Summing Up The Week

The debt ceiling debate drove a lot of the price action this week, finally. I say “finally” because many analysts had anticipated the approaching debt ceiling deadline to cause a selloff in stocks, but it never happened. The markets seemed to ignore the potential deadline for the entirety of May before finally wising up this week.

Even potentially dovish Federal Reserve meeting minutes released on Wednesday couldn’t sway the market’s downward trajectory.

Let’s look at the news that moved the markets…

Market News

Debt ceiling talks will likely continue to 11th hour

While it should come as no surprise that the political theater would result in debt ceiling talks continuing until the 11th hour right before the deadline, both House Speaker Kevin McCarthy and President Joe Biden had intimated repeatedly that talks were proceeding smoothly and that a compromise would be reached.

Well, not so much.

On Wednesday, reports that the debt ceiling talks had hit a snag made their way to the media, reported CNBC. A Democratic official described the issue as a “speed bump” to NBC News.

This speed bump couldbe related to comments McCarthy made in interviews Tuesday evening, “Let me be very clear, we are not putting anything on the floor that doesn’t spend less than we spent this year.”

Fed divided about more interest rate hikes

In the FOMC’s meeting minutes for April released on Wednesday, Federal Reserve officers were divided over where to go with interest rates, reported CNBC. Some felt the need for additional hikes to slow growth while others felt the need to wait to see the effects of existing hikes.

“Participants generally expressed uncertainty about how much more policy tightening may be appropriate,” the minutes stated. “Many participants focused on the need to retain optionality after this meeting.”

Unsurprisingly, the Fed made the decision to continue monitoring different data points to track the effects of rate hikes and the overall health of the U.S. economy. “In light of the prominent risks to the Committee’s objectives with respect to both maximum employment and price stability, participants generally noted the importance of closely monitoring incoming information and its implications for the economic outlook,” the document stated.

While the potential for a pause could have normally been a positive catalyst for markets, as I mentioned earlier in this update, the debt ceiling debates dominated market action this week so Wednesday remained a down day for stocks.

Nvidia proves AI hype is far from finished

Going into Nvidia’s (NVDA) earnings report Thursday night, nearly every analyst on the street thought the stock was supremely overvalued and there was no way CEO Jen-Hsun Huang could possibly surprise to the upside.

Analysts were wrong. Very wrong.

Nvidia gave such insanely positive forward guidance over expected sales of its H100 chip, the brains behind the Artificial Intelligence (AI) craze, that Nvidia’s stock surged 25%, bringing the market value of the company right under $1 trillion, putting it nearly in the rare “Trillion Dollar Club” territory alongside Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN), reported CNBC.

I don’t often cover single-stock earnings reports in the Week in Review, but the explosion of this already expensive stock potentially serves as a warning sign that there remains far too much froth in the market as investors piled into Nvidia. With this kind of rabid excitement over AI, the Federal Reserve might once again believe that there is more work to be done and raise interest rates still higher from here.

Inflation rose 0.4% in April, 4.7% from last year

On Friday, the core Personal Consumption Expenditures (PCE) price index rose 0.4% in April and 4.7% from a year ago, both slightly higher than the 4.6% expected, reported CNBC. The PCE remains the key inflation gauge for the Federal Reserve, so while the increase was only modest, many analysts believe the Fed will raise interest rates once again when they meet in June.

“With today’s hotter-than-expected PCE report, the Fed’s summer vacation may need to be cut short as consumers’ vacations fuel spending,” noted George Mateyo, chief investment officer at Key Private Bank. “Prior to today’s release, we believe that the Fed may have been hoping to take the summer off (i.e., pause and reassess), but now, it seems as if the Fed’s job of getting inflation down is not over.”

Next Week’s Gameplan

With next week shortened thanks to the Memorial Day holiday, historically, trading volumes are typically light. However, given that there will be two trading days before the end of the month and the debt ceiling deadline, I anticipate we’ll see a lot more volume and volatility than is typical for this time of year.

As always, I have my shopping list at the ready with buying price targets for every stock and Exchange Traded Fund (ETF) in my portfolios just in case we see the substantial selloff so many bears had promised before May started. We’ll just have to wait and see.

I’ll see you back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

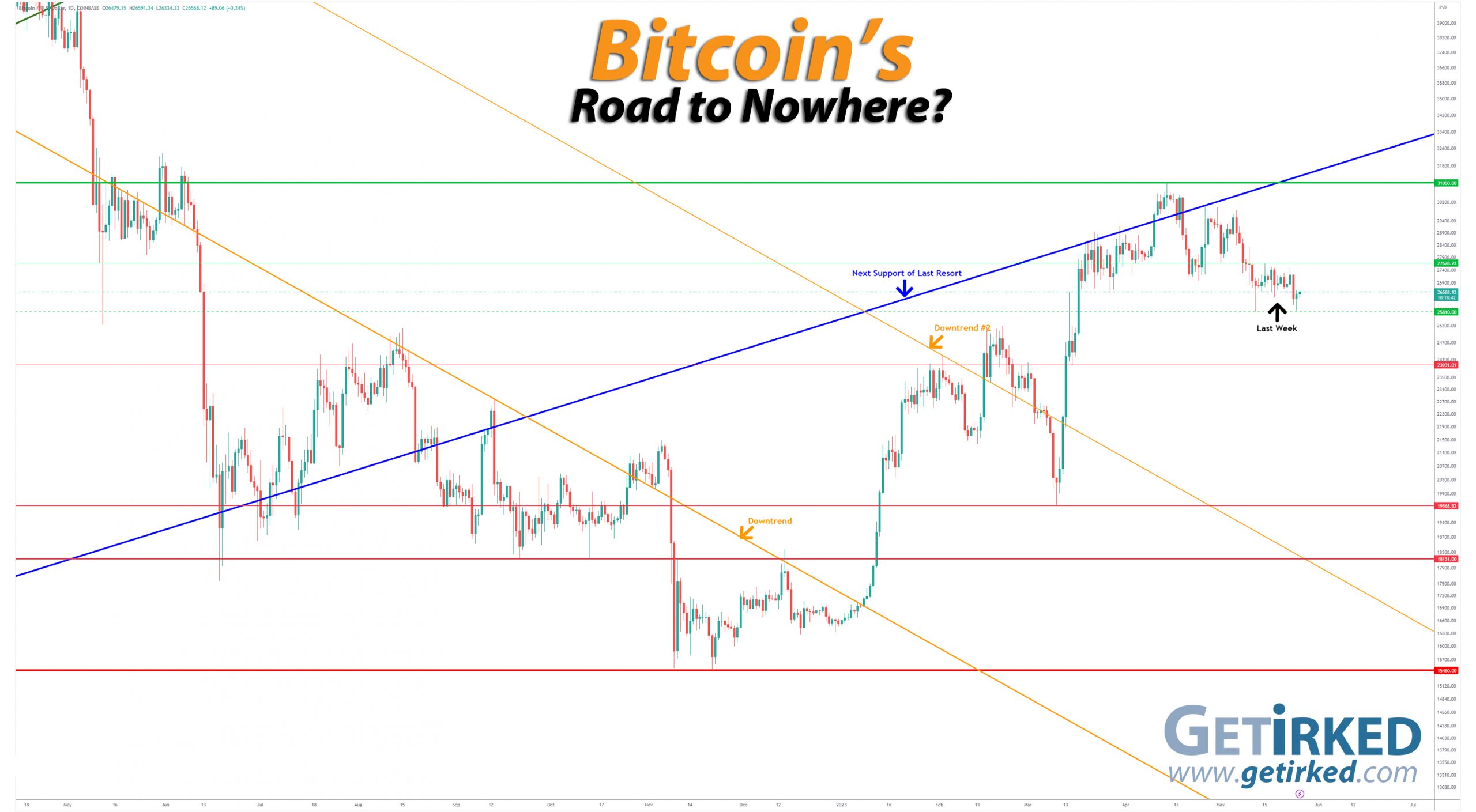

Rangebound volatility continues in Bitcoin

Bitcoin continued to trade within its multiweek range this week, unable to break above its weekly high at $27,678.73 or break below its weekly support at $25,810.00, but that didn’t mean it didn’t violently trade between those two points. After rallying to $27,500 on Tuesday, Bitcoin rolled over and sold off nearly -6% to $25,864.35 on Thursday.

The Bullish Case

Bulls claim the $25,810.00 mark represents a key point of support and that this price consolidation is healthy as Bitcoin prepares to break through its ceiling of resistance, eventually making its way back up to (and through) its 2023 high of $31,050.00.

The Bearish Case

Bears believe Bitcoin’s multiple tests of the $25,810.00 support are an indication that the crypto wants to break down further. At least one popular analyst I follow, DataDash on YouTube, has reiterated his call for a low in the $12K-$13K range.

Bitcoin Trade Update

Current Allocation: 0.267% (+0.050% since last update)

Current Per-Coin Price: $23,775.13 (+1.82% since last update)

Current Profit/Loss Status: +11.75% (-3.12% since last update)

Bitcoin’s rangebound movements continued this week, so when the crypto popped on Monday evening, it triggered my next sell order at $27,458.88.

However, on Wednesday, Bitcoin once again resumed its selloff, triggering a number of buys that left me with an average buying price of $26,182.12 (after fees).

As a result of the buys and sales, I raised my per-coin cost +1.82% from $23,349.38 up to $23,775.13 and increased my allocation +0.050% from 0.217% to 0.267%.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.054% @ $24,778

0.082% @ $23,867

0.109% @ $22,922

0.136% @ $21,928

0.490% @ $20,859

0.545% @ $19,976

1.089% @ $19,327

1.362% @ $18,623

1.362% @ $17,906

2.451% @ $16,360

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.