June 7, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

%

Desired Cash On-Hand

Current Position Performance

Canopy Growth (CGC)

+315.67%

Aurora Cannabis (ACB)

+266.55%

AMD (AMD)

+65.10%

Tencent Music (TME)

+30.28%

Groupon (GRPN)

+20.30%

Cronos Group (CRON)

+18.98%

Tradeweb Mkts (TW)

+16.42%

Yeti (YETI)

+14.68%

Gossamer Bio (GOSS)

+10.27%

Pinterest (PINS)

+10.22%

BiliBili (BILI)

-8.36%

Iridium Comm (IRDM)

-12.28%

New Age Bev (NBEV)

-15.83%

Nio (NIO)

-40.64%

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

Highlights from the Week

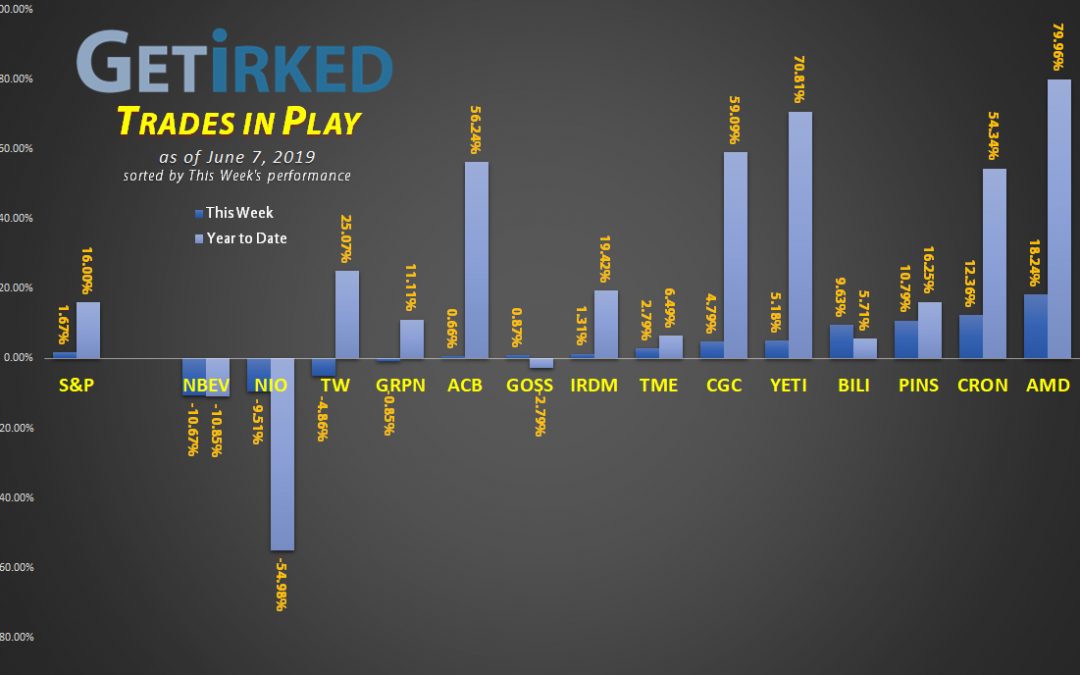

Biggest Winner: AMD (AMD)

AMD’s new announced product lineup combined with hope that next week’s Electronic Entertainment Expo (E3) will bring new partnerships caused AMD’s stock to skyrocket 18.24% this week, easily earning it this week’s Biggest Winner award.

If all goes well and the market doesn’t collapse, we expect AMD to make new all-time highs in short order.

Biggest Loser: New Age Beverages (NBEV)

New Age Beverages (NBEV) got slammed on Monday during the Cannabis Selloff and then never stopped getting hit, dropping a total of -10.67% for the week and eradicating all of its YTD gains.

We’re still not entirely sure why NBEV can’t catch any love with a lot of good news in the works including its partnership with Wal-Mart (WMT) and new product acquisitions, but, that’s the way the stock market crumbles sometimes…

This Week’s Trades

Canopy Growth Corp (CGC): Added to Position

Our assumption that that the Great Cannabis Selloff had started last week continued when Canopy Growth (CGC) and the rest of the sector spiraled down on Monday, triggering a buy order we had in place at $39.15. Our next target level is $38.75.

CGC closed the week at $42.19, up +7.77% from Monday’s buy.

Cronos Group (CRON): Flip-Flopping

It’s Buying Season in the cannabis sector with Cronos (CRON) falling in Monday trading to our per-share cost of $13.67, where we added more to our position.

Following Tuesday’s market rally, Cronos suddenly popped again, jumping more than 10% on Wednesday morning and triggering a sell order we had in place at $16.32 allowing us to capture more than 16% profit on some of Monday’s buy order while also lowering our per-share cost to $13.30.

Given the market’s current extreme volatility and Cronos’ repeated testing of its 12-month Exponential Moving Average (EMA) of $13.72 and 50-week EMA of $13.57 our next target is at slightly above a key Fibonacci Retracement support level at $12.71.

CRON closed the week at $15.82, up +15.73% from Monday’s buy, but down -3.06% from Wednesday’s sell.

Groupon (GRPN): Flip-Flopping

Periodically, there’s a position that we pay little attention to because it’s maintained a consistent trading level with very little action. Since January, we’ve let Groupon (GRPN) sit still despite positive news events regarding growth in the sector and new management.

Over the past few weeks, we’ve noticed GRPN has developed a fairly consistent trading range between $3.35-$3.82, roughly 6% up or down off converging significant Daily, Weekly and Monthly Exponential Moving Averages (EMAs) right around $3.50.

On Tuesday, GRPN suddenly popped to $3.75 before retreating on Wednesday, so, on Thursday, we decided to replace some shares we sold back in January at the 50-day at $3.52 to capture the profits and bet on a pop in the stock, adding at $3.52 and $3.40.

On Friday, GRPN popped again, allowing us to take small profits and reduce the position at $3.55, leaving us with a per-share cost of $2.91.

GRPN closed the week at $3.50, up +1.16% from our average buy of $3.46 for the week.

New Age Beverages (NBEV): Added to Position

New Age Beverages (NBEV), our kombucha cannabis drink play, dumped with the rest of the sector on Monday, triggering a buy order to add more to our position at $4.79. It didn’t stop dropping, collapsing into the $4.20s from there on Tuesday and Wednesday. Our next buy target is much lower at $3.81.

NBEV closed the week at $4.52, down -5.64% from Monday’s buy.

Nio (NIO): Added to Position

Nio (NIO) continued to struggle this week along with the rest of the Chinese stocks, dropping to lower levels never seen since its IPO.

We added to our position at $2.79, lowering our per-share cost to $4.65 with a buy target slightly above a key Fibonacci Retracement level at $2.53.

Nio closed the week at $2.76, down -1.08% from where we added.

Tencent Music (TME): Added to Position

Tencent Music (TME) has truly fallen from its highs thanks to being firmly based in China, so when it seemed to establish support with a low of $12.60 this week, we decided to add back some of what we shared, placing a buy order at $12.82 on Thursday which raised our per-share cost to $10.45, still nearly 20% lower than our first buy at $12.96 in December 2018.

Our next buy target is $11.87, slightly above TME’s all-time $11.81.

TME closed the week at $13.61, up +6.16% from where we added.

Tradeweb Markets (TW): Added to Position

Despite a substantial rally in the markets on Tuesday, Tradeweb Markets (TW) traded down and filled a buy order we had at $42.84, replacing some shares we sold at higher levels previously and raising our per-share cost basis to $36.85.

Our next buy target for the stock is $41.50, a previous level of support, should TW break the levels it seems to be struggling against.

TW closed the week at $42.90, up +0.14% from Tuesday’s buy.

Yeti (YETI): Added to Position

Thanks to China and economic concerns, Yeti (YETI) had a particularly bad week, culiminating in a one-day dropoff of nearly 5% on Thursday where we added to our position at $23.30, raising our per-share cost to $21.94.

Our next buy target for Yeti is below our per-share cost at a key level of support at $20.05.

Yeti (YETI) closed the week at $25.16, up +7.98% from where we added on Thursday.

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.