Summing Up The Week

September and October are notorious for being the worst two months for the year, and, despite many bullish analysts claiming it wouldn’t happen this year, I had a feeling we’d see a selloff simply due to systematic selling.

Why is that? Why do hedge funds and institutions sell in September?

The answer to September’s selloffs is simple – many professional firms see their fiscal year end at the end of September. Since their fiscal year is coming to an end, they need to release performance reports to their clients and shareholders.

As a result, if we’ve seen a particularly good year in the market going into August, these firms will close many of their positions to lock in gains and be able to show positive year-end reports.

It sounds too simple but it’s simply true – the reason September is a rough month every year is because it’s the end of the year for many firms.

Period.

Since September will already be weak each year due to this programmatic selling, the month is made more volatile if we see any negative catalysts, and, as you’ve read in my weekly updates throughout the month (and, as you’ll see below) there are many negative catalysts.

Let’s take a look at the news that moved the markets this week…

Market News

Gov’t shutdown averted… for 45 days

Over the weekend, the Senate passed and President Biden passed a bipartisan continuing resolution which will allow the government to remain open for 45 days, reported CNBC. The intention of the CR is to give the Seante and House of Representatives more time to finish their funding legislation.

Of course, like high school or college students, more time will lead to more procrastination, and it’s more than likely we’ll be right back here worrying about a government shutdown around Thanksgiving.

However, for the moment, crisis averted.

August job openings at 9.6M, more than expected

On Tuesday, the Job Openings and Labor Turnover Survey (JOLTS) showed 9.61 million job openings in August, significantly more than the estimate for 8.8 million, reported CNBC.

While the market takes this data as good news, it’s important to remember that, historically, the job market is at its strongest with unemployment at its lowest immediately before a recession. It might sound crazy or as if I’m trying to be a bearish naysayer, but, unfortunately, this tends to be true.

Additionally, unemployment doesn’t hit a low and stay for a lengthy period of time. Typically, when unemployment reaches a key low, it will snap back as companies realize they need to cut costs in order to maintain their profit margins which means layoffs.

10yr & 30yr Treasury yields hit highest level since 2007

On Tuesday, the 10-year and 30-year Treasury yields rose to their highest levels since 2007, 4.758% and 4.874%, respectively, reported CNBC. As a result, the market selloff intensified as investors tend to sell what they can when the yields rise too high in an effort to go to cash and evade a market selloff.

Naturally, if you’re a long-time reader of Get Irked, you know that my discipline is to never, ever sell into a market panic. When the market is selling off, I have two choices – to buy or to hold, never to sell.

If you’re a long-term investor with a time horizon of 10+ years, you should look at systemic market selloffs as SALES as investors throw quality stocks away at discounted prices. Granted, we don’t know how low the market can go so it’s always important to buy in stages and reserve cash on the sidelines.

Marketwide selloffs are never a reason to panic and sell. Ever.

Jobs increased by 336K in September, nearly doubling estimates

In another example of “good news is bad news,” Friday’s payroll report showed nonfarm jobs increased by 336,000 in September versus the 170,000 estimate provided by Dow Jones economists, reported CNBC.

The undeniably resilient economy continues to provide reasons for the Federal Reserve to not just keep the interest rates higher for longer, but to even increase them further to reign in the economy.

Initially, the markets did take this report as bad news. However, a strong economy is a strong economy. The indexes flipped around mid-day and ended up finishing the day in the green.

Next Week’s Gameplan

Many analysts believe the market’s selloff has become so oversold that we’re due for a bounce, as much as 3-5% higher from current levels according to certain, more-bullish pundits.

As always, I maintain my discipline to have a plan for both directions. If the market bounces, I will look for profit-taking opportunities. If the market continues to sell-off, I’ll look for opportunities to add to my positions (as I have been doing for the past few weeks).

Since I’m a long-term investor with more than a 20-year time horizon, my personal bias is always bearish – not because I want people to lose value in their portfolios, rather because I’d like to put more cash to work at lower levels in my own portfolios.

If you’re feeling beaten down by all the selling, just remind yourself that September and October are notoriously bad months in the market. Just like all else in life, this, too, shall pass.

I’ll see you all back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

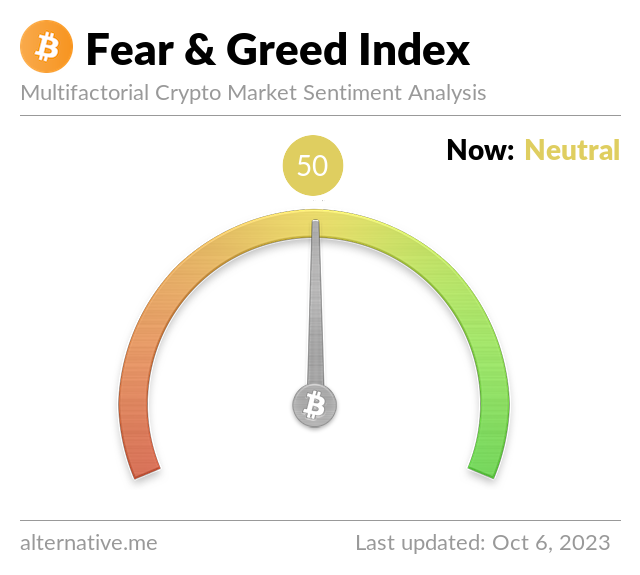

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Divergence! Bitcoin rallies when equities fall!

Despite risk assets selling off substantially this week, Bitcoin actually diverged and rallied through several through key levels of resistance at $27,313.86; $27,500.00; and $28,184.89, setting a new high at $28,613.37 on Monday before pulling back to raise its weekly low at $27,160.47 on Tuesday.

The Bullish Case

Bulls believe this divergence between Bitcoin and stocks may indicate the start of a new era for Bitcoin as it truly becomes a safe-haven/store-of-wealth asset. Bulls predict that this rally indicates Bitcoin will make an attempt to break free of its key resistance at $31,682.21 to set new higher-highs for the year.

The Bearish Case

Bears have to stand back and reassess after the week’s price action. Bears still believe Bitcoin will sell off in the event of a stock market crash or unforeseen Black Swan Event, but these analysts must concede that this week’s price action was in direct contradiction to what many of them expected would happen in the space.

Bitcoin Trade Update

Current Allocation: 2.217% (+0.017% since last update)

Current Per-Coin Price: $27,568.22 (-0.14% since last update)

Current Profit/Loss Status: -0.28% (+2.30% since last update)

My buy orders started filling this week with my first at $26,689.20 (before fees) last Friday. I was only able to make a second buy at $27,061.80 on Sunday before Bitcoin rocketed skyward, leaving me with an average buy price of $26.928.77 (after fees).

When Bitcoin shot through my cost basis, it was time to flip from adding to the position to trimming it with a series of buys that went through with an average selling price of $27,976.72 (after fees).

Then, when Bitcoin sold off through my cost basis again, it was time to start adding back in with a series of buys leaving me with an average cost of $27,348.15 (after fees).

The combination of buys and sales lowered my per-coin cost -0.14% from $27,605.91 down to $27,568.22 and increased my allocation +0.017% from 2.200% to 2.217%.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $27,007

0.014% @ $26,675

0.014% @ $26,406

0.014% @ $26,227

0.014% @ $25,813

0.027% @ $25,385

0.027% @ $25,026

0.027% @ $24,785

0.054% @ $23,971

0.081% @ $23,032

Not Your Keys, Not Your Crypto…

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.