Summing Up The Week

Inflation reports continue to roll in and there’s no sign of the “transitory” hopes mentioned so often in 2021. The Fed’s stated it’s going to take action, and, naturally, the market is losing its mind.

Let’s take a look at the news that moved the markets this week…

Market News

Rising interest rates cause market selloff to continue

On Monday, the rising benchmark 10-year Treasury yield rose above 1.8%, causing the markets to selloff as rising interest rates degrades potential future profits for companies, reported CNBC.

In short, as the cost to borrow money rises due to increasing interest rates, the amount of money a company could make in the future will become hampered by the cost to borrow money. Accordingly, investors and traders adjust their valuations for their positions, and, in this case, the valuation adjustment resulted in a pretty substantial selloff despite last week’s rout.

Inflation rises 7% in 2021, highest since ’82

On Wednesday, the Labor Department released the Consumer Price Index (CPI), an inflation gauge which showed a rise of 7% in December 2021 from a year earlier, the fastest pace of inflation since June 1982, reported CNBC. Most analysts expected the CPI report to come in hot, and it certainly did not disappoint.

Economists from Dow Jones had expected the 7% annual increase, which comes as a result of supply shortages and cash stimulus into the U.S. economy from Congress and the Federal Reserve.

“The December CPI report of a 7% increase over the last 12 months will be shocking for some investors as we haven’t seen a number that high” in almost 40 years, said Brian Price, head of investment management at Commonwealth Financial Network. “However, this print was largely anticipated by many, and we can see that reaction in the bond market as longer-term interest rates are declining so far this morning.”

Wholesale prices pop 10% in 2021, another sign of inflation

On Thursday, the Labor Department released the Producer Price Index (PPI), an inflation gauge which tracks the cost of materials to make goods, and it showed a jump of 0.2% in December, less than the 0.4% expected, but still representing a total 9.7% gain over the course of 2021, reported CNBC.

The combined datasets from the week led members of the Federal Reserve to comment hawkishly about the strong state of the economy. “After nearly two years of accommodation, I think we can expect a fair amount of tightening in 2022,” Philadelphia Fed President Patrick Harker said in remarks Thursday morning.

Retail sales dropped 1.9% in December

On Friday, the Commerce Department reported that retail sales fell -1.9% in December, more than expected, reported CNBC. Yet another sign of inflation, retail consumers curb their spending whenever they feel the need to conserve funds due to inflating prices.

To make matters worse, sales numbers are not adjusted for inflation which indicates to a slow ending to 2021 when sales had been strong earlier in the year. Restaurants and bars saw a -0.8% decline for the month with gas stations dropping -0.7% despite gas prices falling -0.5% into year-end.

Next Week’s Gameplan

When it comes to tightening economic policy and inflation, it’s important to remember that different sectors act very differently. High-growth tech stocks, for example, will get positively slammed as a lot of their valuation depends on easy money policies enabling greater potential future earnings. With harder money, those earnings decrease and so does the value of tech stocks.

Accordingly, we’re once again in a “stock picker’s market,” but, really, when aren’t we? As always, I regularly re-evaluate my plans for each and every position I hold, making changes based on the data at hand. A consistent theme across all my portfolios is that we’re definitely entering Buying Season now, as virtually none of my positions are near profit-taking targets of any kind.

Let’s see what next week will bring!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

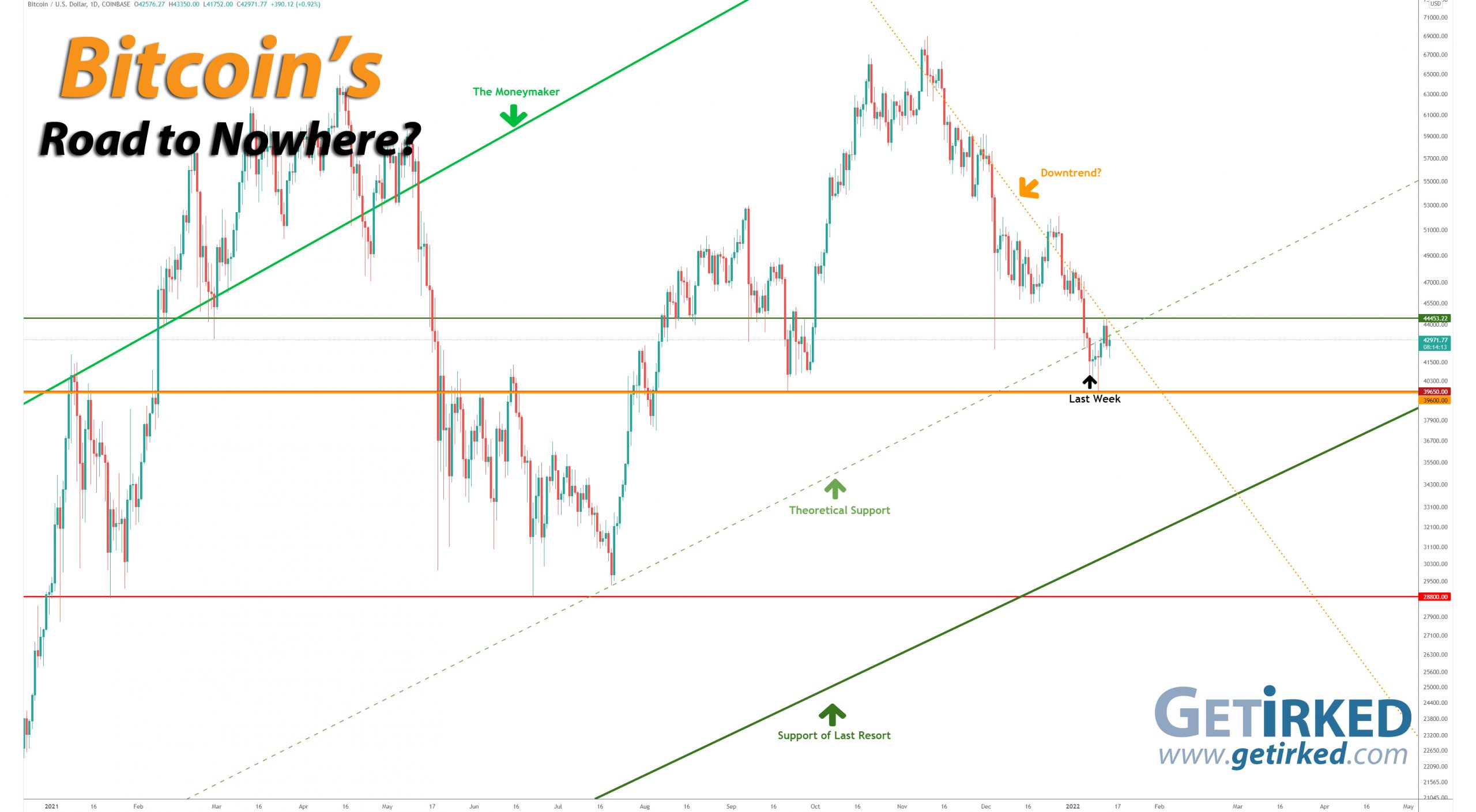

Is the Crypto Carnage over or is this just a relief rally bounce?

After continuing its selloff, nearly breaking through the key $39,600.00 support, Bitcoin found support at $39,650.00 and bounced this week to make a new weekly high at $44,453.22.

In order to maintain a longer-term view of the macro trend in Bitcoin, I have added a new orange “Downtrend?” line that you can see on the above chart.

The Bullish Case

Despite Bitcoin not holding the $40K level, Bulls point to Bitcoin holding the support level established last September as a sign that the selling has ended. Bulls continue to adhere to institutional buying as the savior of the space, claiming that we won’t see the $30K level again and that new all-time highs are very near.

The Bearish Case

Bears continue to maintain the upper hand as Bitcoin remains in a very bearish macro downtrend, currently. Even during bear markets, assets will bounce, or “correct,” to the upside just like assets will retreat, or “correct,” during bull markets.

Bitcoin Trade Update

Current Allocation: 3.586% (+0.385% from last update)

Current Per-Coin Price: $48,826.91 (-0.902% from last update)

Current Profit/Loss Status: -11.992% (+1.774% from last update)

It was once again time to put money to work when crypto’s selloff continued on Monday with a buy order that filled early Monday morning at $40,937.70. The buy lowered my per-coin cost -0.902% from $49,271.23 to $48,826.91 and increased my allocation +0.385% from 3.201% to 3.586%.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.746% @ $39,033

2.378% @ $34,838

4.792% @ $29,967

4.137% @ $26,227

4.456% @ $24,392

11.53% @ $20,955

2.613% @ $18,913

3.260% @ $14,904

3.260% @ $12,337

3.260% @ $10,419

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45.

- Later in March, Bitcoin dropped -19% to a low of $50,305.00.

- In April 2021, Bitcoin rallied +29% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In January 2022, Bitcoin dropped -43% to a low of $39,650.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.