Summing Up The Week

Euphoria swept away the stock market this week following the release of a much greater-than-expected jobs report on Good Friday. Since the market was closed for the holiday, the price action took place this week, and, man, was there some serious bullish price action!

Let’s look at the news that moved the markets…

Market News

Jobs boom by 916K in March, blowing expectations

The markets may have been closed last Friday for the holiday, but the news didn’t stop flowing as the nonfarm payroll report showed 916,000 new jobs in March and unemployment rate declining to 6% versus expectations of just 675,000, reported CNBC.

Many had beeen expecting the report to miss expectations, a result which have promoted additional stimulus as the economy would be growing slower than hoped… this was not the case.

The result was a stronger rotation into reopening cyclical stocks and out of high-growth tech stocks.

“Double-Mutant” Covid variant in California

On Thursday, medical researchers at Stanford University in California announced that six cases of a “double mutant” strain have been detected in the state, reported CNBC.

The new variant finds its origins in India where it caused a 55% surge in cases in the state of Maharashtra, home of Mumbai, following months of declining cases.

The single new variant contains two mutations, E484Q and L452R, which had been previously found separately in other variants but not together in a single strain. The L452R mutation has been shown to make the virus more transmissible while the E484Q mutation helps the virus become less suceptible to neutralizing antibodies.

“The variants that scare me the most are the ones that haven’t been invented as yet… the more the virus replicates, we will continue to see these escape mutants,” said Peter Chin-Hong, an infectious diseases expert at the University of California San Francisco. “We need global vaccination equity and continued battles against pandemic fatigue.”

While the market basically shrugged off the disturbing news, should new variants of Covid-19 cause nations or even regions to re-enter lockdown, negative consequences will be felt in the global economy.

Producer Price Index shows real inflation

On Friday, the Labor Department’s Producer Price Index (PPI) showed prices jumped 1.0% in March after rising 0.5% in February, the largest annual gain in 9-1/2 years, reported CNBC.

In the past year, the PPI has increased 4.2% compared to the previous year-on-year record of 2.8% set in September 2011. Economists had expected inflation in the PPI as companies struggle to make products with headwinds including supply line issues and increasing consumer demand.

While the Federal Reserve and U.S. Treasury claim this inflation is temporary and can be controlled, other economists are not so sure and have been warning the U.S. might experience hyper-inflation as a result of interest rates near zero and seemingly never-ending stimulus.

Japan, for example, has seen no growth in nearly 30 years despite attempts from the government to print money, inject stimulus through infrastructure projects, and more in an effort to revive its struggling economy.

Next Week’s Gameplan

Despite the positive economic reopening news stories, I’m still well aware that the S&P 500 entered overbought territory this week, according to the Relative Strength Indicator (RSI).

Now, just because the S&P is overbought doesn’t mean we’re in for an immediate selloff. In fact, historically the S&P 500 has been able to grind higher into significantly more overbought conditions than what we’re currently seeing.

All that being said, I’m continuing to exercise extreme caution when adding to positions in order to ensure I’ve got dry powder on the sidelines in case we see a negative news catalyst such as new Covid-related lockdowns, additional supply line constraints, a battle in the Middle East, or any of the unknown unknowns that loom out there.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

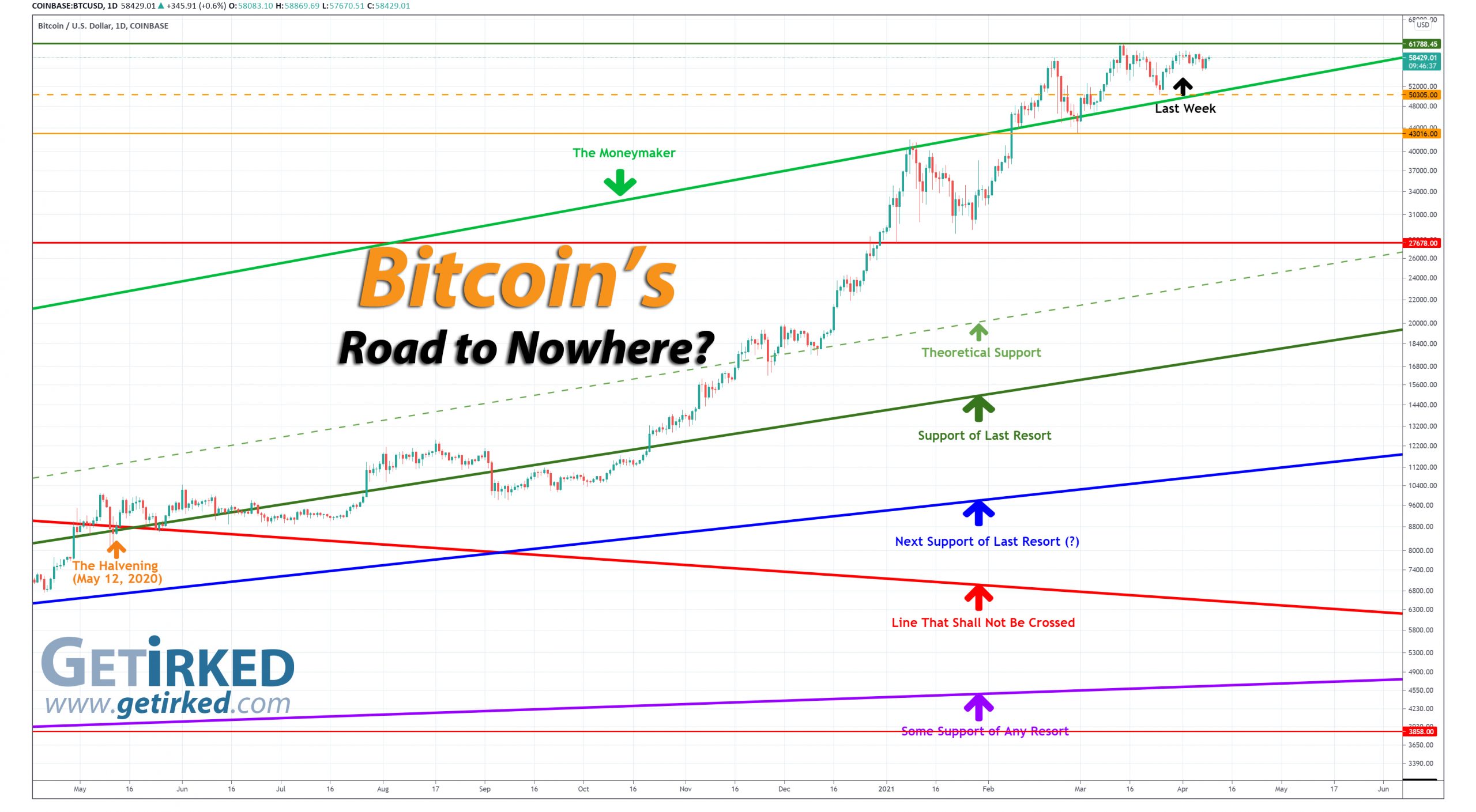

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Where has all the volatility gone?

In the past week (and a day, thanks to Good Friday), there is less than an 8% range between Bitcoin’s high and low. In any other asset class, 8% is a decent range, but we’re talking Bitcoin here, people!

Is the volatility gone for good?

The Bullish Case

Bulls continue to hold on to the thesis that institutional buying has created stabilization in the crypto market, and, so far, this thesis certainly appears well-founded as the Bulls continue to buy any dips when Bitcoin sells off.

The Bearish Case

Bears continue to argue that this time is not different, pointing to the overbought Relative Strength Indicator on the Monthly chart as foretelling Bitcoin’s inevitable doom. That being said, I’ve heard more than one Bear comment on how unusual Bitcoin’s price movement has been near its all-time high this time.

Bitcoin Gameplan

Current Allocation: 2.338% (-0.216% since last week)

Current Per-Coin Price: $56,910.94 (-0.314% since last week)

Current Profit/Loss Status: +2.667% (+0.166% since last week)

Trim a little…

With the Monthly Relative Strength Indicator (RSI) remaining incredibly oversold and Bitcoin continuing to appear as if it’s trading in a range early in the week, I decided to use stop-loss limit orders to take tiny profits on Monday when the crypto briefly pulled back and triggered a sell that filled at $58,685.94.

The sale reduced my allocation by -0.216% from 2.554% to 2.338% and decreased my per-coin cost -0.314% from $57,089.96 to $56,910.94.

Naturally, I want to believe the Bull case, but it just feels too good to be true at these levels so I’m going to remain conservative and protect against risk.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.469% @ $51,547

0.935% @ $46,073

1.403% @ $32,987

1.871% @ $29,644

2.369% @ $21,291

6.417% @ $13,531

5.793% @ $10,887

2.501% @ $9,280

8.691% @ $7,068

16.048% @ $4,782

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45

- Later in March, Bitcoin dropped -19% to a low of $50,305.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.