Summing Up The Week

This week was all about the U.S. consumer and the debt ceiling debate.

Home Depot (HD) kicked off the week with a complete earnings miss and a terrifying view of the consumer and Target (TGT) warned consumers were pulling back. However, Walmart (WMT) blew away all expectations and acknowledged that while families were spending less, they saw a resilient consumer.

So, retail earnings were a mixed bag.

As for the debt ceiling, comments throughout the week from both Democrats and Republicans reassured the markets that the U.S. would not default on its debt despite the slow movement of the negotiations on raising the debt ceiling.

… until Friday when the Republicans walked out of negotiations and rolled the markets.

In other words, it was a busy week.

Let’s take a look at the news that moved the markets this week…

Market News

Home Depot releases “awful” earnings report

On Tuesday, Home Depot (HD), a bellwether for both homebuilders and the consumer, disappointed with forward guidance indicating demand destruction with a significant revenue miss, 2.7% below expectations, reported CNBC.

Analysts were looking forward to this week’s retail earnings reports as a “tell” on the U.S. consumer. If earnings met or beat expectations, then the U.S. consumer could be considered still going strong and the economy would likely also remain resilient.

However, with Home Depot revealing a weak consumer, the report had a double-whammy effect as many professionals use Home Depot for supplies, so not only are consumers pulling back, potentially so are homebuilders, a sector of the economy that had been standing up strong in the face of weak macroeconomic data.

Target sees U.S. consumers spending less on discretionary items

On Wednesday, Target (TGT) reported good earnings and even maintained its forward guidance, however the company did report that it saw customers spending less on discretionary items, reported CNBC. While not devastating to the markets, a decrease in discretionary spending does indicate a potential tightening in the economy.

Biden, McCarthy say U.S. won’t default, deal coming soon

On Wednesday, President Joseph Biden announced and House Speaker Kevin McCarthy told CNBC in an interview that the U.S. won’t default on its debt even as the negotiations continue slowly. This news caused markets to rally significantly as the potential of a debt ceiling debacle had been weighing on stocks for some time.

“I think at the end of the day we do not have a debt default,” House Speaker Kevin McCarthy told CNBC in a “Squawk Box” interview Wednesday morning.

President Joe Biden echoed that sentiment later in remarks from the White House, “We’re going to come together because these is no alternative,” he said. “Every leader in the room understands the consequences of failure.”

On Thursday, McCarthy further reassured the American people, saying that the House could vote on a debt ceiling deal as soon as next week. “I see the path that we can come to an agreement,” McCarthy told reporters in the Capitol. “And I think we have a structure now and everybody’s working hard, and I mean, we’re working two or three times a day, then going back getting more numbers.”

Walmart beats expectations, raises full-year guidance

On Thursday, Walmart (WMT) proved that not all retailers are created equal beating earnings and revenue expectations while also raising full-year guidance, reported CNBC. While Home Depot (HD) and Target (TGT) earlier in the week left some analysts feeling the like the U.S. consumer was pulling back, Walmart’s results were contrarian.

“We’re seeing in these economic indicators that there is some strain on the consumer, but the resilience has surprised us,” said Chief Financial Officert John David Rainey in an interview with CNBC. “And I think that’s in part probably because balance sheets are much stronger than they were pre-pandemic, even at this point.”

CEO Doug McMillion acknowledged in the conference call that persistently higher prices on food and home goods do continue to limit families’ abilities to spend money in other ways. Despite this, Walmart expects to see increased profits throughout 2023.

Debt ceiling talks halted, republicans say dems aren’t reasonable

Like clockwork, news broke that the Republicans had walked out of debt ceiling negotiations on Friday, saying that the White House isn’t being “reasonable,” reported CNBC.

Nothing’s ever easy when it comes to the government, is it? It’s all about political theater and grandstanding. Following walking out, the Republicans answered reporters’ questions as to why: “Until people are willing to have reasonable conversations about how you can actually move forward and do the right thing, then we’re not gonna sit here and talk to ourselves,” Rep. Garret Graves, R-La., told reporters. “We decided to press pause because it’s just not productive,” he added. Graves said he did not know if talks would resume this weekend.

So, what had been a huge negative catalyst taken off the table has now been put back on. That’s right – we don’t know if the U.S. will default on its debt. Naturally, the markets, which had been up in the day, rolled over immediately on this news.

Next Week’s Gameplan

With the debt ceiling debate still raging, we can expect more volatility in the markets next week as investors try to figure out what’s happening next. If the Artificial Intelligence (AI) craze keeps making Big Tech run, I’ll continue taking profits with my two biggest positions – Nvidia (NVDA) and Apple (AAPL) – both nearing selling targets.

In the meantime, I am also eyeing other positions which have bounced off their lows, raising my buying price targets to meet those lows should they be tested in the coming weeks.

I’ll see you all back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

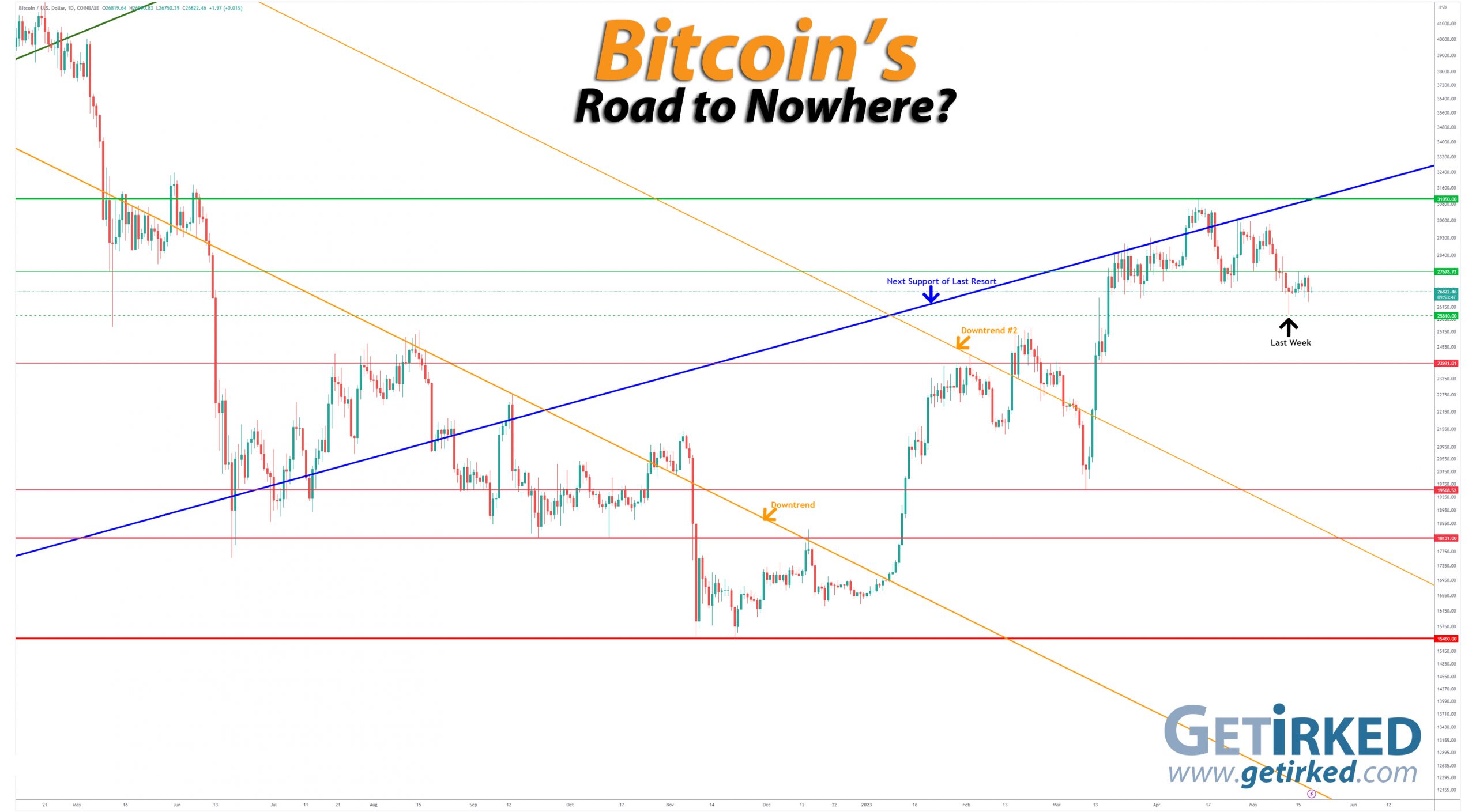

Bitcoin Price Action

Volatility is here, as promised!

As I mentioned last week, the departure of the market makers has left a volatility hole in Bitcoin which the traders capitalized on this week. Shortly after last week’s update, Bitcoin broke down and cracked through the low at $26,133.00 before finding support at $25,810.00 last Friday and bouncing.

The crypto found resistance at $27,678.73 on Monday and started to sell off once more after consolidating a bit on Thursday. From here, Bitcoin either needs to break through the new weekly high or weekly low to see a significant move, otherwise it will continue to consolidate in this new range.

The Bullish Case

Bulls point to the technicals with claims that conditions remain favorable for a new bull market for Bitcoin, setting their sights on new all-time highs. Bulls believe the support found last week at $25,810.00 is a good sign and that this pullback is just healthy consolidation as Bitcoin prepares to restart its bull run shortly.

The Bearish Case

Bears reveal that absolute interest in Bitcoin appears to be waning. Despite the price action, the trading volume is low across the board and many other indicators aren’t lining up with previous bull markets. Most Bears believe Bitcoin will definitely test its March low around $19,600, many believe the November low at $15,460.00 is likely in play, and at least one major Bear believes that low won’t hold and Bitcoin will work its way down to the $12,000-$13,000 range.

Bitcoin Trade Update

Current Allocation: 0.217% (Unchanged since last update)

Current Per-Coin Price: $23,349.38 (-0.35% since last update)

Current Profit/Loss Status: +14.87% (+2.11% since last update)

Bitcoin’s volatility remains strong resulting in me taking profits on some of the crypto I added last week with a sale that went through Monday at $27,370.11.

Then, when the selloff picked up again, I started adding back in with a small buy at $26,606.40 (before fees) on Thursday. The resulting swaps of buys and sells left my allocation unchanged at 0.217% but lowered my per-coin cost -0.35% from $23,431.02 to $23,349.38.

As always, volatility can be your best friend if you capitalize on it. For me, I never buy all at once or sell all at once, so it’s just a matter of position management until Bitcoin decides which way it wants to move big next.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $26,006

0.054% @ $24,702

0.082% @ $24,122

0.109% @ $23,639

0.136% @ $23,053

0.245% @ $21,756

0.817% @ $20,762

1.089% @ $19,817

1.362% @ $18,727

1.362% @ $18,023

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.