Summing Up The Week

The regional bank crisis reared its ugly head early in the week with banks like First Republic Bank (FRC) reporting earnings and setting off fear in the markets. However, the selling was offset when the tech sector brought great reports with Microsoft (MSFT) and Meta (META) shining, specifically.

Economic numbers showing a slowing U.S. economy also buoyed the markets as investors continue to rely on the “bad news is good news” adage.

Let’s take a look at the news that moved markets this week…

Market News

First Republic Bank loses $72B in deposits

Despite being the center of the regional banking crisis in March, many investors and analysts had high hopes for First Republic Bank (FRC) going into earnings Monday night. Well, First Republic said it lost a net total of $72 billion in deposits, an outflow that would have been in excess of $100 billion had other banks not stepped in with liquidity, reported Yahoo! Finance.

First Republic’s even-more-disappointing-than-expected earnings sent the entire market – not just the regional banks – into a bit of a pullback during Tuesday trading as many pundits began fearing the bank crisis may be far from over.

Microsoft and Alphabet earnings stem tech selloff

The market sold off in earnest on Tuesday going into the close with the S&P 500 down more than -1.50%. However, after the bell, both Microsoft (MSFT) and Alphabet (GOOGL) reported unexpected surprises for their earnings reports, with Microsoft stealing the show providing bullish outlook on the potential earnings coming from its investment in OpenAI’s artificial intelligence platform.

As a result, the NASDAQ and much of the market recovered a bit on Wednesday, stemming the general market-wide selloff at least temporarily as investors continued to pile into A.I. names like Microsoft.

U.S. GDP rose 1.1%, the economy is slowing

On Thursday, the U.S. Gross Domestic Product was revealed to have grown at an annualized pace of 1.1% in the first quarter, below the 2% estimate and an indication that the economy is definitely slowing, reported CNBC.

“The U.S. economy is likely at an inflection point as consumer spending has softened in recent months,” said Jeffrey Roach, chief economist at LPL Financial. “The backward nature of the GDP report is possibly misleading for markets as we know consumers were still spending in January but since March, have pulled back as consumers are getting more pessimistic about the future.”

Naturally, the market took this as good news and rallied Thursday morning as investors and analysts believe this could indicate that the Federal Reserve may pause rate hikes at next week’s meeting.

Key inflation gauge rose 0.3%, as expected

On Friday, the Personal Consumption Expenditures (PCE) index showed an increase of 0.3% for March, in line with Dow Jones estimates, reported CNBC. Some analysts were hoping that the Federal Reserve’s interest rate hikes would demonstrate more of an effect and that the PCE would come in lower, however that was not the case.

The PCE measures the consumer cost for all goods and services including food, energy, and housing. While some figures in the report show inflation continues to slow, the economy remains in a disinflationary period – where inflation is slowing – and not a deflationary period, where prices actually start returning to previous points.

Next Week’s Gameplan

Three key catalysts are staring down the end of next week: the Federal Reserve meeting on Wednesday, Apple’s (AAPL) earning report after the market close on Thursday, and April’s nonfarm payroll report which will be released Friday.

Combine those catalysts with the fact we’re entering into May, a seasonal time in the markets when many professionals “sell in May and go away.” Personally, I’m hoping we’ll see more of a pullback as I have pulled more profits out of my portfolio since the start of the year than I’ve added to positions.

Regardless, next week should continue to bring the excitement as the number of market-moving catalysts is growing as we head deeper into spring

See you all back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

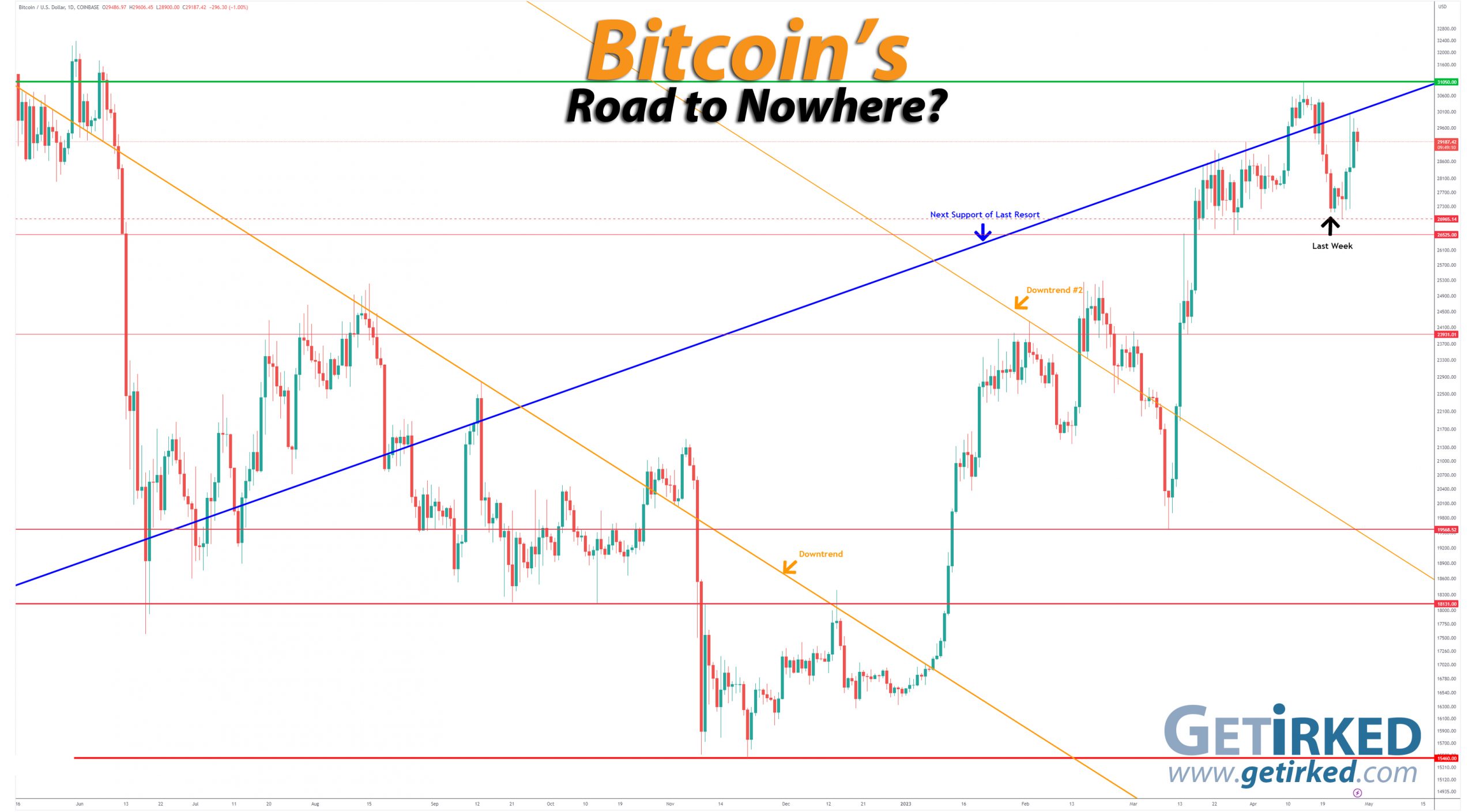

Something strange is going on in Bitcoin…

Bitcoin retreated this week, breaking through the previous week’s low of $27,815.00 before finding support at $26,965.14 and rebounding. If you look at the chart, Wednesday’s price action was incredibly suspicious with a peak-to-trough move of -9.38% within a single hours of trading.

Crypto “news outlets” point to rumors of the U.S. government selling a significant chunk of seized Bitcoin and Ether during that time, however that kind of sale doesn’t explain the sudden run-up to nearly $30K, it only explains the selloff.

The Bullish Case

Bulls continue to point to Bitcoin’s resilience as a sign of the upcoming Bull Rally to higher highs, explaining that every time Bitcoin dips to $27K, the crypto is snapped up by waiting buyers.

The Bearish Case

Bears acknowledge Bitcoin’s strength, but Bitcoin rarely tests support a third time without breaking through. In other words, if Bitcoin does retreat to $27K again, Bears believe it’s likely that it will crash through and drop to lower levels, perhaps testing the next level of key support at $23,931.01.

Bitcoin Trade Update

Current Allocation: 0.083% (-0.034% since last update)

Current Per-Coin Price: $19,234.62 (-12.10% since last update)

Current Profit/Loss Status: +51.74% (+22.97% since last update)

it was a wild week thanks to the crazy price action which happened on Tuesday and Wednesday. I kicked off the week with a few buys at an average price of $27,044.55, but just as quickly switched to profit-taking when Bitcoin made a stab at $30K with sales averaging $29,011.50 in price.

At the end of the day, I reduced my per-coin cost -12.10% from $21,882.39 down to $19,234.62 and decreased my allocation -0.034% from 0.117% to $0.083%. Let’s see if the price volatility continues from here!

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $27,697

0.014% @ $27,269

0.014% @ $26,227

0.028% @ $25,634

0.055% @ $24,385

0.083% @ $23,909

0.110% @ $23,053

0.110% @ $22,736

0.138% @ $21,673

0.193% @ $20,990

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.