Summing Up The Week

Earnings season kicked off with positive reports from companies, for the most part. Despite raging inflation and increasing costs, companies have found that the U.S. consumer continues to demonstrate strength, allowing them to raise prices that are absorbed by consumers.

The result was a relatively mild week in terms of price movement and volatility, particularly when compared to the past few months.

Let’s take a look at the news that moved the markets (or didn’t) this week…

Market News

Amazon Founder Jeff Bezos warns on the economy

Typically, I take CEOs of companies foreseeing economic conditions with a huge grain of salt. Sure, they may understand what’s going on in the micro environment of their own businesses, but that doesn’t make them a macroeconomist. On Wednesday, Jeff Bezos, Amazon’s (AMZN) founder and ex-CEO, warned rougher times are coming for the economy on Twitter, saying “it’s time to batten down the hatches,” reported CNBC.

The only reason I take Bezos’ comments more seriously than other CEOs is because of the nature of Amazon’s business itself. In addition to fully grasping the buying and selling patterns of consumers throughout the world, the company’s Amazon Web Services (AWS) division provides it with a great deal of data of how enterprises are acting, too.

In other words, when Bezos says it’s time to batten down the hatches, it might be worth looking up what that archaic term means, at least (I’m kidding… I’m just poking fun at Bezos for being ooooollllllddddd).

UK Prime Minister Liz Truss resigns… shortest PM ever

While UK Prime Minister Liz Truss’ completely-expected and well-earned resignation on Thursday wasn’t a market-moving event, her shortest-ever term as Britain’s PM certainly was. Her inept government’s attempt to lower taxes and increase spending in the middle of the most runaway inflation since the 1970s nearly sent the U.K. economy into a financial crisis akin to the one seen in 2008-09.

U.K. Prime Minister Liz Truss resigned Thursday following a failed tax-cutting budget that rocked financial markets and which led to a revolt within her own Conservative Party, reported CNBC. Truss was PM for 44 days, making history as the shortest-ever term for a prime minister in Britain’s history.

Philly Fed Prez sees ‘Lack of Progress’ against inflation

On Thursday, the Federal Reserve trotted out Patrick Harker, president of the Philadelphia Federal Reserve, to add hawkish sentiment, saying he sees a “lack of progress” against inflation, reported CNBC.

“We are going to keep raising rates for a while,” said Harker in a speech in New Jersey. “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year.”

Despite this being a “known-known,” really, (I mean, did anyone in the markets think the Fed was done raising rates??) the markets still took the opportunity to roll over on Thursday, turning what had been a rally up to that point into a pullback.

Next Week’s Gameplan

Without any unexpected news events, the next week should be relatively quiet as more companies report earnings. The Federal Reserve will likely roll out a few bank presidents to talk hawkish prior to the big Fed meeting in the first week of November, but I don’t anticipate the market making any significant moves, either bullish or bearish.

That being said, I always have price targets for all of my positions, both in terms of where I will add more if they sell off as well as where I will take profits if they head higher.

Have a great week, everyone, and I’ll see you back here next Friday!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

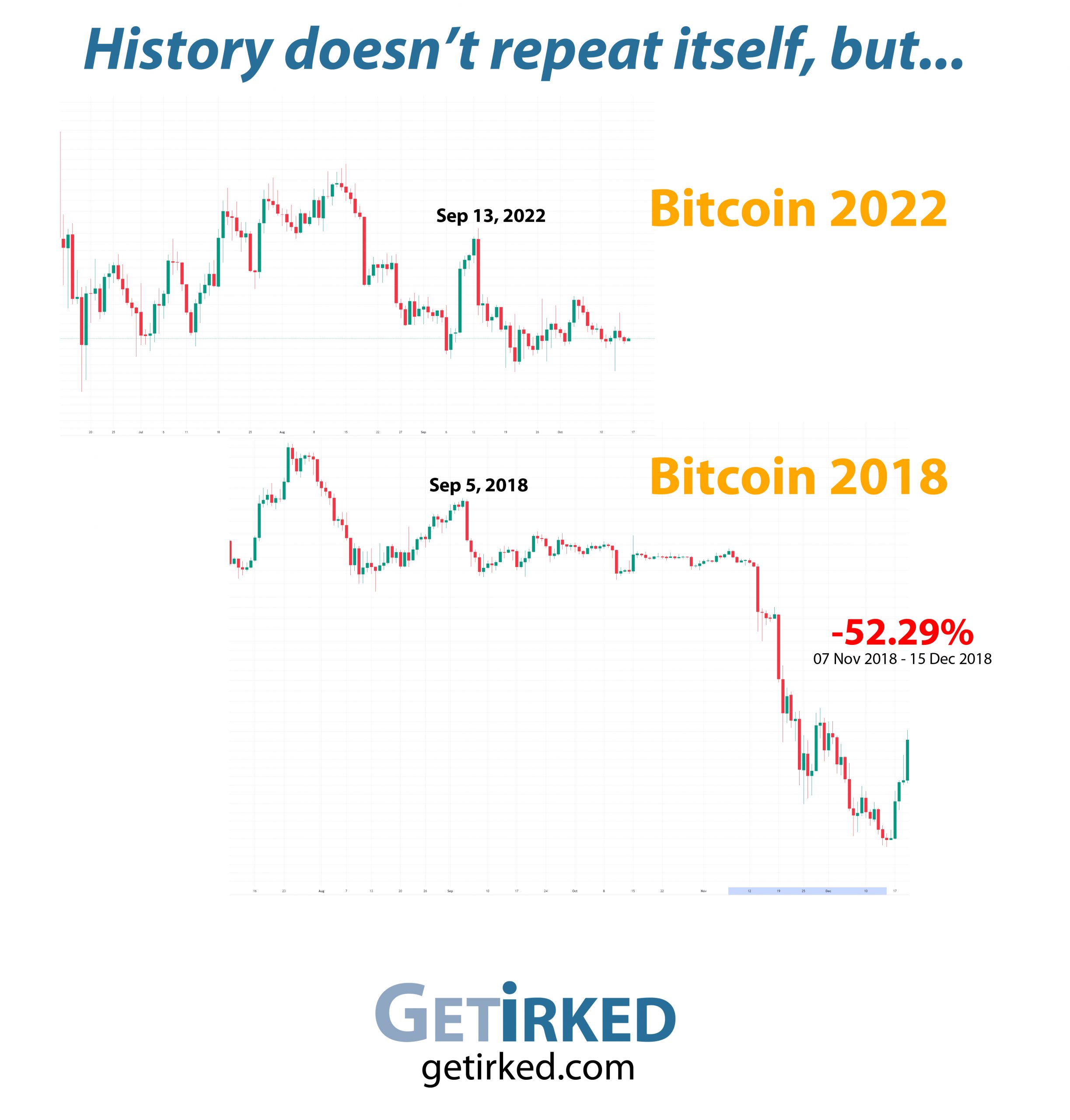

History doesn’t repeat itself, but…

Over the past few weeks, Bitcoin has been trading in a very distinct range, one that seemed very familiar to me. I referred back to the charts in 2018 and noticed some very key similarities between the weaker momentum in Bitcoin back then and the ever-weakening momentum in Bitcoin now.

As the literary great, Mark Twain, is credited with saying, “History doesn’t repeat itself, but it often rhymes.”

With no positive catalysts on the space in the crypto sector and nothing but negative macroeconomic and geopolitical concerns, it’s starting to look like the last few months of 2022 could have a very negative effect on Bitcoin’s price.

Naturally, there’s no way to know if a 50%+ selloff is actually coming, but my discipline requires me to plan for any possibility. No matter how improbable, nothing is impossible.

Note: You may also notice that I have once again adjusted the Downtrend line, making it even more severe as its rejection strength seems to be increasing as we move further into the macro-bearish environment.

The Bullish Case

Bulls believe that the decreasing volatility in the crypto sector is the sign of stabilization and the consolidation Bitcoin needs to return to higher highs. Many bulls are touting the importance of “stacking sats” (short for “stacking satoshis,” the individual incremental pieces of Bitcoin), claiming now will be the lowest price the crypto will ever go.

The Bearish Case

Those who were in the crypto space in 2018 have been feeling an eerie sense of familiarity to everything going on Bitcoin right now. Lots of bullish sentiment with no reason to be bullish combined with waning volatility, and an overall investment environment with negativity. In other words, Bears think Bitcoin’s headed south for the winter… deep south.

Bitcoin Trade Update

Current Allocation: 16.538% (Unchanged since last update)

Current Per-Coin Price: $23,455.26 (Unchanged since last update)

Current Profit/Loss Status: -20.164% (-3.958% since last update)

While it looks like Bitcoin may finally be weakening, there were no moves to be made in my trade over the past week as I wait patiently for Bitcoin to either sell off more significantly or reverse course and head higher.

I do continue to schedule small buys above the 2022 low despite my belief that the low won’t hold since, as always, I could be wrong. My discipline remains consistent across all investment classes – have a plan for what to do if the asset goes up, have a plan for what to do if the asset goes down.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.142% @ $18,209

0.142% @ $17,850

0.142% @ $16,905

0.566% @ $15,601

0.850% @ $14,932

1.133% @ $14,456

1.416% @ $13,559

1.416% @ $12,806

1.416% @ $11,558

1.416% @ $11,192

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In June 2022, Bitcoin crashed -75% to a low of $17,567.45.

- In August 2022, Bitcoin rallied +44% to a high of $25,214.57.

- In October 2022, Bitcoin dropped -28% to a low of $18,131.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.