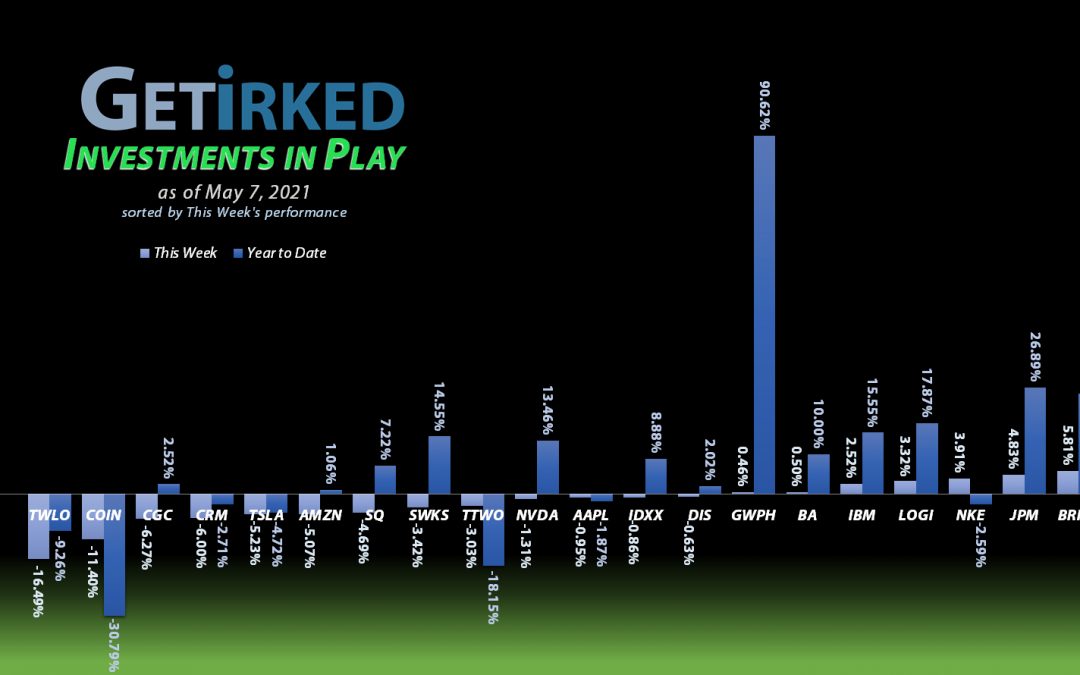

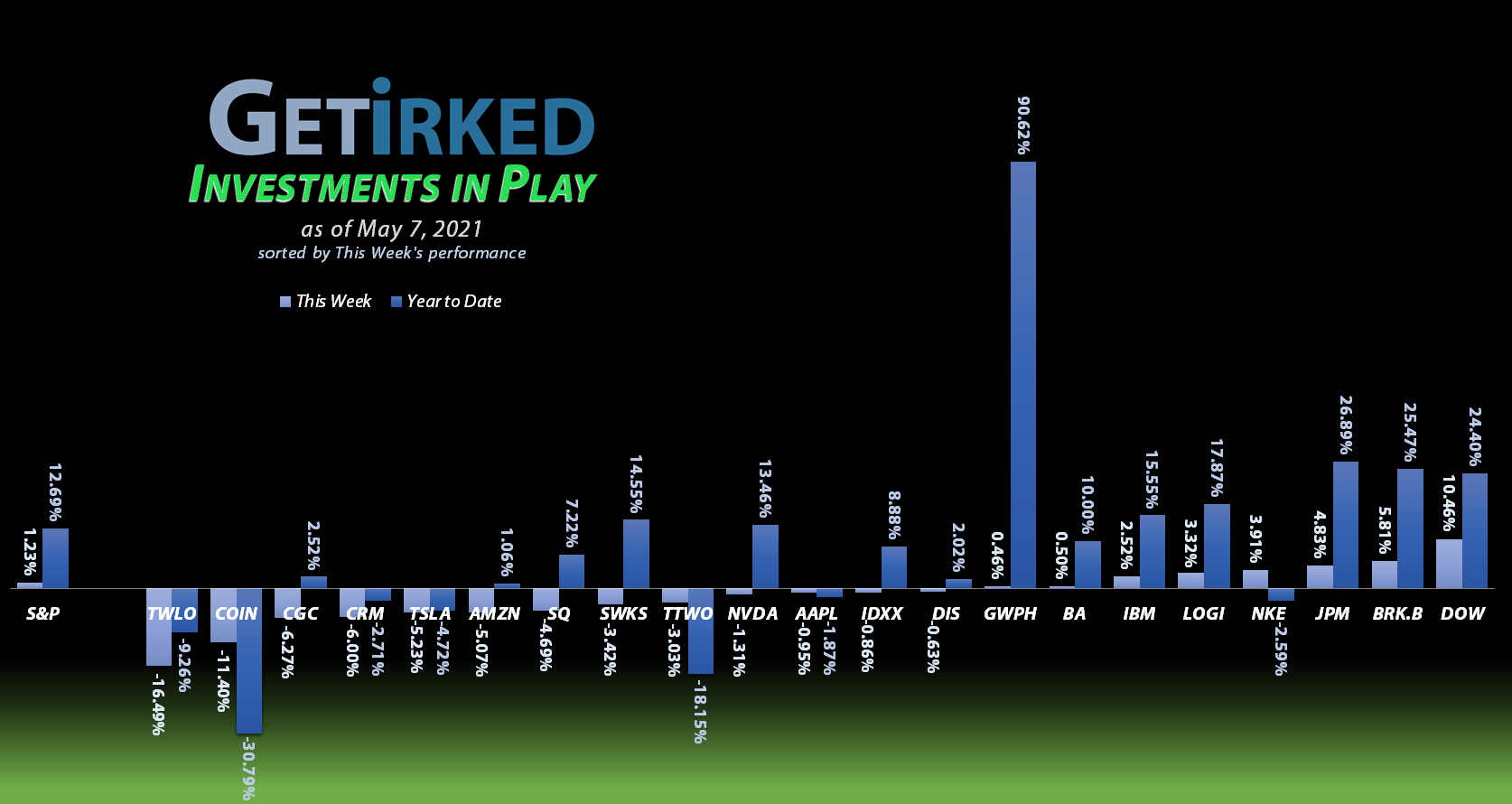

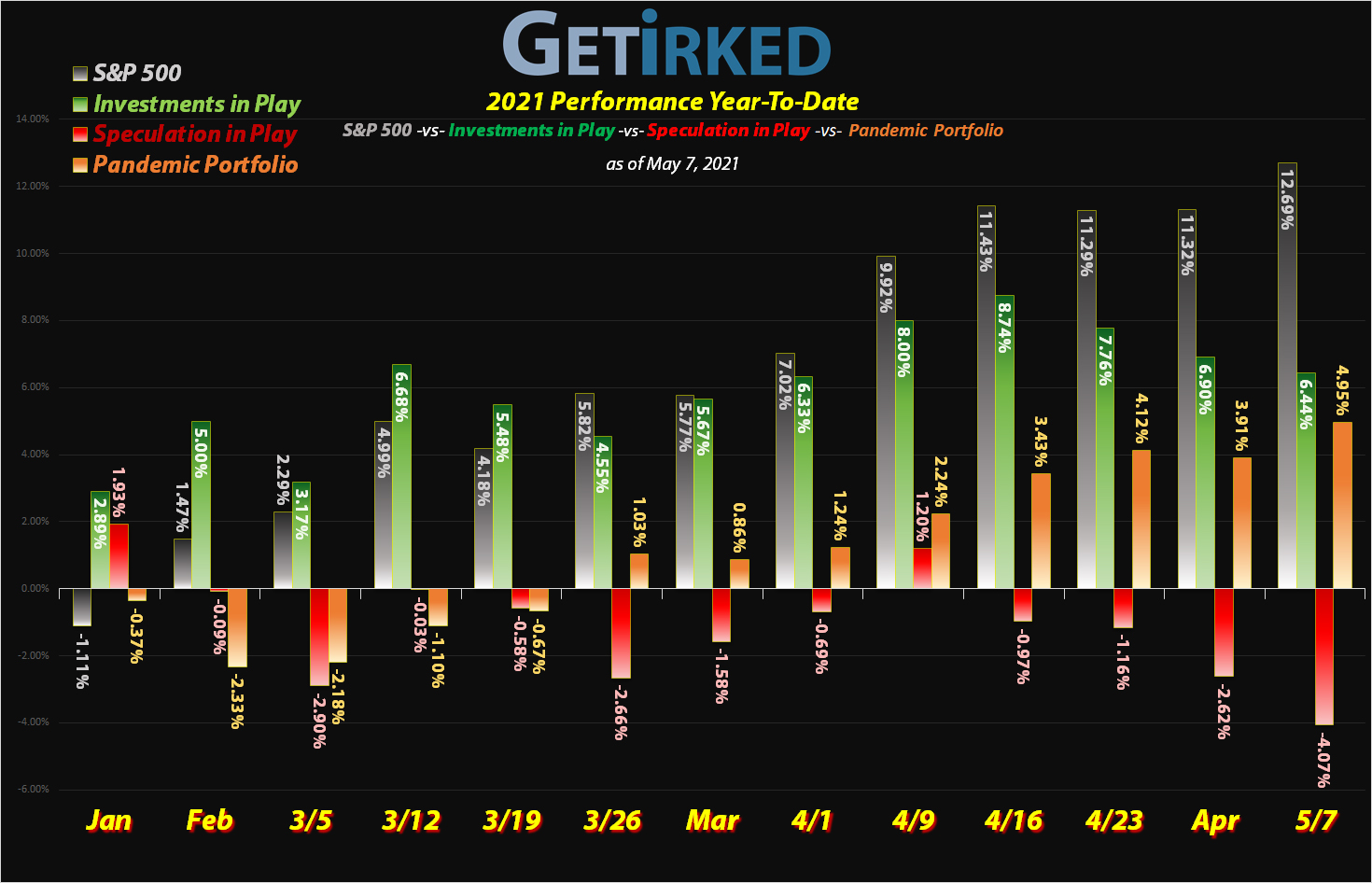

The reopening plays are out in full-force with industrials and commodities leading the way for this market. That means, Dow Chemical (DOW), this portfolio’s leading chemical play, locked in a +10.46% gain during a week where the S&P saw just +1.23%. Dow is definitely the Week’s Biggest Winner.

Twilio (TWLO)

Some stock analysts believe tech may be at a precarious peak with high-flying growth plays like Twilio (TWLO) reporting stellar earnings only to have the stock price dashed afterward. A similar occurrence to this happened before the stock market crash in 2001. TWLO lost an epic -16.49% after great earnings, slotting itself in for the Week’s Biggest Loser spot.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Canopy (CGC)

+1195.38%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $1.95

Square (SQ)

+1021.67%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$146.20)*

Logitech (LOGI)

+957.89%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+718.66%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$45.02)*

Boeing (BA)

+704.88%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$292.05)*

Tesla (TSLA)

+585.79%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$117.85)*

Nvidia (NVDA)

+554.12%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Nike (NKE)

+519.12%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$24.71)*

IDEXX Labs (IDXX)

+481.24%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+386.46%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$0.04)*

Amazon (AMZN)

+275.97%*

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: -($4,999.10)*

GW Pharm (GWPH)

+188.42%*

1st Buy 7/25/2018 @ $142.28

-Buyout Offer Complete-

Twilio (TWLO)

+171.51%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Take Two (TTWO)

+144.16%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($19.95)*

JP Morgan (JPM)

+137.13%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $68.00

Skyworks (SWKS)

+121.55%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.04

IBM (IBM)

+108.39%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $69.80

Dow (DOW)

+94.71%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.46

Salesforce (CRM)

+87.93%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

Berkshire (BRK.B)

+77.43%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $163.97

Coinbase (COIN)

-31.41%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $384.45

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

GW Pharmaceuticals (GWPH): *Buyout Offer Complete*

This week, I bid a fond farewell to GW Pharmaceuticals (GWPH), the extremely volatile stock belonging to a company that uses cannabinoids to create fantastic pharmaceuticals treating epilepsy in young children. The long-term prospects for this one were so great that Jazz Pharmaceuticals (JAZZ) decided to buy the company with an announcement early in 2021 that it would purchase GWPH for $220/shr, causing the stock to pop more than +40% overnight.

That buyout completed on Wednesday, May 6, at which point GWPH will no longer trade publicly and its ticker has been retired.

I initially opened this position on July 25, 2018 at $142.28. Over the course of less than three years, the stock saw prices as high as the mid-$190s, dropped to around $90 during the December 2018 selloff, bounced back to a new all-time high around $195, and then collapsed to $70 (and below) during the March 2020 pandemic selloff.

It’s been a wild rider.

I made a total of +88.49% on my investment in less than three years, an annualized return of +29.33% a year. If I could do that consistently, I’d take that every day of the week and twice on Sundays.

Of course, here’s another high-quality problem – with GWPH making up nearly 1% of the Investments in Play portfolio and getting liquidated, I now have that much cash added to the horde that needs to go to work.

Farewell, GWPH, you’ve done me right!

JP Morgan (JPM): Profit-Taking

JP Morgan (JPM) rallied with the rest of the financial sector this week, leading me to take profits near its all-time highs again with a sale order that failed at $160.23 on Thursday, locking in +39.38% in gains on shares I bought for $115.79 back on February 28, 2020.

The sale, combined with the dividend JPM paid out this week, lowered my per-share cost a substantial -10.05% from $75.60 to $68.00.

While I do like JPM as a long-term holding, I’ve ridden this cycle before, getting to new all-time highs only to have the financials rotate and crash. Accordingly, I felt like reducing my position was appropriate. From here, I have no additional sell targets and my next buy target is $105.40, nearly -35% lower than where I sold Thursday. It might sound like an extreme downside target, but it really, really isn’t. Maybe “it’s different this time,” but I’ve been in this game to never, ever bet on that failed adage.

JPM closed the week at $161.24, up +0.63% from where I took profits.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.