Summing Up The Week

With this week’s volatile price action in the markets, I felt it might be a good time to remind myself of my key rule:

As long term investors, it’s more important to have disciplined strategies than bullish or bearish narratives.

The question isn’t which way is the market going to go? The question is what are YOU going to do when the market goes up or when the market goes down?

A lot of investors confuse themselves when they listen to traders on CNBC or read books like Market Wizards. Educating yourself and listening to others’ perspectives is positively invaluable, but if we’re long-term investors, we must remember that the rules which govern trades are vastly different than those that govern investments.

A trader wants to sell weakness and buy strength. An investor, on the other hand, must identify the stocks of quality companies to buy on weakness and sell on strength – the exact opposite to what traders do. This is because investors shouldn’t be looking for short-term gains, we should be looking for long-term opportunities.

Systemic market selloffs might seem frightening, but they really shouldn’t be. For long-term investors, systemic selloffs remove most – if not all – individual company risk. There may be nothing wrong with your particular investments, they may be selling off with the rest of the market. If this is the case, your stocks are on sale and it may be a good time to add to positions.

Regardless of whether you’re comfortable buying into a market selloff, the most important thing to remember is to never, ever, sell into a market panic. No one made a profit selling into a panic. During a downturn, the two options are to buy and to hold, never to sell.

With that, let’s take a look at the news that drove the markets this week…

Market News

Credit card losses rising fastest since GFC

In a study from Goldman Sachs (GS), the financial firm found credit companies are racking up losses at the fastest pace in almost 30 years – the fastest since the Great Financial Crisis (GFC), reported CNBC. What might be an even more disconcerting fact is that this delinquency rate increase is happening when the economy and job market are supposedly strong.

“We think delinquencies could continue to underperform seasonality through the middle of next year and don’t see losses peaking until late 2024 / early 2025 for most issuers,” analyst Ryan Nash wrote in the note.

In reviewing the past five credit card loss cycles, Nash found three were in recessions with the other two occuring in the mid ’90s and from 2015-2019.

“In our view, this cycle resembles the characteristics of what was experienced in the late 1990s and somewhat similar to the ’15 to ’19 cycle where losses increase following a period of strong loan growth and has seen similar pace of normalization thus far this cycle,” Nash said.

Given that the markets have been relying on a strong U.S. consumer, the rate at which consumers are racking up credit card debt (and not paying it back, apparently) should be very concerning to everyone.

Consumer Confidence disappoints, recession-level expectations

The week’s theme of a weakening U.S. consumer continued on Tuesday when the Conference Board’s consumer confidence index fell to 103 in September, down from 108.7 in August and missing Economists’ estimates of 105.5, reported CNBC.

Additionally, the expectations index – which surveys consumers about their feelings for the near future of the economy – dropped to 73.7, below the level that analysts typically associate with recessions.

This news, combined with raising credit card delinquincies and reports of American household holding the most credit card debt in history (more than $1 trillion) does not paint a rosy picture of consumers. Since the U.S. economy relies heavily on consumption, these data points do not bode well for both the economy and the stock market at this point.

10-year Treasury yield hits new 15-year high

The majority of the week’s volatile price action was a result of the U.S. 10-year Treasury hitting 15-year highs throughout the week, reported CNBC. On thursday, the benchmark yield reached as high as 4.688% intraday, the highest level since October 15, 2007 when the 10-year yielded 4.719%.

While a rising yield is typically a good thing for equities, we’re in a very, very different environment in 2023 than we have been in the past. With the Federal Reserve needing to fight inflation while the U.S. government continues to overspend on policies, the fiscal policy is in direct conflict.

The U.S. government needs to issue more treasurys to cover its ever-increasing debt, and with buyers seemingly shunning these bonds, the yield must increase to entice investors.

At some point, the rising yield could become so tempting that stock investors may opt to sell their equities in favor of the low-risk, relatively high-yield offered by U.S. Treasurys. When this has happened in the past, the stock market often sells off dramatically, sometimes even crashing outright.

While there is no guarantee this would happen now, the likelihood of a potentially devastating selloff in October is becoming stronger and stronger.

Inflation rose less than expected in August

On Friday, the Personal Consumption Expenditures (PCE) price index showed inflation increased 0.1% in August, less than the 0.2% expected, reported CNBC. The PCE is the Federal Reserve’s preferred gauge for inflation, so a lower number than expected was good news for the stock market as the PCE potentially indicates the Fed’s actions against inflation are working.

“The Fed must be pleased with the overall direction of the PCE report, but declaring victory on quelling inflation would be premature,” said Quincy Krosby, chief global strategist at LPL Financial.

Despite having a particular rough week for the first three days, the market continued the rally it saw on Thursday on the back of the PCE report.

Next Week’s Gameplan

Now that we’ve reached the end of September, many bulls believe October will see stocks rally. However, historically, this is rarely the case. Typically, the stock market bottoms in October, and, while this is certainly great news, that means it’s likely that we still have additional downside ahead in the coming weeks.

With a looming government shutdown, the first student loan payments in three years due on the 1st of October, rising yields on U.S. treasuries, and so many more potentially negative catalysts, it’s important to prepare your buying plan.

Not only do I plan buying targets for every single one of my investments in advance, I will also plug in 2-3 limit orders for each investment at the corresponding buying level. This way, if the market experiences a “flash crash” or a one-day capitulating selloff, I’ll be able to add to my positions at these weakened levels.

Of course, my next buy is never my last buy; I always keep cash on the sidelines in case the next level of support doesn’t hold and we see lower-lows.

As always, keep calm and keep investing on. I’ll see you back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

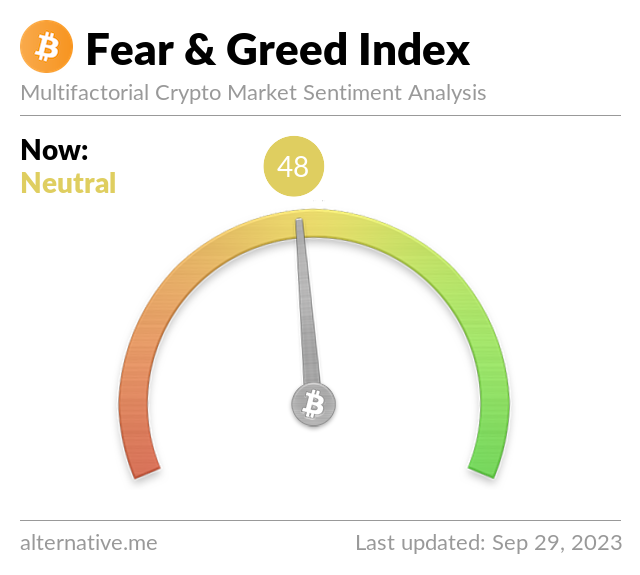

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Bitcoin’s home, home on the range…

If you were just looking at its price, you’d think Bitcoin had a pretty uneventful week, but the underlying price action throughout the week was as volatile as the equities markets.

Bitcoin broke through its previous weekly low at $26,359.70 on Sunday, not setting new support until Monday at $25,983.78. On the upside, Bitcoin was unable to approach the previous high at $27,500.00, setting a lower high at $27,313.86 on Thursday.

This is decidedly bearish price action – a lower low followed by a lower high is never a good sign for any asset.

The Bullish Case

Bulls chose to ignore this week’s price action and, instead, argued that the rally on Wednesday and Thursday indicates the institutions are rushing in to buy. Additionally, with Michael Saylor’s MicroStrategy (MSTR) continuing to add to its Bitcoin stockpile at (arguably) terrible prices, the Bulls believe the Bitcoin bull run is about to start.

The Bearish Case

Bears maintain the upper-hand. Between Bitcoin’s bearish price action and a number of negative catalysts that could be terrible for both stocks and crypto, there’s nothing on the horizon that suggests the Bears have the wrong idea when it comes to Bitcoin becoming weaker and weaker in the coming week.

Bitcoin Trade Update

Current Allocation: 2.200% (+0.167% since last update)

Current Per-Coin Price: $27,605.91 (-0.32% since last update)

Current Profit/Loss Status: -2.58% (+1.25% since last update)

My buy orders started filling this week with my first at $26,606.40 (before fees) on Saturday. After a filling a series of other buys over the course of the week, I was left with an average buying price of $26,554.78 (after trading fees).

The buys lowered my per-coin cost -0.32% from $27,695.78 down to $27,605.91 and raised my allocation +0.167% from 2.033% to 2.200%.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.027% @ $26,689

0.027% @ $26,137

0.027% @ $25,813

0.027% @ $25,385

0.027% @ $25,026

0.027% @ $24,785

0.027% @ $24,205

0.054% @ $23,267

0.147% @ $22,404

0.540% @ $21,569

Not Your Keys, Not Your Crypto…

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.