Cash on the Sidelines

One of the key strategies to my success is keeping cash on the sidelines. New investors might think keeping cash on the sidelines means missing out on gains since the more money you have invested, the more gains you see, however, by having cash available, investors can take advantage of selloffs in individual positions or the market as a whole by adding at lower levels.

In fact, I prefer systemic market-wide selloffs because as long as I own the stocks of companies I have faith in, the systemic selloff means everything is on sale and I can add at key levels without concerns of a specific company having trouble.

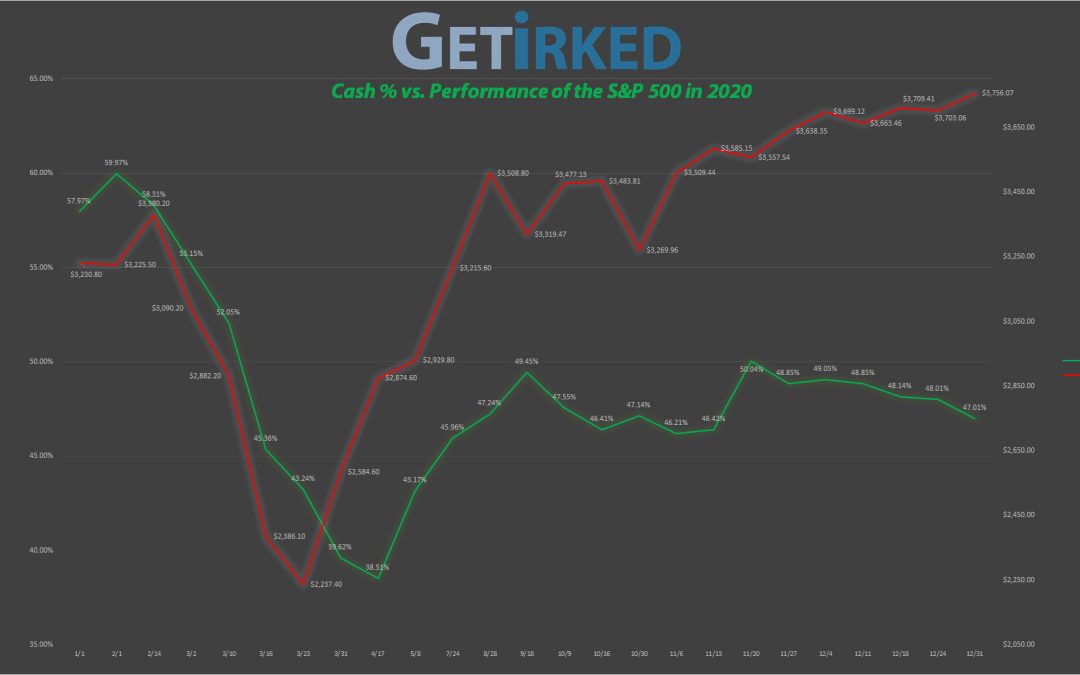

Click on the chart to enlarge it for a bigger view

Buying in Stages in Action

The above chart shows the percent of my accounts I held in cash (the green line) on certain dates in 2020 compared to the performance of the S&P 500 (the red line). Going into 2020, I had made some adjustments to my total asset allocation that left me with a significant amount of cash.

In fact, on February 1, 2020, I held nearly 60% of all of my assets in cash – a frankly insane amount. While I wish I could say I was positioned this way because I knew the pandemic was coming, I was just lucky as I had recently liquidated some large positions and was preparing to reallocate those funds when the selloff started.

You can follow along as the market sold off, I continued to add to my portfolios. Although the percent of cash in my accounts is often directly correlated to the performance on the S&P 500, you might notice a lag time where my cash percentage bottomed in April after the S&P 500 bottomed in March.

This is a result of the S&P 500 increasing in value. As my investments increased with the rest of the market, the overall portfolio size increased, thus decreasing the percentage of my portfolio’s total value made up by cash.

Selling in Stages in Action

After the market’s bottom on March 23, you can see that my cash position started increasing in May as I started to take profits in stages. Since the market had sold off so dramatically and no one knew how the economy was going to react during the pandemic, I started taking profits in positions that had bounced incredibly.

Finishing off the Year

For the rest of the year, you can see that when the market dipped, so did my cash position as I put money to work. In November, the markets saw some of their biggest one-month gains ever, causing me to sell quite a bit of my assets to liquidate nearly half of my assets throughout December.

With news of vaccines on the way and considerable stimulus being put to work in December, I started reallocating funds into the end of the year combined with the market reaching all-time highs which further reduced the percentage of my portfolio’s value made up by cash.

For comparison, the quantity of cash I held at the end of 2020 was actually 14.611% more than I had at the beginning of 2020. However, that larger cash pile only makes up 47.01% of the entire asset portfolio versus the 57.97% it made up at the beginning. This variation is a result of the epic returns the stock market provided investors this year.

It may also be worth noting that even at the market’s lows, I still held 38.51% cash. Despite this still-large cash position, my total asset performance ended the year up 27.88%, significantly outperforming the S&P 500’s 16.26% gain.

Why did I still have so much cash at the market’s lows?

As always, no one knows when the market is going to hit its top or drop to its bottom. With some analysts claiming the market had much, much further to drop, going “all-in” when the market was “only” down -35% when the “experts” were suggesting further drops down to down -50% or even down -80% wouldn’t have been the prudent investment strategy.

The market only has two directions – up or down. Rather than try to guess what the market’s going to do, develop trading plans for both directions. What will you do if your positions rise tomorrow? What will you do if they fall?

“I can predict where the market’s going to move every day:

it’s going to go up… or it’s going to go down. Plan accordingly.”

– Eric ‘Irk’ Jacobson

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.