Summing Up The Week

The shortened four-day trading week was packed full of inflation news with record reports showing that inflation is not slowing at all. Also, Earnings Season kicked off with JP Morgan (JPM) on Wednesday morning, and, well, it looks like it’ll be a spicy one.

Let’s look at the news that moved the markets this week…

Market News

Consumer prices rose 8.5% in March, more than expected

On Tuesday, the Labor Department released its March Consumer Price Index (CPI) showing a year-over-year increase of 8.5%, slightly above Dow Jones estimates of 8.4%, reported CNBC. Many pundits excitedly claimed that this appeared to represent the peak of inflation, indicating that it would slow following March’s figures.

“The big news in the March report was that core price pressures finally appear to be moderating,” wrote Andrew Hunter, senior U.S. economist at Capital Economics. Hunter said he thinks the March increase will “mark the peak” for inflation as year-over-year comparisons drive the numbers lower and energy prices subside.

I always find this kind of reaction somewhat amusing – any positive CPI figure indicates inflation in consumer pricing. In other words, in order for the U.S. economy to see prices begin a return to lower pricing, we would need a negative CPI number. Not to be a downer, but the price hikes we’ve seen are not only likely to stay, but could get even higher before we see inflation truly slow down.

Producer prices rose 11.2% in March, biggest gain ever

On Wednesday, the Bureau of Labor Statistics released the updated Producer Price Index (PPI) which showed a year-over-year rise of 11.2% in March, the highest reporter rise on record which beat Dow Jones estimates, reported CNBC.

Whereas the CPI gauges how much prices have gone up for consumers, the PPI attempts to gauge how much more it costs companies to make the products that consumers buy. Of course, with inflation raging for consumers, it should come as no surprise that inflation is also raging for the producers, too.

Many economists consider the PPI to be a forward-looking inflation measure, however. In other words, if the PPI is up, this means that inflation for consumers will continue to increase into the future.

Naturally, this PPI report is not good for consumers, the economy, or the inflation outlook.

JPMorgan reports $524M loss due to Russia

On Wednesday, JP Morgan Chase (JPM) gave its quarterly earnings and reported a $524 million due to “market dislocations caused by Russia sanctions,” reported CNBC. JPM is considered the best-in-breed of the major money-center banks, so many consider it the bellweather stock which will dictate which way Earnings Season will take us since it’s also the first major company to report.

Despite Russia-Ukraine war woes weighing down on the stock, CEO Jamie Dimon remained positive about the U.S. economy, “We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine.”

Next Week’s Gameplan

Earnings Season is always interesting. Traders often try to profit by betting on which way the companies’ reports are going to go while many investors pull all of their moves entirely until they hear from their companies.

For me, I leave everything as-is when it comes to both my buys and sells.

While that might seem counter-intuitive to some since a particularly bad report could send one of my positions spiraling, it’s why I do all my analysis in advance. Unless a company is actually broken, I am in this for 20 to 30 years so I want to add on the way down, even if, over the short term, that could mean pain for the portfolio.

All that being said, it’s important to do what makes you feel most comfortable. If you prefer to have all your orders pulled to wait for results, you do you. The great thing about investing is that there’s really no “right” way to do it (only wrong ways…).

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

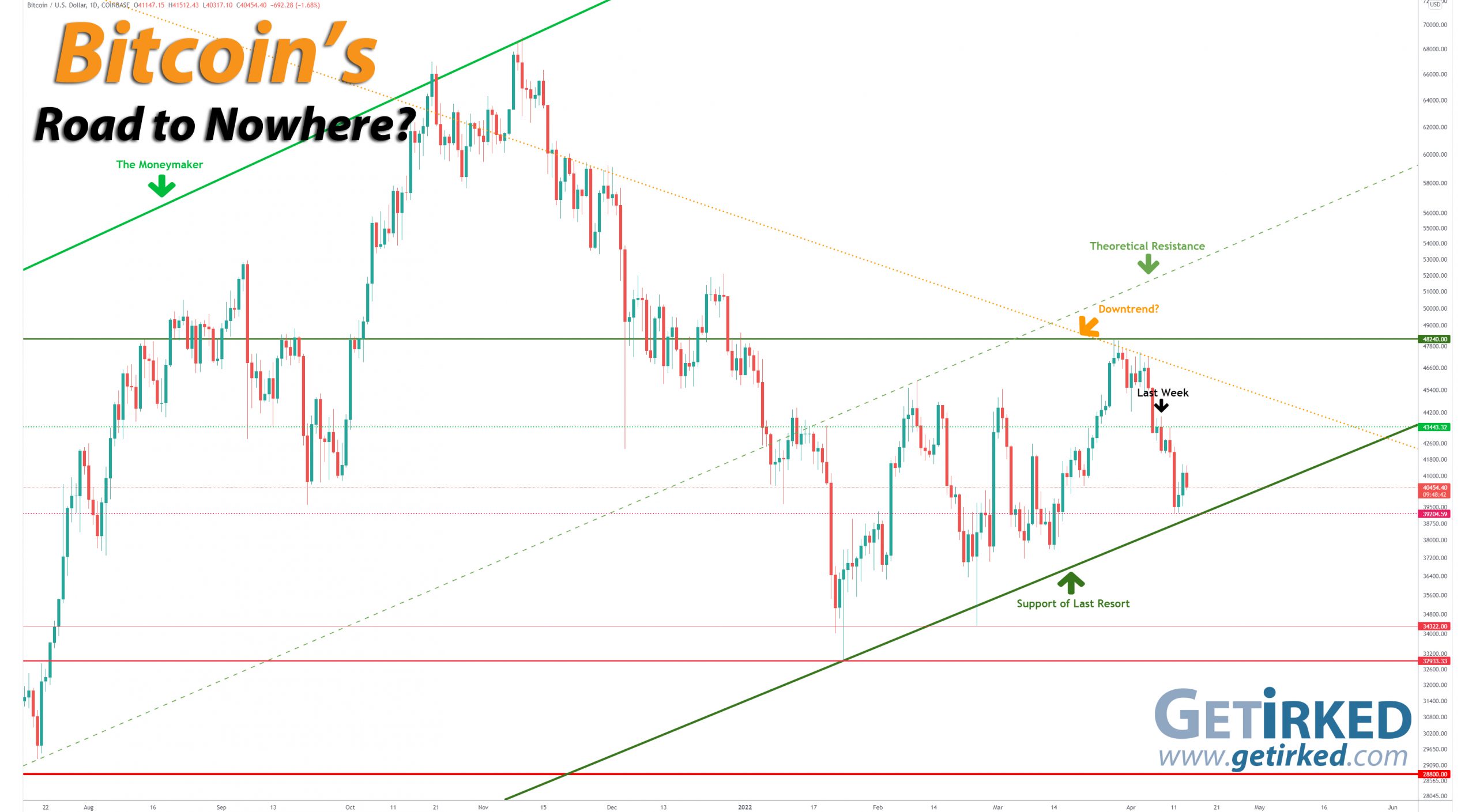

Bitcoin break-down…

Bitcoin lost its support this week, crashing through the previous weekly low of $42,734.69 last Saturday and not finding new support until $39,204.59 on Monday. Since establishing a new weekly low, Bitcoin bounced weakly on Tuesday and Wednesday. The weekly high is now $43,443.32, set on Sunday after a temporary bounce over the weekend.

If our new weekly support doesn’t hold, the next significant support level is $34,322.00, followed by $32,933.33, and then deep into $28K.

The Bullish Case

Bulls still adhere to the concept that the $39K-40K level will provide significant support as both retail investors and institutions try to add to positions. Many Bulls still argue that Bitcoin is a hedge against inflation despite all evidence to the contrary; much of it still suggesting that gold remains the one true hedge against inflation, not crypto.

The Bearish Case

Bears continue to maintain the macro thesis – the long-term trend is downward for Bitcoin. Bears point to the weak bounce of Bitcoin off its weekly low indicates that buyers are falling off, a sign that there could be more downside ahead for the crypto space.

Bitcoin Trade Update

Current Allocation: 2.955% (+0.025% from last update)

Current Per-Coin Price: $39,456.24 (-$0.80 from last update)

Current Profit/Loss Status: +2.530% (-6.328% from last update)

After timing my profit-taking perfectly last week (it’s better to be lucky than good), I didn’t do much but wave at Bitcoin as it crashed. The crypto did briefly trigger a tiny buy order I had which filled on Tuesday at $39,295.50.

The buy reduced my per-share cost an absolutely negligible -$0.80 from $39,457.04 to $39,456.24 and increased my allocation just 0.025% from 2.930% to 2.955%.

Obviously, I’m leaning bearish when it comes to which direction I think Bitcoin is headed; I have no interest in increasing either my per-coin price nor my allocation until we see lower buying prices from here.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.117% @ $38,971

0.146% @ $36,349

0.293% @ $34,707

0.585% @ $32,306

0.986% @ $30,029

1.406% @ $28,407

4.134% @ $24,875

4.801% @ $22,680

7.984% @ $20,410

2.926% @ $16,105

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything. Here are some of Bitcoin’s price movements over the past couple of years:- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89. In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In January 2022, Bitcoin crashed -52% to a low of $32,933.33.

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.