Summing Up The Week

Despite the fact there were economic datapoints released earlier in the week like new home sales and GDP revisions, the market was truly waiting for Nvidia's (NVDA) earnings on Wednesday.

Headed into the print, it looked like there was no possible way for Nvidia to blow away expectations since the entire market needed the company to reaffirm that demand for their products was out-of-this-world since the entire bull market up until that point rested entirely on the narrative that artificial intelligence capital expenditure spending would continue propping up the economy.

The markets took Nvidia's report in stride and actually rallied to new all-time highs on Thursday. However, things changed when Friday's Personal Consumption Expenditures (PCE) report came out in-line with expectations as core inflation rose 2.9% in July. It seems this wasn't what the markets wanted, though, as stocks sold off.

Let's take a deeper dive into what happened this week...

Market News

Nvidia Blew Away Earnings, BUT...

Nvidia (NVDA) reported earnings after the bell on Wednesday and, while it did exceed expectations on both the bottom and top line, data center revenue came in lighter than expected Nvidia announced they had made no Q2 H20 chip sales to China-based customers which caused the stock to drop after-hours, reported CNBC.

China makes up more than 15% of Nvidia's revenue so not having sales there definitely strikes a blow to its earning potential. Even with increased demand from elsewhere in the globe, investors were disappointed at the lack of Chinese sales, especially since Nvidia recently announced they were developing a more powerful chip for China which likely means customers won't order the H20 and will wait for that chip, instead.

U.S. Q2 GDP grew 3.3%, more than expected

On Thursday, the Commerce Department released the Gross Domestic Product (GDP) report for Q2 and found the United States' economy rose by an annualized pace of 3.3% from April-June, more than the 3.1% Dow Jones estimate, reported CNBC. The strength of the report flies in the face of the Bears who continue to claim the economy is weakening, when the reality is quite the opposite.

"The good news is consumption came in higher than previously thought. Americans are continuing to spend despite the tariffs and uncertainty, albeit at a slower pace than past years," said Heather Long, Chief Economist at Navy Federal Credit Union. "Going forward, the economy is likely to stay in this slower speed mode with spending and growth around 1.5% as the tariffs become more visible to American consumers."

Core inflation rose 2.9% in July, high but as expected

On Friday, the Personal Consumption Expenditures (PCE) report, the Federal Reserve's preferred gauge of inflation, showed that core inflation rose 2.9% in July, the highest since February but still as expected by Dow Jones economists, reported CNBC.

Despite inflation returning, many pundits still believe the Fed will cut rates in September due to the weakening labor market. "The Fed opened the door to rate cuts, but the size of that opening is going to depend on whether labor-market weakness continues to look like a bigger risk than rising inflation," said Ellen Zentner, Chief Economic Strategist at Morgan Stanley Wealth Management. "Today’s in-line PCE Price Index will keep the focus on the jobs market. For now, the odds still favor a September cut."

Even though the report came in as-expected, the markets seemed to think it would be cooler as the indexes sold off after the report came out Friday morning.

Next Week's Gameplan

Next week is a holiday-shortened week thanks to Labor Day on Monday, however that doesn't mean it will be slow by any rate. On Tuesday, we get the ISM manufacturing and manufacturing PMI numbers followed by payroll-processor ADP's employment report on Thursday.

The big datapoint comes on Friday when we get to see the new payroll report which will particularly interesting since President Trump fired the head of the Bureau of Labor Statistics in August when the report wasn't up to his liking. Will we see the labor market strengthen this time or will the revisions in last month's report continue to show signs of cracks?

And, despite the fact that it feels like earnings season should be done, it isn't for my portfolios as Salesforce (CRM) reports Wednesday after the bell followed by UiPath (PATH) reporting Thursday evening.

Join me back here next Friday as we see what happens next, friends!

Check out Get Irked Premium on Substack!

After providing FREE content since 2018, the time constraints of producing Investments in Play, Speculation in Play, the Pandemic Portfolio, and Stock Shopping List have become too much to continue doing for free.

On Substack, you can subscribe for FREE to have the Week in Review and Crypto Corner, now separate newsletters, sent to your email inbox at no cost. The portfolio updates and Stock Shopping List are now part of a premium subscription plan.

I hope you will join me on Substack as I continue on this exciting journey!

THANK YOU FOR YOUR ONGOING SUPPORT!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

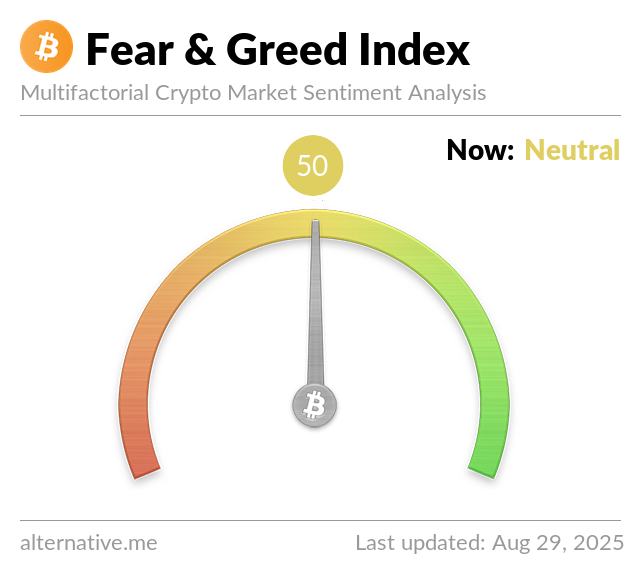

Crypto Cliffhanger: Will Bitcoin Find Its Footing?

The Bearish situation went from bad to worse for Bitcoin over the past week with the crypto breaking through last week’s low at $111,649.75 and not finding support until $108,670.00 on Tuesday. While the world’s largest cryptocurrency did bounce from those levels, Bitcoin isn’t remotely close to making a higher-high than the weekly high set at $117,416.73 last week.

On Thursday, Bitcoin was rejected from its new lower-high and rolled over, dipping below $110K once more early Friday morning before finding brief support.

The Bullish Case

The current low for this downtrend means Bitcoin has pulled back nearly -13% from its all-time high. Historically speaking, this kind of a pullback happens regularly with Bitcoin still maintaining the broader secular Bull Market. In fact, Bitcoin has pulled back more than -20% in past Bull Market cycles only to fully recover and make much higher all-time highs. Many Bulls believe this scenario is playing out in real-time with the current cycle.

The Bearish Case

The continued series of lower-lows and lower-highs is a Bearish downtrend that Bitcoin shows no signs of breaking for the moment. Despite Bitcoin having only pulled back less than -13% (not a significant selloff when it comes to crypto), the Bears are rejoicing and claiming this is only the start of a much more serious pullback. Reasonable Bears believe a test of $100K is coming while some of the more … ambitious … permabears believe we’ll see Bitcoin under $80K once more in the coming weeks and months.

Bitcoin Trade Update

Premium subscribers to Get Irked get access to all the moves I've made in my Bitcoin trade over the past week as well as my next thirty (30) ... yes, 30 ... buys in Bitcoin including price levels, quantities, and a full layout of my ongoing long-term trade in the world's biggest crypto.

Not Your Keys, Not Your Crypto...

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges - Gemini and Coinbase - in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use my Gemini referral link to open an account.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin's price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

- In January 2024, Bitcoin rallied +97% to a high of $49,102.29.

- Later in January, Bitcoin dropped -22% to a low of $38,501.00.

- In March, Bitcoin rallied +92% to a new all-time high of $73,835.57.

- In August, Bitcoin dropped -33% to a low of $49,050.01.

- In January 2025, Bitcoin rallied +150% to a new all-time high of $109,358.01.

- In April, Bitcoin dropped -32% to a low of $74,420.69.

- In May, Bitcoin rallied +51% to a new all-time high of $112,000.00.

- In June, Bitcoin dropped -12% to a low of $98,247.01.

- In July, Bitcoin rallied +25% to a new all-time high of $123,231.07.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.