Summing Up The Week

The markets recovered this week on the back of reports showing that inflation is weakening across the board from wholesale to consumer prices. Combine these reports with last Friday’s nonfarm payrolls report which showed the economy is weakening but remains strong, and you’ve got a week that brought good news to stocks.

Let’s take a look at the news that moved markets this week…

Market News

Jobs grew 236K in March, near 238K expected

This week’s news kicked off last week when the nonfarm payrolls report showed 236,000 new jobs in March vs the 238,000 expected by analysts when the markets were closed on Friday, reported CNBC. Average hourly earnings rose 0.3% making the 12-month increase 4.2%, the lowest its been since June 2021.

“Everything is moving in the right direction,” said Chief Economist for ZipRecruiter Julia Pollak. “I have never seen a report align with expectations as much [as] today’s over the last two years.”

In an odd twist of fate, the Federal Reserve continues to look at bad news as good news – a weakening job market means the Fed’s rate hikes are finally taking effect and that the fight against inflation may actually be working. Of course, since rate hikes are a lagging indicator, it may be some time before the economy sees the full effect of the 5.00% worth of hikes made in the past year.

Consumer Price Index indicates inflation easing

On Wednesday, the Consumer Price Index (CPI) showed inflation cooling in March with an month-over-month increase of 0.1% and year-over-year increase 5.0% versus Dow Jones estimates for 0.2% and 5.1%, respectively, reported CNBC. The positive news did cause a pop in the markets initially.

“As the economy slows, consumer prices will decelerate further and should bring inflation closer to the Fed’s long-run target of 2%,” said Jeffrey Roach, Chief U.S. Economist at LPL Financial. “Markets will likely react favorably to this report as investors gain more confidence that the next Fed meeting may be the last meeting when the Committee raises the fed funds target rate.”

Minutes show the Fed now expects a recession

Later on Wednesday, the minutes released from the Federal Reserve’s March meeting showed the FOMC staff (not the Fed governors or presidents) expects a recession as a result of the regional banking crisis, reported CNBC. Even though the FOMC members continue to argue a soft landing is possible, the market, which had rallied following the CPI report earlier in the day, rolled over.

“Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” the meeting summary said.

Wholesale inflation shows biggest drop since Pandemic

On Thursday, the Producer Price Index (PPI) showed the biggest drop in wholesale prices since the start of the pandemic, sinking 0.5% in March for the biggest decline in three years and exceeding estimates for no change, reported MarketWatch.

While the Federal Reserve prefers to look at Personal Consumption Expenditures (PCE) and the CPI reported earlier this week, the substantial decrease in inflation in PPI is certainly a good indication the Fed’s efforts to fight inflation may be taking effect.

Next Week’s Gameplan

Despite investors and traders rejoicing this week, Michael Gayed, my “Axe in the Space” (analyst with the most correct calls on the market currently), indicated that we should expect the melt-up to continue for the first two weeks of April, however he has been fervently warning that conditions indicate the market could roll over starting next week.

I have been taking quite a bit off the table this week in my precious metals plays as gold and silver continue to rally ferociously (as well as Bitcoin) and I remain prepared to start buying if we see a significant selloff.

Of course, if stocks keep heading higher, the name of my game is profit-taking.

See you all here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

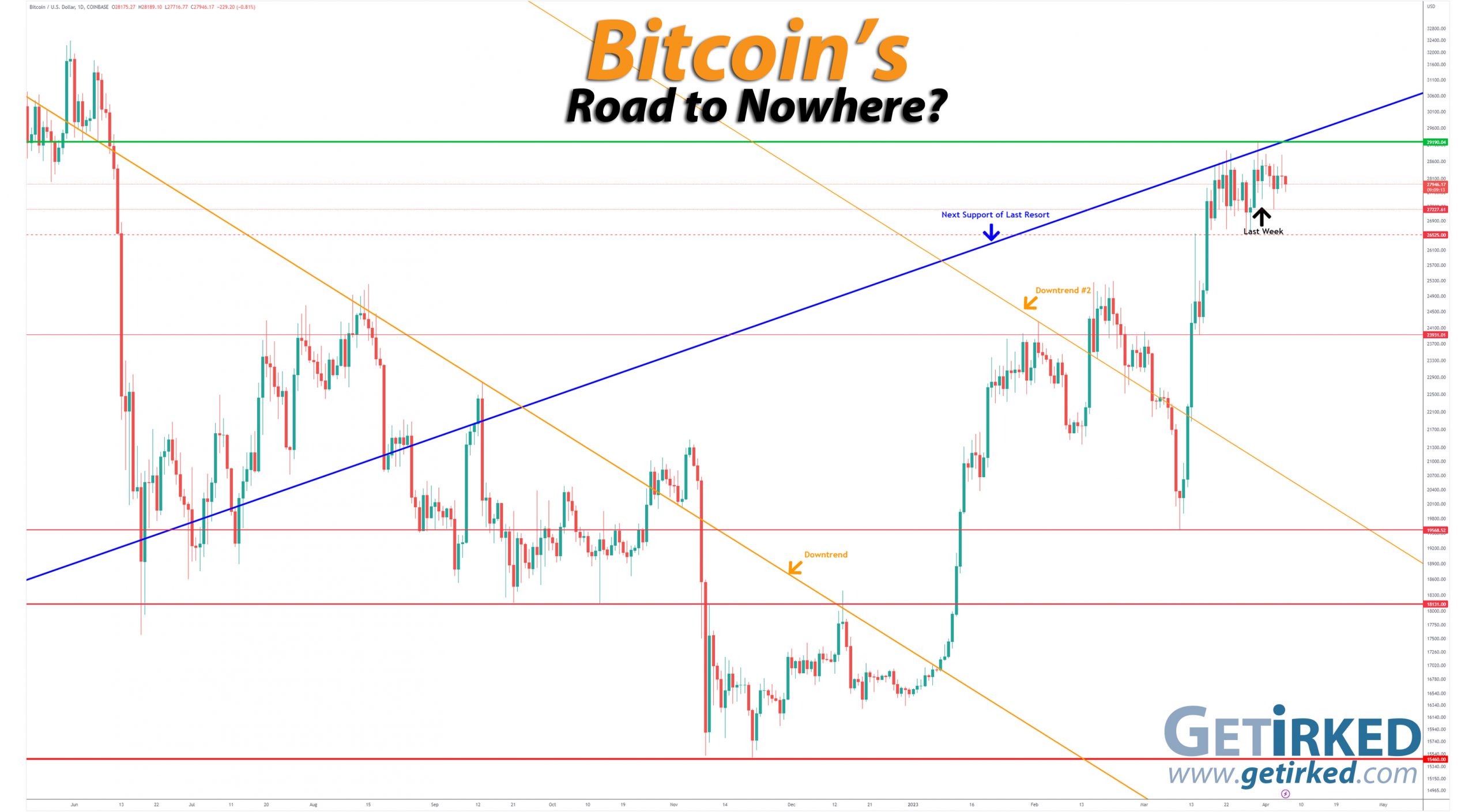

The Bitcoin Blitz??

After retreating slightly last week, Bitcoin blasted through $30K, blowing away all bearish expectations for the crypto. On Tuesday, Bitcoin broke through its $29,190.04 high and the Next Support of Last Resort trendline that hasn’t been in play for YEARS before finding resistance and setting a new high on Friday at $31,050.00.

The Bullish Case

Bulls remain in control as Bitcoin and the rest of the crypto space continues to make higher highs with each passing week. Despite the Bears’ skepticism of the move, there’s no denying that Bitcoin remains entirely in bull rally mode.

The Bearish Case

Bears must once again lick their wounds. While many Bears continue to claim that not only will Bitcoin retest its $15,460.00 low, but that it will break through to lower lows, the facts and the narrative are not currently on their side.

Bitcoin Trade Update

Current Allocation: 0.033% (-0.267% since last update)

Current Per-Coin Price: $17,876.30 (-33.54% since last update)

Current Profit/Loss Status: +72.18% (+68.28% since last update)

My bearish tendencies got the best of me this week as I used stop-loss limit orders to take profits on Bitcoin’s run to $30,000 with a number of sales which gave me an average selling price of $28,709.44.

The sales dramatically reduced my per-coin cost -33.54% from $26,898.27 to $17,876.30, and cut my allocation -0.267% from 0.300% down to 0.033%.

If Bitcoin cracks $35,000 and gives me a double, I will close the trade entirely, however if Bitcoin turns around and sells off, I will actually start buying up my cost basis with very small buys starting at key levels of support in the upper $20Ks (and long-time readers will know much I absolutely hate buying up my cost basis…).

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.014% @ $28,973

0.014% @ $28,311

0.027% @ $27,262

0.027% @ $26,903

0.027% @ $26,413

0.027% @ $25,889

0.041% @ $25,061

0.041% @ $24,530

0.055% @ $23,978

0.109% @ $22,322

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.