May 24, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

%

Desired Cash On-Hand

Current Position Performance

Aurora Cannabis (ACB)

+298.70%

Canopy Growth (CGC)*

+186.82%

AMD (AMD)

+56.60%

Groupon (GRPN)

+49.45%

Tradeweb Mkts (TW)

+43.39%

Tencent Music (TME)

+36.58%

Yeti (YETI)

+29.16%

Gossamer Bio (GOSS)

+22.81%

Cronos Group (CRON)

+13.35%

Pinterest (PINS)

+1.80%

New Age Bev (NBEV)

-0.24%

Iridium Comm (IRDM)

-11.27%

BiliBili (BILI)

-16.26%

Nio (NIO)

-27.01%

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

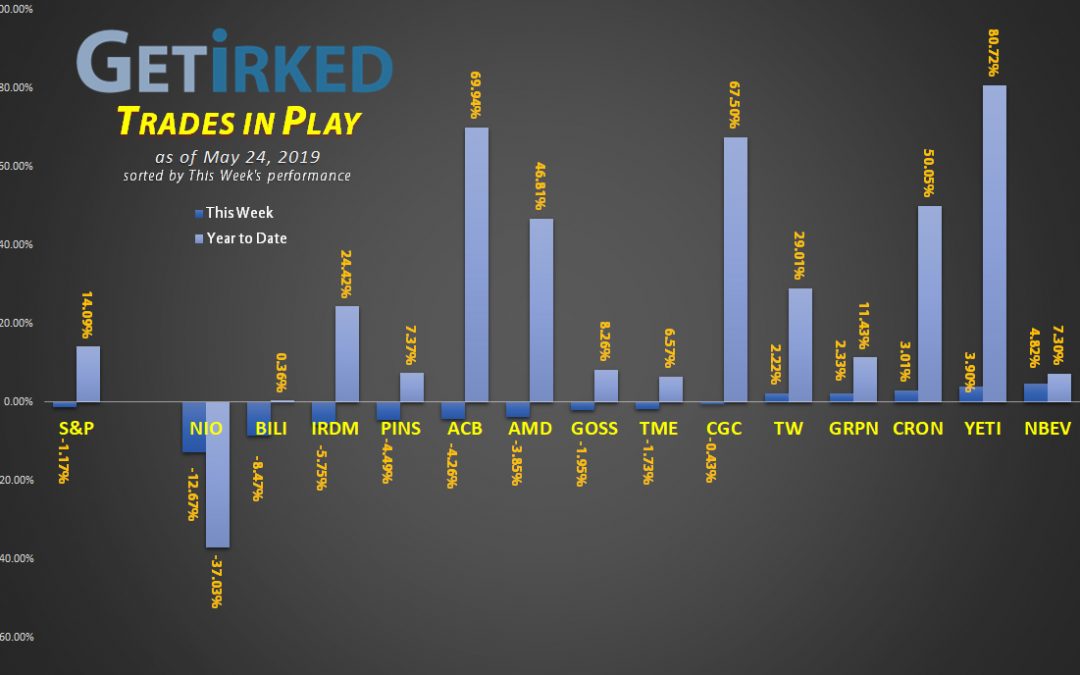

Highlights from the Week

Biggest Winner: New Age Beverages (NBEV)

New Age Beverages (NBEV), our cannabis and kombucha drink play, finally started to grind its way off its $5 price range, gaining +4.82% this week and earning it the title of our weekly winner.

Biggest Loser: Nio (NIO)

Nio (NIO), the Chinese electric vehicle (EV) manufacturer similar to Tesla (TSLA), got absolutely destroyed this week on trade war news, dropping -12.67% for a YTD loss of -37.03%. Despite minimal exposure outside of China, the combination of trade wars concerns along with Tesla’s own substantial decreases in demand has made investors nervous about the EV space entirely.

This Week’s Trades

BiliBili (BILI): Added to Position

BiliBili (BILI) gapped lower on Monday morning, down more than -3% as trade tensions increased between the U.S. and China. We filled a buy order we had in place at $14.98 which lowered our per-share cost to $16.78 from $17.38

We have additional buy targets at $12.88, $10.78 and $9.84.

BILI closed the week at $14.05, down -6.21% from where we bought Monday.

Gossamer Bio (GOSS): Profit-Protection

Wednesday’s volatile market action combined with Gossamer Bio’s (GOSS) unsettling price action led us to place a stop-limit sell order to protect some gains.

Slightly after mid-day, GOSS failed momentarily to hold a key level of support and triggered our sell order at $20.30, freeing up some capital and lowering our per-share cost to $16.75 from $17.46, a reduction of about 4%.

We have buy targets at $16.08, $15.88 and $15.62 to replace the sales we’ve made over the past few weeks.

GOSS closed the week at $20.57, up +1.33% from where our sell order triggered.

Iridium Communications (IRDM): Added to Position

Irdium Communications (IRDM) spiraled downward right from the start of the week, having lost key support levels during last week’s selloff.

We added to our position as IRDM fell through a key buying target at $23.53 on Monday.

The company’s outlook and potential profit margins are positive for long-term growth, so we will continue to add if IRDM heads lower. Our next buy target is $21.16.

IRDM closed the week at $22.62, down -3.83% from where we added.

New Age Beverages (NBEV): Profit-Taking

After weeks of floundering in oversold levels around the $5.00-$5.25 range, New Age Beverages (NBEV) popped +5% on Wednesday.

We took the opportunity to take profits (it was more of a position reduction, actually) at $5.54 a share, reducing our per-share cost to $5.46, but, more importantly, reducing our position size to a more appropriate allocation so we can add to it should NBEV take another dive.

NBEV closed the week at $5.44, down -1.81% from where we took profits.

Nio (NIO): Added to Position

As one might expect, any Chinese stock will continue to be hit particularly hard during the trade wars, and Nio (NIO) is no exception, opening lower right off the bat this week.

Nio dropped through a key buy target of ours at $4.31 on Monday. We added to our position, lowering our per-share cost from $5.53 to $5.29.

Our next buy target is $3.40. Should Nio become that oversold, that will completely fill our allocation as we wait for its electric car thesis to play out (or not).

Nio closed the week at $3.86, down -10.44% from where we added.

Pinterest (PINS): Added to Position

We expected PINS to suffer a much greater selloff following its report last Thursday, potentially hitting its IPO price of $19.00. So, when Pinterest (PINS) pulled back more than -3.33% during trading on Monday, we added a little more exposure at our per-share cost of $25.72.

The week’s market-wide selloff wasn’t nice to PINS, causing it to drop nearly another -8% where we added again at $23.71 on Thursday, lowering our per-share cost to $25.05. Our upcoming buy-targets are now below PINS all-time low of $23.05 starting at -6.29% lower and going down from there: $21.60, $20.01, $17.74 and $15.67.

We want to ensure that if our original thesis does play out and we see a more significant selloff either due to company-specific news or market-moving events that we will be adding at key levels.

PINS closed the week at $25.50 with our position up +1.80%.

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.