Summing Up The Week

As I discussed last week, volatility is definitely back in the markets with a dramatic selloff in technology names kicking off the week on Monday only to be followed by a huge bounce in those same names on Tuesday.

Market News

Fauci warns Covid decline… declining…

On Tuesday, White House Chief Medical Advisor Dr. Anthony Fauci warned Covid-19 cases in the United States may plateau at a very high level, reported CNBC.

In an interview with the Center for Strategic and International Studies, he reported that the decline in cases may be “going down a little more slowly which means we might plateau again at an unacceptably high level.”

Some health experts believe the U.S. will see a fourth wave of infections, particularly with highly-contagious variants making the rounds. Fauci’s report comes amid states reopening including Mississippi which reopened fully last week and Texas which announced it would reopen on Wednesday this week. Both states also removed mask mandates.

While additional lockdowns both at the Federal and State level are extremely unlikely, another wave of high Covid-19 cases could dramatically hinder the progess of the U.S. economy.

Consumer prices rise 0.4% in February, as expected

On Wednesday, the U.S. Labor Department reported its consumer price index increased 0.4% in February following a 0.3% increase in January, in line with economists’ expectations, reported CNBC.

The Consumer Price Index (CPI) is a key index used by the Federal Reserve to determine the rate of inflation. Many analysts will argue this logic is flawed, however, pointing to how inflation starts much earlier in the lifecycle of products, and that the Producer Price Index (PPI), the cost of commodities for manufacturers, is a better gauge of inflation.

Looking at the way the commodities markets have been flying with lumber costing twice what it did pre-pandemic and copper racing to all-time highs, it’s quite possible inflation is much higher than the CPI indicates.

What’s the problem with inflation?

At its most basic level, inflation is the cost of products and services increasing. At the consumer level, this means consumers will start spending less as the cost of household goods and everyday needs increase. At the company level, corporations will slow investment due to costs and potentially reduce their labor force.

Globally, if inflation is localized to the United States, it will cause the value of the U.S. dollar to drop comparatively to other countries’ currencies, making the U.S. less competitive, lowering companies earnings, and eventually causing the stock market to drop as a reaction.

$1.9 trillion in Covid relief coming soon…

On Wednesday, the House passed the $1.9 trillion Covid relief bill and sent it on to President Joseph Biden who signed it into law on Thursday, reported CNBC.

The bill extends jobless aid at $300 a week; sends $1,400 checks to most Americans; expands child tax credit for a year; puts $70 billion into vaccine manufacturing, testing, and contact tracing; adds rental & utility assistance; provides $300 billion to state and local governments; gives $120 billion to K-12 schools; extends PPP; and much more.

With this much stimulus being pumped into the U.S. economy, other countries have suggested that the U.S. may become an engine of growth for the entire global economy. While that is the bullish argument, the bearish argument is that this much debt will eventually create a debt bubble that could threaten the world’s economy when it pops.

Only time will tell. In the meantime, if you’re getting a $1,400 check, feel free to let me know what you plan to do with it in the comments.

Just don’t buy Gamestop (GME), okay? Yeesh…

U.K. Covid variant 64% more deadly than other strains

On Thursday, a study showed that a variant of Covid-19 first identified in the United Kingdom appears to be 64% more deadly than the other strains, reported CNBC.

Researchers analyzed data from more than 100,000 patients, comparing death rates among people infected with the B.1.1.7 variant and those infected with other previously circulating strains. People infected with B.1.1.7 were between 32% and 104% more likely to die.

Combine this news with the fact that governors in Texas, Maryland, Mississippi, Connecticut, Arizona, West Virginia, and Wyoming announcing plans to significantly reopen their economies and terminate mask mandates, as reported by CNBC, and you’ve got a recipe for a wave of Covid far worse than any we’ve seen before.

New weekly jobless claims 712K vs 725K

On Thursday, the Labor Department reported that first-time filings for jobless benefits totaled 712,000 for the past week versus expectations for 725,000, reported CNBC. Continuing claims decreeased 193,000 but still remain at 4.1 million unemployed Americans.

Once again, employers added 379000 jobs in February with strong hiring at restaurants and bars. Hopefully, the new stimulus plan will help small businesses including restaurants and bars to reopen and (re)create jobs.

Covid ‘Third Wave’ hits Europe

On Friday, Germany declared a Covid ‘third wave’ has begun and Italy has set for an Easter lockdown, reported CNBC.

“We have clear signs: the third wave in Germany has already begun,” Lothar Wieler, head of the Robert Koch Institute for Infectious Diseases, told reporters during a news conference on Friday. “The virus is not going to disappear, but once we have a base level of immunity in the population, we can control it.”

In Italy, Prime Minister Mario Draghi has been discussing tougher health measures to be imposed from March 15 to April 6 to tame the spread of the virus. The intent would be to place the entire country in a “red zone” – the maximum level of restrictions based on Italy’s tiered coronavirus system with schools, non-essential shops, restaurants, and bars all closed.

While not directly impactful on the U.S. economy, any restrictions or lockdowns throughout the world impact the global economy and could restrict every nation’s return to normalcy.

Next Week’s Gameplan

With $1.9 trillion in stimulus coming soon to an economy near you, states reopening like they’re on fire, and consumers with $1,400 stimulus checks burning a hole in their pockets, it’s hard to say what next week will be like.

Will inflation fears temper any stock market enthusiasm with a sudden rise in bond interest rates or will the ‘lennials buy any meme stock or crypto kitty that moves with their newly-gotten stimmies?

I guess we’ll have to wait to find out…

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

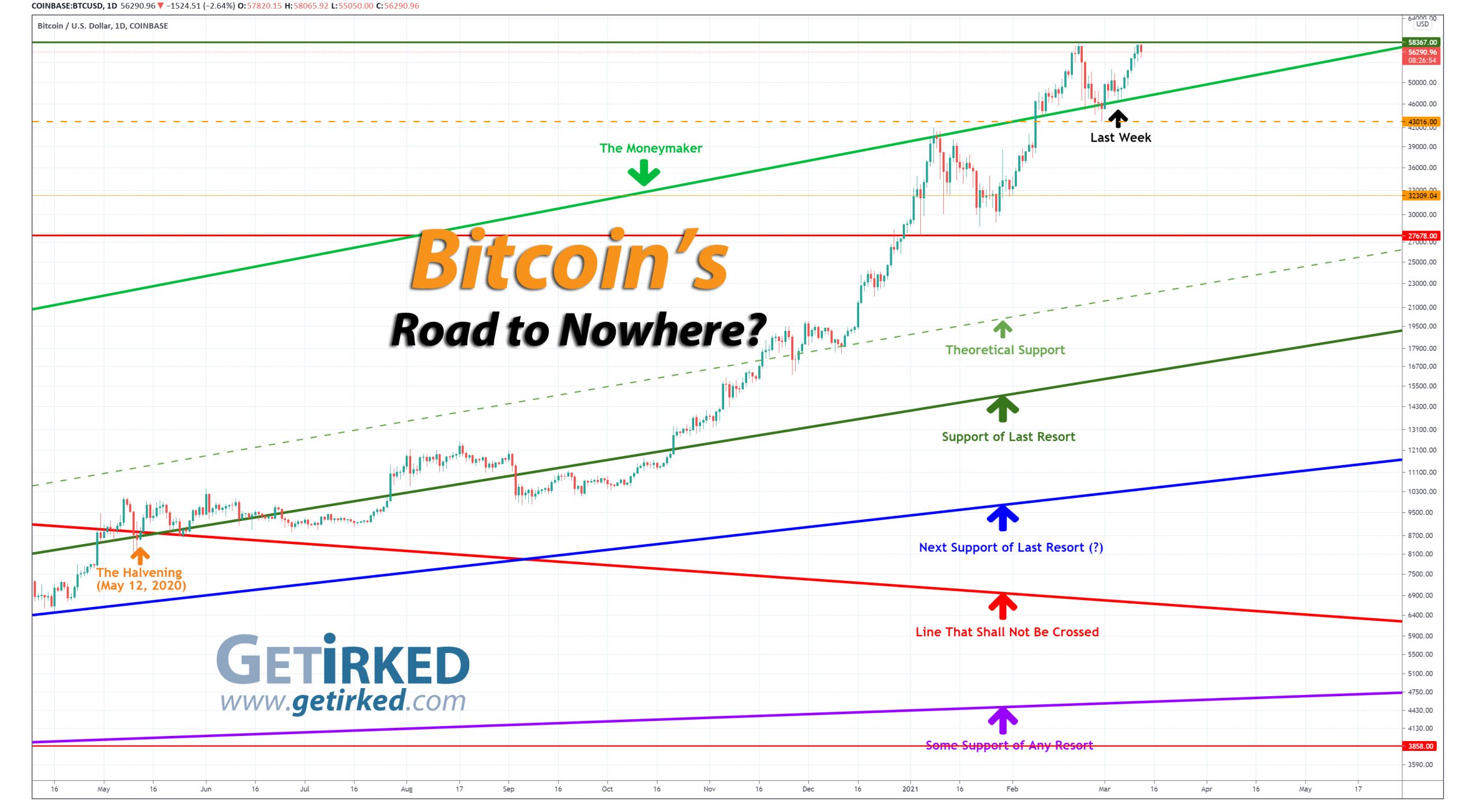

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Double-Top means…. what???

Bitcoin had a very eventful week after finding support on The Moneymaker trendline last Friday, Bitcoin made a stab at breaking through its all-time high at $58,367.00 and missed by just a few hundred dollars on Thursday and Friday.

The Bullish Case

Bulls point out that, historically, Bitcoin has never gotten so close to breaking its all-time high after such a relatively small pullback before the second attempt. Bulls point to ongoing institutional interest as the reason for “this time being different.”

The Bearish Case

Bears adhere to Bitcoin’s “Rule of Threes” where Bitcoin will often test resistance or support three times before breaking through. Accordingly, should Bitcoin attempt to break its all-time high a third time, it may break through, however Bears point to the strong resistance at the $58,000 mark and believe the pullback Bitcoin sees this time will be much, much larger than the last. Bears believe $43,016.00 won’t hold support and we’ll see Bitcoin pull back to $30,000 and potentially lower.

Bitcoin Gameplan

Current Allocation: 3.739% (-0.754% since last week)

Current Per-Coin Price: $50,856.29 (-1.696% since last week)

Current Profit/Loss Status: +10.686% (+18.247% since last week)

Sell a Little… Sell a Little…

Bitcoin’s attempt to test its all-time high resulted in me taking profits in my position to reduce my per-coin cost. Early Tuesday morning, I sold a small amount at $54,509.44 and then I sold a bit more on Wednesday at $57,097.66. On Thursday, I used a stop-loss limit order which filled at $57,458.76 to lock in a bit more profit when Bitcoin failed at making a new all-time high.

In all, the sales reduced my per-coin cost -1.696% from $51,733.91 to $50,856.29. In addition, I’ve freed up capital that can be reapplied if Bitcoin retreats from its all-time high again.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.457% @ $47,142

0.456% @ $42,738

0.456% @ $38,341

0.456% @ $35,581

0.456% @ $32,644

0.456% @ $30,738

0.519% @ $26,761

1.644% @ $23,018

1.546% @ $20,621

2.490% @ $17,726

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.