Summing Up The Week

Many stock market pundits have complained for well over a year that the stock market’s narrative has been all about the Federal Reserve Bank’s next moves and inflation.

Well, be careful what you wish for.

When Silicon Valley Bank, noted for venture capital investing in startup companies, and Signature Bank, known for crypto investing (ala famed Silvergate Capital fame), were shut down by the FDIC over the weekend, the narrative completely flipped to be all about the regional banking crisis.

Let’s take a look at the news that moved the markets this week…

Market News

Regional bank ruckus roils all markets

After the FDIC shut down Silicon Valley Bank on Friday and followed up by shutting down Signature Bank on Sunday, the markets came in hot as everyone started panicking about regional banks nationwide. First Republic Bank (FRC) dropped -70% in early morning trading despite the government’s plan to protect the account holders of SVB, reported CNBC.

It’s worth noting that Treasury Secretary Janet Yellen and President Joseph Biden both announced that the investors in these banks – stock shareholders and bondholders – would not be bailed out. To me, this is an imperative – the U.S. government bailed out investors in banks during the Great Financial Crisis and created a moral hazard – investors felt they could take risks without any penalties.

Investing always involves risk, and any investor must be prepared to lose their entire allocation, no matter how secure or conservative the investment may seem.

Gold, bonds, and Bitcoin all rallied as investors piled into investments with either conservative risk profiles or no counterparty risk. After initially selling off, the stock market even rallied mid-day as investors hoped the breakdown of the regional bank sector might result in the Federal Reserve pausing rate hikes.

CPI up 6% YoY, in-line with expectations

On Tuesday, the Consumer Price Index (CPI) showed a rise of 0.4% in February and an increase of 6% from a year ago, in line with market expectations, reported CNBC. At the risk of sounding like a broken record, I have to point out that a positive CPI of any amount indicates inflation, so while this number shows inflation isn’t increasing as fast as it has been, it’s still increasing.

Accordingly, despite the fallout from the regional banks fiasco earlier in the week, pundits still expect the Federal Reserve to raise the interest rate by at least 0.25% when they meet next week. “Even amid current banking scares, the Fed will still prioritize price stability over growth and likely hike rates by 0.25% at the upcoming meeting,” said Jeffrey Roach, chief U.S. economist at LPL Financial.

Even still, stocks positively roared on Tuesday, likely the combination of a relief rally from oversold conditions Monday combined with a CPI report that was neither too hot nor too cold.

Credit Suisse in freefall causes markets to slide

Despite the Producer Price Index (PPI) coming in a tiny bit cooler than expected off 0.1%, the big news on Wednesday was Saudi National Bank saying it cannot provide additional financial help for floundering Credit Suisse (CS), reported CNBC. The Swiss bank has been under pressure for months and months after concerns caused depositors to start withdrawing funds in 2022.

Naturally, the bank’s CEO, Ulrich Koerner, said the bank’s liquidity is “very, very strong” in interviews, however, failing banks never say they’re in trouble or ask for assistance prior to their demise as doing so would virtually guarantee bankruptcy. In other words, it’s hard to know whether the Swiss bank’s days are numbered.

European stocks were slammed on the news and the American stock market fared about the same, returning much of the recovery seen after the FDIC opened a new loan desk to help struggling American regionals.

Next Week’s Gameplan

With Black Swan Events (the “unknown unknowns”) potentially looming just over the horizon, investors and traders have become notably skittish – appropriately, in my opinion.

As a result, volatility has returned to the stock market in a big way, so, as always, my key disciplines remain very much at the forefront of my mind:

Always a have a plan for both directions: What will you do if stocks go up tomorrow, and what will you do if stocks go down tomorrow?

Buy on Red Days and Sell on Green Days: Never sell into a panic, never buy into a rally.

I find repeating those two rules to myself helps me keep my head on straight when the markets start to go crazy. Oh, and, of course, if you don’t know what to do, do nothing.

I’ll see you all here next week!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

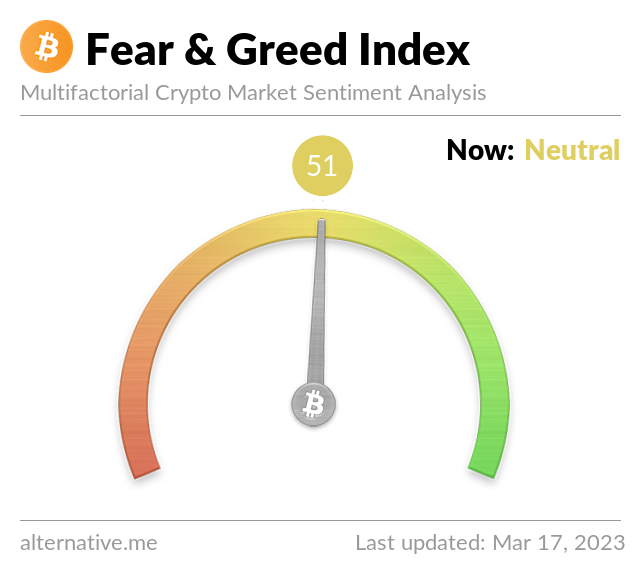

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Has Bitcoin’s “time” finally come?

Bitcoiners piled into the crypto on Monday when the regional banking hijinks roiled the stock market, pushing the price of Bitcoin up nearly 10% in a matter of minutes.

Bitcoin pundits point to the lack of counterparty risk as a primary reason to own Bitcoin, so when the FDIC shut down two banks in two days and left shareholders and bondholders holding the bag, it gave every Bitcoiner what they’ve been waiting for, the chance to to say, “I told ya so!”

On Friday, Bitcoin definitively broke through the $25,288.88 high set earlier this year, rallying until the crypto found resistance at $27,033.04, an epic rally of more than +38% its low last week to this week’s new high!

The Bullish Case

Despite last week’s sudden crash below $20K, Bulls believe the Crypto Winter is finally and completely over, pointing to Bitcoin’s use case being proven out this week when bank runs showed the importance of an asset with no counterparty risk.

The Bearish Case

Bears believe the rally in Bitcoin is a temporary overreaction to the regional bank craziness. Most Bears believe a retest of 2022’s low is a certainty, claiming that macroeconomic and geopolitical concerns will cause Bitcoin to turn back into a risk asset when catalysts align. For the moment, however, the Bulls certainly have the upper hand.

Bitcoin Trade Update: Trade Closed +22.31%

** Trade Closed: 11/11/2021 to 3/14/2023 +22.31% lifetime gain **

As much as the Bitcoin thesis seemed to crystallize this week, the resulting parabolic move seemed improbable to me, so I decided to close the entire trade on Tuesday with an average selling price of $25,166.36 (after fees).

This was certainly my longest “trade” yet with Bitcoin since I started it way back on November 11, 2021 with an initial buy price of $64,826.27. Over the course of the past a year and a half – by buying and selling in stages throughout Bitcoin’s ups and downs – I was able to reduce that per-coin cost -68.26% down to $20,575.84.

With the average price mentioned above of $25,166.36, that gives me a lifetime gain on the trade of +22.31%, roughly +10.94% annually. Not great in the world of crypto, but considering Bitcoin dropped a whopping –78% from its all-time high, I’m calling it good.

From here, I’m going to let things settle out and see where Bitcoin goes from here. I do have buying targets to rebuild the position if the crypto drops below $20K again… which I think is distinctly possible. Bitcoin remains a “risk asset” which means stocks sell off, so will Bitcoin – it remains directly correlated to the NASDAQ and tech stocks.

Plus, as always, I keep the profits in Bitcoin, so even if the Bulls are right and Bitcoin never drops that low again, I’ll have upside exposure in the crypto I hold off-network.

New Trade opened at $24,266.32 on 3/15/2023

Current Allocation: 0.114% (-0.029% from Trade Open)

Current Per-Coin Price: $23,180.61 (-4.47% from Trade Open)

Current Profit/Loss Status: +22.310% (+14.75% from Trade Open)

When Bitcoin pulled back nearly 10% from its high, I decided to open a new trade with a very small buy on Wednesday at $24,266.32 with a 0.143% allocation.

When Bitcoin rocketed to yet another new high on Friday, I took profits at $26,170.82, lowering my per-coin cost -4.47% to $23,180.61 (after fees) and decreasing my allocation -0.029% from 0.143% to 0.114%

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.054% @ $22,039

0.135% @ $20,859

0.269% @ $19,955

0.404% @ $19,424

0.539% @ $19,016

0.808% @ $18,527

1.213% @ $17,733

1.886% @ $17,133

2.425% @ $16,305

2.964% @ $15,629 <– Slightly above the current Crypto Winter 2022 low

Not Your Keys, Not Your Crypto…

In light of everything happening with brokerages, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchange to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use either my Gemini or Coinbase referral links to open accounts.

Given everything that happened with FTX and Sam Bankman-Fried claiming customer funds were safe only to have it go completely bankrupt, I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.