December 31, 2020

The Week’s Biggest Winner & Loser

Tesla (TSLA)

Tesla (TSLA) rode to the end of a year on a high note, closing near its all time high made on December 31 and locking in +6.63% in gains to earn itself the Week’s Biggest Winner.

Twilio (TWLO)

Twilio (TWLO) seems to be dropping from its perch with rumors of competitor unicorns potentially coming public in the coming months. TWLO finished the week -6.72%, but its +244.42% YTD gain is nothing to cry about.

The Year’s Biggest Winner & Loser

Tesla (TSLA)

Unless you’ve been sleeping like a rock, it should come no surprise that Tesla (TSLA) is the Year’s Biggest Winner with a +743.40% gain for the year. However, believe it or not, the Year’s Biggest Winner over in Speculation in Play bested this record by more than an additional 100% earning +869.16%!

Boeing (BA)

Boeing (BA) flew into 2020 in a bad way, still reeling from two lethal plane crashes, a change in CEO ownership and so much more. It comes as no surprise that despite a significant recovery from its March low, Boeing still finished the year down -34.29%, certainly locking in our Year’s Biggest Loser spot.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+963.04%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$153.80)*

Logitech (LOGI)

+816.07%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Apple (AAPL)

+724.43%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Boeing (BA)

+677.48%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Tesla (TSLA)

+608.12%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+527.72%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.48)*

Nvidia (NVDA)

+497.86%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.76)*

IDEXX Labs (IDXX)

+443.71%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Disney (DIS)

+378.88%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-2.00)*

Twilio (TWLO)

+188.12%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Salesforce (CRM)

+178.15%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Take Two (TTWO)

+149.98%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Skyworks (SWKS)

+83.14%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $83.42

IBM (IBM)

+78.13%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $70.69

Canopy (CGC)

+73.32%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.20

Berkshire (BRK.B)

+63.09%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+54.03%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $36.03

JP Morgan (JPM)

+46.94%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.42

GW Pharm (GWPH)

+26.44%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $91.10

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Strategy Update: Getting More Aggressive

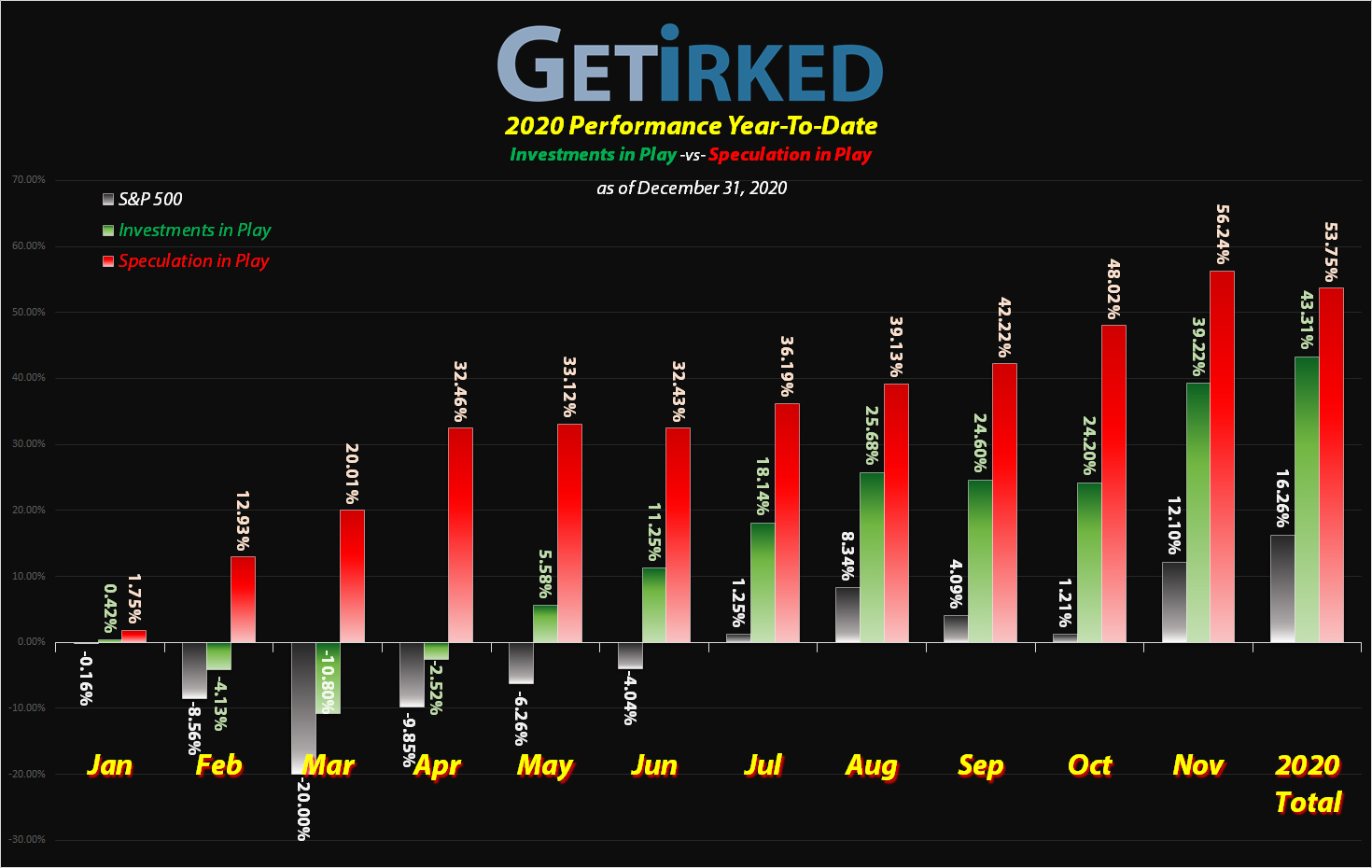

Even being as conservative as I was this year, the Investments in Play portfolio performed on the downside and the upside. At the end of March, the portfolio was down almost half of what the S&P closed out the month: -10.80% vs. the S&P’s -20.00% loss.

At the end of the year, the portfolio closed 2020 with a whopping +43.31% gain, nearly tripling the S&P 500’s +16.26% gain. Of course, the Speculation in Play portfolio locked in an additional 10%+ in gains, closing 2020 up +53.75%. However, that extra gain came with a lot of risk with the portfolio taking part in put spread options as well as jumping in on some positions that could have potentially gone to zero.

It’s worth noting that the entire Speculation in Play portfolio is nearly 1/20 the size (5.162%) of the Investments in Play portfolio. Accordingly, a more risk-averse approach must be taken for the portfolio’s size.

Looking forward to 2021…

With the presidential election and so many potential negative news catalysts in the last-half of 2020, my buying price targets were extremely conservative in order to protect against a potential test of March’s lows.

Now that we have multiple vaccines in distribution and the potential for an economic reopening by Summer 2021 as well as new stimulus and eviction moratorium extensions, I’ve started becoming more aggressive, raising my buying price targets for many of my positions.

In 2021, I will be looking to add to all of my positions during any significant selloffs while still capitalizing on upside profits where necessary. For the moment, I have no plans to change my core positions, but who knows what the future holds?

Thanks for sticking with me through this historically volatile year, and I hope you come back to follow Investments in Play in 2021.

HAPPY NEW YEAR!

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.