Summing Up The Week

The unbelievable rally taking place all year in the S&P 500 and the NASDAQ, in particular, took a breather this week with stocks pulling back. Many analysts blamed Fed Chair Jerome Powell’s testimony before Congress.

However, I think this may simply be a matter of profit-taking as the rally has been absolutely stupendous – the S&P 500 was up over 14% and the NASDAQ over 30% in the first six months of the year, after all! An “average” year for the S&P 500 is 7-8%.

Let’s take a look at the news that moved the markets this week…

Market News

Powell tells congress inflation fight “has a long way to go”

During his testimony in front of Congress on Wednesday, Federal Reserve Chair Jerome Powell reiterated that there is “a long way to go” with the Fed’s fight against inflation and expects several more rate hikes in addition to keeping the rate “well above” where it should be, reported CNBC.

Despite the fact that his testimony didn’t really introduce anything the markets didn’t already hear last week, stocks pulled back on news that Powell would remain steadfast in comments made at last week’s FOMC meeting.

Fast Money trader says 2023 is “inverse of 2022”

During CNBC’s Fast Money on Wednesday night, Dan Nathan, longtime trader and co-host of the On The Tape podcast, referenced an analyst report that showed 2023’s price action is the “inverse of 2022’s.” This is far from a bullish comparison.

Longtime readers of Get Irked likely remember that stocks sold off pretty spectacularly into mid-month of June 2022 before finding support and rallying into the end of August on the back of hopes that the Fed was done raising rates (sound familiar?). While that rally ended up culminating in a selloff to even lower lows than those seen earlier in 2022 by the mid-October, 2022’s summer rally was pretty fantastic.

If 2023 were the inverse, that would indicate that the peak of the market was last week, and that stocks are about to roll over, selling off until the end of August. Whether this forecast comes to fruition or not, I make it a practice to worry more about downside risk than I do about upside profits.

Next Week’s Gameplan

Seasonally, the summer is actually a bullish time for the markets with most years seeing a summer rally on light volume. However, if 2023 is the inverse of 2022, we could be heading into a very… exciting… July and August. Only time will tell if this analyst report’s forecast comes true.

In the meantime, I’ll keep my plan for both directions – taking profits in positions when they hit my upside price targets and adding to positions if they pull back far enough.

I’ll see you all here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

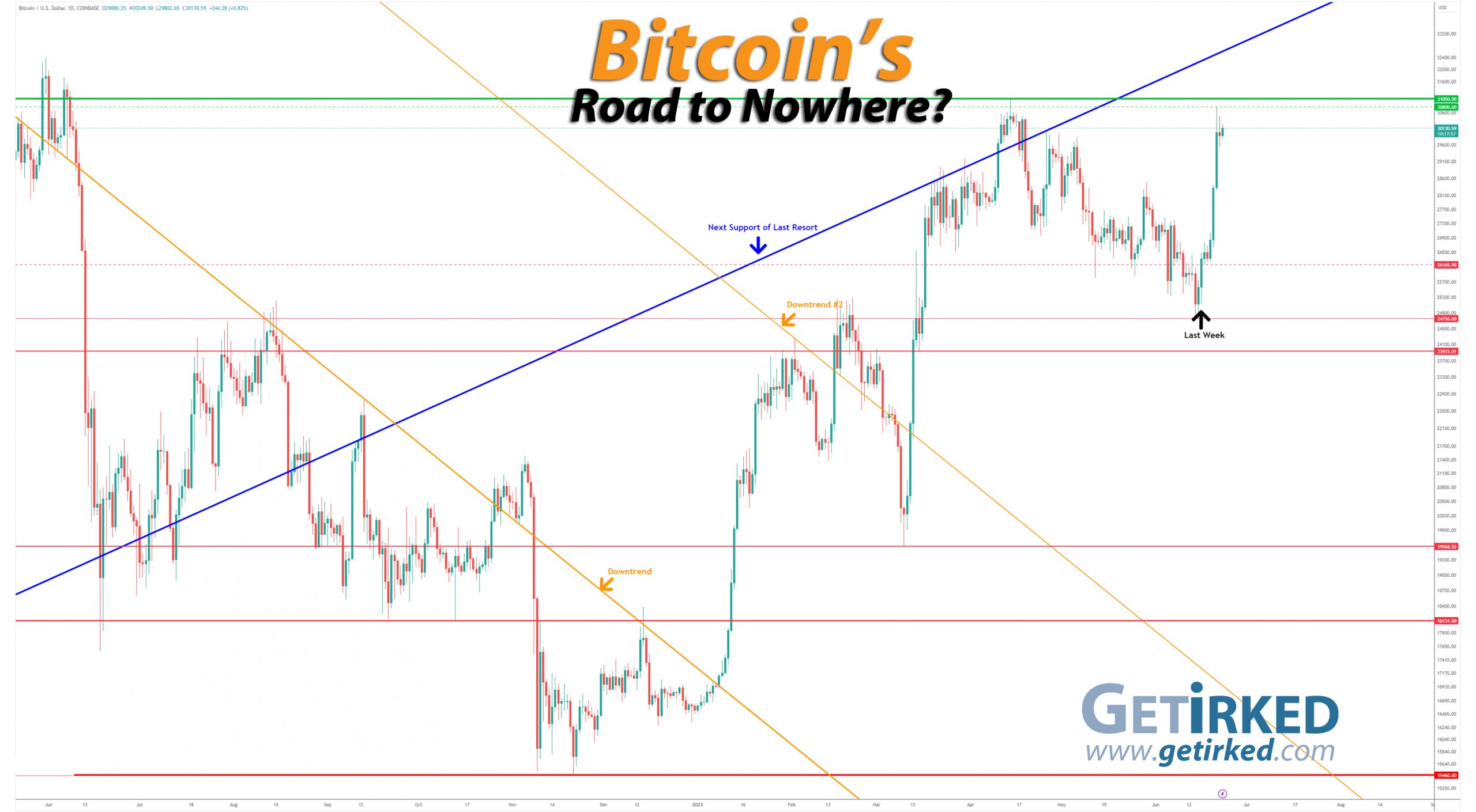

Bitcoin moons through $30K!

Bitcoin skyrocketed through $30K on Wednesday following news that traditional finance (TradFi) firms are continuing to push their way into crypto with the launch of EDX Exchange, backed by Fidelity, Charles Schwab, and Citadel, reported Coindesk.

Bitcoin flew through almost all of its overhead resistance levels before making a new weekly and monthly high at $30,800.00, just under the 2023 high at $31,050.00. Bitcoin’s new floor of support is set at its weekly low at $26,165.98 set following a brief pullback on Saturday before the rally got started.

The Bullish Case

Bulls have new fodder for their thesis that Bitcoin is most certainly in a new bull market. Key to the Bullish narrative is new money flowing into the space, particularly institutional money (the EDX exchange only supports institutional money), and with major TradFi firms showing no fear of the SEC’s lawsuits, the Bullish case heading forward is strong.

The Bearish Case

Bears must concede that the new bullish catalysts are certainly strong. In the short term, Bears point out that Bitcoin has rapidly entered extremely overbought territory, and that a pullback from Wednesday’s blowoff top may be in order, with a conservative target of around $27,800 – the 50% retracement of the move – being on the horizon.

Bitcoin Trade Update

Current Allocation: 0.267% (*NEW* since last update)

Current Per-Coin Price: $29,802.93 (*NEW* since last update)

Current Profit/Loss Status: +1.10% (*NEW* since last update)

**Trade closed: +18.49% Gain in Three Months**

With Bitcoin seeing a pretty epic rally this week, I decided it was time to fully reset the trade, closing the previous trade with a gain of +18.49% over the course of three months with the trade opening on March 19 and closing on June 21.

As always, I take original USD capital used in the trade back out to use in future trades, but I keep the profits in Bitcoin (not USD), transferring the profits off on to cold wallets as my way of accumulating more of the crypto over time at (relatively) no cost to me.

**New Trade Opened**

After taking profits and reducing the allocation size, I opened my new trade at $29,802.93 with an allocation of 0.267%. If Bitcoin continues to rally, I’ll start taking profits and reduce the allocation slightly under $31K. I will also start adding to the position more aggressively as it appears the $25K mark provides significantly more support than the Bears believed.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.011% @ $28,358

0.016% @ $27,911

0.027% @ $27,324

0.049% @ $26,303

0.044% @ $25,944

0.115% @ $25,164

0.098% @ $24,674

0.066% @ $24,426

0.126% @ $23,957

0.388% @ $22,818

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June 2023, Bitcoin dropped -20% to a low of $24,750.01

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.