Summing Up The Week

August is a seasonally volatile month for markets and the first full week of trading for the month confirmed everyone’s expectations – volatility has certainly returned.

A smattering of different macroeconomic and microeconomic news events caused stocks to pop and drop throughout the week combined with earnings reports both surprising and shocking.

Let’s take a look at the news that moved the markets this week…

Market News

Moody’s cuts ratings of 10 U.S. banks

On Tuesday, Moody’s Ratings Agency caught banks off-guard by cutting the ratings of ten U.S. banks and putting several bigger banks on downgrade watch, reported CNBC. The firm lowered the ratings of ten banks and put several major banks like Bank of New York Mellon, U.S. Bancorp, State Street, Truist Financial, Cullen / Frost Bankers, and Northern Trust under review for potential downgrade.

“U.S. banks continue to contend with interest rate and asset-liability management (ALM) risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains systemwide deposits and higher interest rates depress the value of fixed-rate assets,” Moody’s analysts Jill Cetina and Ana Arsov said in the accompanying research note.

“Meanwhile, many banks’ Q2 results showed growing profitability pressures that will reduce their ability to generate internal capital. This comes as a mild U.S. recession is on the horizon for early 2024 and asset quality looks set to decline from solid but unsustainable levels, with particular risks in some banks’ commercial real estate (CRE) portfolios.”

The surprise downgrade of the financial sector threw the entire market for a loop, causing last week’s selloff to resume after stocks had experienced a relief rally on Monday.

Deflation strikes China’s economy

On Tuesday, China reported that its economy is experiencing deflation with consumer prices following in July for the first time in two years, reported The New York Times.

With all the talk of inflation over the past 24 months, you’d be forgiven if you thought that deflation would be a good thing for an economy.

It’s not.

In fact, many economists believe deflation may be a more severe risk for an economy than inflation as consumers hoard money and refuse to buy products as prices head lower and lower.

“The Chinese economy is squarely facing the specter of deflation, increasing the urgency of government measures to stimulate the economy and, perhaps more importantly, steps to rebuild household and business confidence,” said Eswar Prasad, an economics professor at Cornell University and former China division chief at the International Monetary Fund.

July CPI report rises 3.2%, less than expected

On Thursday, the Consumer Price Index (CPI) showed prices rose 3.2% in July, less than the 3.3% expected, reported CNBC. Of course, a rise in CPI of any kind indicates that inflation remains present in the system, however a deceleration could be a sign that the Fed’s disinflation attempts are taking hold.

That being said, the soft numbers are not likely to dissuade the Federal Reserve from remaining stalwart, some analysts believe. “While inflation is moving in the right direction, the still-elevated level suggests that the Fed is some distance from cutting rates,” said Seema Shah, chief global strategist at Principal Asset Management. “Indeed, disinflation is unlikely to be smooth and will require some additional economic pain before the 2% target comes sustainably into view.”

Wholesale prices rose 0.3% in July, more than expected

The mixed inflation signals continued rolling in when, on Friday, the Producer Price Index (PPI) showed an increase of 0.3% in July, more than the 0.2% estimate, reported CNBC. The PPI gauges the price prodcers of products receive for their products (as opposed to what consumers pay). The increase was the biggest monthly gain since January.

Markets naturally sold off on the news since any sign of inflation not easing does not bode well for what the Federal Reserve may decide to do, even with the Fed’s next meeting more than a month away near the end of September.

Next Week’s Gameplan

With few significant catalysts on the horizon and low trading volume due to so many traders and investors taking their final summer vacations, expect volatility to remain very much in the system as we head forward.

While it feels as though “Selling Season” is coming to an end and “Buying Season” is upon us, there may still be opportunities to take profits if there are significant pops in any positions. As always, plan for both directions.

I’ll see you all back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

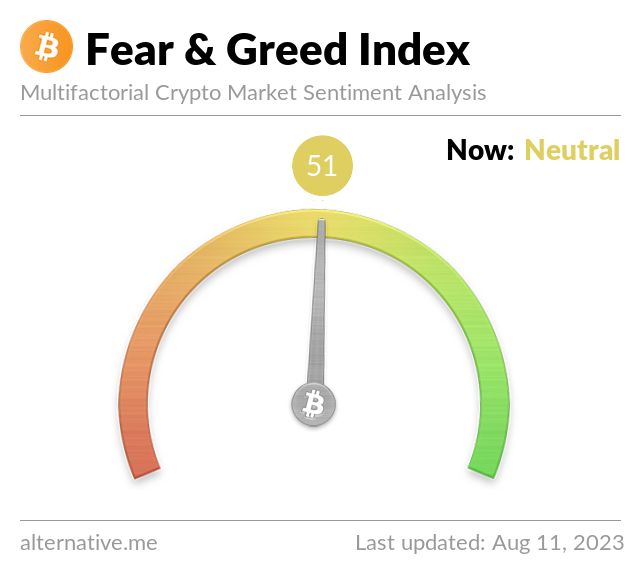

Bitcoin remains rangebound…

Despite positive news catalysts in the cryptocurrency like the announcement of a new futures ETF trading spot Ethereum (ETH), Bitcoin remains very much stuck in a trading range between our low at $28,477.00 and our high at $30,349.88. Until the crypto can decisively break either support or resistance, Bitcoin will likely remain trading within this range for the foreseeable future.

The Bullish Case

Bulls believe the potential approval of the upcoming Bitcoin ETFs plus the ongoing seemingly positive news catalysts in the space will prove that this sideways consolidation period is simply the rest Bitcoin needs before resuming its bull rally.

The Bearish Case

With the third quarter historically being a bad time for all risk assets both in crypto and the stock market, Bears believe that the coming days and weeks will only mark the start of significantly more selling pressure in Bitcoin. The Bears still believe Bitcoin will make it below $20K once more before the end of 2023.

Bitcoin Trade Update

Current Allocation: 0.807% (+0.074% since last update)

Current Per-Coin Price: $30,106.17 (-0.37% since last update)

Current Profit/Loss Status: -2.22% (+1.13% since last update)

I started buying Bitcoin again after it broke down once more Friday evening. My buys started at $29,000.70 with my lowest buy at $28,800.60, giving me an average buy of $29,019.15 (after trading fees).

The buys lowered my per-coin cost -0.37% from $30,219.37 down to $30,106.17 and raised my allocation +0.074% from 0.733% to 0.807%.

As long as Bitcoin continues to test its lows, I will continue adding, but I’m reducing the quantity I buy with each retest until Bitcoin breaks out one way or the other.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.011% @ $29,056

0.011% @ $28,939

0.027% @ $28,759

0.027% @ $28,504

0.027% @ $28,007

0.027% @ $27,434

0.114% @ $26,738

0.200% @ $26,165

0.189% @ $25,737

0.444% @ $24,888

Not Your Keys, Not Your Crypto…

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.