Summing Up The Week

While there’s always plenty of news in the markets, the key takeaway this week was the rising 10-Year Treasury Bond yield, which hit a one-year high of 1.49% on Thursday.

Do the bond yields signal the end of the Bull Market in stocks?

Read on to find out…

Market News

Do rising bond yields mark the Bull Market end?

On Monday, the yield on the 10-Year Treasury Bond jumped to 1.34%, near its highest level since February 2020 and the benchmark yield ticket a high of 1.37%, reported CNBC.

On Thursday, the 10-Year Treasury Bond reached a one-year high of 1.49% and then briefly broke 1.6% in such rapid succession, the move spooked investors, reported CNBC.

While increasing bond yields historically signal a strengthening economy, in the current global economic environment, the increasing bond yields more likely signify inflation due to money-printing worldwide.

As for the stock market, increasing interest rates in bonds begins to attract wealthier investors who more often seek to protect their wealth rather than grow it. While a sub-2% yield isn’t going to make you rich, a guaranteed return on your investment with no downside often pulls large amounts of money out of stock equities into the relative safety of bonds.

The rising bond yields typically cause investors to rotate out of high-flying growth names like the technology sector and into reopening plays and more defensive stocks like consumer staples or utilities.

December home prices rose 10.4%, highest in 7 years

On Tuesday, S&P CoreLogic Case-Shiller’s Home Price Indices showed home prices increased 10.4% in December compared to November, the strongest annual growth rate in more than six years, reported CNBC.

“These data are consistent with the view that Covid has encouraged potential buyers to move from urban apartments to suburban homes,” said Craig Lazzara, managing director and global head of index investment strategy at S&P Dow Jones Indices. “This may indicate a secular shift in housing demand, or simply represent an acceleration of moves that would have taken place over the next several years, anyway.”

However, mortgage rates started to increase sharply last week, which should cool demand for homebuying combined with the skyrocketing prices. Don’t worry the tasty froth on this housing market will likely blow over. While your own house value may fall, the reduction will bring the housing boom back down to reality.

Unlike 2008, where the financial crisis was driven by toxic mortgage products, the new regulations placed on mortgage education and raised minimum economic requirements for mortgage applications should eliminate the possibility of a financial crisis – we’ll likely just see housing prices cool off as demand decreases in the coming months and years.

Inflation still ‘soft’ according to Fed

In a statement made Tuesday to the Senate Banking Committee, Federal Reserve Bank Chairman Jerome Powell described inflation in the United States as ‘soft’ and reinforced previous statements that the current Fed policies will continue, reported CNBC.

“The economy is a long way from our employment inflation goals, and it is likely to take some time for substantial further progress to be achieved,” said Powell. “[The Fed is] committed to using our full range of tools to support the economy and to help ensure that the recovery from this difficult period will be as robust as possible.”

While Powell’s reassurances are slightly comforting, the increase in bond yields is more than a little concerning. In addition, many economists point to the fact that the Federal Reserve has never been able to truly control inflation in the past, so, if hyper-inflation were to occur, the Fed may not have the tools to reduce it.

What’s the result of hyper-inflation?

Rising prices on products across the board from clothing to food to fuel; a potentially catastrophic crash in the stock market; (more) rampant unemployment; and a scenario where the U.S. dollar is no longer the world’s reserve currency resulting in the dollar carrying less buying power comparative to currencies across the globe.

Will all of that happen? Who knows, but the scenario is certainly worth keeping an eye on.

Weekly new jobless claims drop to 730K vs 845K estimate

On Thursday, the Labor Department said first-time jobless claims in the past week fell to 730,000 vs. the 845,000 expected by Dow Jones economists, reported CNBC. While a falling number that’s lower than estimates may make for a good headline, it’s worth noting the figure isn’t cumulative – it’s not all of the continuing claims, it’s just the new ones added in the last week.

Continuing claims are currently slightly more than 4.42 million, and it’s worth noting… again… that the decreasing continuing claims may more be a result of unemployed people no longer receiving benefits, not that the unemployed are able to find jobs in the current economic conditions.

Next Week’s Gameplan

With the interest rates continuing to stay high and a bond market betting on a red hot economy, stocks could be in for continued selling pressure next week.

Is the Bull Market over or is the market just consolidating before the next move higher? Only time will tell…

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

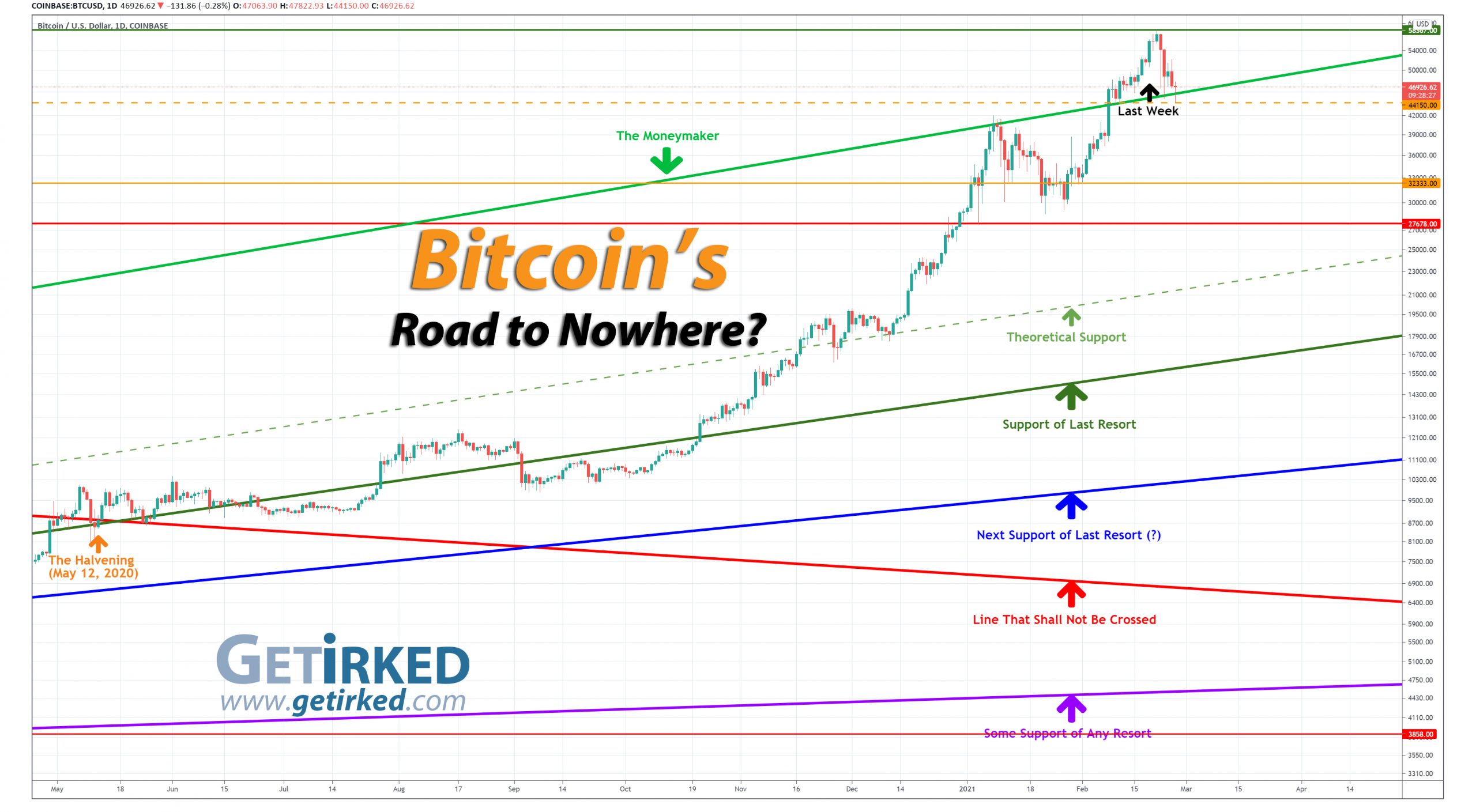

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Has the Bitcoin rollercoaster started again?

After pegging a new all-time high at $58,367.00 on Sunday, Bitcoin pulled back nearly 20% exactly (-19.9989%, to be precise) to $46,700.00 on Monday before bouncing ferociously as Bulls bought up the dip, only for the sell off to start again on Tuesday, with BTC dropping -24.36% from its high to a weekly low of $44,150.00 on Friday.

Some analysts point to Tesla (TSLA) CEO Elon Musk as the reason for the selloff after Musk tweeted, “BTC & ETH do seem high lol” on Friday evening in response to tweets from notorious Bitcoin Bear, Gold Bull, and successful fund manager, Peter Schiff.

That being said, I’ve been expecting a 20% dip for some time. In fact, a drop from its new high of 30-40% would be far from unusual for Bitcoin. In the past three years, Bitcoin has dropped more than -80% from its all-time-highs twice in the past three years, the second time taking place in March 2020 where it dropped more than -50% in less than 48 hours.

As I always say, make sure you have a strong stomach if you speculate in cryptocurrency because the rollercoaster of volatility is not messing around.

The Bullish Case

Bulls continue to make the argument that thanks to institutional investing and Bitcoin’s sky-high valuation, the incredible volatility and eye-watering -80% selloffs are a thing of the past. Bullish analysts say this pullback is simply a correction before Bitcoin returns to its rise to $150k.

The Bearish Case

Bears counter the Bulls with the consistently-accurate Twainian stock market adage: “history might not repeat itself, but it sure does rhyme” combined with the hard-and-fast rule: “never, ever say ‘this time is different.'” Sure, Bitcoin made an astounding new all-time high, but Bears say we’re in for further downside, eyeing the February monthly low at $32,333.00 followed by key support at $27,678.00.

Bitcoin Gameplan

Current Allocation: 4.556% (+4.125% since last week)

Current Per-Coin Price: $52,398.72 (-1.491% since last week)

Current Profit/Loss Status: -10.443% (-13.598% since last week)

Yeah, I should have stuck to my knitting…

My getting into the trade near Bitcoin’s all-time high once again reiterates the importance of having trading discipline (which I failed to follow…). Instead of waiting for a pullback, I continued to add in small quantities as BTC approached its all-time high, adding at $56,414.16 and $57,568.56 thereby raising my per-coin cost +5.280% to $56,000.22 and giving me an allocation of 2.102%.

Every time I ignore my discipline and FOMO into a trade or investment, it ends up biting me on the butt and this time was no different. Bitcoin careened through my new per-coin price, crashed through my original $53,191.96 coin price and dropped (much) further down before finding support.

Had I waited for the 15-20% pullback I knew was coming (because it historically always does in the space), I would be in a far better starting position for my trade, but, hey, this is why I plan my trades in advance and use painfully small quantities as starters. By exercising conservatively-small starting trades, I get to make mistakes, learn, reinforce my discipline, and move on to become better at both trading and investing without losing my shirt or getting kicked out of the trade.

On the way down, I did add over the past week at $54,357.10; another at $51,366.82; a third time at $49,059.04; a fourth at $47,237.12; and a fifth at $46,276.50. The combined orders reduced my per-coin cost by -1.491% from my original per-coin cost of $53,191.96 to $52,398.72, but, more importantly reduced my cost -6.431% from my ridiculous $56,000.22 price.

My current allocation now sits at 4.556%, and, as always, my gameplan accounts for a potential pullback of not just -80% from current highs, but even a re-test of the $3200 low in 2018-2019 (and even lower). When it comes to Bitcoin, the price action really can take us just about anywhere…

Let’s look at what I plan to do from here…

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.277% @ $41,265

0.462% @ $38,060

0.462% @ $36,083

0.462% @ $33,229

0.185% @ $30,036

0.277% @ $29,229

0.462% @ $26,352

0.462% @ $23,428

1.091% @ $20,504

0.644% @ $19,416

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -24% to a low of $44,150.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.