Summing Up The Week

The markets remained relatively flat for the majority of the week, thanks, in part, to a complete dearth of market-moving news. Additionally, company earnings have been coming in relatively as expected with no real disappointments outside of Tesla (TSLA) which announced its sixth price cut this year in an effort to drive up sales demand during its report on Wednesday.

Tesla’s news did end up pulling down the NASDAQ on Thursday, but the markets still held up relatively well.

Let’s take a look at the news that (didn’t really) move the markets this week…

Market News

Fed Governor casts doubt on need for digital dollar

While not a market-moving event, on Tuesday, Federal Reserve Governor Michelle Bowman said in a speech that she felt that a digital U.S. dollar could “potentially [be] an impediment to the freedom Americans enjoy in choosing how money and resources are used and invested,” casting doubt on Fed plans to develop a Central Bank Digital Currency (CBDC), reported CNBC.

There are many skeptics of CBDCs, including myself, who feel that a government with full control over the money supply may present too much of a temptation for those in powers to direct the populace. For instance, CBDCs would permit the government to track every transaction made by a citizen and also allow the government to “print money” whenever they would like, potentially raising the deficit.

Additionally, a CBDC could allow the introduction of a “social credit score” similar to the one in place in China where if a citizen speaks out in ways not “approved of,” the government can limit where the individual can spend money and even restrict travel, access to social services, and more.

Hearing Bowman express similar concerns lent me some hope that maybe the Fed will either backpedal or not be quite so quick at following the idea of needing to further pursue such a potential ethical quagmire.

Investor David Roche warns of credit crunch for mid-America

On Thursday, veteran strategist David Roche warned that a credit crunch may be coming to “small-town America” thanks to the collapse of Silicon Valley Bank, reported CNBC.

“I think we’ve learned that the big banks are seen as a safe haven, and the deposits which flow out of the small and regional banks flow into them (big banks), but we’ve got to remember in a lot of key sectors, the smaller banks account for over 50% of lending,” Roche, president of Independent Strategy, told CNBC’s “Squawk Box Europe” on Thursday.

“So I think, on balance, the net result is going to be a further tightening of credit policy, of readiness to lend, and a contraction of credit to the economy, particularly to the real economy — things like services, hospitality, construction and indeed small and medium-sized enterprises — and we’ve got to remember that those sectors, the kind of small America, small-town America, account for 35 or 40% of output.”

A recession is coming and stocks will get hurt, strategist says

On Friday, Christ Watling, Chief Executive of Longview Economics, said in an interview that he believes a recession is coming, reported CNBC. Watling’s comments come on the back of a Leading Economic Index falling 1.2% in March, slipping to its lowest level since November 2020 and providing a potential indicator that economic weakness may soon intensify across the U.S. economy.

“The reality is if you look at profit margins, they went to record highs in 2021 and a bit of 2022, and of course when you have a lot of inflation around, you can get very good operating leverage so you can get record high profit margins,” Watling said.

“When you get into recession, we’ve got to do a double hit on profit margins. You’ve got to normalize them back to normal levels and then you’ve got to price in a recession. So, I think the expectations for earnings are way too optimistic and therefore the stock market will have to contend with that at some point.”

Next Week’s Gameplan

As we continue through earnings season, company reports may cause pops here and there both in specific sectors as well as individual companies. As a result, we might still see some rallying in the market next week.

However, I continue to side with my analyst crush, Michael Gayed, who believes we’re due for some significant volatility to the downside. The combination of the debt ceiling debate beginning to heat up and the seasonal selloffs that often happen in May do not fill me with bullish vibes right now.

See you here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

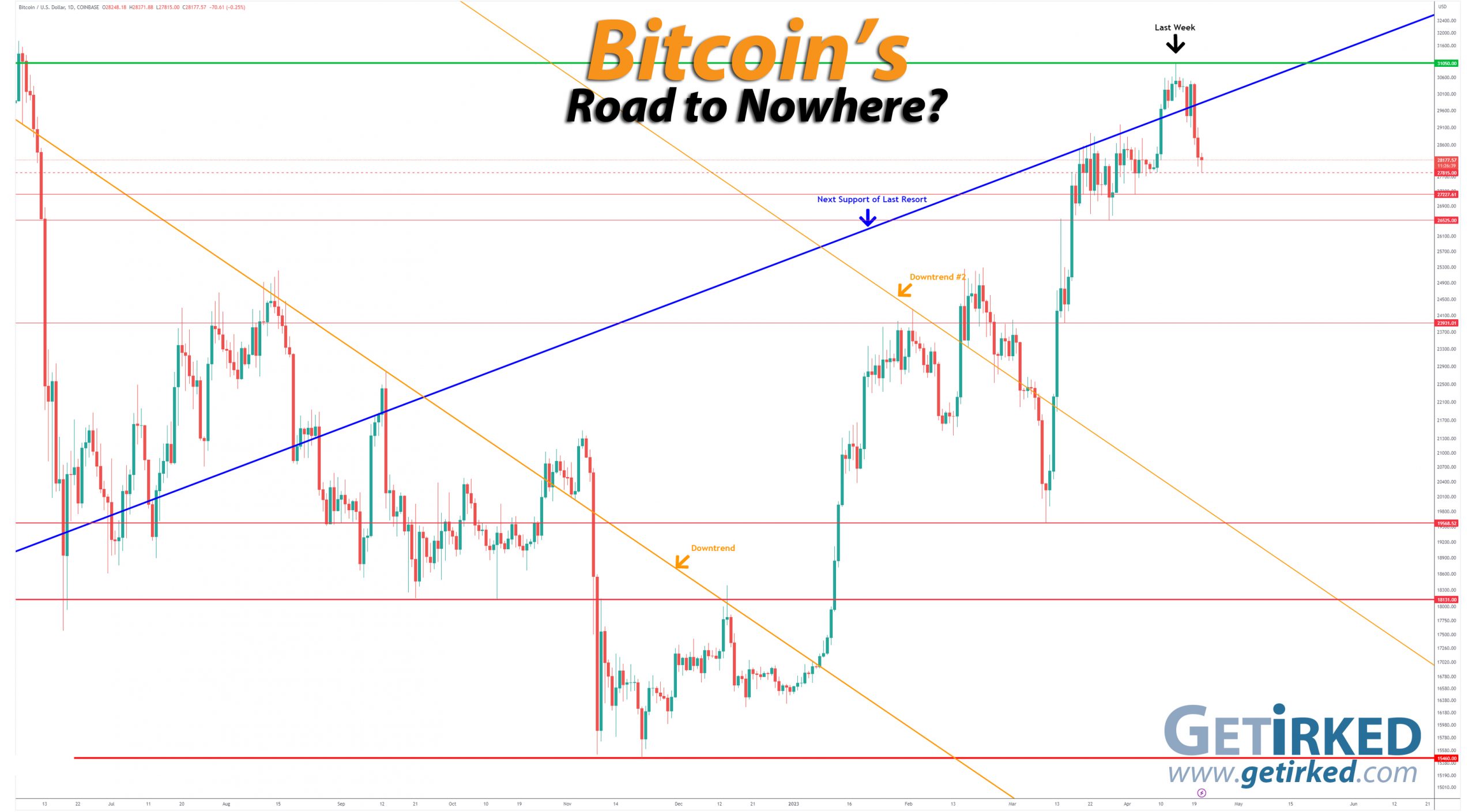

Bitcoin breakdown…

Bitcoin started to lose support on Monday when it cracked through the Next Support of Last Resort trendline. Although it appeared to bounce on Tuesday, the crypto made for lower lows on Wednesday and continued the selloff through Friday before finding new support at $27,815.00.

The Bullish Case

Bulls believe Bitcoin’s selloff is a healthy pullback which will lead to consolidation as it prepares to continue through a new Bull market. Many bulls have already started pointing to the “halvening” which will happen in summer of 2024 as the reason to get excited for more upside from here.

The Bearish Case

Bears continue to ring the “inflation” and “rate tightening cycle” drums, pointing to the fact that Bitcoin typically correlates to risk assets like the NASDAQ. Bears argue that Bitcoin’s $31,050.00 high made last week marks the high for crypto in 2023 and that we should expect Bitcoin to test (and break through) its $15,460.00 low from 2022.

Bitcoin Trade Update

Current Allocation: 0.117% (+0.084% since last update)

Current Per-Coin Price: $21,882.39 (+22.41% since last update)

Current Profit/Loss Status: +28.77% (-43.41% since last update)

When Bitcoin sold off below $30K over the past week, it was time for me to start adding to my position again with teeny, tiny quantities starting at $29,443.00 on Monday. The buys continued, giving me an average $28,720.05 buying price which raised my per-coin cost +22.41% from $17,876.30 to $21,882.39 and my allocation +0.084% from 0.033% up to 0.117%.

Just as is my style, if Bitcoin continues to sell off, I will continue adding, however, at this point, I will wait for Bitcoin to break through to new highs for 2023 before I consider reducing the position at all.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $27,007

0.014% @ $25,958

0.041% @ $24,778

0.055% @ $24,191

0.082% @ $23,315

0.109% @ $22,584

0.137% @ $21,942

0.164% @ $21,211

0.191% @ $20,528

0.218% @ $20,058

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.