Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

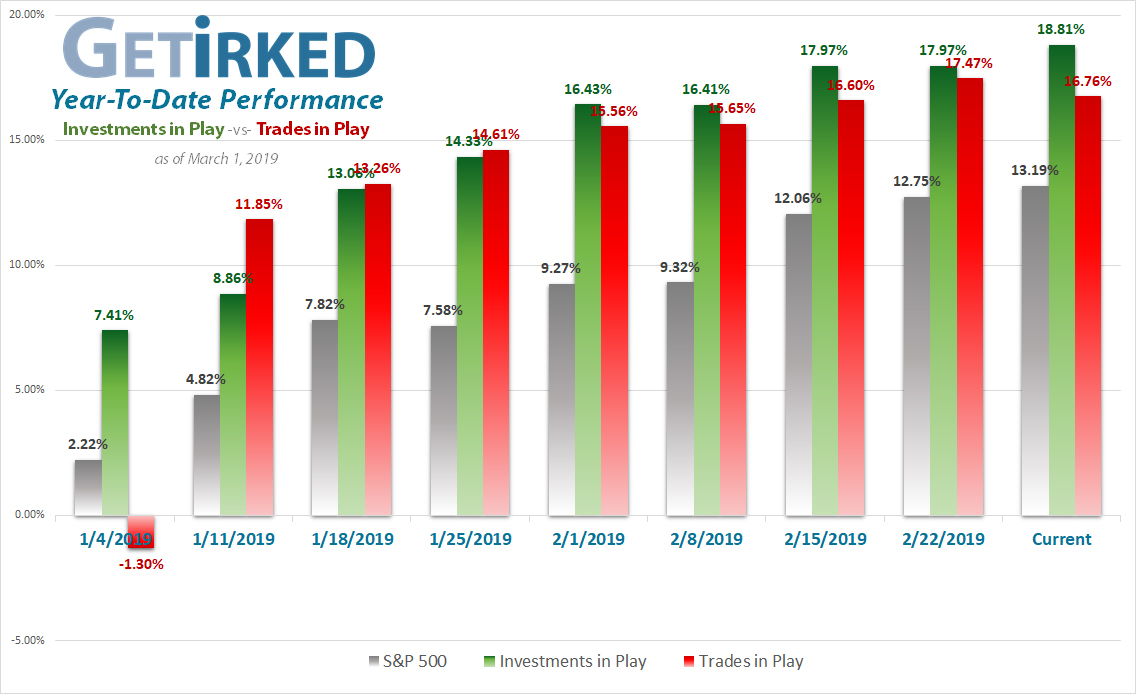

March 1, 2019

Click any chart for an enlarged version

Highlights from the Week

Biggest Winner: Canopy Growth (CGC)

Cannabis has returned with Canopy Growth Corporation (CGC) getting a huge bump from Martha Stewart. Yes, that Martha Stewart. Martha signed on with the company to help them develop CBD products thanks to the counsel of Snoop Dogg. No, we can’t make this up.

Biggest Loser: Corbus Pharma (CRBP)

Corbus Pharma (CRBP) got hit with a lawsuit this week and there’s no quicker way to destroy a stock’s value than to scare away all the investors. CRBP got slammed to the tune of -26.57%! TransEnterix (TRXC) didn’t fare much better, down 16.62% after beating on earnings but giving a dim future outlook.

Novavax (NVAX) fails pretrial testing – drops 65%

We don’t typically revisit closed trades, but this one is an example of how it’s better to be lucky than good. As we said in last week’s episode, we closed our NVAX position with a 28.09% gain. On Wednesday evening this week, NVAX announced its drug once again failed pretrials and the stock opened gapping down – way down – dropping 65%. To read more, visit the post we wrote.

This Week’s Trades

Corbus Pharmaceuticals (CRBP)

CRBP got bad news this week in the form of a securities investigation. Although this happens from time-to-time, it’s never good news and there are alleged claims that investors have committed securities fraud. The stock dropped $1.32 a share – nearly 16%. We forgot about a limit-buy order we had in the stock at $7.58 (always pay close attention to any open orders) and ended up picking up more at that level. Mistakes happen, you just have to fix them. We used a stop-loss order to sell a significant portion of our position above our per-share cost when CRBP dropped Friday, triggering our order to fill at $6.76, lowering our per-share cost to $6.50 and substantially decreasing our position size. CRBP closed the week at $6.30 with our position -3.08%.

Gossamer Therapeutics (GOSS)

GOSS, fresh-faced IPO, continued its volatility streak this week. We took profits at $23.19 only to turn around and buy back in when GOSS pulled back dramatically at several levels: $22.52., $21.28, $20.78, $20.57 and $20.21. GOSS closed the week at $23.00 with our substantially-increased position at +14.19%.

New Age Beverages (NBEV)

NBEV can’t catch a break as consumer cannabis (outside of CGC, of course) continues its downward slide. We added to our position at $6.09, $5.79 and $5.48 as it dropped. NBEV closed the week at $5.89 with our position down -3.20%.

Tencent Music (TME) *Cost Basis Removed*

TME continued its upward climb eventually tapping $18.86 where we were able to remove our cost basis. By taking out our entire initial investment, we can allow the remainder of the position to ride higher, making additional profits while avoiding all downside risk to our capital (i.e. even if TME goes to $0.00, we haven’t lost any of the funds we used to originally purchase the position). TME closed the week at $18.20 and us with a +195.21% gain.

TransEnterix (TRXC)

Despite finally seeming to turn its volatility around last week, TRXC gave a poor showing in this week’s earnings report resulting in some very strange action. Earnings were good, however forward guidance was not. The day after earnings, we added to our position at $2.56 only to turn around and actually perform a day trade (an incredibly rare occurrence for Get Irked) when TRXC bounced with a stop-limit sell order filling the same day at $2.70. TRXC closed the week at $2.71 with our position up +9.33%.

Yeti (YETI) *New Position*

Yeti makes very popular outdoor equipment including innovative waterproof coolers capable of floating (perfect for river excursions). After reporting excellent earnings earlier in the week, Yeti pulled back slightly, offering us the opportunity to start a position at $23.23. We flipped our entire position when YETI started to become overbought at $25.71 and then immediately started buying back in stages at $25.02 and $24.67 making for a very busy Friday. The flip caused us to raise our per-share cost from $23.23 to $23.61, however our initial buy was incredibly small and YETI is exhibiting incredible strength due to its growth, making it a very intriguing ongoing play. YETI closed the week at $25.09 with our position up +6.29%.

Want further clarification?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below! We’ll see you next week!