Summing Up The Week

For the last week of May, the markets saw some pretty significant strength as we approached the end of the month. Historically, the week before Memorial Day is good for markets and this year seemed to stick to the trend.

That being said, June is often NOT so good for the markets…

Let’s take a look at the news that moved the markets this week.

Market News

Mixed inflation messaging from the Fed

On Monday, Kansas City Federal Reserve President Esther George cautioned against a “rigid” approach to monetary policy in a post-pandemic era, saying “I am not inclined to dismiss today’s pricing signals or to be overly reliant on historical relationships and dynamics in judging the outlook for inflation,” reported CNBC.

While it’s true that the Federal Reserve Bank is made up of many more members than Fed Chair Jerome Powell, the institution as a long history of intentionally having different reserve presidents contradicting the consensus message from the Fed. Often, it seems the Fed tries these messaging tactics as a method of taming a potentially-overheated economy or increasing economic activity.

However, these the markets have become numb to these techniques, so George’s comments had little to no effect on the market on Monday as it rocketed higher.

March home prices saw highest growth in over 15 years

Home prices in March were 13.2% higher compared with March 2020 according to the S&P CoreLogic Case-Shiller National Home Price Index released Tuesday, reported CNBC. The March gain is the largest since December 2005, and we all remember what happened a year later, don’t we?

Wait. Don’t we?!

It almost seems as everyone has chosen to overlook the Great Financial Crisis (GFC) of 2008 with many potential homebuyers echoing the same concerns expressed by those in 2005 – those of a lack of inventory, prices potentially never coming back to normal, and a general FOMO pushing people to buy homes.

As someone who closed on a home at the absolute peak in November 2006, if any potential homebuyers are reading this blog, I implore you to wait until later this year to see what happens after eviction moratoriums are lifted and we see a bit more of the economy reopening. I am truly concerned that the mixed messaging and static of the current situation are creating a rise in home prices that likely is unsustainable.

Jobless claims total 406K vs 425K

On Thursday, the Labor Department reported 406,000 new jobless claims in the past week versus estimates for 425,000, reported CNBC.

I continue to ponder whether the “lower” numbers are a cause for excitement or just proof that economists are getting a little better at estimating the week’s figures.

Particularly when looking deeper into the report reveals there are still 15.8 million Americans receiving benefits and who knows how many unemployed NOT receiving benefits.

Personal Consumption Expenditues index increases 3.1%

On Friday, the Commerce Department reported that a key inflation indicator, the core Personal Consumption Expenditures (PCE) index, rose 3.1% in April versus the expected 2.9%, reported CNBC.

The PCE tracks price movements across goods and services, generally considered a wider-ranging measure for inflation due to its focus on consumer behavior and broader scope than the Consumer Price Index used by the Labor Department which rose 4.2% in April.

Next Week’s Gameplan

As we head into June, I’ve got my Buying Plan ready as I believe we could see a turbulent month. In fact, I’m hoping for a decent 10-20% downside correction in the markets as I’d really like to put a lot more cash to work.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

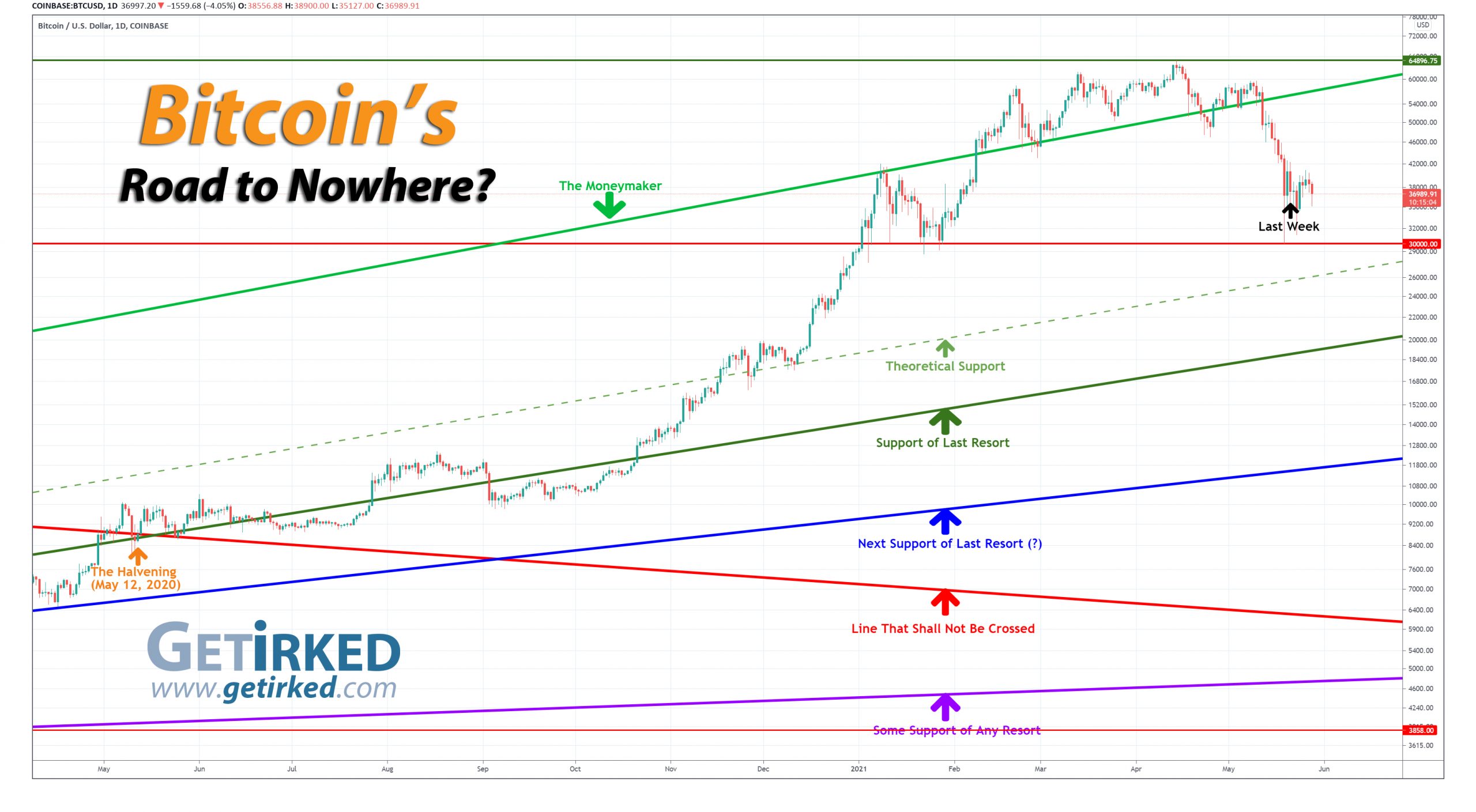

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Whipsaw Action Continues…

Volatility is definitely back in a big way for Bitcoin and the rest of the cryptocurrency space with double-digit percentage moves, both up and down, happening nearly every day this past week.

The Bullish Case

Bulls continue to adhere to institutional buying as the reason Bitcoin’s current support of $30,000 will continue to hold. Despite its amazing run since its lows in March 2020, bullish pundits believe Bitcoin could crack $100K before the end of 2021, an amazing target from the crypto’s current levels.

The Bearish Case

Bears believe this Bull Cycle is over. Looking at the Monthly charts, Bitcoin has only just begun to consolidate, and many of the other major cryptos, Ether (ETHUSD) in particular, haven’t even begun to consolidate with Ether remaining in the green for May. Bears believe June could be a bloodbath for crypto and I have a hard time coming up with any argument against that possibility.

Bitcoin Gameplan

Current Allocation: 4.024% (-0.297% since last week)

Current Per-Coin Price: $38,845.70 (-2.888% since last week)

Current Profit/Loss Status: -4.777% (+2.261% since last week)

Taking Advantage of Volatility

Bitcoin continues to exhibit characteristics of a bear market with ferocious selloffs. Over the weekend, I added to my position with buys at $34,435.94 and $33,780.45, lowering my per-coin cost -2.169% from $40,000.92 to $39,133.26. I also increased my allocation +1.103% from 4.321% to 5.424%.

During the week, I added a tiny bit more on Wednesday at $38,258.55 before Bitcoin saw a rally early Thursday morning leading me to take more off the table when it rose above my per-coin cost with sales at $39,751.20. Early Friday morning, Bitcoin once again sold off, triggering a buy order which filled at $36,739.89.

Those orders reduced my per-coin cost another -0.735% from $39,133.26 to $38,845.70 and reduced my allocation -1.400% from 5.424% to 4.024%.

Just as I always do with this amazingly volatile sector, I’m approaching this trade very carefully, taking profits when I can and adding in small quantities in case we see a drop in excess of -80% from the all-time high as we have in the past.

As a reminder, the drop from 2017’s high to 2018’s low was -84.36%. An identical drop from the current 2021 high of $64,900 gives us a downside target of $10,150.36, more than -70% lower than my current per-coin cost.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.468% @ $33,982

0.468% @ $31,457

0.468% @ $29,017

0.468% @ $27,518

1.113% @ $25,116

2.027% @ $22,728

3.173% @ 20,106

2.011% @ $18,237

2.290% @ $16,407

7.922% @ $11,338

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45.

- Later in March, Bitcoin dropped -19% to a low of $50,305.00.

- In April 2021, Bitcoin rallied +29% to a new all-time high of $64,896.75.

- In May, Bitcoin crashed -54% to a low of $30,000.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.