Summing Up The Week

While the Bank of Japan executed an historic move this week, it had no effect on the bull spirits in stocks… yet. On Wednesday, Federal Reserve Chairman Jerome Powell said all the sweet nothings the market desperately wanted to hear, and stocks rallied incredibly for the majority of the week.

Let’s take a look at the news that moved the markets this week…

Market News

Bank of Japan ends Yield Curve Control

On Monday, the Bank of Japan (BOJ), the country’s central bank, announced it would be ending yield curve control which it had in place since 2007, and raised interest rates above negative for the first time in 17 years, reported CNBC. The bank raised its short-term interest rates to 0-0.1% from -0.1%.

The BOJ did so to avoid potential inflation. “The likelihood of inflation stably achieving our target has been heightening … the likelihood reached a certain threshold that resulted in today’s decision,” BOJ Governor Kazuo Ueda said at a press conference after the central bank’s decision, according to a translation provided by Reuters.

However, there are potential long-reaching negative consequences for the BoJ’s decision. Many investors have been executing what’s been called the “Reverse Yen Carry Trade.” These investors would borrow Japanese Yen, and then use that borrowed money to make leveraged investments elsewhere. However, with the Yen no longer having negative interest, these investors will have to scramble to sell their investments and pay back the loans.

Some analysts, such as Michael Gayed, theorize that this could cause a liquidity crisis throughout the globe and potentially bring a crash to stock markets, including those in the United States. Gayed says that there is likely a 1-3 week lag between the rate hike and its potential effects, so we’ll have to wait and see if he’s right.

Fed holds rates steady, indicates 3 cuts this year

On Wednesday, the Federal Reserve announced that it would be holding rates steady with no cut this month, but continued to indicate that there would three rate cuts in 2024, reported CNBC.

Some more Bearish pundits thought that the dot plot – the grid that shows what each FOMC member sees for upcoming rate cuts – would show just two cuts in 2024, however this was not the case. This surprised some as, since the Fed is determined to remain apolitical, some of the cuts will take place in and around key elements of the presidential election cycle, and, therefore, the cuts (or lack thereof) could be seen as political.

During the press conference, Chairman Jerome Powell reiterated the Fed’s discipline in sticking to data-dependency. “We believe that our policy rate is likely at its peak for this type of cycle, and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year,” Powell said. “We’re looking for data that confirm the low readings that we had last year, and give us a higher degree of confidence that what we saw was really inflation moving sustainably down to 2%.”

Apparently, investors were expecting the Fed to reduce the number of cuts expected this year. When the Fed announced they intended to cut three times just as they had said at the last meeting, stocks rallied spectacularly following Powell’s press conference.

Next Week’s Gameplan

Next week has a few potential catalysts in the form of the consumer confidence survey coming out on Tuesday and PMI on Thursday, but, outside of that, the shortened holiday week doesn’t seem to serving up a lot.

Additionally, we’re pretty much out of earnings season entirely, so with the catalysts off the table, it will be up to the “animal spirits” to decide which way stocks will want to go. As always, make your buying and selling plan in advance, because it’s the “quiet weeks” that often bring the unknown-unknowns that no one was expecting.

I’ll see you back here next Thursday, friends!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

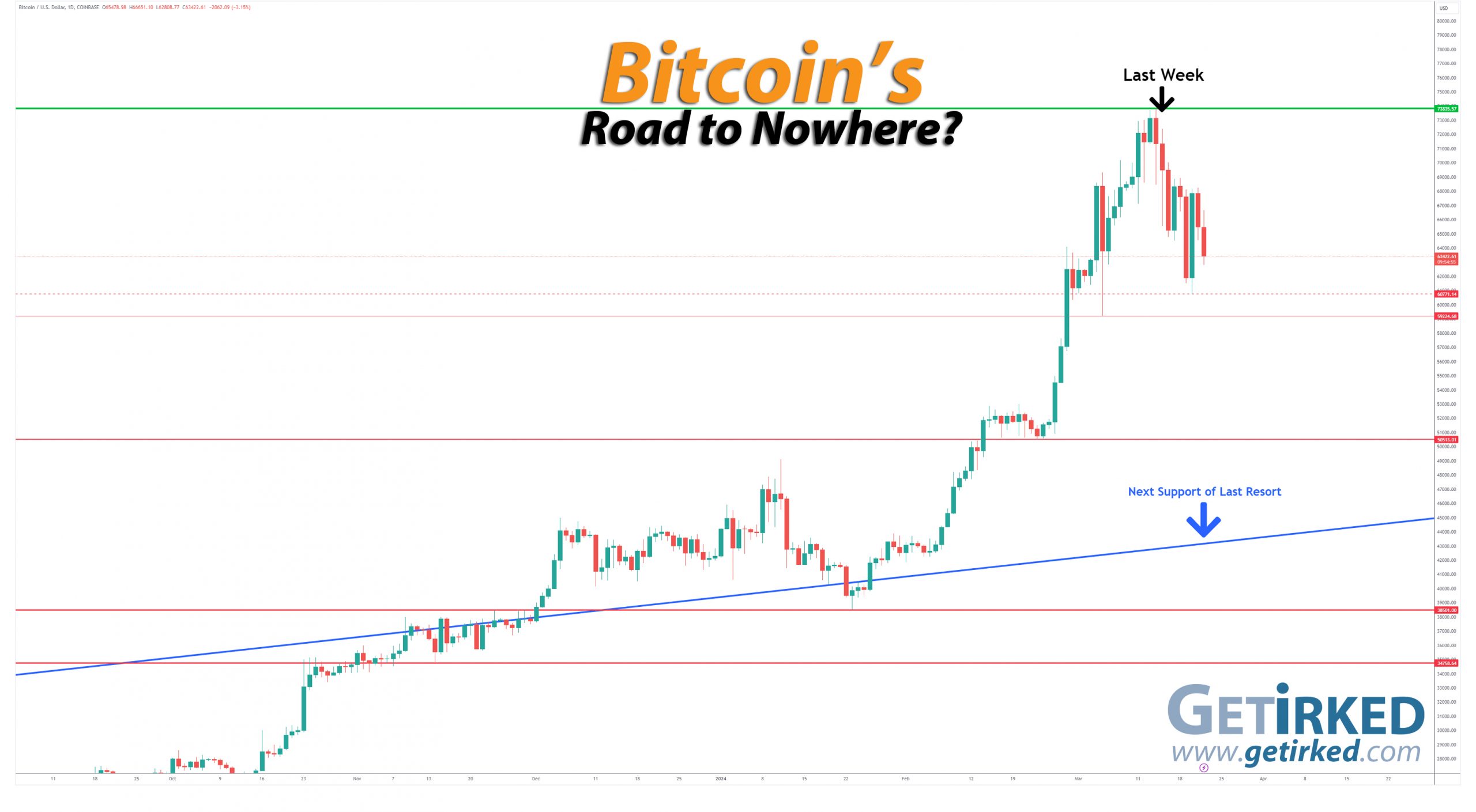

Bitcoin Whale Dumps Are Still Real!

Bitcoin got rattled over the last week thanks to the return of Whale Dumps! In a survey I conducted on X, many respondents thought Whale Dumps were no longer a thing since return of bullish sentiment over 2023 and 2024.

What, exactly, is a “Whale Dump?” Glad you asked!

A shockingly small number of wallet holders hold the vast majority of existing Bitcoin. These holders are called “whales.” By coordinating a massive sale at the same time (a “whale dump“), the whales force the price of Bitcoin significantly lower, causing other holders to panic-sell.

After Bitcoin’s price has collapsed, the whales slowly reacquire what they sold (and more) at the newly-discounted prices. The whales’ buying causes Bitcoin’s price to rise, which brings new buyers into the market who think the selling is over. The new buyers cause Bitcoin’s price to rise even more.

Then, the whales wait.

This allows even more new buyers to come in, all of them thinking the selling is done. After enough time passes, the whales execute another coordinated mass sale. However, with all the new buyers having weak hands and many using tight stop losses, the whales only need to use a fraction of the Bitcoin they used before.

When the new buyers’ stop losses are triggered, this process creates a selling cascade with even more new holders (and even old ones) selling into the panic. The whales are then able to acquire even more Bitcoin at even lower prices.

Rinse and repeat until finished.

When you’re talking about a market like Bitcoin, there’s a lot of FOMO on the way up and a lot of panic-selling on the way down. If you control the majority of an asset, you can move the market whichever way you want.

In regulated markets, this kind of manipulation isn’t allowed. Welcome to cryptocurrencies. The lack of regulation is why many call the space “The Wild West.”

The Bullish Case

Bulls had their heads handed to them over the past week as the whales took control over the markets and decided “enough was enough” with new all-time high after new all-time high. Some Bulls believe that the downward momentum will soon subside and Bitcoin will head back to new all-time highs, but even the more bullish analysts don’t know if we’ve seen the end of the selling, yet.

The Bearish Case

Bears have the upper-hand, there’s no doubt about it. In addition to Bears arguing for Bitcoin to head lower, some even make the reasonable suggestion that perhaps we’ve seen the high for this bull market cycle.

While past bull market cycles saw all-time highs significantly higher than the previous ones, that doesn’t mean Bitcoin will stay that way. With so many new buyers in the space, the launch of the ETFs, and everyone knowing about catalysts like the upcoming Halving, maybe Bitcoin’s finally matured and will simply trade in a tightening range from now on?

Obviously, as a long-term holder, I certainly hope that thesis doesn’t play out, but there’s no reason to think Bitcoin won’t become exactly like physical gold and remain trading in a range for months, years, or, perhaps, even decades.

Bitcoin Trade Update

Current Allocation: 2.600% (+30.00% since Last Update)

Current Per-Coin Price: $70,247.36 (-3.76% since Last Update)

Current Profit/Loss Status: -9.72% (-4.49% since Last Update)

I made nine (9) buys during Bitcoin’s epic selloff last week. The buys left me with an average buying price of $64,401.18 (after fees) and lowered my per-coin cost down -3.76% from $72,989.46 to $70,247.36. The buys also raised my allocation +30.00% from 2.000% to 2.600%.

You’ll notice I’m still not buying in any significant size, and that’s simply been the strategy that’s worked for me since 2018. If we see Bitcoin sell off even more substantially, I will start to increase my quantities. If not, that’s a high-quality problem and what I have is what I have.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.067% @ $60,876

0.067% @ $59,953

0.067% @ $58,536

0.067% @ $57,156

0.067% @ $55,857

0.093% @ $54,618

0.273% @ $53,370

0.327% @ $52,057

0.327% @ $50,884

0.393% @ $49,629

Not Your Keys, Not Your Crypto…

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use my Gemini referral link to open an account.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

- In January 2024, Bitcoin rallied +97% to a high of $49,102.29.

- Later in January, Bitcoin dropped -22% to a low of $38,501.00.

- In March, Bitcoin rallied +92% to a new all-time high of $73,835.57.

- Later in March, Bitcoin dropped -18% to a low of $60,771.14.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.