Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

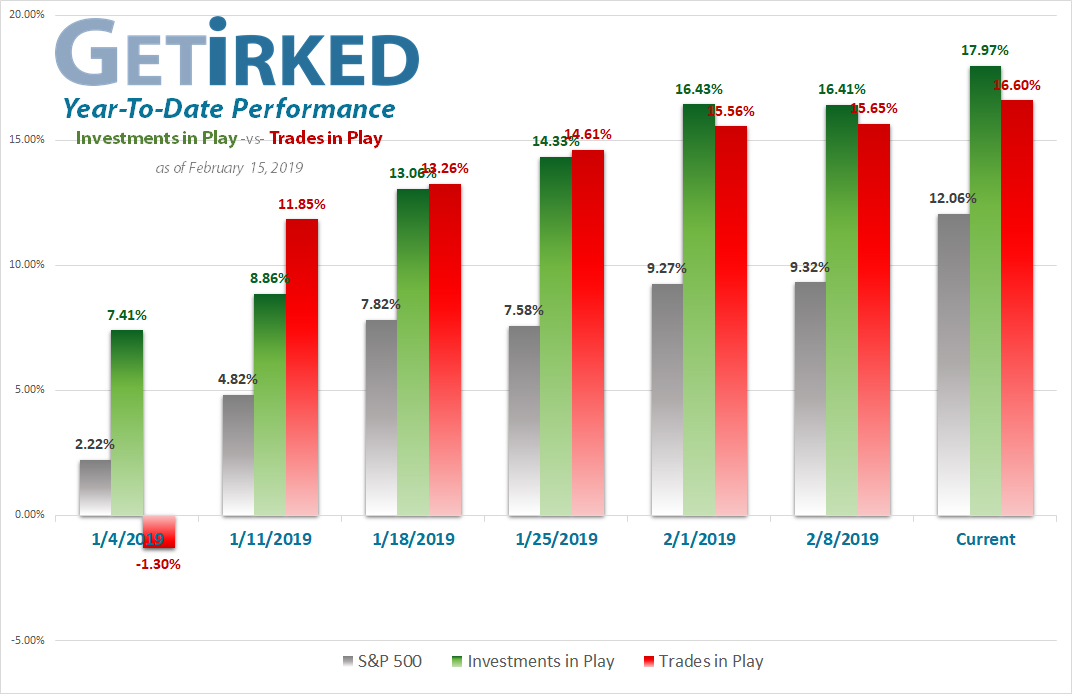

February 15, 2019

Click any chart for an enlarged version

Highlights from the Week

Corbus Pharmaceuticals (CRBP) came into its own this week, rocketing its way to be our big weekly winner with a 16.54% gain for the week taking it to third place for the Year-to-Date spot with 55.65% since the start of the year.

Insys Therapeutics (INSY) continued its bounce this week, adding 12.47% to last week’s gains and creating a YTD gain of 42.53% from a YTD loss just two weeks ago.

Groupon (GRPN) bombed its earnings but dropped only 3.06% this week, maintaining a 10.79% gain since the start of the year.

Aurora Cannabis (ACB) is the loser of the cannabis group and our biggest loser this week after reporting lackluster earnings, closing down 7.11%. ACB still has a 44.17% YTD gain, so even with bad earnings, everyone’s a winner when it comes to pot stocks.

This Week’s Trades

Corbus Pharmaceuticals (CRBP)

CRBP really came into its own this week riding the wave higher and higher. We took profits at $8.17 and $8.74. CRBP closed the week at $8.86, leaving us up +64.30% in our position.

Insys Therapeutics (INSY)

INSY continued last week’s bounce with us taking additional profits at $4.62 and $4.81 to capitalize on its upward movement (and to free up some capital in case it decides to pull a nosedive). INSY closed the week at $4.99 with us up +68.99%.

New Age Beverages (NBEV)

NBEV is definitely a head-spinner when it comes to the cannabis crazies. It dove this week with us adding to our position at $6.12 and again at $6.06, nearly pegging its $6.05 low. It closed the week at $6.49, leaving us up +2.54% on our position.

Square (SQ) *CLOSED POSITION*

SQ is one of our biggest all-time winners for our Investments in Play, buying in at $11 a share in August 2016. Due to its high share price limiting how much movement we can make with this stock as a trade, however, we decided to sell it – begrudgingly – at $75.39. We still have our Investments in Play position so we’re taking our 19.11% profit from this trade and putting it to work elsewhere. SQ closed the week at $75.64.

Tencent Music (TME)

TME has finally found its stride (maybe?), heading upwards yet again. We’re peeling off the profits on the way up, selling at $15.34, $15.99 and $16.28 as TME continued upward to ring the $17 bell. TME closed the week at $16.17 with us up +157.21% in our position.

TransEnterix (TRXC)

TRXC continues to be incredibly volatile and a huge mover even compared to other low-dollar stocks. After adding to our position at $2.34 last week, we sold some at $2.69 (+14.96% from $2.34) and $2.82 (+20.51% from $2.34) as TRXC pushed higher. We were able to lower our per-share cost to $2.66 and free up some capital for its next dive lower (yeesh). TRXC closed the week at $2.76 with us up +3.91% in our position.

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.