Summing Up The Week

The week started slow as investors waited to hear what comments would come from the Federal Reserve Bank on Wednesday. In fact, Tuesday was nearly flat as no one wanted to make a move without knowing how Wednesday’s Fed meeting would go.

After a brief move to the upside Wednesday, a sudden spike in the 10-year treasury yield, a bad jobless claims report, and France locking down Paris due to Covid once more caused the markets to sell off on Thursday.

Let’s look at the news that moved the market this week…

Market News

Fed sees strong economy, inflation, no rate hikes

On Wednesday, the Federal Reserve ramped up expectations for economic growth while indicating no interest rates are likely through 2023, reported CNBC.

The news caused markets to soar as many analysts had been expecting the announcement of potential interest rate increases following treasury yield spikes over recent weeks.

“Following a moderation in the pace of the recovery, indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak,” the committee said in its post-meeting statement. “Inflation continues to run below 2 percent.”

Gross Domestic Product (GDP) is expected to increase 6.5% in 2021 and cool off in subsequent years according to projections from the Federal Open Market Committee. In addition, members forecast unemployment to fall to 4.5% from its current 6.2%.

Despite the good news about the economy, many analysts believe the markets may leave the Fed with no choice but to raise rates. If treasury yields begin to spike with no way for the Fed to cool them using their current tools, either a rate hike or a forced peg of the rate could potentially cause markets to roil.

In the meantime, the markets saw nothing but blue sky Wednesday afternoon.

Tech hit hard as 10-Year Treasury yield spikes

On Thursday, the 10-year U.S. Treasury yield spiked above 1.75% despite reassurance from the Fed on Wednesday, reported CNBC. The rapid rising yield on the treasury indicates the bond market doesn’t believe the increasing rates are as a result of a growing economy, rather the resul of inflation which will weaken company profits and damage the stock market, particularly in high-growth names like technology.

The NASDAQ dropped like a rock once more as investors rotated out of expensive high-growth technology names and into value and cyclical plays.

“While no response [from the Fed] right now is arguably the only move on offer, whatever Powell does at this juncture, the Fed are taking bond markets to the danger zone,” Hinesh Patel, a portfolio manager with Quilter Investors, said in an interview with CNBC on Wednesday. “If they don’t do anything, the bond market will continue pushing yields higher looking for the Fed to increase or adjust bond-buying while if he does act now, then he will be accused of overstimulating and running too hot.”

New jobless claims total 770K vs 700K estimates

On Thursday, the Labor Department reported there were 770,000 new jobless claims in the past week compared to the 700,000 expected by Dow Jones economists, reported Yahoo! Finance.

This unexpected bad news in spite of reopening state economies across the United States combined with the spike in treasury yield to create a down day in the markets on Thursday.

Paris locks down – Covid’s not done with us, yet…

While rate fears were getting all the attention on Thursday, France’s lockdown of Paris to limit the spread of new Covid-19 variants got the attention of many traders on Thursday, reported CNBC.

“The Paris story was not what the markets wanted to hear,” Steve Sosnick from Interactive Traders told CNBC in an interview. “The market was not in a mood to receive more bad news; the bond market was not particularly happy with Powell’s comments, and it didn’t help you have a [quadruple witching] expiration [Friday], which likely caused more volatility.”

If the new variants of Covid gain ground and the vaccines have less effect against them, the potential that the pandemic may once again damage the global economy and, by extension, the stock market, is very real.

Next Week’s Gameplan

With the market making new highs, volatility will be the watchword going forward. When the market’s running with all cylinders firing, any misstep or bad news will cause at least some selloff.

Could a larger selloff be in store? Absolutely. A combination of bad economic news, affects from new Covid variants, and/or a spike in the 10-year treasury yield could send the markets spiraling.

As always, have your plan at the ready and approach the markets with extreme caution.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

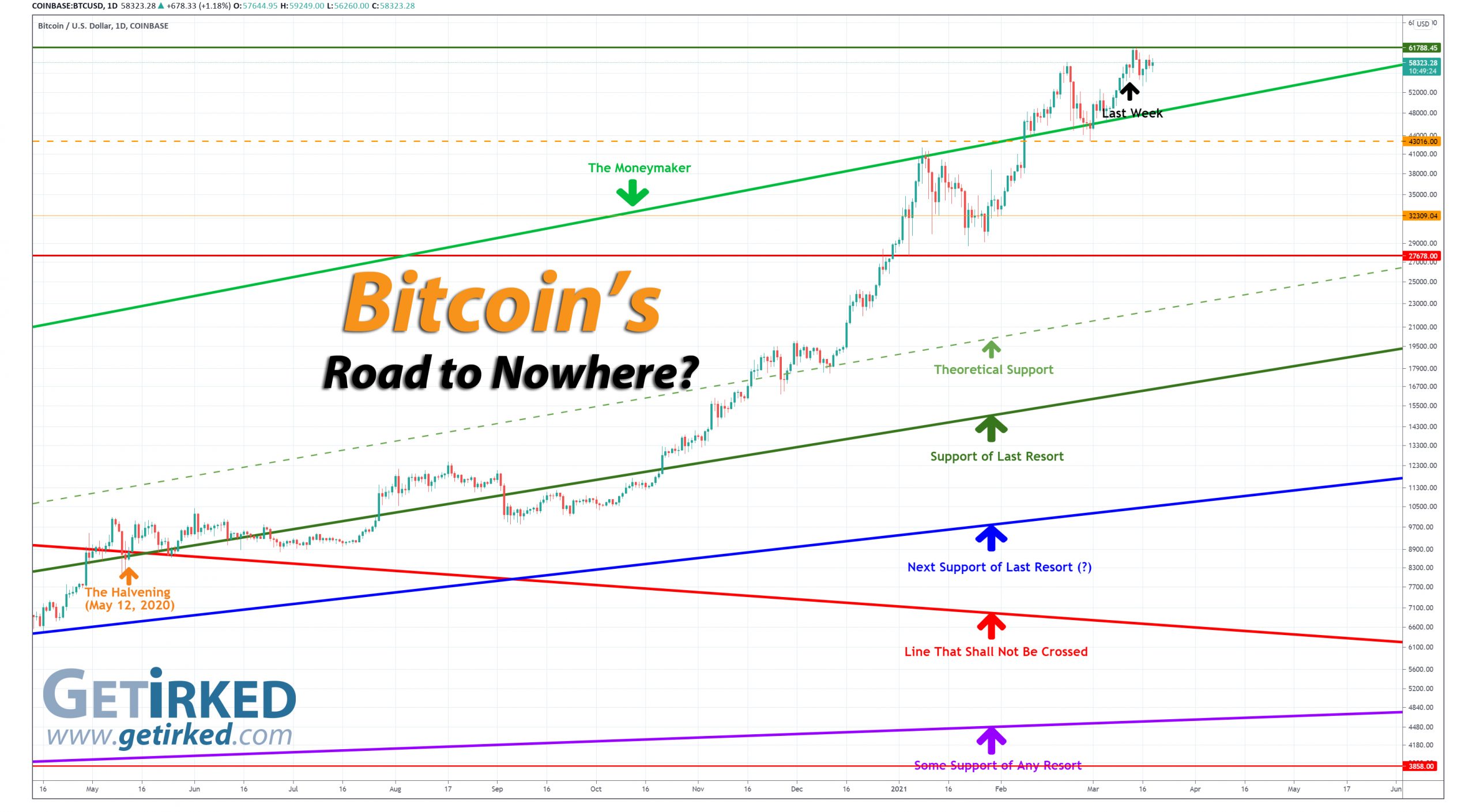

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

And, yet another new all-time high…

Bitcoin broke out Saturday and made an new all-time high at $61,788.45 before finding resistance and pulling back -13.87% to $53,221.00. From there, Bitcoin found a remarkable amount of support has been spending the majority of the week consolidating.

The Bullish Case

Bulls point to Bitcoin’s newfound resilience as a sign that the days of extreme selloffs are behind us. With institutions like Morgan Stanley (MS) announcing its accredited customers can now invest in Bitcoin, just this week, Bulls believe the current levels will hold despite past selloffs.

The Bearish Case

Bears argue that the more things change, the more they stay the same. While Bitcoin has demonstrated an extreme amount of strength at the $45k-$60k level, there is no reason to believe “this time is different.” An 80%-selloff from its new high gives Bears a potential low target below $10,000 and potentially deep into the $9,000s.

Bitcoin Gameplan

Current Allocation: 3.610% (-0.129% since last week)

Current Per-Coin Price: $49,951.37 (-1.779% since last week)

Current Profit/Loss Status: +16.760% (+6.074% since last week)

Risk and Position Management…

When Bitcoin rallied to a new all-time high on Saturday, it was time for me to use stop-loss limit orders to lock in a small amount of profits to reduce my per-coin cost.

My stop was triggered early Sunday morning and locked in profits at $60,529.02, reducing my per-coin cost -1.779% from $50,856.29 to $49,951.37.

Since then, I’ve been sitting on my hands as we wait for Bitcoin’s next big move. If it breaks bullish to new all-time highs, I’ll once again use stop-loss limit orders to lock in more profits and potentially close the entire position if profits are so great that my discipline dictates I do so.

If Bitcoin breaks bearish and hits my lower price targets, I’ll build up my current position and wait for the next bullish breakout.

If it does nothing, well, I’ll just keep sitting on my hands… sigh.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.093% @ $48,446

0.128% @ $47,420

0.182% @ $46,623

0.456% @ $44,924

0.456% @ $40,537

0.456% @ $36,082

0.519% @ $31,622

1.644% @ $27,556

1.375% @ $23,738

1.389% @ $21,137

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.