February 5, 2021

The Week’s Biggest Winner & Loser

GW Pharmaceuticals (GWPH)

Perennial range-bound cannabis pharma play, GW Pharmaceuticals (GWPH) finally hit its final homerun, its last hurrah, on Wednesday when news came out that it would be acquired, causing the stock to rocket more than 40% overnight, becoming Week’s Biggest Winner with a +40.73% gain and the biggest winner so far at up +85.92%.

IBM (IBM)

Despite a lackluster earnings report a few weeks ago and a plan that’s taking longer to get in place than it took Americans to get into space, a rising tide lifts all boats, so while IBM was the Week’s Biggest Loser, it earned the title by gaining the least, not losing, up +2.25% for the week.

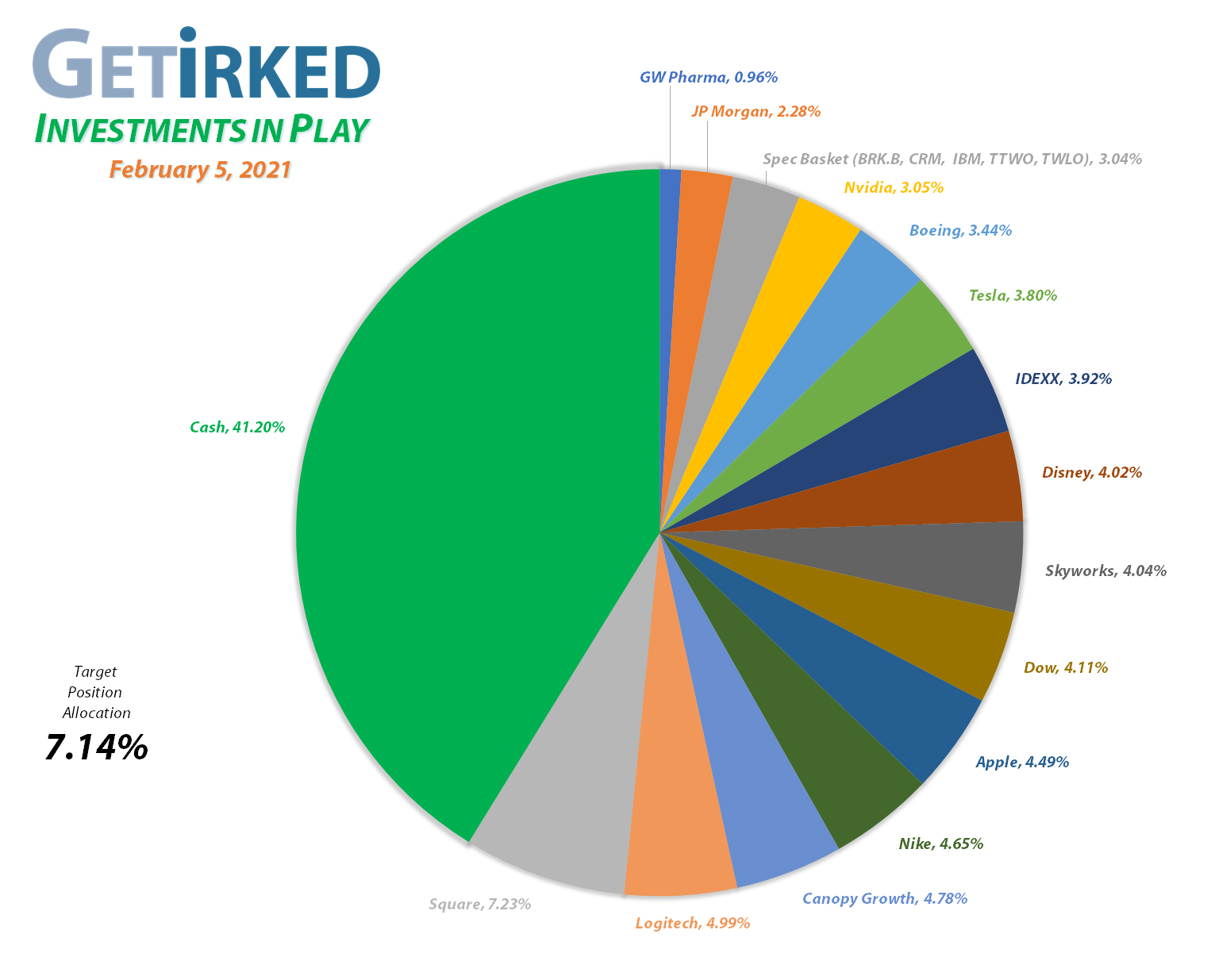

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+1024.19%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$140.11)*

Logitech (LOGI)

+935.67%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+739.97%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Tesla (TSLA)

+713.59%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Boeing (BA)

+670.76%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$333.52)*

Nike (NKE)

+538.30%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.48)*

Nvidia (NVDA)

+515.05%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

Canopy (CGC)

+505.86%*

1st Buy 5/24/2018 @ $29.53

Current Per-Share: -(1.26)*

IDEXX Labs (IDXX)

+445.93%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+378.94%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.00)*

Twilio (TWLO)

+220.78%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

GW Pharm (GWPH)

+186.25%*

1st Buy 7/25/2018 @ $142.28

Current Per-Share: (-$1.20)*

Take Two (TTWO)

+149.91%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Skyworks (SWKS)

+125.73%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $79.28

Salesforce (CRM)

+107.37%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $115.20

IBM (IBM)

+72.28%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

Berkshire (BRK.B)

+65.35%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

JP Morgan (JPM)

+60.74%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $85.84

Dow (DOW)

+60.56%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $35.65

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corporation (CGC): Profit-Taking

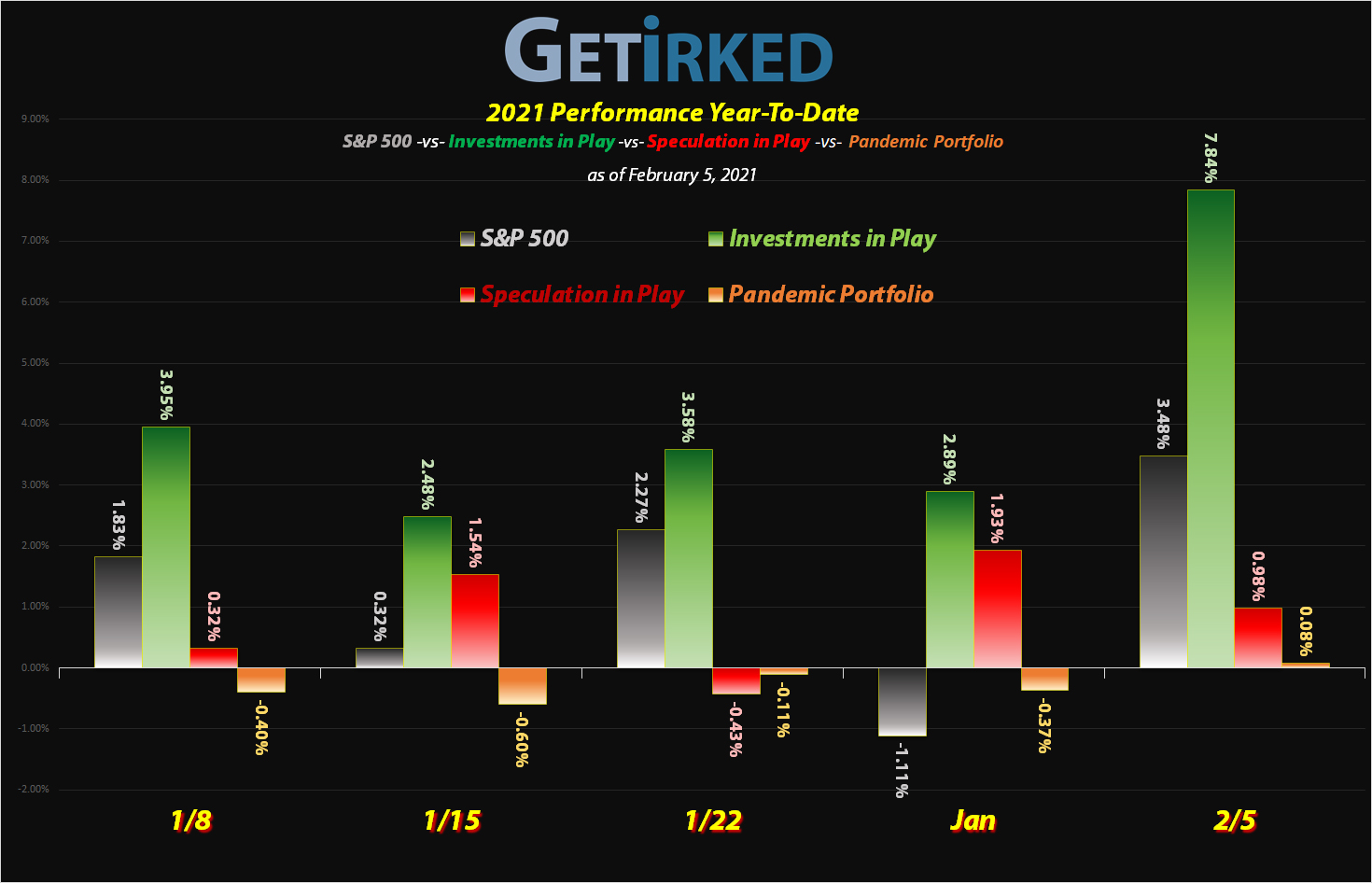

2021 has certainly been the year for consumer marijuana plays with Best-of-Breed Canopy Growth Corporation (CGC) dominating the portfolio with Year-To-Date (YTD) gains in excess of +75%.

That’s 75% in basically five weeks! The buyers must be high! (oh… wait…)

As much as I believe in the long-term prospects for both the sector and for CGC, specifically, my Discipline Monster sitting on my shoulder started growling at me for still having any capital in my position so I took profits on Wednesday at $43.81, selling enough shares to get my entire original investment out of the position, leaving me with a per-share “cost” of -$0.01 (each share in the portfolio cost nothing plus adds $0.01 to the portfolio’s value).

The sale locked in an astounding +424.52% in profits on shares I bought last year during the selloff on March 12 and 18 for an average price of $10.32 a share. That’s a quadruple in less than a year.

Now, I’m playing with the house’s money as I no longer have any capital in the position. Plus, despite taking out my capital, CGC still made up nearly 5% of the overall portfolio at the time of the sell – those are some serious gains. As of Wednesday, the position has netted me nearly 500% of the original investment (e.g. if you had invested $10,000 initially, it would now be worth nearly $50,000).

My next sell target won’t be until CGC exceeds the allocation size for the portfolio which gives me a price target of around $65, higher than CGC’s all-time high of $59.25.

My buy target remains in the low $14.00 range.

Why such a low buying price target?

I’ve seen this play before. I rode CGC up to its all-time high back when cannabis was the darling-of-the-dance in 2018. My initial buy was on May 24, 2018 at $29.53, I practiced Buying in Stages as CGC dropped down to $24.66 into July, Constellation Brands (STZ) announced its investment in August, and then it was off-to-the-races as CGC took off to $59.25.

While I did take profits, Selling in Stages on the way up, I woefully underestimated the hype in the space. The cannabis bubble popped in an epic way, and I ended up raising my per-share cost Buying in Stages while riding the position all the way down to $9.00 a share (far lower than my raised per-share cost) during the pandemic selloff.

Now that I have a second opportunity, it’s time to let discipline take over and do it the right way. Until I take more profits out of the position, I won’t add capital back in unless the right opportunity comes around.

At least, that was my buying price target until I freed up some more capital from the position by “renting” it out (see the Covered Call Option section below).

CGC closed the week at $42.93, down -2.01% from where I sold Wednesday.

Canopy Growth Corp (CGC): Covered Call Options

Now that I have my initial capital out of the stock, I decided to try my hand at an options play I haven’t used it before – the Covered Call.

For stocks with momentum, holders of the shares can capitalize on the upside by selling an out-of-the-money call option (an option to buy the stock at a price higher than it is now) and receive the premium from the option sale.

However, if the stock price increases beyond the call option’s strike price before the expiration date, the holder of the shares will have to sell the shares at the option’s price, regardless of how much higher the stock may have gone.

With a Covered Call, the seller must have enough shares to cover the options sold and since option contracts are sold in 100-lots, the shareholder must own 100 shares of the stock for each contract sold.

On Wednesday, I sold Mar 5 $60 Covered Calls on my CGC position which netted me $1.2535 per contract ($125.35 per option), lowering my per-share cost to -$1.26. However, if Canopy rises above $60.00 before the March 5 expiration, I will have to sell my position for $60.00.

Overall, this sale brought in an additional 2.8% gain on the position. The downside is I have to sell my position at $60.00 (higher than the stock’s all-time high of $59.25), nearly +35% higher from Wednesday’s levels, if CGC crosses $60.00 before March 5. I still get to collect that nearly 35% gain, but I will have to close my position at that time.

Of course, if Canopy Growth drops in value, the value of the call options also decrease, so I can always buy the options back at a lower price to remove the risk of having to sell my shares. However, in addition to buying back the call, I’ll use any weakness in the stock to add to my position using the capital I just earned from selling the call options (careful to keep some of the capital to buy the option back at a cheaper level).

I’ve raised my next buying price target to $40.05, near a recent point of price consolidation.

Naturally, I’ll revisit this topic sometime between now and March 5. If CGC isn’t higher than $60.00 by March 5, it’ll be good news for this play as I won’t be called away before the call options expire worthless.

GW Pharmaceuticals (GWPH): *Corporate Buyout*

On Wednesday, Jazz Pharmaceuticals (JAZZ) announced it would acquire GW Pharmaceuticals (GWPH) for $7.2 billion in a cash and stock transaction expected to close in the second quarter of 2021 valuing GWPH at $220/shr.

The result?

GWPH’s stock skyrocketed nearly +50% in a single day, popping to $217.50 from the previous day’s close at $146.25.

What now?

Now that the buyout price has been announced, shareholders can either wait for the deal to close and receive the full $220 a share or sell in GWPH’s current range around $213-$218.

The risk to waiting is that the deal might fall through, causing GWPH’s stock to plummet – likely to the $140 level. However, waiting for the deal to close might yield an additional 3% on the investment (the difference between $213 and $220).

For me, a buyout announcement means taking my initial capital out of the investment immediately and letting the rest run for a couple of days to see how the price action settles. I sold my capital investment for $213.90 a share, a gain of +203.40% over Tuesday’s per-share cost of $70.50, leaving me with a new per-share “cost” of -$1.20 (each share in the portfolio cost nothing plus adds $1.20 to the portfolio’s value).

Naturally, I’ve removed any buying price targets for the stock as I plan to sell the remaining shares within the next few weeks. For proper tracking in the portfolio allocation chart, I’ve pulled GWPH out of the Speculative Basket, now leaving BRK.B, CRM, IBM, TTWO, and TWLO to take the allocation and GWPH will stand on its own until the deal closes or I sell the remainder of the position.

GWPH closed the week at $214.57, up +0.31% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.