Summing Up The Week

After weeks (if not months) of nothing but a bull rally, the market started to get skittish this week when the yield on the 10-year treasury bond hit 1.30%, gold sold off, and signs of inflation started to peek around the corner.

Let’s take a look at the news that moved the markets this week…

Market News

Bond yields rise… Bad sign for stocks…

On Tuesday, the S&P 500 reversed course and headed lower as rising bond yields caused analysts to become nervous, reported CNBC. The 10-year Treasury yield jumped 9 basis points to hit 1.30%, a concerning sight for many analysts as the 1.20% mark was already making many jittery.

If bond interest rates increase, more conservative and wealthier investors may leave stocks for the more relative safety provided by bonds. The mass departure from stocks could potentially cause the market to pull back substantially.

“Higher yields, while good for banks, are hitting bond surrogate sectors like REITs, Utilities, and Staples, said Art Hogan, National Securities chief market strategist, in an interview with CNBC. “The market can digest rising yields, especially when they are going up for the right reason, but not when they go up in a linear fashion.”

January retail sales rise 5.3% vs. 1.2% estimate

On Wednesday, reports showed retail sales rose 5.3% in January versus the 1.2% expected from economists survey by Dow Jones, reported CNBC. Spending rose across the board except for autos, with every category seeing significant increases. CNBC attributed the increase in spending to the stimulus approved by Congress in December of last year.

The biggest increase was in the electronics and appliances sector which rose 14.7%. Furniture and home furnishing increased 12%, online spending increased 11%, and food and drink increased 6.9%, the smallest rise of the major categories.

While increased consumer spending is historically a sign of economic strength as consumers demonstrate faith in the economy, given the huge number of unemployed Americans and the stimulus checks mailed to millions of citizens, the increase in January is difficult to attribute to an economic rebound in my opinion.

Household debt rises to $14.6T due to home loans

On Wednesday, the Federal Reserve released a report showing that consumer debt rose to nearly $14.6 trillion at the end of 2020, due to the rise in new mortgages in the housing market, reported CNBC.

Mortgage debt passed $10 trillion for the first time in history and was rising at the fastest pace since the four quarter in 2006, the apex of housing demand before the financial crisis which started in 2007 and continued through the early 2010s.

While housing sales are typically a sign of a strong economy, due to the pandemic and civil unrest, many economists warn that housing sales may no longer be correlated to a strong economy and should be viewed accordingly.

Jobless claims 861K vs. 773K expected

On Thursday, the Labor Department reported 861,000 new jobless claims in the past week versus the 773,000 expected by Dow Jones economists, reported CNBC. While continuing claims and the total number of Americans receiving benefits declined, as I’ve discussed on a nearly weekly basis this is deceiving since there are likely many unemployed who no longer receive benefits simply because the benefits have expired, not that the people don’t need the benefits.

Next Week’s Gameplan

Bulls think the rally’s far from over as the Fed’s low interest rates combined with money-printing and potential big stimulus providing theoretical backstops to any market selloff.

As for me, I continue to be wary, despite the fact that I am adding to positions here and there. My biggest adds are in the goldmining space as gold sees continued selling pressure – the only commodity that is as the rest of them skyrocket.

Accordingly, gold’s really the only asset that seems cheap right now, but only if you’re looking at the miner ETFs – the failed Silver Squeeze by the Reddit Rebellion caused premiums on physical bullion to fly to the moon making purchasing coins or bars a fool’s game with silver premiums as high as 30% over spot!

As the days and weeks go by without any significant selloff, I’m certainly curious to see what next week will bring…

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

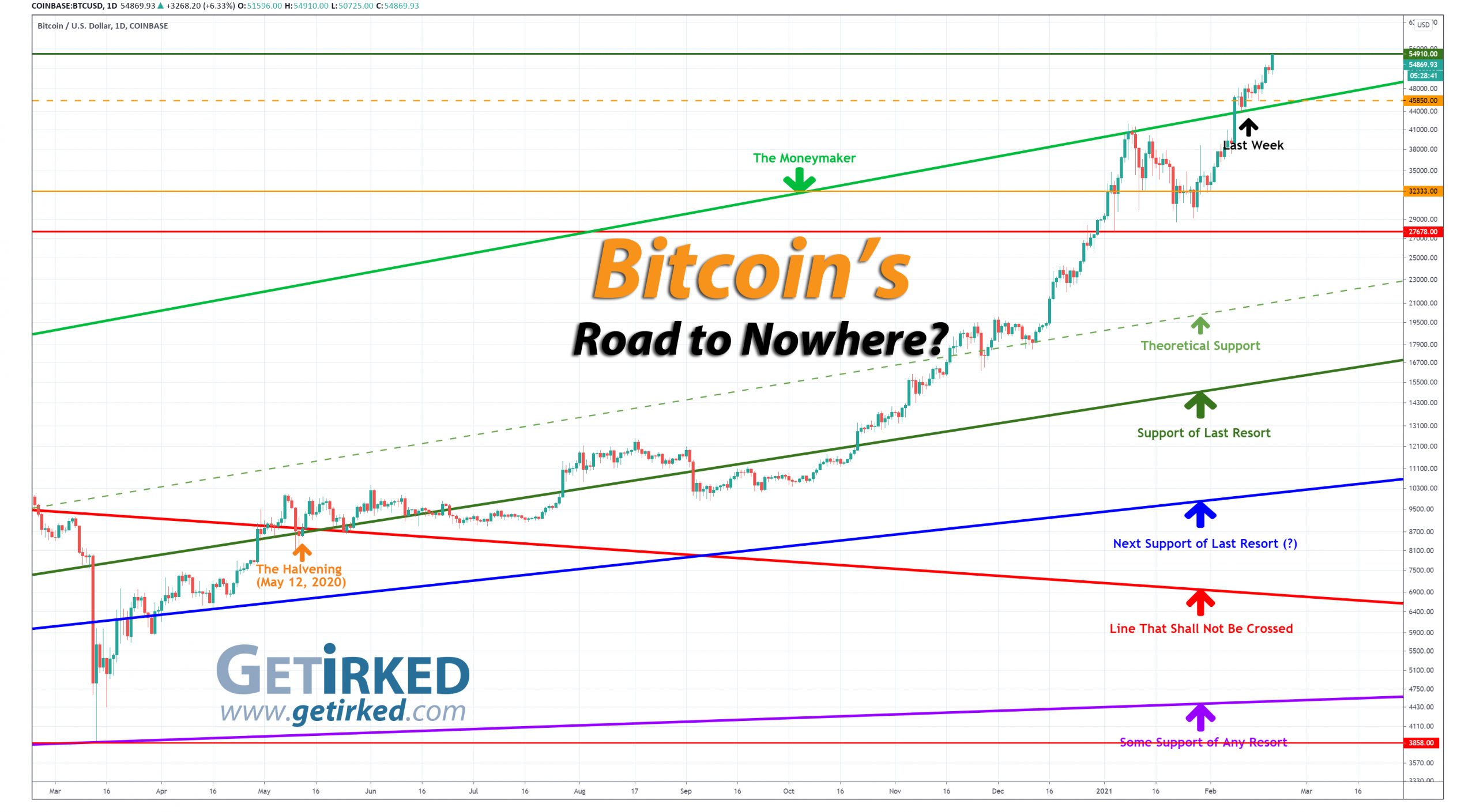

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Bye, bye $50K. Hello, $150K?!

So, that happened – Bitcoin destroyed the $50,000 mark with barely a hesitation, rocketing to a new high of $54,910.00 on Friday. In fact, it’s likely that Bitcoin’s headed higher than that by the time you’re reading the end of this sentence…

The Bullish Case

With a Canadian Bitcoin ETF about to launch, Bitcoin Bulls believe this rally hasn’t run out of gas, yet, with some suggesting that it won’t end until the crypto hits a high of $150,000 a coin.

The Bearish Case

Bears point to the Relative Strength Index (RSI), an indicator that shows how overbought or oversold an asset is. Currently, Bitcoin’s monthly RSI is disturbingly high, clocking in figures last seen… you guessed it… shortly before Bitcoin crashed from $20k to $3100 over the course of 2017-2018. Bears believe we’ll see another substantial pullback of 30-80%.

Bitcoin Gameplan

Current Allocation: 0.431% (New trade)

Current Per-Coin Price: $53,191.96 (New trade)

Current Profit/Loss Status: +3.155% (New trade)

Are the bulls right?

Sooooo… I may have gotten sucked into the hype and opened a trade on the way up. While I typically wait for Bitcoin to pull back at least 20% before opening a trade, the frenzy was getting to me, so I decided to kill my FOMO by letting myself open a small position so I could build on it when we finally do see Bitcoin pull back.

Using limit orders, my 0.431% allocation filled at $53,191.96 which, at Bitcoin’s near all-time high here, gives me a +3.155% gain. Personally, I’m a bit bearish when it comes to Bitcoin’s current moves – I mean, we’re used to seeing Bitcoin go parabolic but these moves have to be reaching a fever pitch… don’t they???

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

1.343% @ $51,061

0.443% @ $48,658

0.443% @ $45,838

0.443% @ $43,928

0.443% @ $40,159

0.443% @ $38,441

0.443% @ $35,127

0.443% @ $32,954

0.443% @ $30,211

0.443% @ $28,417

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +91% to a new all-time high of $54,910.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.