Summing Up The Week

The bull rally which started late last week continued this week despite mixed earnings reports and ongoing geopolitical and macroeconomic concerns.

More bullish analysts claim that the lows are in for the Bear Market, and while we may retest those lows, these analysts believe the lows will hold. Bearish analysts warn that the current rally is simply due to oversold conditions market-wide and there’s still even lower lows in store for stocks.

Let’s take a look at the news that moved the markets this week…

Market News

Mixed earnings show it’s a “Stock-Picker’s Market”

Earnings were incredibly mixed over the course of the week with tech companies like Microsoft (MSFT) and Alphabet (GOOGL) reporting dramatic slowdown in spending both from consumers and enterprises. However, just last week Pepsico (PEP) reported a blowout quarter, causing the stock to reach for new highs, and healthcare providers like UnitedHealth (UNH) are also reaching for all-time highs.

What the heck is going on?

In a bull market, nearly every stock heads higher as investors pile in to take advantage of the exciting market activity. To the contrary, in a bear market, certain companies will succeed based on their business model and how well it holds up during downturns. According, tech and growth stocks will get slammed in bear markets whereas consumer staples and necessities like food and health insurance, outperform.

The result is that individual stock-picking can often be a preferable choice to simply investing in a broad-based index fund as savvy investors can beat the averages. Of course, I choose to invest both in Exchange Traded Funds (ETFs) and individual stocks to protect against my own arrogance and the fact that the market has handed my head to me more than once in the decades I’ve been doing this.

GDP +2.6%! Is the Recession over? Not so fast…

On Thursday, the Bureau of Economic Analysis released figures showing the U.S. economy grew 2.6% in Q3, beating Dow Jones’ estimates for 2.3%, reported CNBC. The positive growth (the first for 2022) led some pundits to claim the recession over (or to “told ya so” and claim there wasn’t one in the first place).

However, economists point out that the GDP growth was due to a narrowing trade deficit, a one-off occurrence that won’t happen again in the future, explaining that if the economy isn’t currently in a recession now, it will be by 2023.

“Overall, while the 2.6% rebound in the third quarter more than reversed the decline in the first half of the year, we don’t expect this strength to be sustained,” wrote Paul Ashworth, chief North America economist at Capital Economics. “Exports will soon fade and domestic demand is getting crushed under the weight of higher interest rates. We expect the economy to enter a mild recession in the first half of next year.”

“Stocks haven’t bottomed, yet” warns Goldman Sachs

Despite the S&P 500 rallying more than 7% since its October 12 low, on Thursday, Goldman Sachs (GS) research executives said the bottom is still not in for this bear market, reported TheStreet.com.

“The broader case for U.S. equities doesn’t look very strong, and the normal conditions for an equity trough are not clearly visible yet,” said the executives in a commentary. “Equities haven’t fully reflected the latest rise in real yields, and any significant easing in financial conditions through higher equities will likely be offset by policy in the end.”

Now, Goldman Sachs’ perspective doesn’t mean you should sell everything and go to cash – history has shown that while no one is really good at it, individual investors are absolutely terrible at timing the markets. The most prudent approach for a buy-and-hold investor is to just keep adding to positions in a scheduled way and not panic during a selloff.

However, if you prefer to be an active investor (like me), there’s no harm in taking small profits when you have them. For me, I never sell huge quantities of any position – I’m in this for the long term – but as you’ll see in my Investments in Play update from this week where I both added to positions and took profits in others, each position tells its own story, and I have no problem capitalizing on volatility while still maintaining the bulk of my position for the long haul.

Next Week’s Gameplan

The rally off of rumors that the Fed may pause after the expected 0.75% rate hike next week continued throughout this week, even bringing some of my positions into Selling Season where I needed to take profits.

Will the bull rally continue through year-end like some expect?

Maybe. Everyone’s favorite answer, right? A lot depends on next week’s Fed meeting. If Fed Chair Jerome Powell comes out and says the Fed is pausing, that could open up some of the way to more bull action, however we have to remember there are a ton of unresolved negative catalysts out there including the Ukraine-Russia war, China’s new even-more conservative leadership, ongoing inflation, OPEC production cuts, and more I can’t even remember.

Regardless of what the Fed may do, it’s important not to FOMO into anything right now. The market is still very much in a bearish downtrend on the macro, so while I have been raising my next buy targets for some of my positions, I’m not feeling bullish right now…

Next week should be exciting, though, so I’ll see you back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

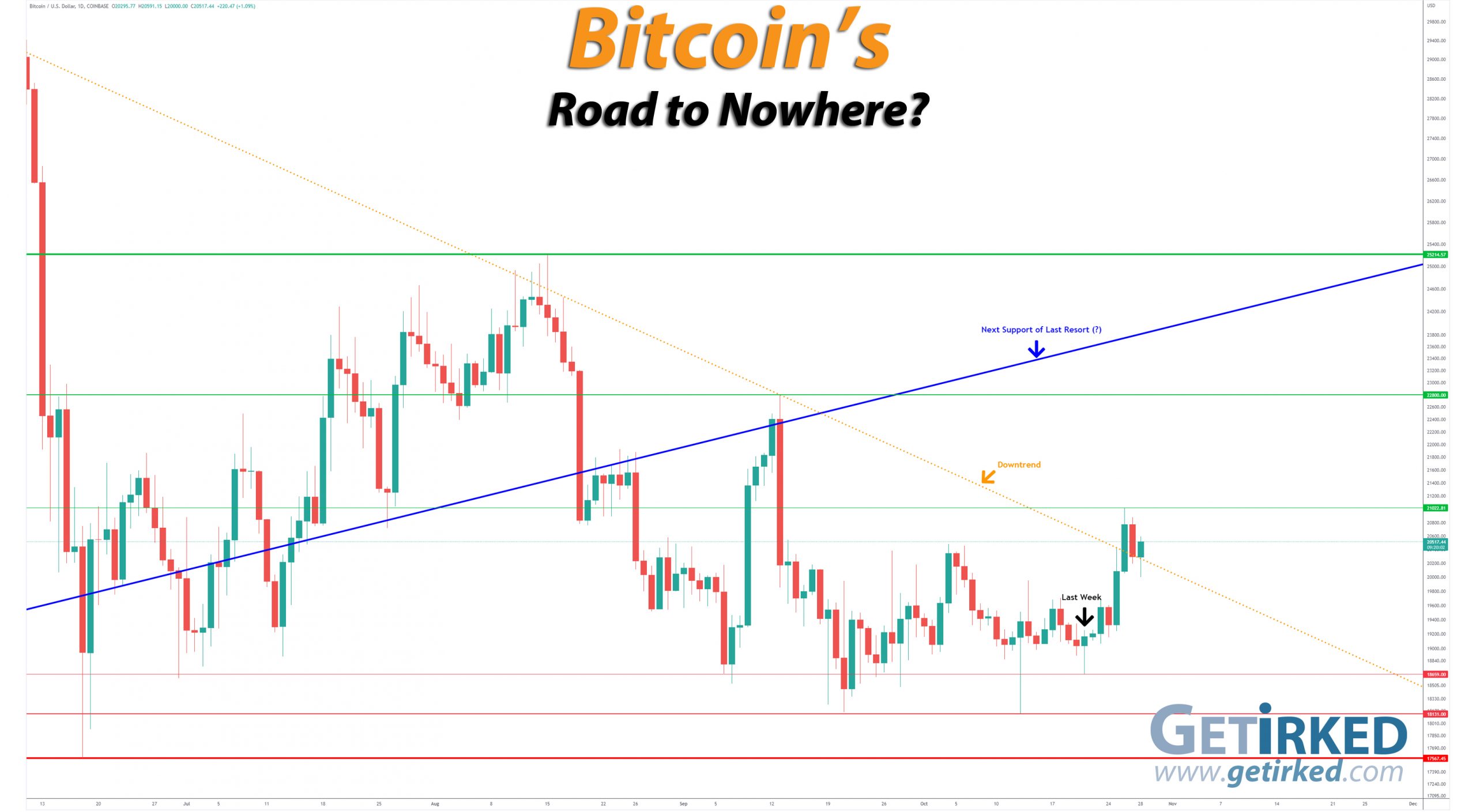

Crypto rally on dollar weakness!

Bitcoin finally caught a break this week and rallied over $20K when the U.S. dollar (DXY) started to pull back from its inexorable bull run that’s lasted for months.

Bulls rejoiced when Bitcoin broke through the Downtrend line, cracked the previous weekly high at $20,479.43, and continued upward before setting a new weekly high at $21,022.81. While I have adjusted the trendline to reflect this strength, the crypto’s breakout is undeniable as it has significantly overshot the downward action, for the moment.

Bitcoin also established a new weekly low of support at $18,659.00 last Friday. From here, the next big move will happen depending on which breaks, the new high or the new low.

The Bullish Case

Bulls took to Twitter declaring the Crypto Winter has ended and that Bitcoin is entering a new bull market with visions of dollar signs and Lamborghinis floating in their minds.

The Bearish Case

Bears concede that the downward triangle pattern on the charts which typically precedes further downside saw the crypto reverse to the upside, an occurrence that does happen in such a pattern (the move is typically violent in either direction). However, given the many negative catalysts and headwinds facing investment assets of all kinds, Bears warn that it may be too soon to celebrate as historical patterns in Bitcoin still point to the potential of a dramatic selloff of 50% in the coming weeks and months.

Bitcoin Trade Update

Current Allocation: 16.538% (Unchanged since last update)

Current Per-Coin Price: $23,455.26 (Unchanged since last update)

Current Profit/Loss Status: -12.525% (+7.639% since last update)

Another week of rangebound trading meant I did very little in my crypto portfolio, just sat back and ate popcorn while watching Bitcoin’s volatility return.

As always, my approach to all of my investments is to have no thesis about where I think the price is headed, I simply have a plan: what am I going to do if Bitcoin goes up tomorrow and what am I going to do if Bitcoin goes down tomorrow?

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.144% @ $18,775

0.144% @ $18,209

0.144% @ $17,975

0.144% @ $17,367

0.144% @ $17,029

0.578% @ $15,987

0.722% @ $14,649

1.011% @ $13,793

1.445% @ $12,047

1.734% @ $11,316

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In June 2022, Bitcoin crashed -75% to a low of $17,567.45.

- In August 2022, Bitcoin rallied +44% to a high of $25,214.57.

- In October 2022, Bitcoin dropped -28% to a low of $18,131.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.