Summing Up The Week

Despite reports which came throughout the week showing inflation may be easing and the Federal Reserve Bank’s actions may be taking the desired effect, the looming deadline of the debt ceiling has sat in the market’s driver’s seat and now determines which way stocks are going to go.

Let’s take a look at the news that moved the markets this week…

Market News

Treasury Secretary warns of potential “Economic Chaos”

In an interview with ABC on Sunday, Treasury Secretary Janet Yellen warned that should Congress fail to raise the debt ceiling, the U.S. would enter a “steep economic downturn” and that “financial and economic chaos will ensue,” reported CNBC.

“Our current projection is that in early June, a day will come when we’re unable to pay our bills unless Congress raises the debt ceiling, and it’s something I strongly urge Congress to do,” Yellen told ABC’s This Week. “It’s widely agreed that financial and economic chaos will ensue.”

Should the debt ceiling not be raised in time, the U.S. government would not have the necessary funding to pay its bills, defaulting on debt owed to individuals, companies, and countries throughout the world.

The U.S. has never defaulted on debt payments in its entire history, so chances are likely that Congress will raise the debt ceiling, however there are certain Republican members of Congress who may try to make doing so a difficult time for both parties.

Debt Ceiling Meeting yields no results

On Tuesday, President Joseph Biden’s meeting with top congressional leaders ended with no resolution on the looming debt ceiling deadline, reported CNBC.

While Biden did make a point to acknowledge everyone in the meeting understood the risk of default, his words were far from encouraging. “Everyone in the meeting understood the risk of default,” Biden said. “I made clear during our meeting that default is not an option.”

House Speaker Kevin McCarthy reiterated his goal of reducing government spending and expressed exasperation at not finding progress. “I asked [Biden] numerous times if there were places we could find savings,” in the federal budget, he said. “He wouldn’t give me any.”

The group announced plans to meet again on Friday to continue talks to try to lift the debt ceiling before the federal government runs out of money in early June.

Inflation increased 4.9% in April, better than estimates

On Wednesday, the markets received some “good news” when the Consumer Price Index (CPI) showed the rate of inflation had slowed to 4.9% in April, less than the 5.0% expected by analysts, reported CNBC. The downward trend provides some hope that the Federal Reserve’s attempts to curb inflation may be taking effect, knowing that rate hikes have a lag of anywhere between 7-12 months from when the hike is made to when effects on the economy can be observed.

“Today’s reports suggests that the Fed’s campaign to quell inflation is working, albeit more slowly than they would like,” said Quincy Krosby, chief global strategist at LPL Financial. “But for financial markets … today’s inflation print is a net positive.”

Wholesale prices rose 0.2% in April, less than expected

On Thursday, more good news on inflation rolled in when the Producer Price Index (PPI) showed a 0.2% increase in goods and services in April versus the Dow Jones estimate for 0.3%, reported CNBC.

“This morning’s PPI release indicates that prices are inching lower, a significant indicator for a market concerned about an elevated trend in prices paid,” said Quincy Krosby, chief global strategist at LPL Financial. “The higher than expected initial unemployment claims release, similarly is market friendly as the resilient labor landscape, underpinning higher wages, is showing signs of easing.”

However, despite the news that inflation may be easing, markets became soft and started to sell off as the ongoing tax ceiling debate has taken center stage.

Next Week’s Gameplan

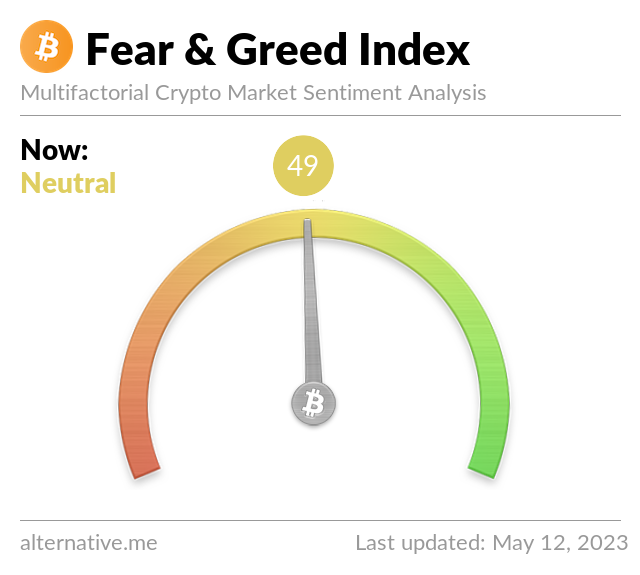

With the debt ceiling deadline set at June 1 and neither the Democrats or Republicans seeming to want to give any ground, it’s likely that the next few weeks will be bearish for stocks and potentially other risk assets like Bitcoin.

Since I have a high level of conviction that neither party will allow the U.S. to default on its debt payments – this has never happened in the history of the country – any systemic selloff will provide buying opportunities. I make my buying plans in advance, so if we see a big selloff throughout the coming weeks in May, I’ll be ready. As always, keep calm and invest on!

I’ll see you all here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

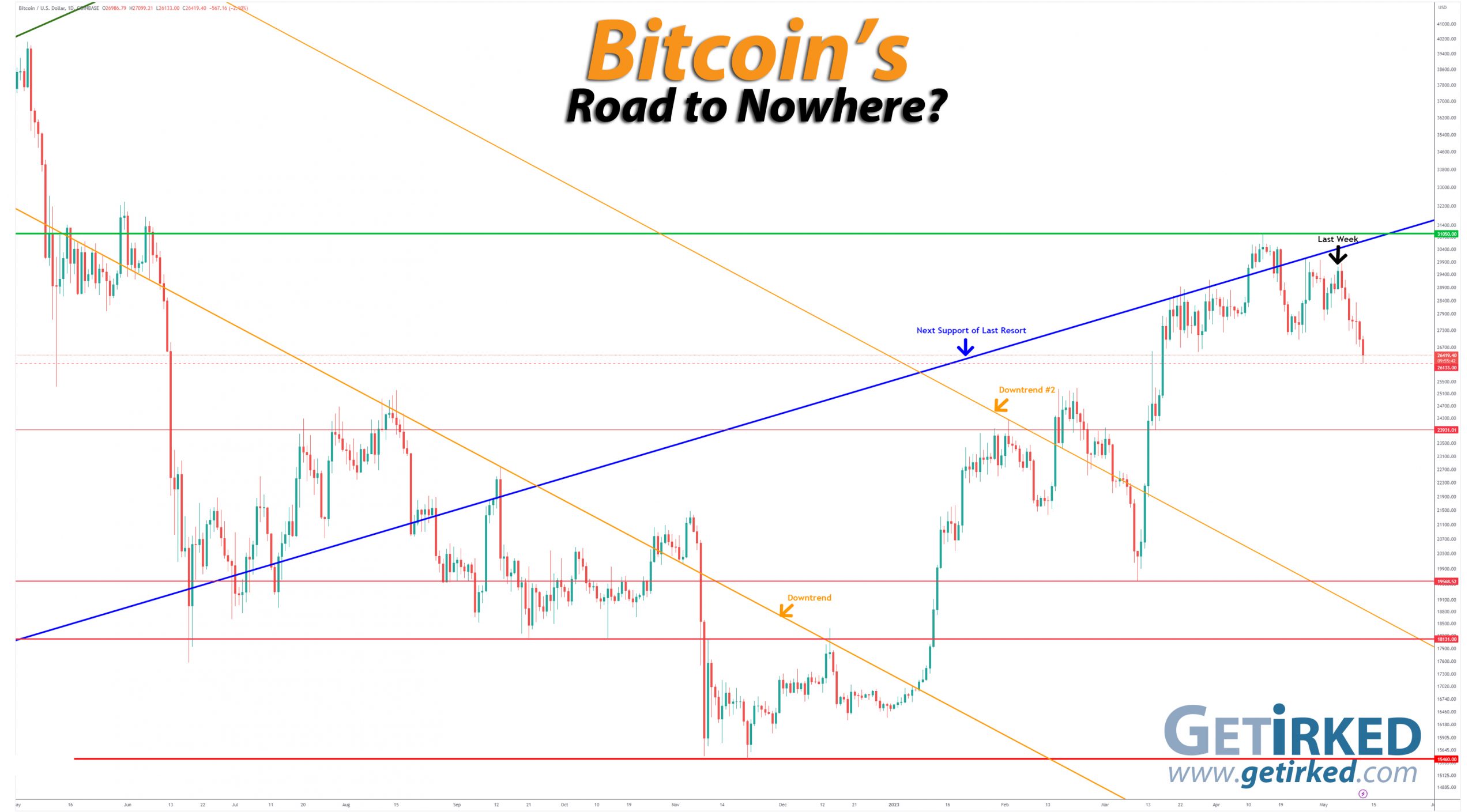

Volatility increase incoming??

Bitcoin pulled back on Thursday, when news broke that big market makers Jane Street and Jump Crypto were stepping back now that U.S. regulators have started cracking down. Market makers are responsible for providing liquidity (basically, significant buy and sell orders) which typically stabilize markets, preventing extreme movements in either direction.

With big market makers backing away from Bitcoin and crypto, the theory is that the market could see an increase in dramatic moves one way or the other.

Bitcoin broke through key support at $26,525.00 on Friday, not finding new support until $26,133.00. As you can see in the chart, there’s a bit of an “air gap” now where there’s no significant support for Bitcoin until around $23,931.01.

The Bullish Case

Bulls believe Bitcoin has held up exceptionally well when noting the lack of liquidity in the market, but even the Bulls think Bitcoin is due for a correction and it’s hard to determine how low the crypto will go before finding support.

The Bearish Case

Bears point to the lack of key support and predict that Bitcoin will retest its low from March at $19,568.52 in the coming months with some predicting a crash happening as soon as the next week or two. With Bitcoin currently pulling back, the Bears certainly have the upper hand currently.

Bitcoin Trade Update

Current Allocation: 0.217% (+0.117% since last update)

Current Per-Coin Price: $23,431.02 (+16.35% since last update)

Current Profit/Loss Status: +12.75% (-32.15% since last update)

After last week’s update, I took more profits when Bitcoin with a sale at $29,673.76 when Bitcoin had its last rally before rolling over. On Sunday, the crypto started falling through my buy orders with my first one filling at $28,448.70 and my lowest at $26,744.40.

Both the buys and the sales left me with an average buy price of $27,266.63, and rose my per-coin cost +16.35% from $20,138.27 to $23,431.02 with my allocation increasing +0.117% from 0.100% to 0.217%.

As always, the gameplan forward remains the same: take profits if Bitcoin makes another run into the mid-$29K range, add in stages if Bitcoin continues to pull back.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $26,165

0.027% @ $25,061

0.054% @ $23,619

0.082% @ $23,156

0.191% @ $22,328

0.272% @ $21,459

1.089% @ $20,686

2.178% @ $19,562

1.361% @ $18,837

1.361% @ $17,919

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.