Summing Up The Week

The week kicked off with several disturbing news reports about the extremely high valuations of the stock market in combination with stock activity last seen right before the dot-com burst in early 2001.

A precarious selloff on Wednesday was followed by a rally on Thursday, but Friday showed weakness as investors are uneasy about the market’s levels combined with the speculative frenzy and disappointing vaccine results from Johnson & Johnson.

“What speculative frenzy?,” you ask?

Read on… it was a crazy week…

Market News

Stock Market at or near Most-Expensive Levels… Ever…

Last Saturday, Goldman Sachs released a battery of valuation tests that show the stock market to be at or near the most-expensive levels in recent history on most measures, reported CNBC.

In addition, CNBC described a “greed hive” related to the stock market, referring to the amount of retail traders using options to gain leverage, high-risk trades, coordinated short squeezes, and traders buying relatively worthless stocks in droves to create (and chase) momentum.

While all of these data sound dire, the stock market is actually not “worryingly overvalued” when compared to the bond market, according to CNBC. Thanks to the Federal Reserve backing up the market, the yields in bonds are incredibly low which drives investors into stocks for income, instead.

However, simply because both markets are overvalued doesn’t protect either (or both) from a potentially dramatic selloff.

Should we be worried?

Maybe. As always, make a trading plan in advance for what you will do if the market heads higher or if the market heads lower. Preparation is key to dealing with potential market volatility.

Does Gamestop’s (GME) +1,800% 2-week pop mean the top?

A new trend in the markets is for followers of the Reddit group Wall Street Bets to buy out-of-money call options in heavily-shorted stocks.

What does that mean in English?

Since January 13, seemingly out-of-touch bricks-and-mortar video game retailer Gamestop (GME) has seen its stock jump more than 1,800% from $20 to a high of $380 on January 27 thanks largely to retail investors, reported CNBC. Bears have targeted the stock as the majority of video games are sold on digital channels now, bypassing the need for a physical store. However, the bears have shorted (pushed the stock down) so hard, that coordinated buyers bought so much of the stock that the bears had to buy back the shares they sold, causing the epic pop in stock price.

A similar phenomenon happened in 1999. Retail traders would gather in stock chat groups on Yahoo.com (who remembers Yahoo?!) and coordinate to buy stocks with heavy bear interest… in droves. In order to protect against their short positions, the bears have to buy the stock. This action combined with the retail traders also buying the stock causes the price to jump, sometimes dramatically.

However, many stock market historians point to this repetition as a sign the market has reached its top, as the dot-com markets in the early 2000s saw this phenomenon reach its peak in December 2000, about 3 months before the epic dot-com bubble burst on March 10, 2001.

That being said, other market analysts like Jim Cramer argue that the market isn’t overvalued and while this price action should certainly concern bears, with the Federal Reserve backing the market, the likelihood of anything more than a garden-variety pullback is unlikely.

On Thursday, Interactive Brokers, Robinhood and other stock brokers started limiting trading on Gamestop (GME) and other short squeeze stocks to try to protect retail investors who may not be aware of the risks due to the stocks’ newfound extreme volatility, reported CNBC.

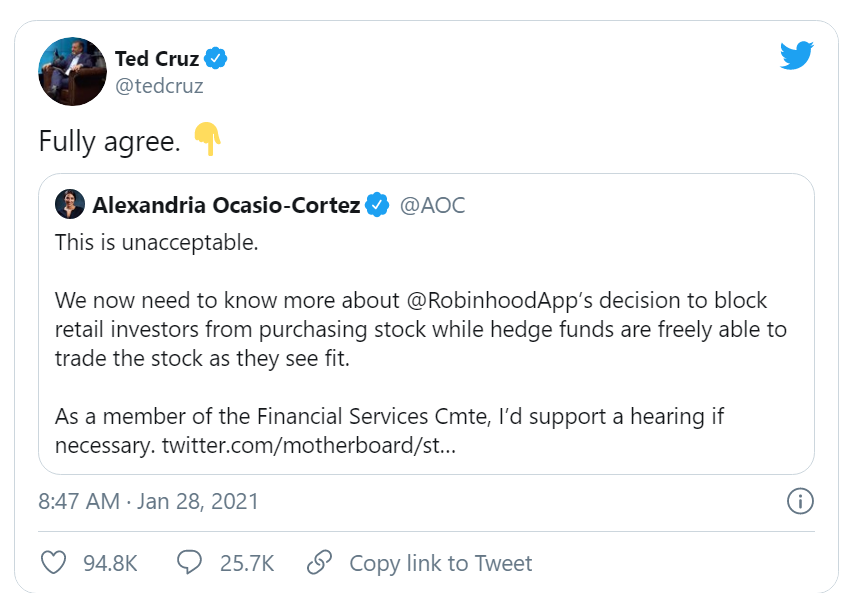

The result of limiting trading caused a firestorm resulting in staunch Republicans and Democrats to agree with each other against the brokers’ limiting of retail investors rights. (Dogs and cats living together, what’s next?!)

Republican Senator Ted Cruz tweeted “fully agree” to Democratic Representative Alexandria Ocasio-Cortez (@AOC) tweet: “We now need to more about @RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit. As a member of the Financial Services Cmte, I’d support a hearing if necessary.”

Drop in 10-Year Bond Yield causes Market selloff

The markets sold off on Wednesday morning after a drop in the 10-year treasury bond yield indicated many investors were moving out of stock equities and into bonds for protection against potential downside. The Federal Reserve Chairman Jerome Powell was scheduled to speak later in the day with some believing that Powell may try to soothe the markets, but that his attempts may not work, reported CNBC.

Powell was expected to acknowledge that the economy has softened, consumer spending has weakened, and the labor market has deteriorated since the December meeting.

“Markets are expecting little at this meeting, but likely see Fed communication risks as asymmetric: it will be hard for the Fed to sound more dovish but easy for the Fed to sound more hawkish,” said Bank of America strategists in a note. “As such, markets may misinterpret Chair Powell’s discussions around upside risk to be hawkish.”

As a result of the combination of the lowering yield on the 10-year bond and low expectations for the Fed meeting, markets saw their first significant selloff in weeks on Wednesday morning.

Fed statement offers little reassurance of economy improving

On Wednesday, the Federal Reserve Bank announced it would continue keeping the interest rate near zero and keep buying at least $120 billion of bonds each month, reported CNBC.

The Fed reiterated its belief that the economy is depending on the progression of COVID-19, and added a “progress on vaccinations” to its watchlist.

The statement also stated that the novel coronavirus is “causing tremendous human and economic hardship across the United States and around the world. The path of the economy will depend significantly on the course of the virus, including progresson on vaccinations.”

In regards to the economy, the Fed differentiated between different sectors. “The pace of the recovery in economic activity and unemployment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic,” the statement said.

Following the release of the Fed’s statement, the market selloff continued for the remainder of the day rather than subsiding, a possible sign that the Fed’s policies may not carry the same weight in calming the market as they used to.

U.S. 2020 economy slightly worse, Jobless claims better

Gross Domestic Product (GDP), the sum of all goods and services produced, increased at a 4% gain in the fourth quarter of 2020, slightly below the 4.3% expected from Dow Jones economists, reported CNBC.

On a bright note also on Thursday, the Labor Department reported new jobless claims at 847,000 for the past week versus the 875,000 expected.

Throughout the entire year of 2020, the economy declined a total 3.5%, the worst year for the U.S. economy since the end of World War II. The economy also contracted at a post-Depression record 31.4% in the second quater, but rebounded to a 33.4% gain in the following three months.

Economists predict a slow start for 2021 followed by an accelerating economy. “Growth is likely to be very weak in the first quarter of 2021, below 1% annualized,” said Gus Faucher, chief economist at PNC Bank. “With record-high caseloads early in the year, consumers have turned more cautious and states have re-imposed additional restrictions on economic activity … but growth should pick up through the rest of 2021.”

Johnson & Johnson Covid vaccine 66% effective

On Friday, Johnson & Johnson (JNJ) announced its single-shot Covid-19 vaccine is 66% effective in protecting against Covid-19, 85% effective in preventing severe disease four weeks after vaccination in all adults, reported CNBC.

The vaccine varies in efficacy depending on region – 72% effective in the U.S., 66% in Latin America, and 57% in South Africa four weeks after receiving the injection. “We’re proud to have reached this critical milestone and our commitment to address this global health crisis continues with urgency for everyone, everywhere,” said J&J CEO Alex Gorsky in a statement.

When compared to the seasonal influenza vaccine’s 40-60% efficacy, 66% effective sounds like a good number, comparatively, however with vaccines from Moderna (MRNA) and Pfizer (PFE) rating over 90% and Novavax’s (NVX) new vaccine apparently scoring an efficacy near 90%, medical experts believe it will be difficult convincing patients to get the JNJ version over its competitors.

However, others touted JNJ’s success. Dr. Scott Gottlieb, a former FDA commissioner, called the J&J data “fantastic,” saying in a tweet that it showed the vaccine produced “sustained (and increasing!) immune protection over time.”

For others, the important finding of the data is that it may keep people out of the hospital and prevent them from getting severe illness. “The most important thing, more important than whether you prevent someone from getting aches and a sore throat is preventing people [from getting severe disease],” said Dr. Anthony Fauci, the nation’s infectious disease expert, in a call with reporters. “That will alleviate so much of the stress and human suffering and death in this epidemic.”

Next Week’s Gameplan

The market remains a stock pickers’ market, offering opportunities in areas of weakness. However, great care must be taken as other areas of the market are, without question, incredibly rich.

The systemic selloff on Wednesday and weakness on Friday yielded several positions for me to add to, however, without additional market-wide weakness, my price targets are specific to each individual position as some experience weakness while others exhibit nothing but unbelievable strength.

However, if the market’s volatility combines with the recent speculative frenzy, we may be looking at a very significant selloff in the coming weeks.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Volatility’s Back, Baby!

As I mentioned last week, Bitcoin’s severe -30%+ drop from its highs means volatility has returned to the cryptocurrency space, and this week was no different as Bitcoin dropped -16.43% from its weekly high of $34,888.00 made on Monday to its $29,156.00 weekly low on Wednesday before rebounding +32.61% dramatically to a weekly high of $38,664.33 on Friday.

When you look at my chart, you’ll notice three new lines: The Moneymaker, Bitcoin Shall Not Cross? and Theoretical Support (which is discussed in The Bearish Case below).

First, the bright green line called The Moneymaker is a trend line starting at the very beginning of Bitcoin tracking on Coinbase in 2015. It marks key movements in the crypto, often marking tops when it reverses a bull rally if Bitcoin is below it, but also marking points of key support if Bitcoin is above it where, if the line is broken, it historically signifies a significant crash.

The second new line is a tentative Bitcoin Shall Not Cross? in dark red. A hashed line due to its relative newness signifying that it hasn’t solidified enough for my taste, yet, this line represents the downward trend from Bitcoin’s new all-time high that the crypto seems unable to stay above.

Typically, when a downward triangle like this begins to form (between the weekly and monthly lows and the descending Bitcoin Shall Not Cross? trendline), the asset, in this case Bitcoin, will consolidate with lower-highs and higher-lows as it approaches the apex of the downward triangle. The apex often signifies a period of a great momentum breakout and can either be bullish or bearish.

While both Bulls and Bears will say this pattern means the breakout will move in their preferred direction, I’ve found instances in the past where the breakout goes to either direction, meaning this pattern basically simply lets us know that something may happen soon.

The Bullish Case

Bulls point to last week’s low of $28,732.00 not breaking Wednesday as a sign that the crypto has found support with additional buyers stocking up whenever the crypto breaks through 30k. Bulls argue that Bitcoin may consolidate at these levels for several days or weeks before making new all-time highs.

The Bearish Case

Bears argue that Bitcoin’s lost its key support at the psychological $30,000 level. Now that Bitcoin has broken $30,000 twice, once on January 22 and once on January 25, that if Bitcoin tests $30k again, it will likely drop through to the monthly support line at $27,678.00 or lower such as the light-green hashed Theoretical Support line currently around $20,000-$20,200.

Bitcoin Gameplan

Current Allocation: 1.113% (Unchanged since last week)

Current Per-Coin Price: $30,470.75 (Unchanged since last week)

Current Profit/Loss Status: +26.890% (+21.017% since last week)

After Bitcoin found support at a higher point than the weekly low, I have raised my next buy price target to account for the trendline that appears to provide support at that level.

However, since I still expect Bitcoin to pull back far more before it breaks its new all-time high, I continue to use small quantities and lots of patience rather than stocking up far too early and missing out on lower-priced bargains.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.542% @ $29,546

0.511% @ $27,858

0.493% @ $26,829

0.478% @ $26,048

0.447% @ $24,361

0.386% @ $21,010

0.347% @ $18,902

0.308% @ $16,807

0.286% @ $15,569

0.778% @ $13,138

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are just a few recent price movements over the past couple of years:

- Bitcoin rose +2,707% from its January 2017 low of $734.64 to make an all-time high of $19,891.99 in December of the same year.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Next, Bitcoin dropped -32% to a low of $28,732.00 later in January 2021.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.