Summing Up The Week

A holiday-shortened trading week certainly doesn’t mean it will be a slow one. Despite markets being closed on Friday for the Good Friday / Easter Holiday, a deluge of negative news catalysts flipped markets from the exuberance seen last week going into the quarter-end.

From a surprise oil production cuts to a series of reports indicating a potentially weakening U.S. economy, there wasn’t any good news for stocks this week.

Let’s take a look at the news that moved the markets…

Market News

OPEC announces 1.16M barrel output cut, surprises markets

Sometimes, market-moving news doesn’t wait for the week to even start. On Sunday, OPEC announced it would cut oil production by an additional 1.16 million barrels per day, reported CNBC.

In recent weeks, the price of oil (measured using West Texas Intermediate crude or WTI) had dropped below $70/barrel from more than $130/barrel in 2022 which led to dropping gasoline prices across the U.S.

However, OPEC’s staggering production cut led some analysts to project that WTI could pop over $80 this week (WTI actually broke through $81.50 on Monday when the markets opened). As a result, Americans can expect gas prices to increase, and since energy costs are a significant part of inflation indexes, the Federal Reserve’s fight against inflation may have just become a lot harder.

Strangely enough, the production cut announcement came only a day before the OPEC+ meeting, with many members indicating there would be no change to production policy. As a result the cut announcement surprised markets going into the start of the week.

Home prices rose unexpectedly in February

On Monday, Black Knight released figures showing that home prices unexpectedly rose 0.16% in February after months of declines, reported CNBC. The housing market is one of the key targets for the Federal Reserve’s fight against inflation, so increasing prices is not a good sign for their efforts.

“The unfortunate reality is that the scarce supply of inventory that’s the source of so much market gridlock isn’t getting any better,” said Andy Walden, Black Knight’s vice president of enterprise research strategy, in the release. “While some price increases – most notably in Miami, which saw the largest of the month – can be chalked up to people moving to the area, we’re seeing stronger price gains more generally in those areas with better affordability and larger inventory deficits.”

JPMorgan CEO warns banking crisis not over

On Tuesday, JPMorgan (JPM) CEO Jamie Dimon wrote shareholders that the banking crisis is not yet over with “repercussions from it for years to come,” reported CNBC. The moneycenter bank’s longtime CEO has a reputation of being able to put his finger on the pulse of the American economy, so when he warns, people pay attention.

Fortunately, Dimon, who guided the premier bank through the Great Financial Crisis in 2008, did go on to say, “But importantly, recent events are nothing like what occurred during the 2008 global financial crisis.”

Dimon pointed out that even though the recent regional bank crisis did not affect the larger banks considered “too big to fail,” the public trust in the financial system is to important to take lightly. “Any crisis that damages Americans’ trust in their banks damages all banks – a fact that was known even before this crisis. While it is true that this bank crisis ‘benefited’ larger banks due to the inflow of deposits they received from smaller institutions, the notion that this meltdown was good for them in any way is absurd,” he said in the letter.

All banks – including regionals, moneycenters, and even money managers like Morgan Stanley (MS) – sold off Tuesday morning with the rest of the market rolling over as the day went on following the release of the JOLTS report.

Job openings below 10M for first time in 2 years

Later on Tuesday, the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) report showed February had 9.93 million jobs, a drop of 632,000 from January, quite a bit below the 10.4 million expected by Wall Street, reported CNBC. It was the first time job vacancies fell below 10 million since May 2021 and many pundits commented that it could show the economy is weaker than thought.

“The labor market is starting to loosen as the number of job openings declined in most sectors. As the economy slows, firms will likely cut openings and workers will be less likely to quit in search of better hours and higher pay,” said Jeffrey Roach, chief economist at LPL Financial. “The Fed could consider pausing rate hikes at the next meeting but only if the upcoming employment report shows signs of material weakness and the March [consumer price index] report reveals lower inflation.”

As a result, the markets weakened quite a bit as many investors became concerned for the upcoming nonfarm payroll report which will be released on Friday – when the markets would be closed for the Good Friday holiday.

Private payrolls rose 145K in March, below expectations

On Wednesday, payroll processor ADP released figures showing jobs in the private sector rose just 145,000, far below the estimate of 210,000 held by analysts, reported CNBC. Combined with Tuesday’s weaker-than-expected JOLTS report, many investors started to express fears that the U.S. economy is weakening significantly.

“Our March payroll data is one of several signals that the economy is slowing,” said ADP’s chief economist, Nela Richardson. “Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

Typically, the ADP report is an inconsistent predictor of the official nonfarm payroll report, however, since the official report would be released Friday when the markets will be closed for Good Friday, stocks reacted more than normal to the ADP report by selling off throughout Wednesday trading.

Next Week’s Gameplan

April’s starting to shape up a bit like certain of my favored analysts have predicted – volatility with a bearish slant. Accordingly, I’ve got my buying targets ready so I can start adding to positions if we see more significant selling.

In the meantime, I hope everyone has a wonderful holiday weekend and I’ll see you back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

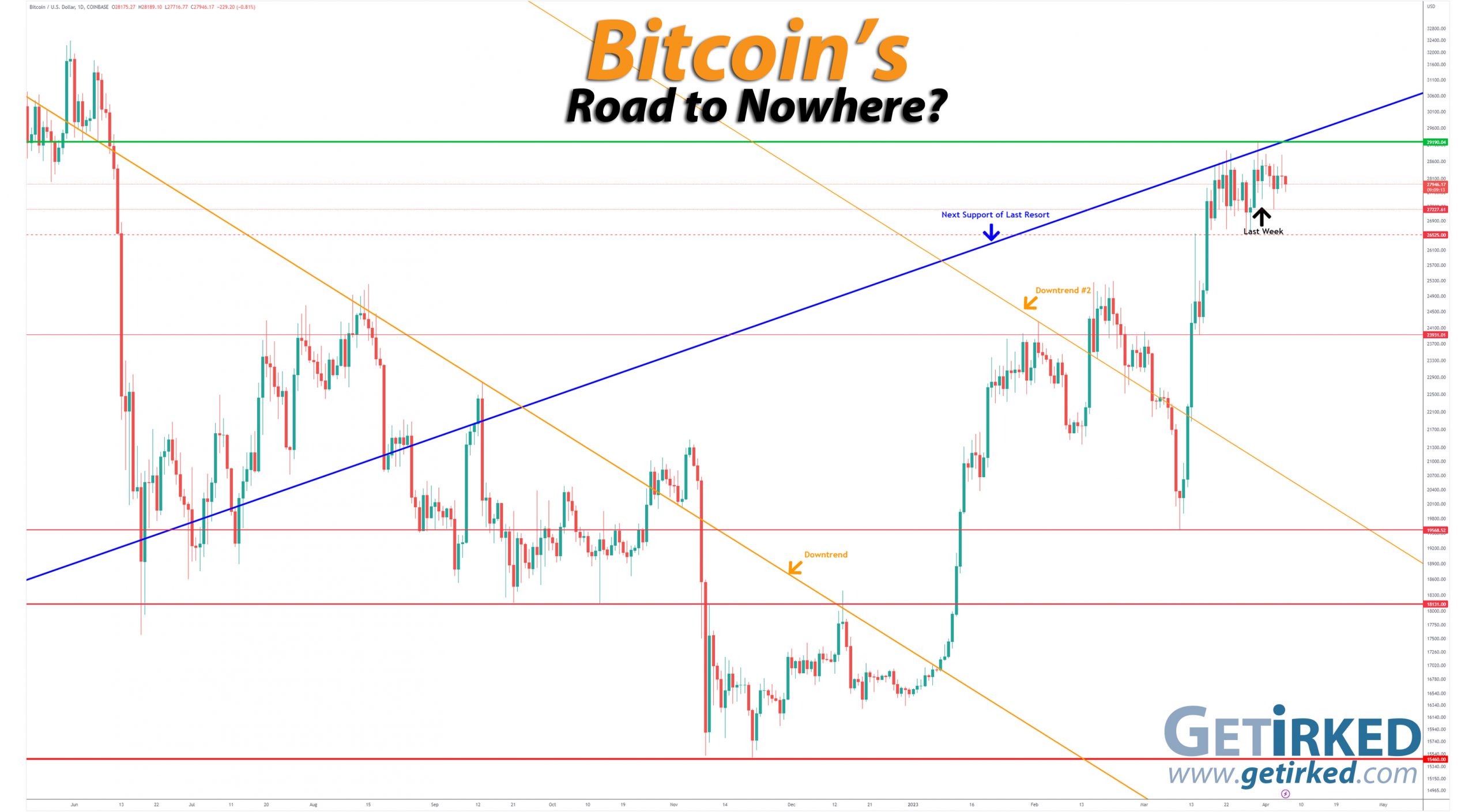

Bitcoin treads water as it waits for its next big move…

Bitcoin traded within a range this week, selling off a bit on Monday to make a higher weekly low at $27,227.61 before recovering and bouncing. This period of consolidation will likely continue until we see the crypto break $29,190.04 on the upside or $26,525.00 on the downside.

The Bullish Case

Bulls continue to argue that Bitcoin is in a new bull market cycle, pointing to historical statistics revolving around the upcoming “halvening” (when Bitcoin becomes twice as difficult to mine) as well as favorable seasonal conditions.

The Bearish Case

Bears have started becoming particularly fervent, arguing that Bitcoin has never seen a rate-tightening cycle and that the global macroeconomic conditions means the crypto will flip over and sell off from these levels.

Bitcoin Trade Update

Current Allocation: 0.300% (Unchanged since last update)

Current Per-Coin Price: $26,898.27 (Unchanged since last update)

Current Profit/Loss Status: +3.90% (-1.72% since last update)

I spent the week sitting on my hands as Bitcoin churned between my next buying target and my next profit-taking target. If there’s one thing I’ve learned in my more than five years trading Bitcoin, it’s to be extremely patient.

Bitcoin seems to exist to test the patience of both the bulls and the bears, egging both sides on to make a move right before Bitcoin jumps in the opposite direction. Accordingly, I’ve found that if I’m tempted to do something stupid, the best approach is to ignore the space altogether until the next move happens.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.055% @ $26,669

0.055% @ $26,130

0.055% @ $25,261

0.137% @ $24,288

0.164% @ $23,736

0.191% @ $22,460

0.219% @ $21,528

0.246% @ $20,555

0.546% @ $19,610

0.820% @ $19,065

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.