Summing Up The Week

While the indexes did make new all-time highs once again this week, it seems as if the markets may actually be exhausted as was hinted to last week. The week saw good news both for Covid and the U.S. economy, yet the news stories did little to push markets too far.

Additionally, company earnings reports have been outstanding. All that being said, it was a pretty flat week overall.

Let’s take a look at the news that moved the markets…

Market News

Fauci believes U.S. will see turning point within weeks

On Monday, White House Chief Medical Advisor Dr. Anthony Fauci said Americans should begin to see a turning point with the pandemic “within a few weeks,” reported CNBC. Facui pointed to the vaccination rate averaging around 3 million per day and a nationwide average of 58,164 new cases per day as of Sunday as reasons the U.S. may start to see dramatically decreased Covid-19 numbers.

“Not down to no infections; if you’re waiting for classic measles-like herd immunity, that’s going to be a while before we get there,” said Fauci. “But that doesn’t mean we’re not going to have a significant diminution in the number of infections per day and a significant diminution in all of the parameters, namely hospitalizations and deaths.”

Fed holds interest rates near zero, sees inflation

On Wednesday, the Federal Reserve declined to let up on its easy-money policy despite an economy that it acknowledged is accelerating, reporting CNBC.

Chairman Jeromee Powell said the recovery is “uneven and far from complete” and that inflation pressures in the coming months will be “one-time increases in prices [and] are likely to only have transitory effects on inflation.”

Q1-2021 GDP increased at 6.4%

On Thursday, the Commerce Department announced that the Gross Domestic Product (GDP) of the U.S. increased 6.4% in the first three months of 2021 on an annualized basis, reported CNBC.

The Gross Domestic Product represents all of the goods and services produced by the U.S. economy. “This signals the economy is off and running and it will be a boom-like year,” said Mark Zandi, Chief Economist at Moody’s Analytics. “Obviously, the American consumer is powering the train and businesses are investing strongly.”

The U.S. consumer represents 68.2% of the economy and has been spending… a lot. Over the first quarter, spending increased by 10.7%, a 2.3% over the quarter prior. Spending on services grew by 4.6% despite limitations due to lockdowns and covid guidelines. Analaysts pointed to the $1,400 stimulus checks as likely aiding this increase in spending.

553K new weekly jobless claims exceeds estimates

On Thursday, the Labor Department showed another 553,000 Americans had filed for first-time jobless claims last week, exceeding the Dow Jones estimate of 528,000, reported CNBC.

The still-increasing number of newly unemployed prompted Federal Reserve Chairman Jerome Powell to note that “indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak.”

The continued weakness in the job market remains the primary reason for the Fed’s accommodative monetary policy of keeping interest rates at or near zero.

Next Week’s Gameplan

“Sell in May and Go Away” is a stock market adage referring to how many traders will sell their stocks and go on vacation for the summer. While this adage may feel dated, it often does have some truth to it.

The six-month period from May-November while historically positive on the whole, sees significantly less gains than the November-April time period year-over-year. Still, it’s never worth selling out just due to seasonality.

I will continue to keep my eye out for opportunities both to buy and sell and will stick to my trading discipline as we head into this more volatile season.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

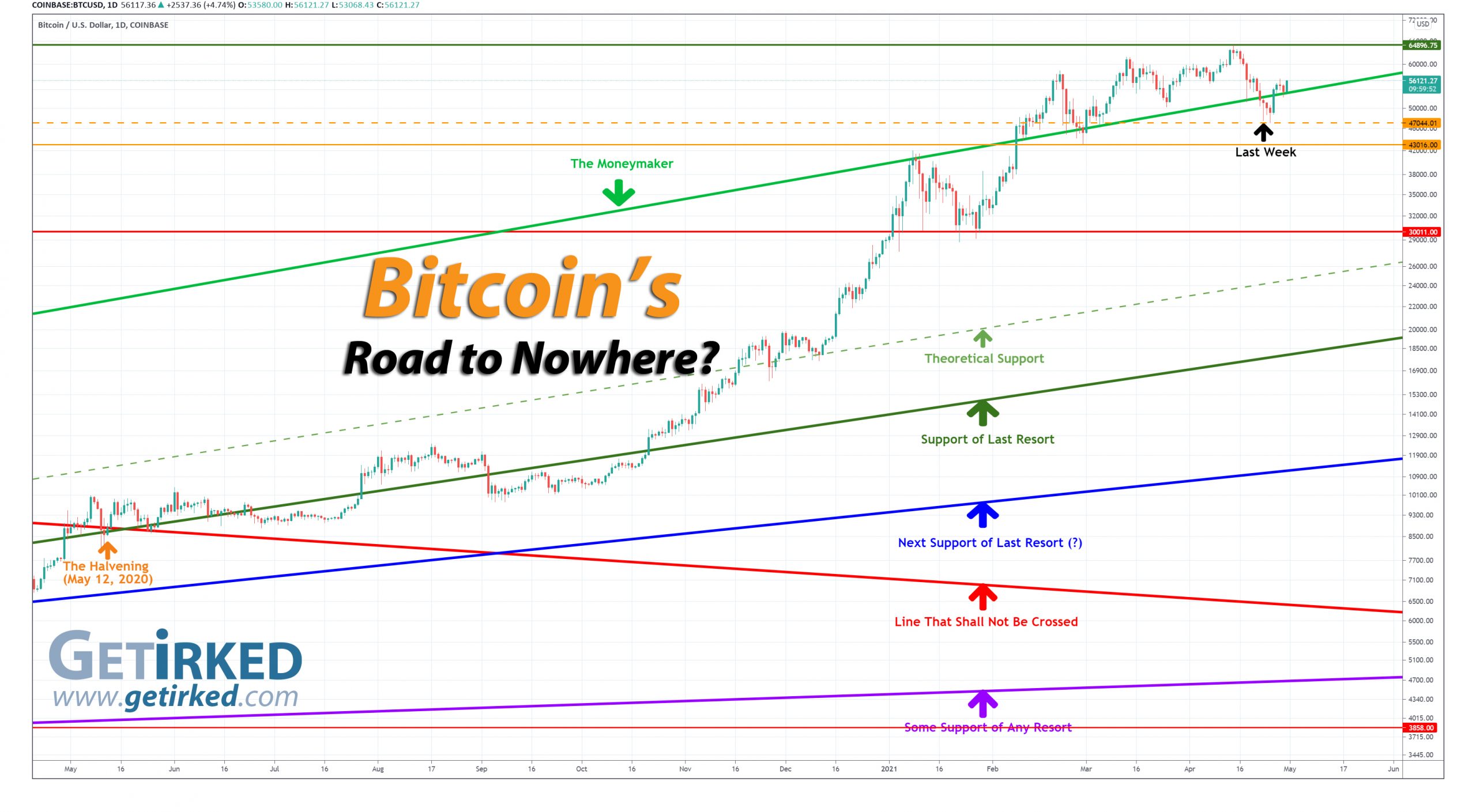

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

… and BOUNCE!!!

Bitcoin continued to come under selling pressure this past weekend, dropping back below the key $50,000 mark on Sunday, breaking through Friday’s support but finding new support Sunday afternoon at $47,044.01 before bouncing back up to The Moneymaker trendline on Monday.

The only crypto news this week came Wednesday when the Securities and Exchange Commission (SEC) announced it would delay its decision on approving the VanEck Bitcoin ETF until June, reported CNBC. The delay of the ETF decision had no impact on the crypto space.

Despite the negative price action of the past few weeks, Bitcoin’s bounce took it through The Moneymaker trendline which seems to have successfully transitioned from resistance to support demonstrated both on Tuesday and Thursday as price the bulls bought the dips.

The Bullish Case

Bulls once again point to the resilience of the crypto’s price action during the selloff. While Bitcoin did pull back around -28% from its high to the low of this past selloff, that amount of volatility is virtually negligible when compared to the epic selloffs of the past. Bulls reiterate that the amount of institutional buying and interest in the space has made those extreme periods of volatility a thing of the past.

The Bearish Case

Bears concede that the past few selloffs have been tame when compared to those of the past, however given that the Relative Strength Indicator (RSI) remains extremely overbought on the Monthly chart, many analysts believe May could see a test of $40,000 and potentially much lower.

Bitcoin Gameplan

Current Allocation: 3.949% (-1.030% since last week)

Current Per-Coin Price: $55,632.20 (-$44.88 since last week)

Current Profit/Loss Status: +0.879% (+12.682% since last week)

Position Management… stick to the discipline!

I added more to my position as Bitcoin declined on Sunday with a small order that filled at $47,870.24, lowering my per-coin cost -$44.88 per-coin from $55,677.08 to $55,632.20. Also, changes in a trading plan I had in place for Ether (ETHUSD) resulted in additional funds in my overall portfolio, so my total trade allocation decreased -1.030% from 4.979% to 3.949%.

From here, I have no price targets to take profits in the trade. Given that the allocation is relatively small, I will wait for either Bitcoin to make new all-time highs before reducing the position’s size, or for Bitcoin to drop where I’ll add more.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.280% @ $50,758

0.470% @ $47,520

0.470% @ $41,867

0.470% @ $35,857

0.470% @ $33,956

1.378% @ $28,089

3.041% @ $22,008

3.367% @ $18,256

6.115% @ $13,973

7.375% @ $11,228

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45.

- Later in March, Bitcoin dropped -19% to a low of $50,305.00.

- In April 2021, Bitcoin rallied +29% to a new all-time high of $64,896.75.

- Later in April, Bitcoin dropped -28% to a low of $47,044.01.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.