Summing Up The Week

It wasn't a great week for stocks with the S&P 500 and Nasdaq both pulling back every single day going into Friday's Federal Reserve Jackson Hole event with Fed Chair Jerome Powell speaking from the annual conference of central banks from around the world.

Technology and growth stocks were taking it particularly hard which makes sense, intuitively, since those sectors were the ones that had seen the greatest gains since the Tariff Tantrum lows in April.

However, the markets turned around and rallied in a big way when Powell came out dovish on Friday, saying that the current economic conditions might require interest rate cuts in order to keep the economy in line.

Let's take a deeper dive into what happened to stocks this week...

Market News

Fed divided about tariffs, inflation, and the labor market

On Wednesday, the minutes from the Federal Reserve's July meeting showed officials concerned about the state of inflation and labor market due to the effect of tariffs, however that most agreed it was too soon to cut interest rates, reported CNBC. The market was already a bit soft going into the news release, however the potential of no rate hike in September certainly didn't turn things around.

"Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment," the minutes noted. While "a majority of participants judged the upside risk to inflation as the greater of these two risks" a few members saw "downside risk to employment [as] the more salient risk."

Powell indicates rate cuts may be coming soon

Stocks rebounded in the morning on Friday going into Federal Reserve Chairman Jerome Powell's speech and exploded higher when Powell gave some indication of possible interest rate cuts ahead despite the high level of uncertainty affecting the economic outlook, reported CNBC.

Powell pointed to "sweeping changes" in tax, trade and immigration policies as causing significant effects throughout the economy resulting a "balance of risks appearing to be shifting" between the Fed's goals of a strong labor market and low inflation. "Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance," he added.

That final comment sent stocks, Bitcoin, and all risk assets rocketing higher, adding 1.50% to the S&P 500 and Nasdaq and more than 3.00% to Bitcoin in the subsequent rally.

Powell went on to emphasize the importance of the independence of the Federal Reserve, "FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach."

Next Week's Gameplan

Next week brings the heat in terms of economic datapoints. On Monday, we get to hear about new home sales for July which will likely be lackluster followed by durable-goods orders and consumer confidence on Tuesday. On Friday, we get the Personal Consumption Expenditures (PCE) index, the Federal Reserve's preferred gauge of inflation, where we'll get to see if it looks more like the tame CPI from August or the hot PPI. Throw into the mix all of the potential geopolitical concerns plus tariff craziness, and the datapoints could be off the chain.

However, that's far from it because, next week, we hear from the biggest (and, arguably, most important) company in the world, Nvidia (NVDA), when Big Green reports earnings after the bell on Wednesday. I will also be looking at Crowdstrike (CRWD) and Snowflake (SNOW) when they report earnings at the same time as Nvidia, but, obviously, Nvidia will be the one who will steal the show.

There will be lots of economic news in the form of both data reports along with Nvidia's thermometer on the state of Artificial Intelligence (AI) spending, so join me back here next Friday and we'll go over it together, friends!

Check out Get Irked Premium on Substack!

After providing FREE content since 2018, the time constraints of producing Investments in Play, Speculation in Play, the Pandemic Portfolio, and Stock Shopping List have become too much to continue doing for free.

On Substack, you can subscribe for FREE to have the Week in Review and Crypto Corner, now separate newsletters, sent to your email inbox at no cost. The portfolio updates and Stock Shopping List are now part of a premium subscription plan.

I hope you will join me on Substack as I continue on this exciting journey!

THANK YOU FOR YOUR ONGOING SUPPORT!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Crypto Carnage: Bitcoin’s Record High Turns to Rubble

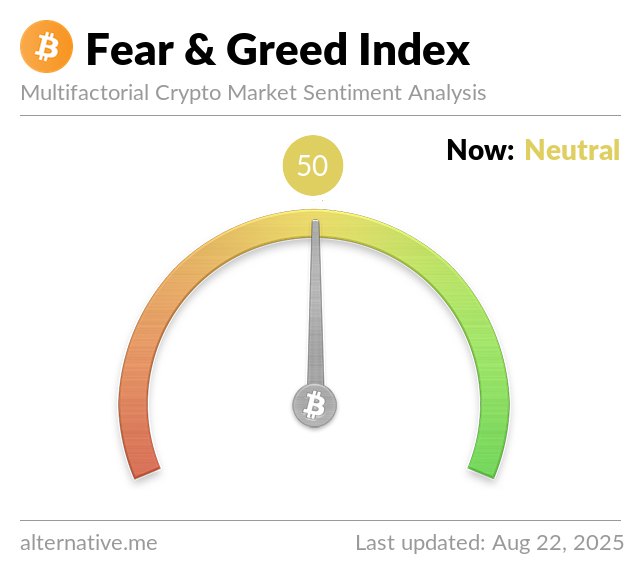

Bitcoin Bears rejoiced when the Big Orange Crypto collapsed after hitting a new all-time high last week. Bulls were shocked to see how Bitcoin crashed through past levels of support as if they were wet tissue paper, including a key support made several weeks ago at $111,903.68. In fact, even at writing, it seems Bitcoin may not have found support at its current low just set earlier this morning (Friday) at $111,649.75 as even that support seems precarious, at best.

The Bullish Case

Bulls scrambled to find a way to explain the week’s price action as anything but Bearish, claiming that Bitcoin’s just finding consolidating after hitting a new all-time high and finding a new trading range. Bulls do have a point - when looking historically at past Bull Market cycles, there are numerous examples of Bitcoin pulling back -20% or more from a new all-time high only to reverse course and make another new all-time high.

The Bearish Case

After weeks of having the snot smacked out of them, Bears were finally vindicated when Bitcoin remained correlated with risk-on assets over the past week and sold off substantially from its new all-time high. Naturally, the more permabearish of the Bears are calling for lows below April’s bottom near $74.4K.

As I say repeatedly, should we see a pullback of that magnitude, it’s simply a magnificent buying opportunity and nothing long-term HODLers should fear.

Bitcoin Trade Update

Premium subscribers to Get Irked get access to all the moves I've made in my Bitcoin trade over the past week as well as my next thirty (30) ... yes, 30 ... buys in Bitcoin including price levels, quantities, and a full layout of my ongoing long-term trade in the world's biggest crypto.

Not Your Keys, Not Your Crypto...

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges - Gemini and Coinbase - in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use my Gemini referral link to open an account.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin's price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

- In January 2024, Bitcoin rallied +97% to a high of $49,102.29.

- Later in January, Bitcoin dropped -22% to a low of $38,501.00.

- In March, Bitcoin rallied +92% to a new all-time high of $73,835.57.

- In August, Bitcoin dropped -33% to a low of $49,050.01.

- In January 2025, Bitcoin rallied +150% to a new all-time high of $109,358.01.

- In April, Bitcoin dropped -32% to a low of $74,420.69.

- In May, Bitcoin rallied +51% to a new all-time high of $112,000.00.

- In June, Bitcoin dropped -12% to a low of $98,247.01.

- In July, Bitcoin rallied +25% to a new all-time high of $123,231.07.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.