Summing Up The Week

The market held up surprisingly well this week despite the historic negative flip in the oil futures markets causing the media to explode with headlines like “Barrels of oil sell for -$37.00!!!!” and more.

Read below to find out why this isn’t at all the case and why your gas-powered car isn’t suddenly becoming a money-generator for you at the pump.

Also, turns out the Payroll Protection Program designed to save small business has a VERY broad definition of what small is as companies worth $1.6 billion received funding from it.

Read on to learn more about the news that moved the markets…

Market News

Public Companies Accepted Millions in Small Business Loans

Shake Shack (SHAK) made headlines on Monday for returning the $10 million loan it received from the Small Business Administration’s (SBA) Payroll Protection Program, reported CNBC.

While I suppose it’s admirable for Shake Shack to return the loan it received, the bigger question for me is how did a publicly-traded company with a market cap of $1,600,000,000 ever qualify for a “small business” loan program in the first place?

On Wednesday, CNBC released a list of the largest businesses who applied and received millions of dollars in aid intended for small businesses including companies like DMC Global with a $405 million market or Wave Life Sciences with a $286 million market cap or even ZAGG, the makers of mobile peripherals, valued at more than $100 million. All of the companies on the list are publicly-traded and have access to equity sales and debt vehicles not available to privately-held small businesses like your local mom-and-pop pizza restaurant.

I’m actively not patronizing any of the companies on this list and I encourage all of my readers to do the same.

The SBA bungled this program from top to bottom. Despite Treasury Secretary Steve Mnuchin repeatedly stating the PPP was designed to save small businesses and sole proprietors, contractors and business owners paid with 1099s had to wait an entire week to even apply while “small businesses” worth billions of dollars applied on day one and received the maximum $10,000,000 loan available.

Once again, the government finds a way to bail out the rich at the expense of Main Street. The SBA set the standard definition for a “small business” as a business with fewer than 500 employees.

I feel that, pretty objectively, a company with 500 employees is far from a small business. However, to make matters even worse, a loophole allowed companies with fewer than 500 employees at each location to apply and receive “small business” loans. With a loophole that big, virtually all companies qualify.

Perhaps the government would have saved the Mom-and-Pop shops if they had limited the qualification to fewer than 50 or even 20 employees and then opened the program up to bigger companies once the real small businesses had been served?

As a long-time owner of small businesses that never employed more than two (2) employees and paid those as independent contractors, I am sorely disappointed by this poor excuse of a government program which was touted as being designed to save the average American small business.

The average American small business is not worth $1.6 billion as Shake Shack market cap currently stands.

Rather than making sole proprietors and independent contractors wait a week after the program became available to apply, the SBA should have limited the program to companies of 20 or fewer employees first, making larger companies wait until these smaller Mom-and-Pop businesses received funding.

After serving the real small businesses the program was intended to save, then the the program could have opened to “small” businesses including the likes of Shake Shack, Ruth’s Chris Steakhouse, and even Harvard University which received nearly $9 million in PPP loans despite its $40 billion endowment (Source: The Boston Herald).

On Wednesday afternoon, CNBC reported that Harvard returned the loan, however, whether it had done so without the intense public scrutiny it received earlier in the week is anyone’s guess (although I’d guess likely “not” knowing Harvard’s money-grubbing reputation and “select” clientele).

On Thursday, CNBC reported that the Small Business Administration issued new guidance making it “unlikely” that publicly traded companies can access the next round of relief.

In addition, the SBA pressured publicly-traded companies who accepted PPP funds to return the money stating, “it is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith.”

We’ll see what happens.

US Oil Futures Go Negative as Storage Runs Out

Oil prices had their worst day ever on Monday when storage ran out for the ongoing surplus due to price wars and COVID-19 demand shortages, reported CNBC.

Prices of the May contract for U.S. West Texas Intermediate (WTI) futures dropped to $11.66 a barrel in early morning trading on Monday, a drop of more than 36%, and a price grade registering its worst day since the creation of the futures contracts in 1983… until later in the day when oil futures went negative.

Yes, you read that: If you wanted to sell a barrel of oil you would have to pay for it.

So, what the heck happened? Did oil really drop below $0? Why isn’t gas free now?

Before you get too excited thinking gas stations will pay you to fill up your car, it’s important to remember that futures contracts are not actually tracking the price of the underlying commodity, in this case, barrels of oil.

Futures contracts try to estimate the future price of a commodity, so when the contracts approach expiration, their value is partially determined by how accurate (or inaccurate) their estimation was. If the value of the commodity is less than the price of the futures contract (called “contango”), the contract’s price will plummet until buyers are found for the contracts.

With the May futures contracts for oil expiring on Tuesday, a large number of potentially-rookie traders were caught off-sides in the trade, unable to take delivery on the oil for which they owned the contracts and having to sell those contracts.

With no storage available for oil right now and global demand at all-time lows, there were no buyers interested in the May contracts, so the sellers got destroyed, ending Monday trading having to pay buyers $37.00 per contract to dump the contracts and get out of their trades.

Again, the prices of futures contracts do not actually equate to oil prices; this was a paper market crash, not an actual commodity crash. While oil prices remain significantly low at sub-$20-per-barrel, the crash in the futures market doesn’t immediately affect the price of oil. Long-term sluggish demand, on the other hand…

For me, this kind of volatility and price contango are a few of the major reasons I don’t trade the futures market: the leverage can lead to amazing gains but it can also destroy a trade, potentially with downright horrific results as those seen here.

On Tuesday, oil continued to sell off with June futures dropping 20% and May futures retaining a negative price, reported CNBC, before rebounding in Wednesday trading as the pricing of the June futures contracts (now that the May contracts had expired) started to improve.

Economy erases all job gains since Great Recession plus more

The Labor Department’s jobs report showed the number of Americans applying for unemployment benefits totaled 4.427 million for a 5-week total of 26.45 million lost, 4 million more jobs lost than the 22.442 million created since November 2009, reported CNBC on Thursday.

The record-shattering loss of jobs has sent some states like Georgia scrambling to reopen their economies as soon as possible against the advice of health professionals in order to reduce the economic damage from COVID-19 prevention.

Next Week’s Gameplan

Many analysts feel like the market’s found an even level, however, I can’t help but wonder what’s going to happen with states like Georgia itching to reopen for business with no available vaccines or treatment for COVID-19.

For me, we’re still in the middle of Selling Season, and I have no plans to add to positions until we see a pullback in the S&P 500 of 5% or more (or positive news about COVID-19 treatment research is confirmed and released…).

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

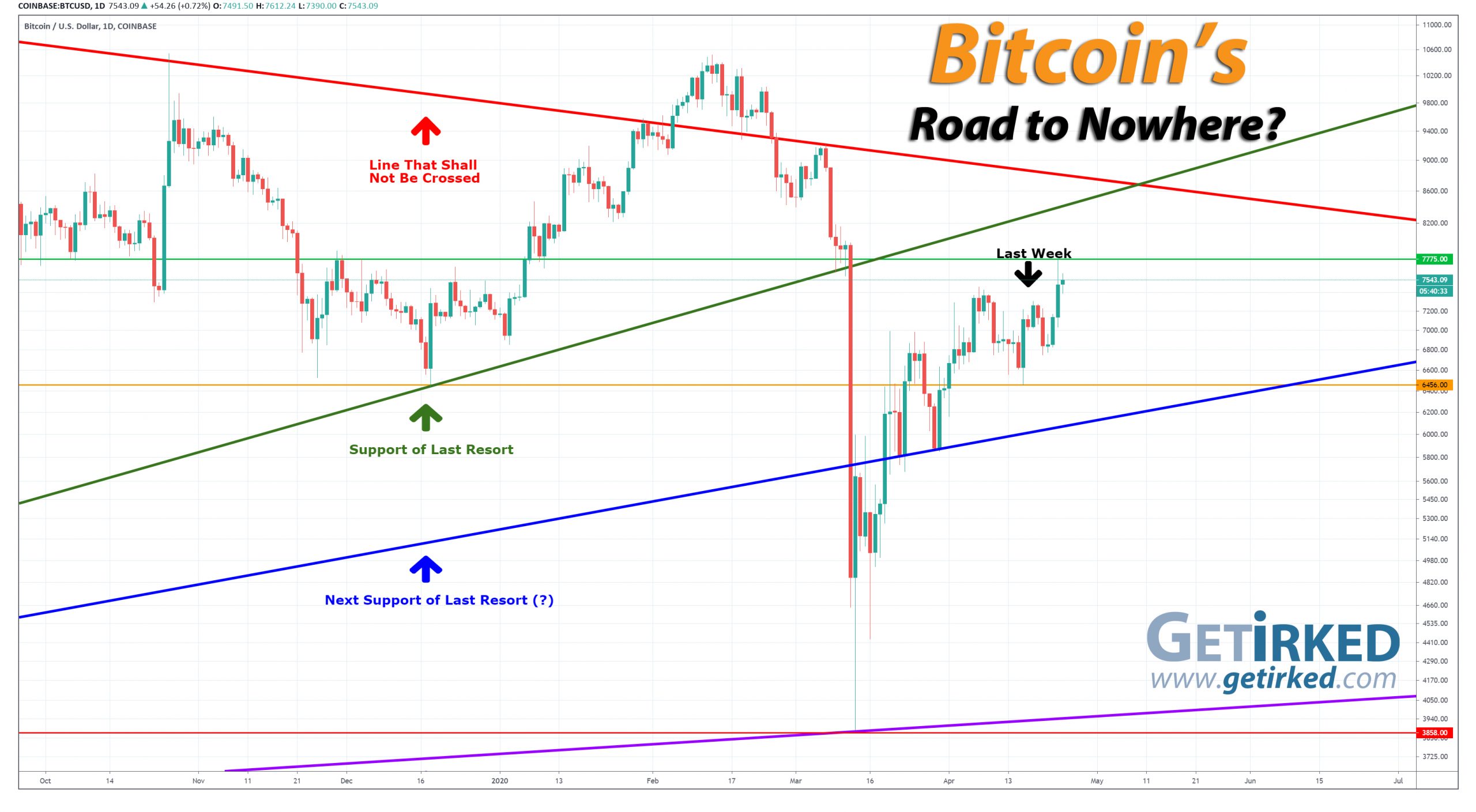

Bitcoin Price Action

After Bitcoin broke through its daily low to create a base of support last week at $6456, it bounced, and bounced hard, ricocheting 20.43% higher to set a new weekly high at $7775.00 on Thursday. Since then, the crypto’s been consolidating right around $7500-7600 level.

The Bullish Case

Bulls rejoiced when Bitcoin rallied since it really looked like we were going to test the Next Support of Last Resort (?) trendline in blue and rallied instead. From here, the Support of Last Resort isn’t actually support, anymore, it’s resistance, followed by the incoming notoriously-resistance Line That Shall Not Be Crossed, so the bulls really need to see a weekly close near $9000 to confirm that this rally is real.

The Bearish Case

Bears were confounded when Bitcoin didn’t pull back further last week – perhaps the halvening is a real deal? However, even with the bullish strength of the last few days, Bitcoin is still very much in a trading range with that monthly low way down at $3858.00 providing a continual reminder that anything is possible in cryptocurrency so don’t get too excited.

Bitcoin Gameplan

Current Allocation: 3.002%

Current Per-Coin Price: $7,060.49

Current Status: +6.835%

Bitcoin surprised me but not pulling back further last week, so I ended up not adding to my position, keeping last week’s 3% allocation with a $7,060.49 per-coin price, leaving me up +6.84% this week.

Bitcoin Buying Targets

Based on past support levels, Moving Averages (both Simple and Exponential), and a positively terrifying past trendline, I’ve come up with the following buy targets:

0.855% @ $6056

0.855% @ $5714

0.855% @ $5259

5.872% @ $4255

7.310% @ $3696

11.054% @ $3219

9.369% @ $2989

19.970% @ $2636

19.171% @ $2435

Bitcoin Selling Targets

Given the rally we’ve seen off its $6456.00 low and the significant resistance above us, I do have sell orders to pull take very small amounts of profits at $7978, $8578, $9143, and $9990 which will sell a total of 23.7% of my current allocation leaving with a total allocation of 1.91% of my total portfolio and a per-coin cost of $6638.

Why the differing quantities at each level instead of a flat percentage?

Rather than buying an equal percentage, I change my buying quantity at each stage as a reflection of how likely Bitcoin could bottom and rebound from that stage. Rather than increasing my quantity on the way down, I’m used a fixed amount of money, so I’m basing how much I buy by how likely I think Bitcoin will drop to a certain level. In this case, I don’t think it’s likely Bitcoin will be able to break its $3128 low, so my quantities under that price point are less to account for the chances it will get to them.

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are just a few recent price movements over the past couple of years:

- Bitcoin rose +2,707% from its January 2017 low of $734.64 to make an all-time high of $19,891.99 in December of the same year.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rebounded +343% from $3128.89 to $13,868.44.

- From June 2019, Bitcoin dropped -53.64% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rebounded +64% from $6430.00 to $10,522.51.

- In March 2020, Bitcoin dropped -63.33% to a low of $3858.00, mostly in 24 hours

- From $3858.00, Bitcoin has rebounded +95.52% to $7543.09.

- Where will Bitcoin go from here? Truly, anything is possible.

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than 2% of my assets to speculating in crypto.

I feel that anyone who doesn’t believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Get Irked in your Email?

We’re making a list and checking it twice! If there’s enough interest, we’ll start sending the Week in Review straight to your inbox!

Interested? Click here to sign up!