Summing Up The Week

With the Federal Reserve meeting next week on June 13-14, the members are in a required “communications blackout,” so this week’s price action was muted, being driven by relatively unremarkable stories such as OPEC+ upholding its production targets, the Euro Zone entering recession (Germany had already been in one for some time now), and the SEC going after Bitcoin and crypto exchanges.

Let’s look at the news that moved the markets this week…

Market News

OPEC+ to stick to 2023 oil production targets

On Sunday, OPEC+, the oil cartel, announced that it would stick to previously-established oil production targets, counter to statements made in recent weeks suggesting the cartel would further cut production, reported CNBC. Saudi Arabia, however, did announce that it would engage in further voluntary declines.

Russia agreed to make cuts to production as well, however, other members of OPEC+ demonstrated skepticism and Russia continues to need revenue to fund its war in Ukraine. “Some of the things that we have seen from Russia on a technical basis just … [don’t] add up from some of the independent sources, and we will be reaching out to those independent sources,” said UAE oil minister Suhail al-Mazrouei on during a press briefing after the OPEC+ meeting on Sunday.

Since a decline in oil supply would lead to higher energy prices, many analysts were going into the weekend expecting an announcement that could cause stocks to sell off Monday, however the reiteration that OPEC+ would be sticking to its prior production plan squashed any bearish narratives.

SEC in full attack mode, goes after Binance and Coinbase

This week, the Securities Exchange Commission (SEC) went after the cryptocurrency industry, suing the two biggest crypto exchanges, Binance and Coinbase.

On Monday, the SEC sued Binance and CEO Changpeng Zhao for U.S. securities violations (Source: CNBC). Then, on Tuesday, the SEC sued Coinbase for acting as an unregistered broker of securities (Source: CNBC).

“These trading platforms, they call themselves exchanges, are commingling a number of functions,” SEC chair Gary Gensler said on CNBC Tuesday. “We don’t see the New York Stock Exchange operating a hedge fund.” The SEC also said in a statement, “We allege that Coinbase, despite being subject to the securities laws, commingled and unlawfully offered exchange, broker-dealer, and clearinghouse functions.”

Euro zone enters recession; Germany, Ireland growth revision

On Thursday, the Eurostat released a report showing the 20-member bloc of the Euro Zone officially entered recession, reporting a Gross Domestic Product (GDP) of -0.1% for the first quarter of 2023, reported CNBC. Additionally, analysts believe this is simply the start of a deeper recession for the Europe.

“News that GDP contracted in the first quarter after all means that the euro zone has already fallen into a technical recession. We suspect that the economy will contract further over the rest of this year,” Andrew Kenningham, chief Europe economist at Capital Economics, said in a note Thursday.

Next Week’s Gameplan

Whereas this week was expectedly calm, there is almost certainly volatility on the horizon as investors try to digest whatever the Federal Reserve does next with interest rates on Wednesday.

There are three basic scenarios:

(1) The Fed hikes rates 0.25% and announces a wait-and-see approach. This will likely have a short-term selloff for stocks as the majority of analysts seem to be expecting a pause.

(2) The Fed pauses but gives hawkish forward guidance suggesting more hikes are very likely. Given all of the changing data, this is the most likely scenario. A hybrid between a hike and a dovish pause, this scenario gives the Fed the leeway to see how current hikes are affecting the economy while not closing the door on future hikes.

(3) The Fed pauses and hints that they think they are done raising rates. This is the most bullish scenario but also the most unlikely. More of a “full stop” then a pause, the Fed could announce they aren’t raising rates from current levels and that the data suggests they won’t need to make additional hikes from here. This would mean the tightening cycle is effectively done and the market would move into a “higher-for-longer” cycle as the Fed would keep rates at this level for some time.

So, next week promises to be exciting… more exciting than this week, at least (which isn’t saying much).

I’ll see everyone back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

The SEC is coming for Bitcoin and the crypto space

Bitcoin broke through all prior support on Monday following news breaking that the SEC sued Binance and CEO Changpeng Zhao for U.S. securities violations (Source: CNBC). Then, on Tuesday, the SEC sued Coinbase for acting as an unregistered broker of securities (Source: CNBC). However, instead of selling off further, Bitcoin strangely caught a bid and rallied off its lows.

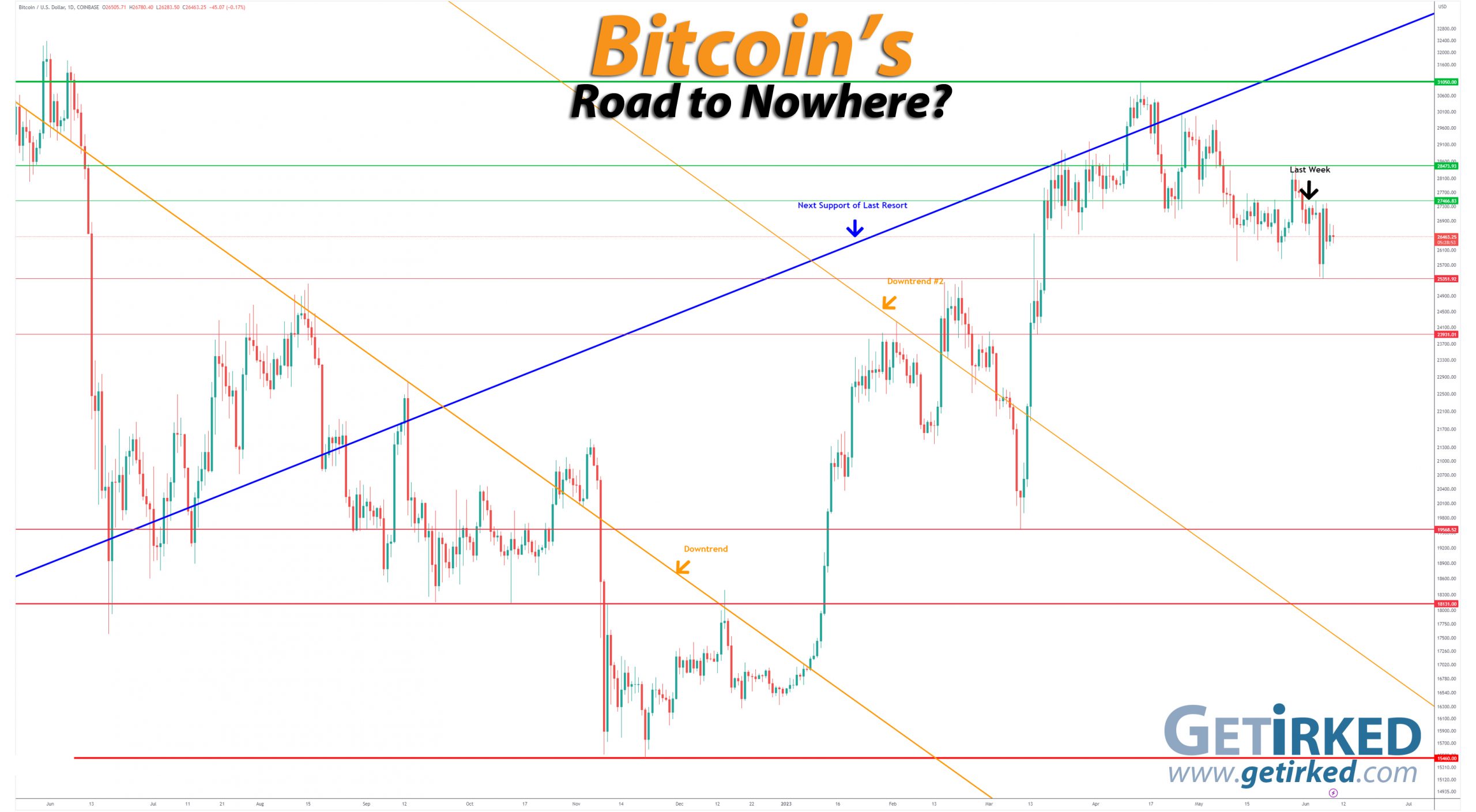

On Sunday, Bitcoin had set new weekly resistance with a brief rally to $27,466.83 before reversing when Monday’s announcement caused the crypto to destroy its weekly support at $26,508.00 as well as the prior support at $25,810.00, not finding new support until $25,351.92 on Tuesday.

I must admit, I’m always amused by diehard technicians who like to use the quote “show me the charts and I’ll tell you the news” which makes the assertion that charts and technicals dictate the price action for investment assets, not news events and fundamentals.

While I personally combine technical analysis with fundamental analysis, often a news event will destroy any technical analysis a chartist could make without taking the fundamentals into account, rendering the technicals worthless against a positive or negative news catalyst. That was certainly the case this week when Bitcoin collapsed on the back of SEC’s announcement of its lawsuits against Binance.

The Bullish Case

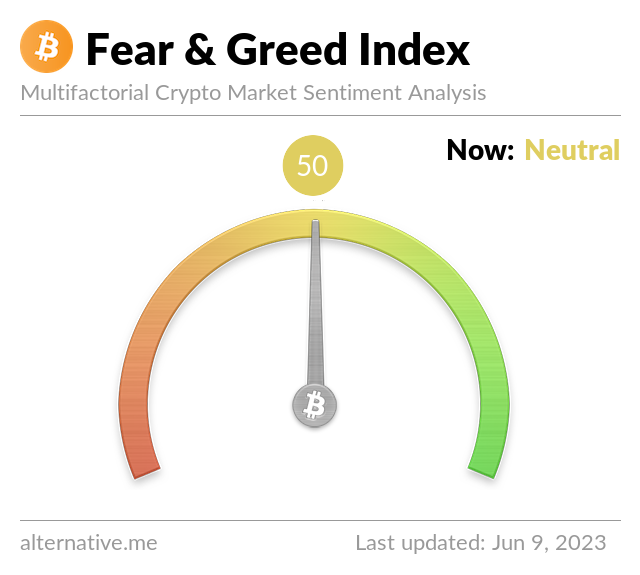

Bulls should have a difficult time making a case for a continued rally in light of the SEC’s new war on crypto. Despite the lawsuits, Bulls still claim that Bitcoin is in the throes of a new bull market and this week’s selloff is just a healthy correction.

The Bearish Case

Bears rightfully point out that the new environment of SEC lawsuits combined with the existing myriad of geopolitical and macroeconomic concerns almost certainly means this week’s selloff in Bitcoin should mark the beginning – not the end – of a downward correction. However, Tuesday’s bizarre price action with the rally off the lows might throw some water on the bearish narrative.

Bitcoin Trade Update

Current Allocation: 0.250% (+0.050% since last update)

Current Per-Coin Price: $23,273.28 (+2.33% since last update)

Current Profit/Loss Status: +13.80% (-5.28% since last update)

Bitcoin shot through my next buy target on Monday which filled at $25,957.80 (before fees). The buy raised my per-coin price +3.22% from $22,742.95 to $23,475.00 and increased my allocation +0.067% from 0.200% to 0.267%.

However, when Bitcoin rallied on Tuesday following the news that the SEC would be suing Coinbase (I still don’t quite understand the price action… why rally??), the crypto started triggering profit-taking sell orders at $27,090.17. The small sales lowered my per-coin cost -0.86% from $23,475.00 to $23,273.28 and decreased my allocation -0.017% from 0.267% to 0.250%.

From here, I will continue adding to my position if the selloff resumes with my next buy at $25,978.50, a key point of support, and I’ll continue taking profits if Bitcoin makes an attempt at its past weekly high at $28,473.93.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $25,489

0.027% @ $24,750

0.054% @ $24,267

0.082% @ $23,108

0.109% @ $22,653

0.136% @ $22,108

0.163% @ $21,031

0.327% @ $20,031

1.090% @ $19,486

1.362% @ $18,437

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.